亚太地区花生四烯酸市场分析

亚太地区花生四烯酸市场预计在预测期内(2020-2025年)复合年增长率为7.4%。

- 花生四烯酸市场的主要驱动力是印度和中国等国家的高出生率,这些国家增加了花生四烯酸在婴儿配方产品、运动营养和膳食补充剂产品中的应用,并增加了产品强化以满足营养缺口。

- 此外,道路事故数量的增加和肌肉损伤病例的增加预计将刺激需求。儿童保育意识、婴儿护理产品以及 ARA 作为运动补充剂的使用水平不断提高,是 ARA 市场的主要增长动力。

亚太地区花生四烯酸市场趋势

ARA 在婴儿配方奶粉产品中的应用推动市场发展

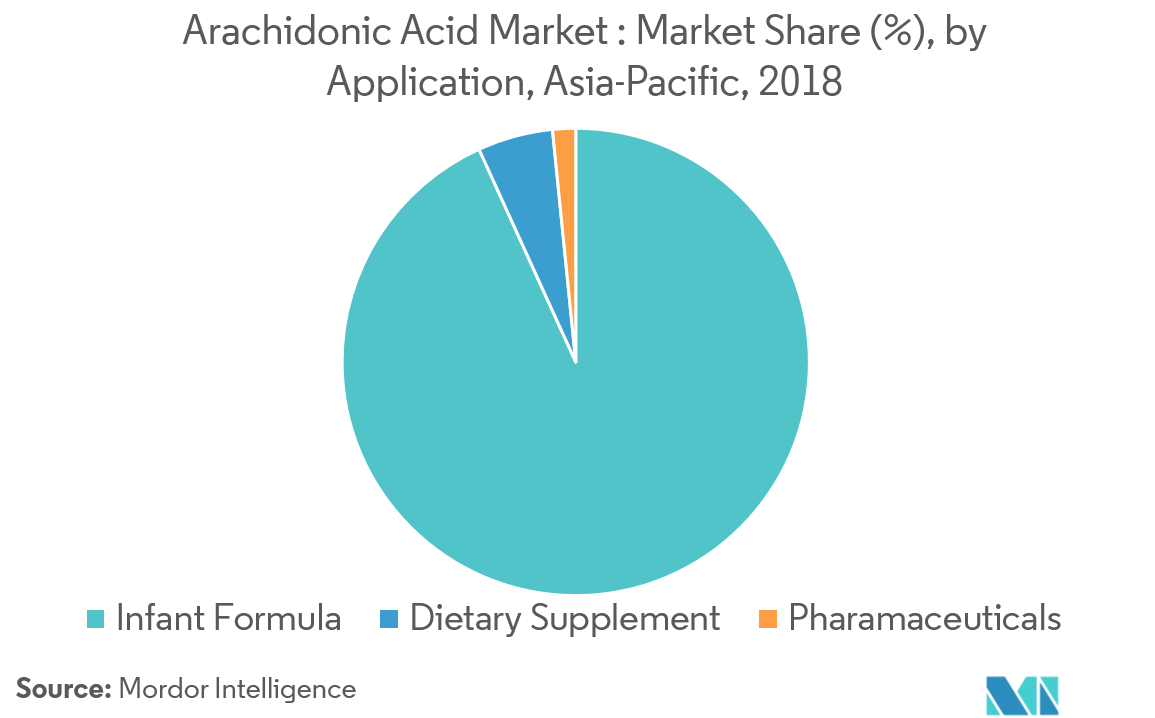

在预测期内,亚太 ARA 市场的婴儿配方奶粉市场复合年增长率为 6.8%。在食品应用中,婴儿营养品占据了主要市场份额。 ARA作为膳食补充剂,主要用于运动营养产品。婴儿在头两年内神经系统发育的营养需求意味着对 ARA 的需求保持不变。这一事实正在推动 ARA 市场的婴儿配方奶粉市场。

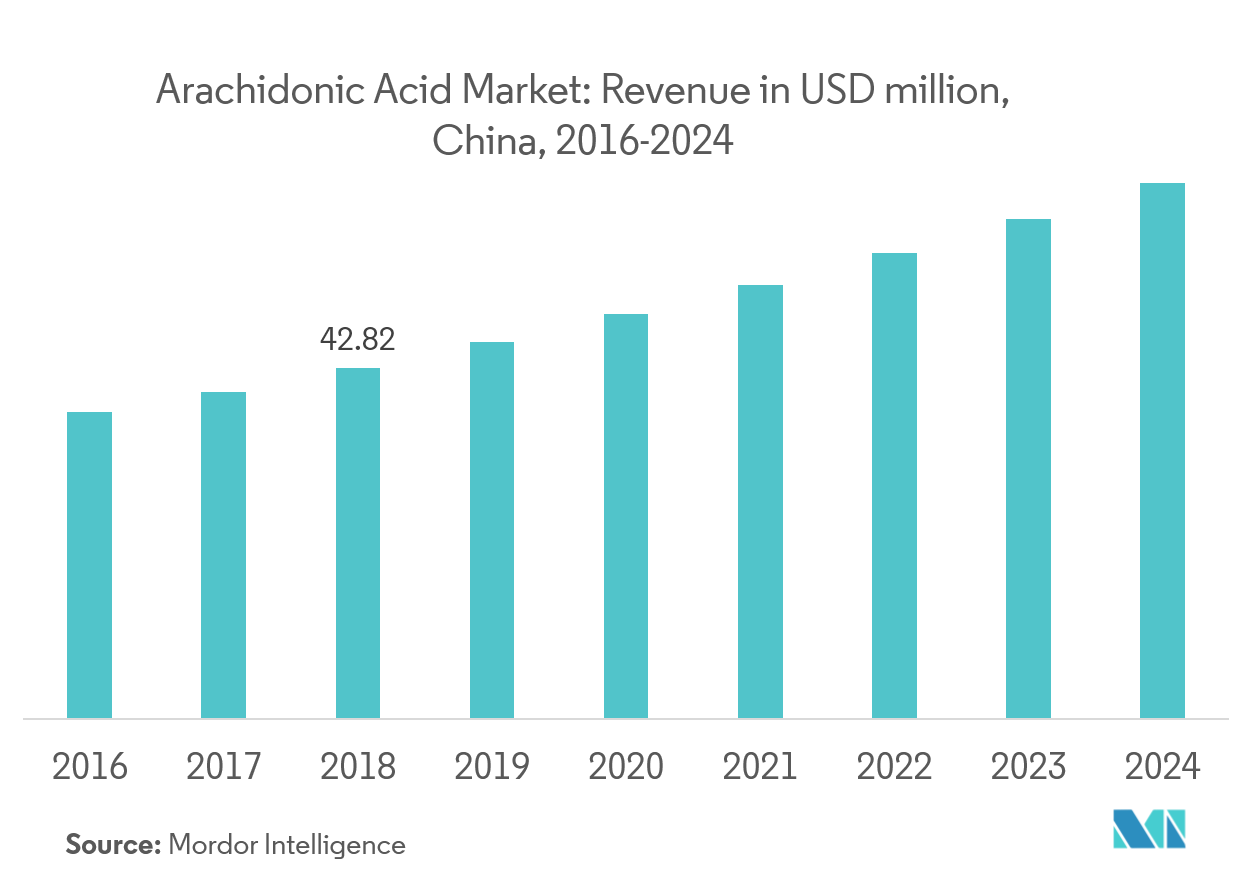

中国是花生四烯酸主要生产国

中国占据该地区市场的最大份额,其次是印度、澳大利亚和亚太其他地区。中国是全球最大的婴幼儿配方奶粉市场,这是其ARA消费量大的主要因素。中国约占全球婴儿配方奶粉市场的65%。由于品质优良,国内对进口婴儿配方奶粉的需求不断增长。日本市场向国际参与者开放,并拥有先进的监管原则,从而推动了花生四烯酸市场的增长。新加坡、马来西亚和泰国的经济相当发达,消费者知道可以使用花生四烯酸产品来改善饮食。

亚太地区花生四烯酸行业概况

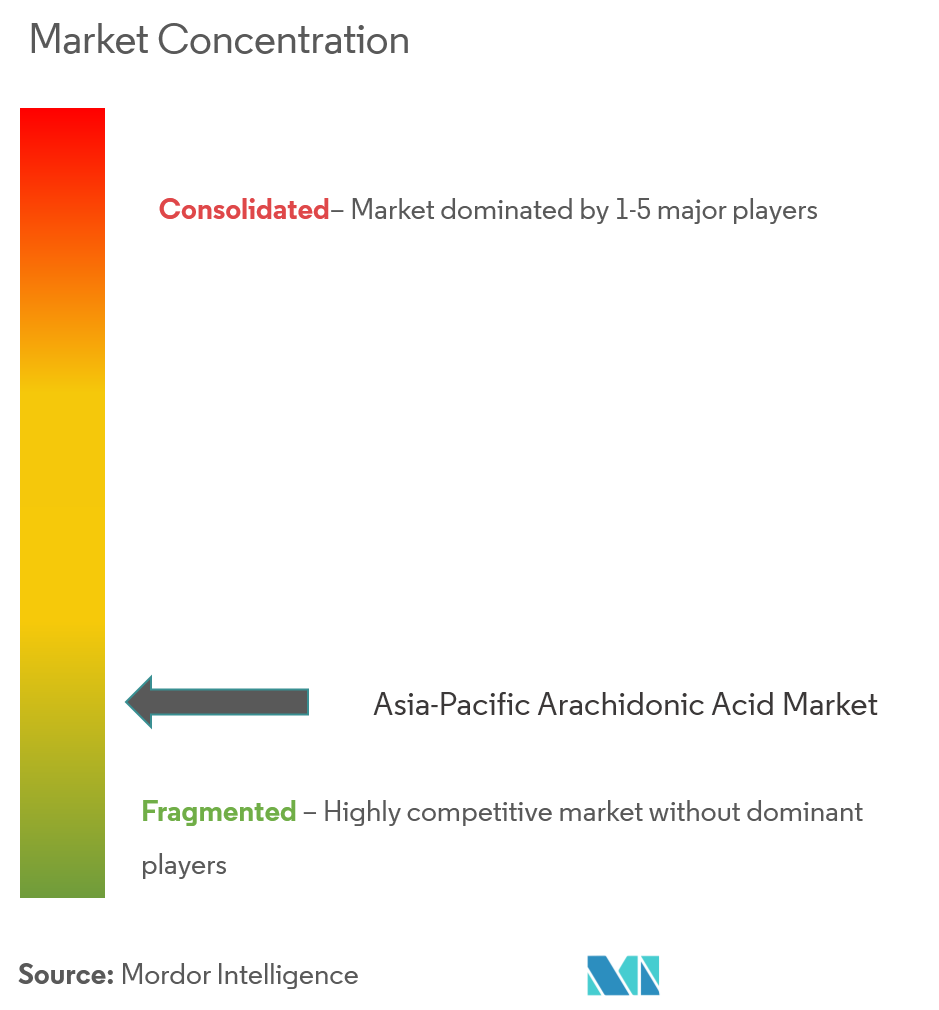

亚太花生四烯酸市场较为分散,主要参与者包括帝斯曼、嘉吉、卡比奥生物工程、广东润科、开曼化学等。生物技术的进步为市场提供了良好的机会。由于商品成本波动,主要竞争对手更愿意投资新产品开发和营销策略,以维持自己的地位。

亚太地区花生四烯酸市场领导者

Cargill Inc.

CABIO Biotech Wuhan Co Ltd

Cayman Chemical

Guangdong Runke Bioengineering Co., Ltd.

Royal DSM

- *免责声明:主要玩家排序不分先后

亚太地区花生四烯酸行业细分

花生四烯酸市场按所使用的技术细分,包括溶剂萃取和固相萃取。在应用类型上,花生四烯酸市场细分为食品饮料和制药。食品和饮料细分市场进一步分为婴儿配方奶粉和膳食补充剂。该研究还涉及对印度、中国、澳大利亚、日本和亚太其他地区等地区的分析。

| 溶剂萃取 |

| 固相萃取 |

| 食品与饮品 | 婴幼儿配方奶粉 |

| 膳食补充剂 | |

| 药品 |

| 亚太 | 印度 |

| 中国 | |

| 澳大利亚 | |

| 日本 | |

| 亚太其他地区 |

| 按技术 | 溶剂萃取 | |

| 固相萃取 | ||

| 按申请 | 食品与饮品 | 婴幼儿配方奶粉 |

| 膳食补充剂 | ||

| 药品 | ||

| 地理 | 亚太 | 印度 |

| 中国 | ||

| 澳大利亚 | ||

| 日本 | ||

| 亚太其他地区 | ||

亚太地区花生四烯酸市场研究常见问题解答

目前亚太地区花生四烯酸市场规模有多大?

亚太地区花生四烯酸市场预计在预测期内(2024-2029年)复合年增长率为7.40%

谁是亚太花生四烯酸市场的主要参与者?

Cargill Inc.、CABIO Biotech Wuhan Co Ltd、Cayman Chemical、Guangdong Runke Bioengineering Co., Ltd.、Royal DSM是亚太花生四烯酸市场的主要公司。

该亚太花生四烯酸市场涵盖几年?

该报告涵盖了亚太地区花生四烯酸市场的历史市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了亚太地区花生四烯酸市场的规模:2024年、2025年、2026年、2027年、2028年和 2029 年。

页面最后更新于:

亚太花生四烯酸行业报告

Mordor Intelligence™ 行业报告创建的 2024 年亚太地区花生四烯酸市场份额、规模和收入增长率统计数据。亚太地区花生四烯酸分析包括至 2029 年的市场预测展望和历史概述。获取此行业分析的样本(免费下载 PDF 报告)。