亚太地区营养化妆品市场分析

今年亚太营养化妆品市场价值XX百万美元,预计未来五年复合年增长率为9.24%。

该地区对食品消费与美容之间联系的认识不断提高,加上消费者对营养和维生素缺乏引起的各种皮肤问题(如皱纹、黑斑、衰老和脱发等)的关注,增加了对美容食品的需求产品反过来又创造了亚太地区对营养美容产品的需求。同样,消费者也将营养美容产品视为一种促进皮肤健康的便捷方式,而无需进行支持皮肤生长的繁琐的夜间例行公事。此外,随着整体美丽和健康的兴起,营养化妆品市场不断增长且竞争日益激烈。由于人们对营养化妆品对指甲、头发和皮肤的优势的认识不断增加,预计亚太地区(主要是中国、日本和印度等国家)的营养化妆品市场将大幅增长。

此外,随着人们对天然、纯素和有机产品的兴趣日益浓厚,由天然成分和可持续制成的营养化妆品在该地区越来越受欢迎。零残忍和环保制造等一些趋势正在进一步推动该地区此类产品的增长。随着对天然产品的需求不断增长,许多新制造商渴望提供此类产品来瞄准适当的消费者群。例如,在印度,SkinLab 提供各种营养美容补充剂,并声称这些补充剂是纯素食且无残忍的补充剂。在美容补充剂方面,天然、植物源、有机和非转基因这些术语变得越来越明显,需求也越来越大,预计将为该地区的参与者创造更多新的机会和消费群。

亚太地区营养化妆品市场趋势

护肤品需求不断增长

日本和中国等国家不断发展的城市化、不断增加的工作人口、不断增长的购买力和不断加剧的老龄化因素一直推动着该地区的市场增长。人们越来越渴望看起来更好并保持皮肤健康,以避免任何不良的皮肤问题,这增加了该地区对护肤营养化妆品的需求。此外,该地区不断增长的工作人口创造了保持皮肤和头发健康的需求,最终推动该地区市场的增长。例如,根据 NITI Aayog 的数据,2021 财年印度全国就业人数超过 5.16 亿,比上一财年全国就业人数仅 5.11 亿有所增加。这些因素增加了该地区对护肤营养化妆品的需求,因为它们被发现是促进和维持皮肤健康的最简单方法。因此,该地区的许多制造商都致力于将其产品组合扩展到营养化妆品类别。例如,2022 年 11 月,印度领先化妆品品牌之一 Colorbar 推出了奇迹软糖,作为其健康系列的一部分。该公司专注于健康和美丽的整体方法,推出了五种款式来满足不同的需求。其产品包括 Hey Gorgeous(针对发光肌肤)、Wow Skin(针对洁净肌肤)和 Love is in the Hair(针对头发)等。该地区发生的此类发展预计将进一步帮助市场渗透,从而推动市场增长。

日本营养化妆品市场正在以更快的速度增长

日本的营养化妆品市场正在以更快的速度增长,产品种类繁多,类别多样,包括功能性食品和饮料以及营养和膳食补充剂。此外,日本消费者普遍倾向于将膳食补充剂纳入日常生活中以支持和维持健康,这也推动了该国对营养化妆品的需求。例如,根据 Healthcare Works Design 的数据,2021 年日本膳食补充剂市场价值约为 1 万亿日元。过去几年,补充剂市场稳步增长,没有出现任何下滑。与此相一致的是,由于生活方式的改变,该国消费者也越来越关注保养皮肤和头发。这清楚地表明了有助于皮肤和头发健康的优质营养化妆品市场的不断增长。

此外,随着营养化妆品市场的不断增长,国内许多大公司都专注于推出只提供营养化妆品的自有品牌,旨在瞄准更大的消费群体,以抢占主要市场份额。例如,2021 年 11 月,日本主要护肤品制造商之一资生堂推出了新的可摄入美容品牌 Inryu。据说该品牌可以从内部改善皮肤的整体健康。该公司声称,当持续服用该品牌提供的系列补充剂时,它们可以将美容成分传播到全身,让消费者每天都焕发光彩。预计该国主要公司的此类举措将进一步向新消费者推广营养化妆品,从而帮助市场在预测期内进一步增长。

亚太地区营养美容品行业概览

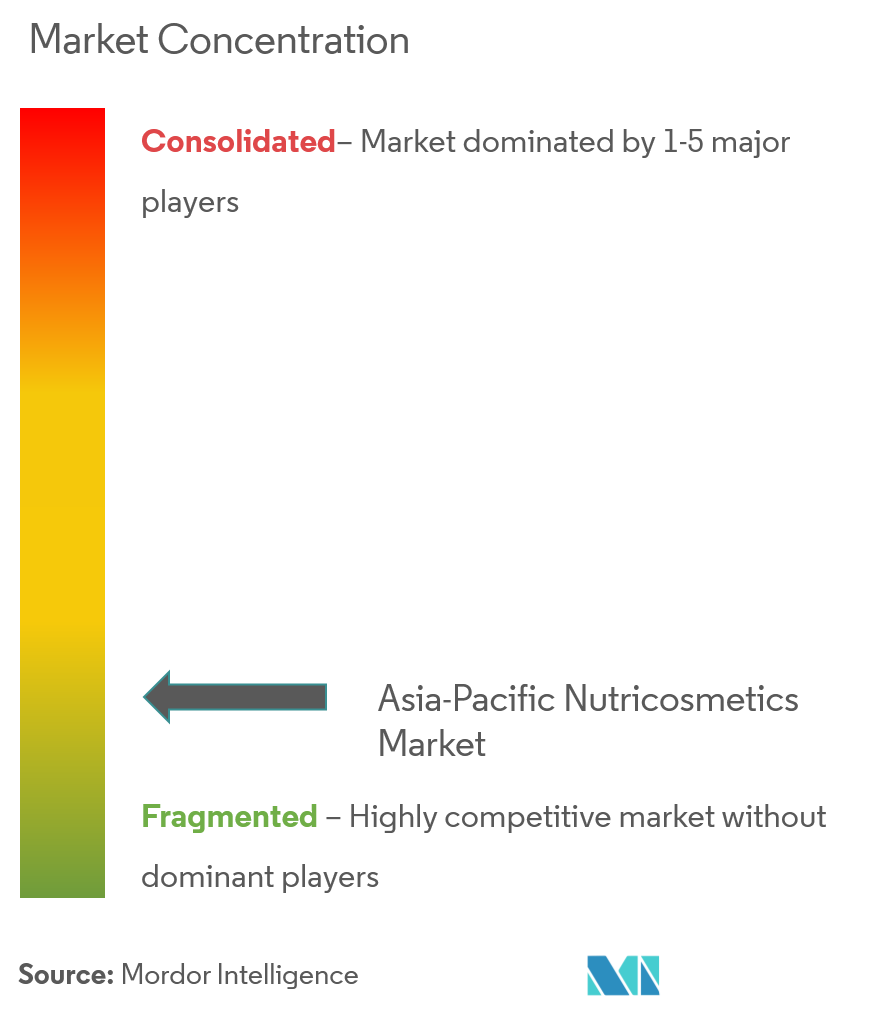

亚太营养化妆品市场分散且竞争激烈,区域和全球参与者数量众多,其需求主要由美容和清洁标签声明驱动。随着营养化妆品需求的不断增长,Dabur India Ltd、Shiseido Cosmetics、FANCL International, Inc.、Jebsen Consumer Products Co. Ltd.和Amway Corporation等主要参与者正在采取并购和研发(RD)等各种策略。以满足市场不断增长的需求。市场上的主要参与者致力于通过向广泛的消费者群体提供产品来增加其市场份额。他们热衷于提供具有不同口味和多功能特性的产品,从而试图渗透市场。

亚太地区营养化妆品市场领导者

Amway

Dabur India Ltd

Shiseido Cosmetics

FANCL International, Inc.

Jebsen Consumer Products Co.. Ltd.

- *免责声明:主要玩家排序不分先后

亚太地区营养美容市场新闻

- 2022 年 11 月,日本补充剂和美容品牌 KINS Co. Ltd 宣布进军新加坡,并在狮城推出护肤系列。 KINS 专门生产使用益生菌来改善健康和保健的订阅产品。

- 2022年1月,来自中国的新初创企业Ortu在中国在线零售商天猫发布了一款清洁标签皮肤保健品。该公司宣布其产品将迎合所有性别、年龄和肤色,并避开传统的美白宣称。

- 2021 年 12 月,健康和护肤品牌Entice在印度市场推出了专门策划的补充剂和有效的产品系列。该品牌于 2021 年 7 月推出网站,旨在在护肤领域带来突破性成果。该公司推出了一个新产品系列,其中包括 Entice 焕彩白茶,据称是富含抗氧化剂的白茶的神秘混合物。

亚太地区营养美容品行业细分

营养美容品是有科学依据的膳食补充剂,口服可促进皮肤健康和美丽。亚太营养化妆品市场按产品类型、形式、分销渠道和地理位置进行细分。根据产品类型,市场分为护肤品、护发品和指甲护理品。根据形式,市场分为片剂和胶囊、粉末和液体、软糖和软咀嚼片。根据分销渠道,市场分为超市/大卖场、药店/药房、专卖店、在线零售商和其他分销渠道。该报告对该地区主要经济体(包括中国、日本、印度、澳大利亚和亚太其他地区)进行了分析。对于每个细分市场,市场规模和预测都是根据百万美元的价值进行的。

| 皮肤护理 |

| 头发护理 |

| 指甲保养 |

| 片剂和胶囊 |

| 粉末和液体 |

| 软糖和软糖 |

| 超市/大卖场 |

| 药店/药房 |

| 专卖店 |

| 网上零售店 |

| 其他分销渠道 |

| 中国 |

| 日本 |

| 印度 |

| 澳大利亚 |

| 亚太其他地区 |

| 产品类别 | 皮肤护理 |

| 头发护理 | |

| 指甲保养 | |

| 形式 | 片剂和胶囊 |

| 粉末和液体 | |

| 软糖和软糖 | |

| 分销渠道 | 超市/大卖场 |

| 药店/药房 | |

| 专卖店 | |

| 网上零售店 | |

| 其他分销渠道 | |

| 地理 | 中国 |

| 日本 | |

| 印度 | |

| 澳大利亚 | |

| 亚太其他地区 |

亚太地区营养化妆品市场研究常见问题解答

目前亚太营养化妆品市场规模有多大?

亚太营养化妆品市场预计在预测期内(2024-2029)复合年增长率为 9.24%

谁是亚太营养化妆品市场的主要参与者?

Amway、Dabur India Ltd、Shiseido Cosmetics、FANCL International, Inc.、Jebsen Consumer Products Co.. Ltd. 是亚太营养化妆品市场的主要运营公司。

亚太营养化妆品市场涵盖哪些年份?

该报告涵盖了亚太营养化妆品市场的历史市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了亚太营养化妆品市场的未来几年规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

亚太营养化妆品行业报告

Mordor Intelligence™ 行业报告创建的 2024 年亚太营养化妆品市场份额、规模和收入增长率统计数据。亚太营养美容分析包括 2024 年至 2029 年的市场预测展望和历史概述。获取此行业分析的样本(免费下载 PDF 报告)。