汽车保险市场分析

技术在新的汽车保险市场中发挥着重要作用。随着自动化、跟踪和物联网技术等新技术的集成,市场正在发生变化。安联、人保和平安等主要参与者正在将技术与汽车保险相结合,为涌入汽车行业的年轻消费者创造利润丰厚的保单和选择。

例如,安联保险 (Allianz Insurance) 和 Marmalade 扩大了与安联保险 (Allianz Insurance) 的合作关系,现在安联保险 (Allianz Insurance) 已成为这些年轻驾驶员产品的远程信息处理服务提供商。 Allianz Connected Car 平台已在多个国家上线,已收集了超过 140 亿公里的驾驶知识。这些知识使安联保险能够支持 Marmalade 为其客户提供最好的产品和服务。

汽车保险市场趋势

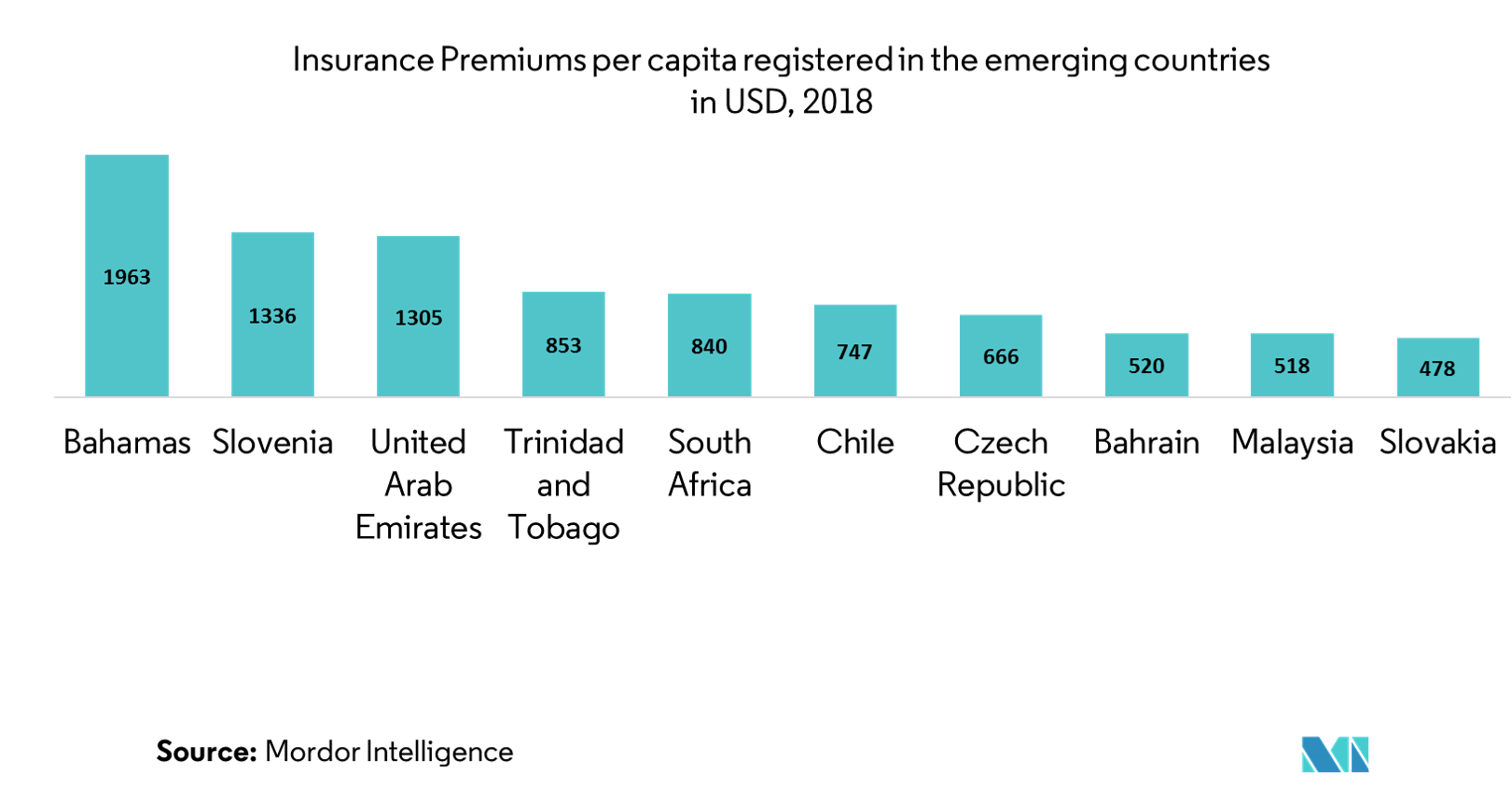

新兴国家推动市场增长

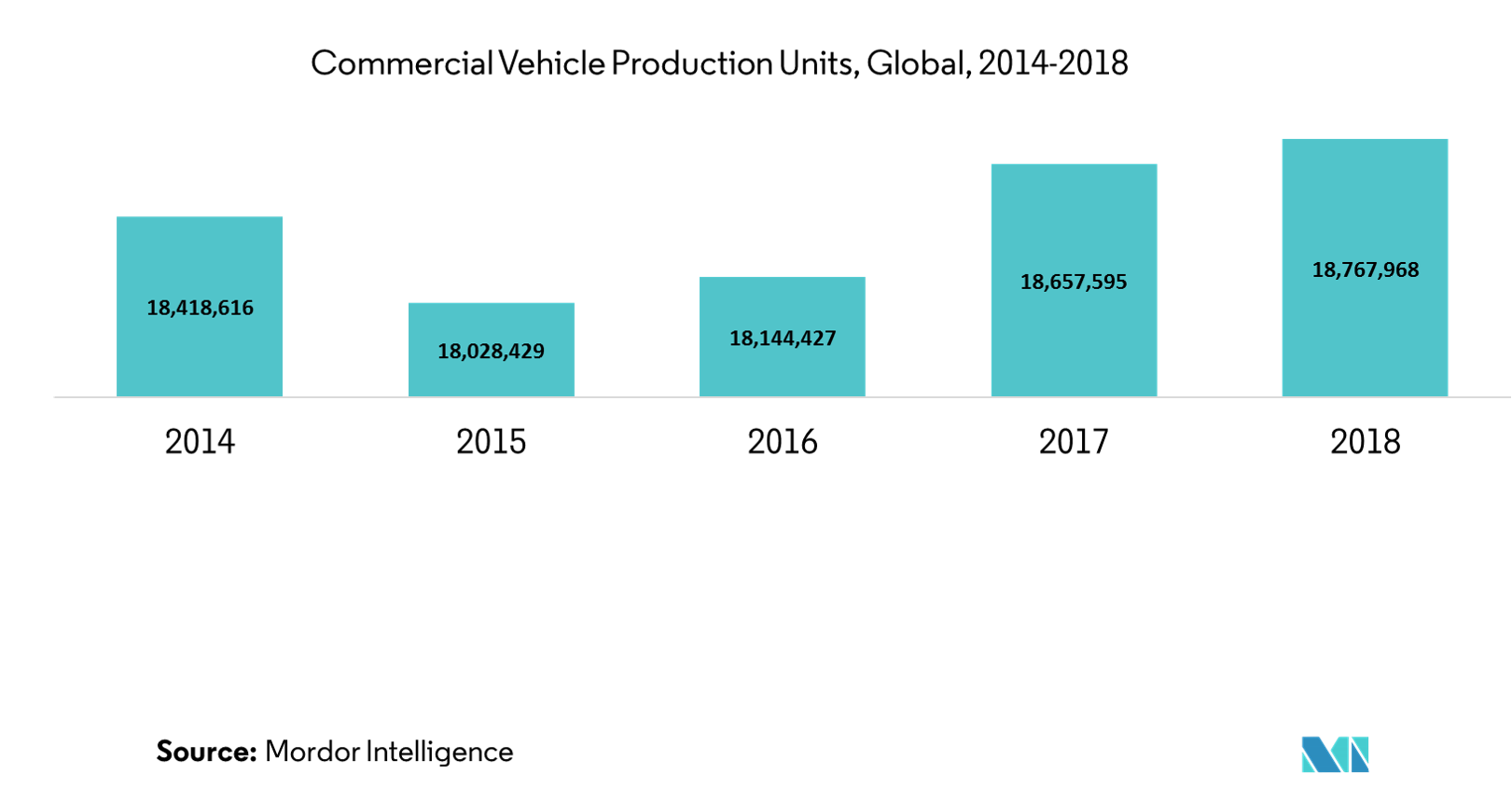

商业船队市场的增长机会

- 根据中国汽车工业协会 (CAAM) 的数据,中国商用车销量下降 13%,至 35.1 万辆。与此同时,商用车产量也出现下降:环比下降8.8%,同比下降8.5%。

- 2012年至2015年,韩国商用车销量稳步增长(从234,000辆增至262,000辆),但2016年略有下降至256,000辆。该数字在 2017 年再次上升至 263,000 辆,并在 2018 年 3 月追踪到 60,000 辆汽车。

- 7 月份德国商业车队注册量增长了 14.9%,也帮助新乘用车细分市场实现了 2009 年以来最好的月份表现。

- 2019 年 5 月,巴西轻型商用车 (LCV) 注册量较去年同期增长 15.6%,今年迄今也增长 9.9%。卡车注册量也大幅增加,与去年同期相比,2019 年 5 月增长了 62.2%。今年迄今为止,该细分市场的注册量也增加了 48.5%。按燃料类型划分,灵活燃料汽车销量同比增长21.6%,柴油车销量同比增长21.5%。混合动力和电动汽车增长 18.2%,至 357 辆,而汽油车则下降 16%,至 6,196 辆。

据观察,全球范围内,2018年和2019年车队规模和销量出现波动。但由于商业车队保险的技术集成度不断提高,市场出现了正增长。

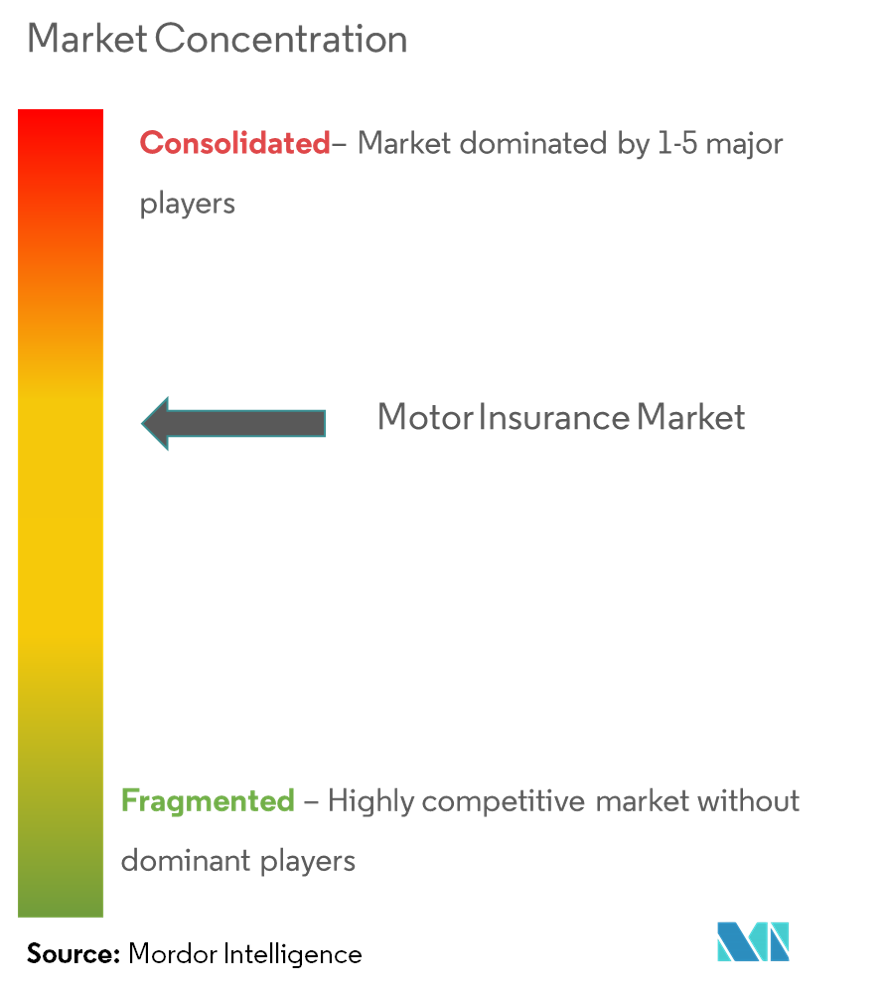

汽车保险行业概况

汽车保险市场领导者

-

Allianz SE

-

Ping An Insurance (Group) Co of China Ltd

-

ICICI Lombard General Insurance Co Ltd

-

Sompo Holdings Inc

-

Aviva Plc

- *免责声明:主要玩家排序不分先后

汽车保险行业细分

汽车保险市场报告通过强调世界主要地区收取的净保费和毛保费来涵盖汽车保险市场的全球概况。该报告分别涵盖了北美和拉丁美洲、欧洲、中东和非洲以及亚太地区等不同地区。该报告按第三方责任险、第三方火灾和盗窃险以及综合保险等保单类型进一步细分。

| 地理 | 北美 |

| 欧洲 | |

| 亚太 | |

| 中东和非洲 | |

| 拉美 | |

| 保单类型 | 第三方责任 |

| 第三方火灾和盗窃 | |

| 综合的 |

| 北美 |

| 欧洲 |

| 亚太 |

| 中东和非洲 |

| 拉美 |

| 第三方责任 |

| 第三方火灾和盗窃 |

| 综合的 |

汽车保险市场研究常见问题解答

目前汽车保险市场规模有多大?

汽车保险市场预计在预测期内(2024-2029)复合年增长率为 5.03%

汽车保险市场的主要参与者有哪些?

Allianz SE、Ping An Insurance (Group) Co of China Ltd、ICICI Lombard General Insurance Co Ltd、Sompo Holdings Inc、Aviva Plc 是汽车保险市场的主要运营公司。

汽车保险市场增长最快的地区是哪个?

预计亚洲在预测期内(2024-2029 年)将以最高的复合年增长率增长。

哪个地区的汽车保险市场份额最大?

2024年,北美将占据汽车保险市场最大的市场份额。

该汽车保险市场涵盖哪些年份?

该报告涵盖了汽车保险市场的历史市场规模:2020年、2021年、2022年和2023年。该报告还预测了汽车保险市场的市场规模:2024年、2025年、2026年、2027年、2028年和2029年。

我们最畅销的报告

Popular Insurance Reports

Popular Financial Services and Investment Intelligence Reports

汽车保险行业报告

Mordor Intelligence™ 行业报告创建的 2024 年汽车保险市场份额、规模和收入增长率统计数据。汽车保险分析包括 2029 年的市场预测展望和历史回顾。获取此行业分析的样本(免费下载 PDF 报告)。