美国危险品物流市场分析

由于美国拥有强大的基础设施和不断增长的石油贸易,预计美国危险品物流市场将在预测期内稳定增长。美国危险品物流市场行业领导者的出现为市场走势提供了推动力。在美国,管道运输占危险品运输量的很大一部分。

- 美国石油行业近期产能有所增加,预计2019年美国石油产量将增加130万桶/日。

- 德克萨斯州、加利福尼亚州和佛罗里达州是所有运输方式中危险品运输量最高的主要州之一。

美国危险品物流市场趋势

美国石油工业的增长

美国页岩油的繁荣是近年来空前增长的结果,这得益于水力压裂技术的发展以及政府为化石燃料开发创造了更有利的环境。美国是目前最大的国际原油生产国,预计2019年产量将超过1200万桶/日,到2020年将达到1290万桶/日。

随着环境保护法的放松管制以及限制进入敏感生态系统和与排放有关的不同法律的软化,石油和天然气行业蓬勃发展,此外,美国的海上钻探也有所增长。

美国出口的天然气数量已经超过进口数量。明年,天然气产量预计将再增长 8%,达到每天 902 亿立方英尺的历史新高。随着美国增加国际石油和天然气出口,预计市场将出现增长。

。

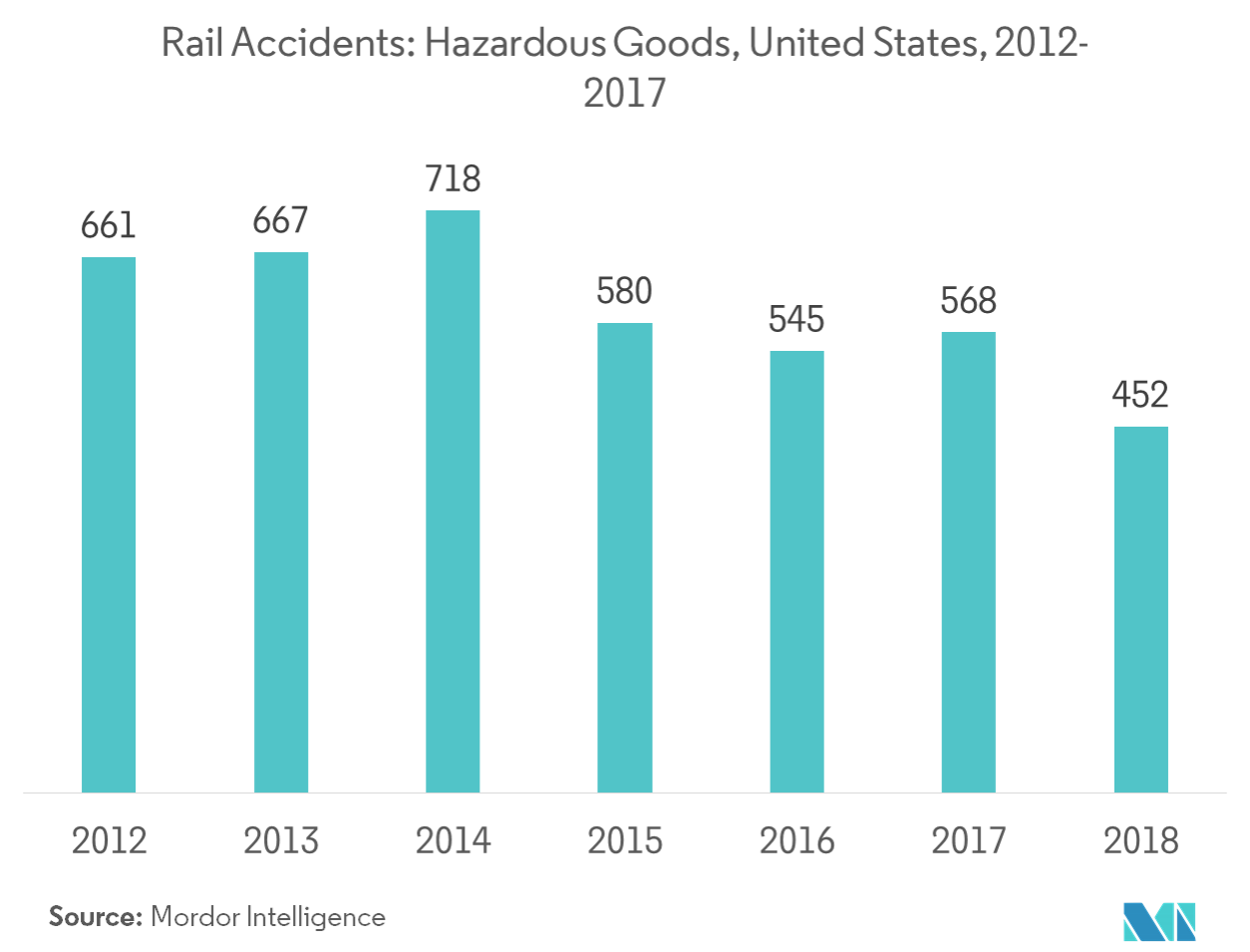

铁路被认为是危险品最安全的运输方式

2017年,超过99.9%的铁路危险品货物没有因火车事故而泄漏而到达目的地。因此,与卡车相比,铁路运输危险品要安全得多。此外,尽管危险品吨里程大致相等,但与卡车相比,铁路发生的危险品事故约占卡车的 10%。 2017年,原油运输车辆出轨事故占全部出轨事故的比例不足1%,自2008年以来,铁路危险品运输事故率下降了41%。铁路网投资的加大,对铁路网更加

安全起到了重要作用。。每年超过 250 亿美元的支出创下历史新高,帮助货运铁路使铁路网络更加安全。美国铁路是资本最密集的行业,这有助于该行业实现最安全的时代,自 2008 年以来火车事故率下降了 23%。实施创新技术来持续

检查轨道、桥梁、设备和部件可能会有所帮助在事故发生之前识别问题并安排维护。

此类技术包括使用无人机调查难以进入的区域,使用超声波技术检测轨道内的缺陷,以及沿路线安装专用监视器,在火车通过时识别有故障或磨损的轨道车部件。

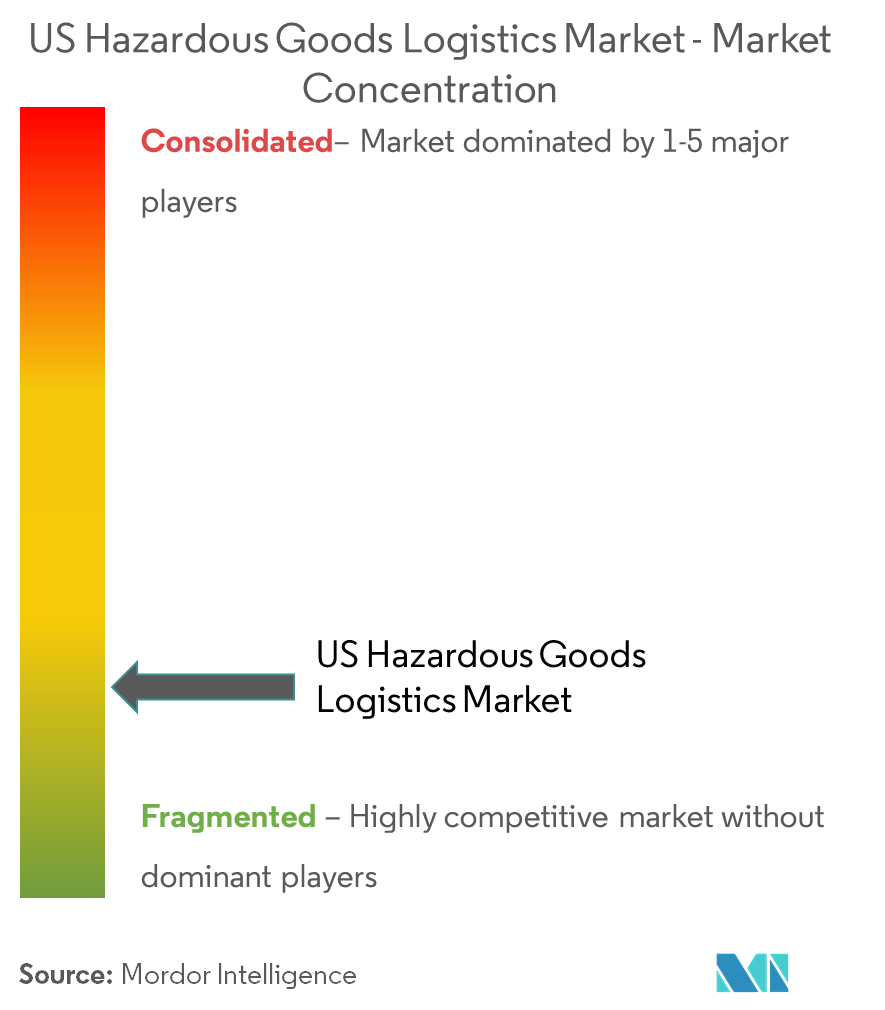

美国危险品物流行业概况

美国危险品物流市场由本地和国际参与者组成。由于大量参与者在市场上运营,市场略微分散。德国邮政 DHL 集团、联邦快递公司、XPO Logistics 和 Kuehne + Nagel 是美国危险品物流市场的主要参与者。由于市场稍微分散,排名前 10-15 的企业占据了总市场份额的三分之一,因此市场可能会转向战略并购以获得杠杆。美国石油和天然气运输的增长预计也将进一步促进物流与石油和天然气生产商之间的伙伴关系。

美国危险品物流市场领导者

Deutsche Post DHL Group

FedEx Corporation

XPO Logistics

Kuehne + Nagel

DB Schenker (The Americas)

- *免责声明:主要玩家排序不分先后

美国危险品物流行业细分

美国危险品物流市场按功能和目的地细分。该报告还涵盖了对不同类别危险品、危险品运输法规和规则、所涉及的技术以及危险品包装等的见解。

| 运输 | 路 |

| 轨 | |

| 水 | |

| 管道 | |

| 空气 | |

| 仓储配送 | |

| 增值服务(包装、报关、货运代理等服务) |

| 国内的 |

| 国际的 |

| 按功能分类 | 运输 | 路 |

| 轨 | ||

| 水 | ||

| 管道 | ||

| 空气 | ||

| 仓储配送 | ||

| 增值服务(包装、报关、货运代理等服务) | ||

| 按目的地 | 国内的 | |

| 国际的 |

美国危险品物流市场研究常见问题解答

目前美国危险品物流市场规模有多大?

美国危险品物流市场预计在预测期内(2024-2029)复合年增长率为 6.53%

美国危险品物流市场的主要参与者有哪些?

Deutsche Post DHL Group、FedEx Corporation、XPO Logistics、Kuehne + Nagel、DB Schenker (The Americas) 是在美国危险品物流市场运营的主要公司。

美国危险品物流市场涵盖几年?

该报告涵盖了美国危险品物流市场历年市场规模:2020年、2021年、2022年和2023年。该报告还预测了美国危险品物流市场历年规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

美国危险品物流行业报告

Mordor Intelligence™ 行业报告创建的 2024 年美国危险品物流市场份额、规模和收入增长率统计数据。美国危险品物流分析包括 2029 年的市场预测展望和历史概述。获取此行业分析的样本(免费下载 PDF 报告)。