实验室自动化软件市场分析

在预测期内(2022 年至 2027 年),实验室自动化软件市场预计将以 8.15% 的复合年增长率增长。

- 自动化用于各种生命科学应用,从蛋白质组学到系统生物学。自动化常规实验室程序,使用专用工作站和软件对仪器进行编程,使科学家和技术人员能够创造性地思考他们的实验的影响,并设计有用的后续项目或开发替代的工作方法,而不是花时间执行任务乏味的重复。

- 由于生产力的提高和实验室运营成本的降低,机器人和自动化的集成正在迅速增加。这可能会在预测期内促进市场增长。对生命本质的理解和发现,包括聚合酶链式反应(PCR)、剪接基因和测序手段,正在不断进步,这可能会推动市场增长。

- 此外,专家们认为自动化是临床试验数量快速增加的关键解决方案。通过数字化和自动化,科学家能够实现整个过程的自动化,从而减少污染、数字数据记录和更快的数据处理。这大大减少了每次试验所需的时间。

- 自动化在帮助实验室最大限度地提高效率、简化操作以及建立可扩展和可持续的方法以最大限度地减少对其提供的服务和所服务的患者的干扰方面发挥着关键作用。然而,COVID-19 大流行的影响加剧了实验室面临的许多现有挑战,包括人员短缺、改进 TAT 和减少诊断测试错误。

- 设置实验室自动化模块(包括软件)的成本较高,阻碍了小企业的发展。预计这一因素将阻碍预测期内的市场增长。

实验室自动化软件市场趋势

实验室信息管理系统有望占据最大市场份额

- 由于实验室努力应对样本量的增加,实验室信息管理系统行业在过去五年中表现出强劲的增长,部分原因是迅速增长的老年人口对诊断测试的需求增加。

- 行业运营商特别注重开发可协助解决数据安全和监管合规等运营问题的软件。该市场是由某些因素推动的,例如遵守法规的压力不断增加、集成医疗保健系统的需求不断增长、从遗留系统向商业现成 LIMS 解决方案的转变,以及 LIMS 产品的技术进步。

- 此外,对基因组和DNA等测试的资助导致实验室信息和数据的增加。因此,基因组研究实践的不断增加有利于市场的增长。相关优势,例如高精度和消除手动数据转录错误,预计也将推动市场发展。

- 据NIH(美国国立卫生研究院)称,2021年NIH的人类基因组资助约为44.3亿美元,预计2022年将达到45.5亿美元。此类资助也有望提振市场。

- 北爱尔兰卫生部长最近宣布启动耗资 4000 万英镑的新实验室信息管理系统 (LIMS),该系统将显着改善医疗保健关键领域的临床诊断服务的提供。

亚太地区预计将成为增长最快的市场

- 由于制药市场的快速增长,亚太地区是实验室自动化软件增长最快的地区。这一增长可归因于该地区药品研发投资的增加。

- 例如,2022年5月,美国制药公司辉瑞公司在印度理工学院马德拉斯研究园设立了亚洲首个全球药物开发中心。该公司已在该中心投资 2000 万美元,用于开发创新配方、小分子和活性药物成分 (API)。

- 此外,2022年2月,澳大利亚生物制药公司贝罗尼集团签署了在中国珠海国家高新技术产业开发区建设新研发中心的合同。这些扩张举措和投资预计将促进该地区的市场增长。

- 此外,与其他大陆不同,该地区拥有大量异质人口群体,因此非常适合进行药物研究。由于拥有熟练劳动力且开发药物所需的成本较低,该地区被认为是外包药物研究的最佳地区。

- 此外,其他地区的公司面临严格的监管和漫长的工期,进一步增加了项目成本。因此,北美公司正在转向CRO(合同研究组织)合作伙伴关系,这使该地区受益匪浅,获得了更多的研究项目。由于时间和预算是开发中最关键的因素,制药公司正在选择自动化实验室软件,以减少与药物发现相关的错误、成本和时间。

- 例如,2021 年 10 月,韩国临床诊断公司 GC Labs 推出了韩国首个微生物学实验室全自动化系统 WASPLab。该解决方案自动处理从样本接收到接种、培养和解释的步骤,而这些步骤以前都是手动进行的。特别是,它会自动将文化解释为积极或消极。它允许测试人员在向临床专业人员报告最终结果之前仔细检查显示器上的图像。

实验室自动化软件行业概述

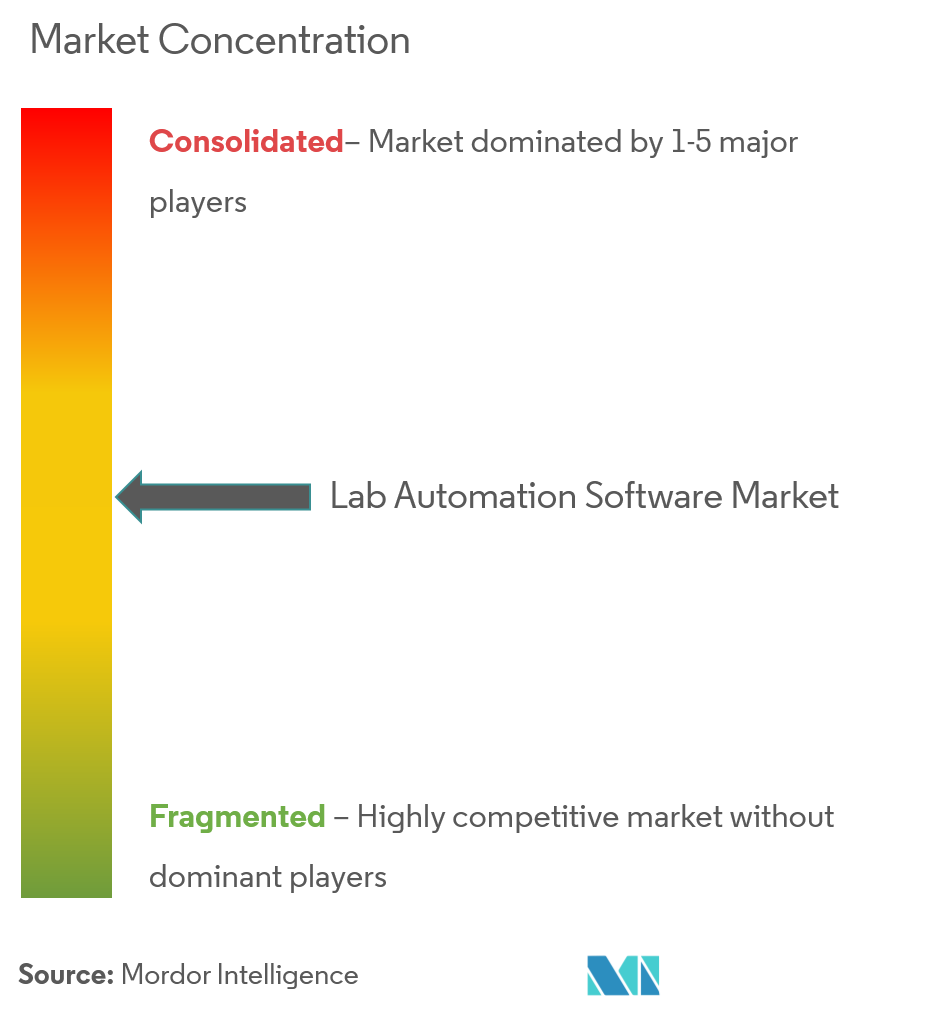

实验室自动化软件市场竞争并不激烈,参与者数量也并不有限。还有其他更新的技术正在开发中,通过这些技术可以实现测试和筛选等常规实验室流程的自动化。自动化工具可以实时处理并发请求,生产力和吞吐量显着提高。

- 2022 年 3 月 - Scispot 是一家由 Y Combinator 支持的生命科学实验室信息学初创公司,推出 Labsheets 来帮助生命科学实验室超越非科学电子表格和过时的实验室信息管理系统。 Labsheets 是一款无代码关系数据库产品,专为生命科学实验室设计,支持其数据管理、样本跟踪、审计跟踪、自动报告创建和集成要求。 Scispot 的 Labsheets 目标是通过减少生命科学实验室管理电子表格中数据的时间来增强生命科学实验室的能力,使实验室专业人员能够设计和自动化工作流程,并更快地将科学突破推向市场。

- 2021 年 9 月 - Veeva Vault LIMS 是 Veeva Systems 的一款新云应用程序,旨在实现质量控制 (QC) 实验室运营现代化。通过将 Vault LIMS 纳入 Veeva Vault 质量套件,制造组织可以将其实验室运营与更广泛的质量生态系统无缝连接。这将通过简化样品管理、测试执行和实验室调查流程来加快批次发布并降低库存成本。

- 2021 年 7 月 - LabVantage Solutions, Inc 推出了其旗舰产品 LabVantage LIMS 的 8.7 版,旨在为实验室的外部客户提供安全的自助服务门户网站。借助升级后的 LabVantage LIMS 8.7,客户可以通过门户将适当的访问权限扩展到实验室之外,同时保护其宝贵的敏感数据,避免手动请求测试和其他服务。

- 2021 年 7 月 - 分析测试实验室 LIMS 软件提供商 Promium, LLC 推出了新版本的 Element LIMS 实验室软件。 Element LIMS 是一个全面的实验室信息管理系统,可管理整个实验室的分析和操作活动。 Element LIMS 版本 7 包括功能增强、重新设计的用户界面和新的开发框架,所有这些都旨在显着提高实验室性能和合规性。

实验室自动化软件市场领导者

-

Thermo Fisher Scientific

-

Danaher Corporation

-

Hudson Robotics

-

Becton Dickinson

-

Synchron Lab Automation

- *免责声明:主要玩家排序不分先后

实验室自动化软件市场新闻

- 2022 年 7 月 - Green Scientific Labs Holdings Inc. 推出了实验室信息管理系统 (LIMS),可在其所有实验室运营中立即使用。该公司专有的 LIMS 技术拥有一套强大的尖端功能,包括人工智能以确保符合州 COA 法规、实时周转时间 (TAT) 跟踪以识别瓶颈并提供行业领先的测试时间、数字批次下载和实时审核日志,用于编译软件内的事件和更改记录。

- 2022 年 3 月 - Biosero 在其 Green Button Go 软件套件中推出了多项新产品和功能。这些产品协同工作,提供一系列先进功能,帮助客户简化、控制自动化实验室系统并生成更好的结果。 Biosero 的 Green Button Go 软件使科学家能够实现从单个工作站到跨多个实验室操作的工作流程自动化。 Green Button Go 软件灵活、可扩展且可轻松定制,可满足各种实验室需求,具有多个扩展、数百个可用驱动程序和直观的控制界面。该公司的 Green Button Go Orchestrator 软件套件是一款端到端解决方案,用于设计、调度、启动和管理实验室内、跨实验室或全球设施之间的实验室工作流程。

实验室自动化软件行业细分

实验室自动化软件会自动检测任何故障或缺陷,并通知相关人员采取行动。此外,它还有助于维护日程安排和实验室例程,可以通过各种平台的软件进行访问。一些实验室已经建立了集成的端到端机器人系统,需要软件来操作和跟踪维护。

| 通过软件 | 实验室信息管理系统(LIMS) |

| 实验室信息系统(LIS) | |

| 色谱数据系统 (CDS) | |

| 电子实验室笔记本 (ELN) | |

| 科学数据管理系统(SDMS) | |

| 按应用领域 | 药物发现 |

| 基因组学 | |

| 蛋白质组学 | |

| 临床诊断 | |

| 其他应用 | |

| 按地理 | 北美 |

| 欧洲 | |

| 亚太地区 | |

| 世界其他地区 |

| 实验室信息管理系统(LIMS) |

| 实验室信息系统(LIS) |

| 色谱数据系统 (CDS) |

| 电子实验室笔记本 (ELN) |

| 科学数据管理系统(SDMS) |

| 药物发现 |

| 基因组学 |

| 蛋白质组学 |

| 临床诊断 |

| 其他应用 |

| 北美 |

| 欧洲 |

| 亚太地区 |

| 世界其他地区 |

实验室自动化软件市场研究常见问题解答

目前实验室自动化软件市场规模有多大?

实验室自动化软件市场预计在预测期内(2024-2029)复合年增长率为 8.15%

谁是实验室自动化软件市场的主要参与者?

Thermo Fisher Scientific、Danaher Corporation、Hudson Robotics、Becton Dickinson、Synchron Lab Automation 是实验室自动化软件市场的主要运营公司。

实验室自动化软件市场增长最快的地区是哪个?

预计亚太地区在预测期内(2024-2029 年)复合年增长率最高。

哪个地区在实验室自动化软件市场中占有最大份额?

2024年,北美在实验室自动化软件市场中占据最大的市场份额。

该实验室自动化软件市场涵盖哪些年份?

该报告涵盖了实验室自动化软件市场的历史市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了实验室自动化软件市场的多年市场规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于: undefined 9, 2023

我们最畅销的报告

Popular Automation Reports

Popular Technology, Media and Telecom Reports

实验室自动化软件行业报告

Mordor Intelligence™ 行业报告创建的 2024 年实验室自动化软件市场份额、规模和收入增长率统计数据。实验室自动化软件分析包括 2029 年的市场预测展望和历史概述。获取此行业分析的样本(免费下载 PDF 报告)。