大豆饮料市场分析

预计全球大豆饮料市场在预测期内(2019-2024年)复合年增长率将达到6.1%。

- 大豆制品是食品和饮料行业蓬勃发展的一部分,因为它逐渐成为我们饮食的重要组成部分。此外,大豆制品是数百万牲畜的重要营养来源。

- 大豆制品被认为营养丰富,尤其是碳水化合物、蛋白质、欧米伽 3 脂肪酸,且不含胆固醇。因此,这些产品在注重健康的消费者中越来越受欢迎。

大豆饮料市场趋势

日益增长的健康关注增加了豆制品的消费

人们消费大豆饮料是因为大豆的供应量增加,而且科学事实证明大豆对健康有许多益处;包括降低血液胆固醇和降低患某些癌症的风险。此外,由于其营养成分,大豆饮料被用作不太健康的饮料的替代品。大豆食品除了是蛋白质的完整来源外,还含有其他重要的营养素,如纤维、B 族维生素和 omega3 脂肪酸。所有这些营养素在婴儿生长、孕妇胎儿生长中发挥着重要作用,并为儿童和成人提供各种其他益处。发展中地区和发达地区健康意识的不断提高正在推动大豆饮料市场的发展。

亚太地区占据大豆饮料市场的主要份额

由于可支配收入的增加和对加工食品的需求,亚太地区拥有最大的大豆饮料市场。其次是北美和欧洲等快速增长的市场。随着北美生活方式疾病的增加和人口老龄化,消费者开始转向提供广泛健康益处的功能性食品。由于健康问题日益严重,南美洲和非洲发展中地区对大豆饮料的需求也在增加。南美洲和非洲发展中地区对大豆产品日益增长的需求为参与者提供了一个巨大的平台,可以扩大他们的影响力,从而增加他们的市场份额。

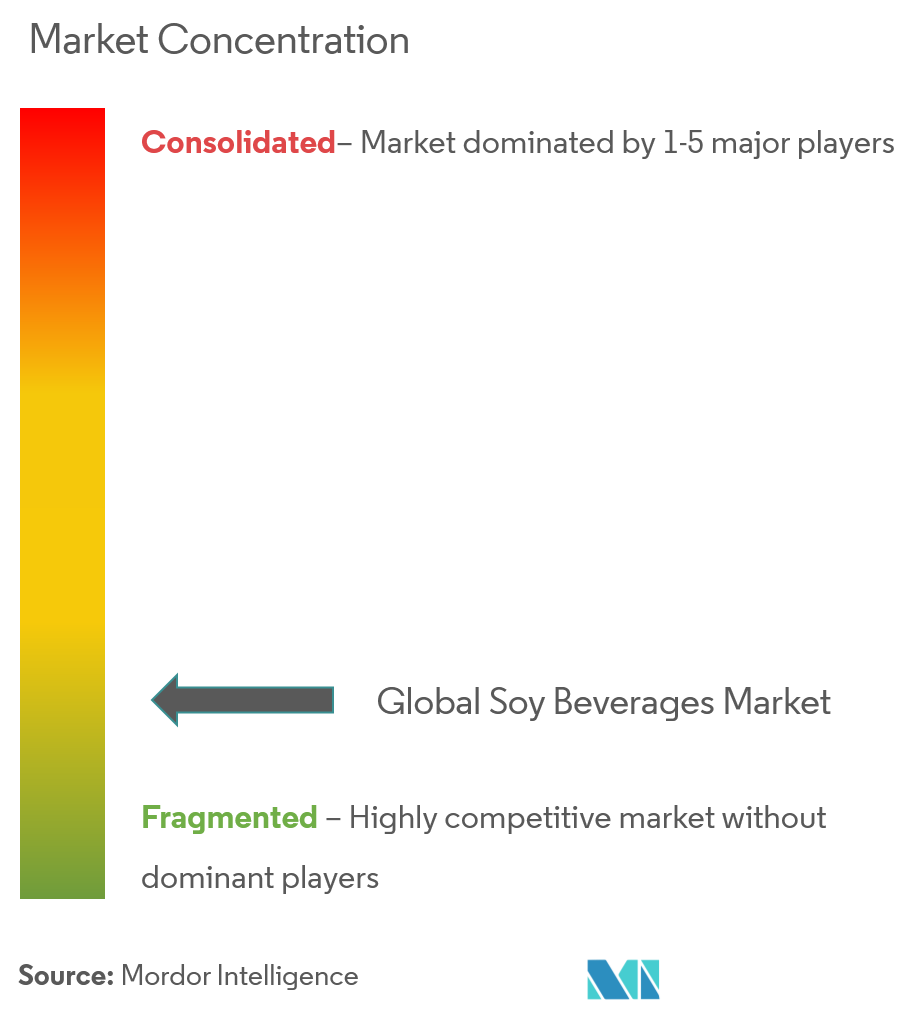

大豆饮料行业概况

新大豆饮料的推出为这个不断增长的市场的发展提供了一个巨大的平台。全球豆饮料市场的一些主要参与者包括达能、有机谷和龟甲万珍珠豆浆机等。

大豆饮料市场领导者

Danone

Organic Valley

Kikkoman Pearl Soymilk

The Hain Celestial Group

ZenSoy

- *免责声明:主要玩家排序不分先后

大豆饮料行业细分

全球大豆饮料市场可以按类型细分,分为豆奶和酸奶冰沙。强烈推荐给乳糖不耐症或乳制品过敏人群。豆奶中的蛋白质含量与牛奶相当,但与牛奶不同的是,豆奶含有少量的饱和脂肪,并且不含胆固醇。根据分销渠道,大豆饮料市场分为超市/大卖场、药店、零售店、便利店等。此外,该研究还对全球新兴和成熟市场的大豆饮料市场进行了分析,包括北美、欧洲、亚太地区、南美以及中东和非洲。

| 我是牛奶 |

| 大豆饮用酸奶 |

| 原味大豆饮料 |

| 风味大豆饮料 |

| 超市/大卖场 |

| 药房/药店 |

| 网上零售店 |

| 便利店 |

| 其他的 |

| 北美 | 美国 |

| 加拿大 | |

| 墨西哥 | |

| 北美其他地区 | |

| 欧洲 | 英国 |

| 德国 | |

| 法国 | |

| 俄罗斯 | |

| 意大利 | |

| 西班牙 | |

| 欧洲其他地区 | |

| 亚太地区 | 印度 |

| 中国 | |

| 日本 | |

| 澳大利亚 | |

| 亚太其他地区 | |

| 南美洲 | 巴西 |

| 阿根廷 | |

| 南美洲其他地区 | |

| 中东和非洲 | 南非 |

| 沙特阿拉伯 | |

| 中东和非洲其他地区 |

| 按产品类型 | 我是牛奶 | |

| 大豆饮用酸奶 | ||

| 按口味 | 原味大豆饮料 | |

| 风味大豆饮料 | ||

| 按分销渠道 | 超市/大卖场 | |

| 药房/药店 | ||

| 网上零售店 | ||

| 便利店 | ||

| 其他的 | ||

| 地理 | 北美 | 美国 |

| 加拿大 | ||

| 墨西哥 | ||

| 北美其他地区 | ||

| 欧洲 | 英国 | |

| 德国 | ||

| 法国 | ||

| 俄罗斯 | ||

| 意大利 | ||

| 西班牙 | ||

| 欧洲其他地区 | ||

| 亚太地区 | 印度 | |

| 中国 | ||

| 日本 | ||

| 澳大利亚 | ||

| 亚太其他地区 | ||

| 南美洲 | 巴西 | |

| 阿根廷 | ||

| 南美洲其他地区 | ||

| 中东和非洲 | 南非 | |

| 沙特阿拉伯 | ||

| 中东和非洲其他地区 | ||

大豆饮料市场研究常见问题解答

目前大豆饮料市场规模有多大?

大豆饮料市场预计在预测期内(2024-2029)复合年增长率为 6.10%

谁是大豆饮料市场的主要参与者?

Danone、Organic Valley、Kikkoman Pearl Soymilk、The Hain Celestial Group、ZenSoy 是大豆饮料市场上经营的主要公司。

大豆饮料市场增长最快的地区是哪个?

预计欧洲在预测期内(2024-2029 年)将以最高的复合年增长率增长。

哪个地区在大豆饮料市场中占有最大份额?

2024年,亚太地区将占据大豆饮料市场最大的市场份额。

该大豆饮料市场涵盖哪些年份?

该报告涵盖了以下年份的大豆饮料市场历史市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了以下年份的大豆饮料市场规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

大豆饮料行业报告

Mordor Intelligence™ 行业报告创建的 2024 年大豆饮料市场份额、规模和收入增长率统计数据。大豆饮料分析包括 2029 年的市场预测展望和历史回顾。获取此行业分析的样本(免费下载 PDF 报告)。