亚太地区药妆市场分析

亚太地区药妆市场预计到 2025 年将达到 270 亿美元,在预测期内(2020-2025 年)复合年增长率为 7.34%。

- 在该地区,中国、印度和越南等国家为市场参与者提供了巨大的增长机会,这主要是由于千禧一代人口的不断增长。

- 此外,人们对抗衰老、防晒和护发产品等药妆和化妆品的高度认识预计将在不久的将来推动市场的增长。对多功能产品的需求正在推动创新,因为对价格敏感的消费者正在选择同时提供保湿和皮肤保护的产品。

- 公司不断地宣传具有药用功效的化妆品,尤其是在 Facebook、Twitter、YouTube 和 Instagram 等社交网站上,美容博主在这些网站上非常受欢迎。

亚太地区药妆市场趋势

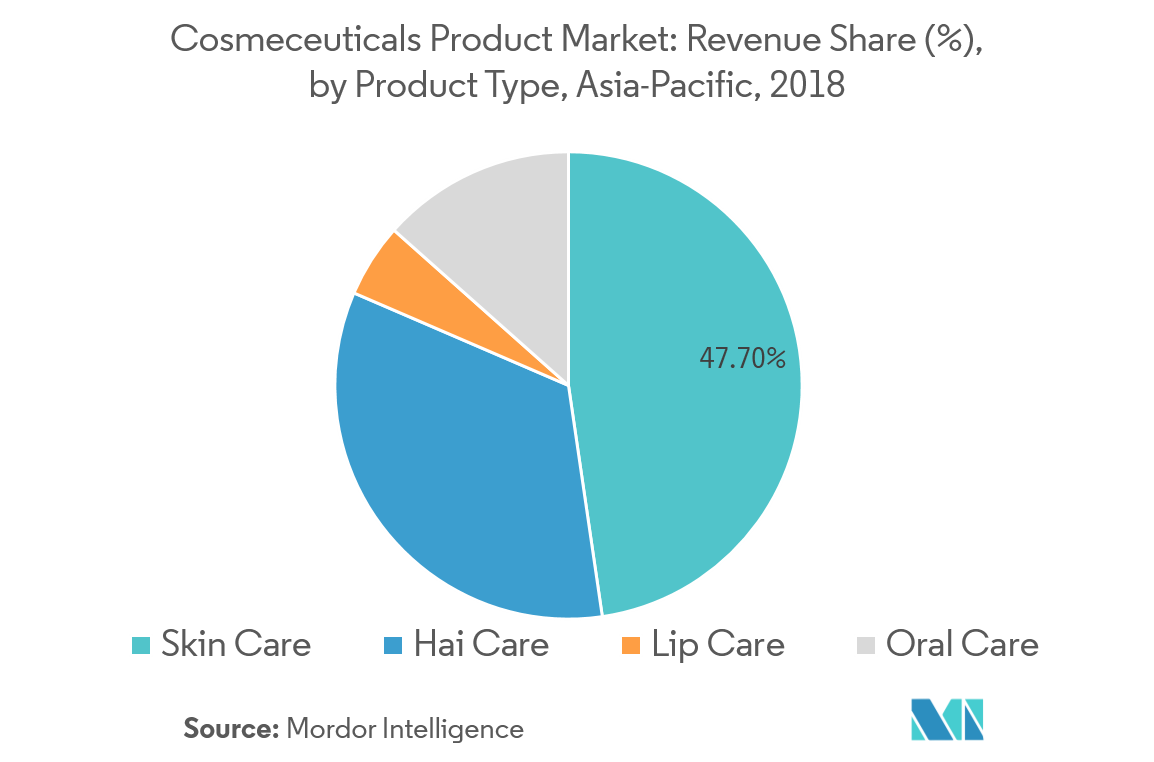

护肤品领域占据领先份额

预计在预测期内,护肤品将成为主导市场,其次是护发品。在皮肤护理产品中,抗衰老细分市场预计将在预测期内贡献最大的收入。抗衰老药妆品的配制是为了对抗衰老对使用者的影响,延缓衰老过程,并弥补气候条件(阳光、寒冷和风)、吸烟、压力和环境刺激物等造成的损害。皱纹、细纹、下垂、毛孔和干燥等问题的增加,使得人们在这些产品上花费更多。亚洲人口迅速老龄化,使衰老成为人们面临的首要美容问题之一,从而导致抗衰老产品的使用量增加。由于亚太地区人口具有美容意识,防晒正在成为美容的重要方面之一。

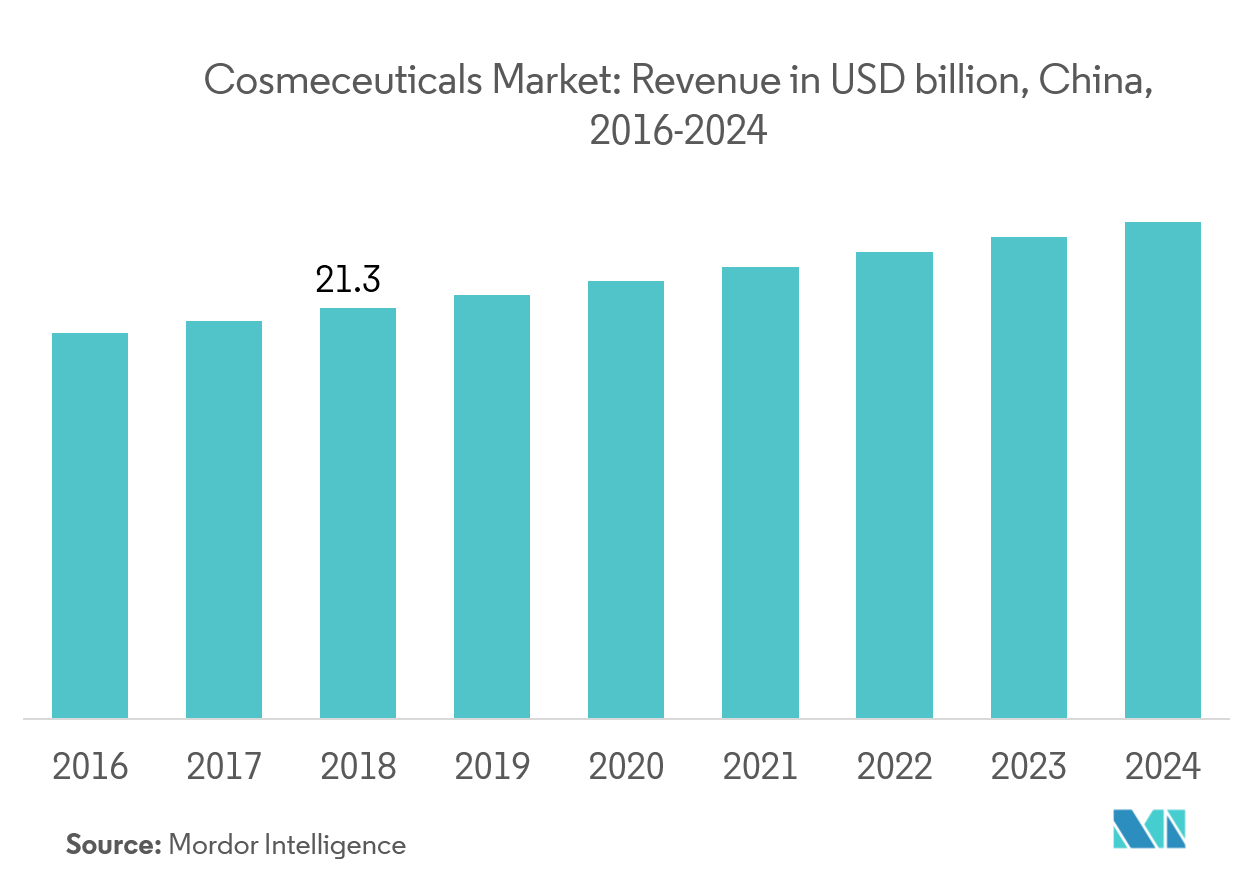

中国主导药妆市场

预计在预测期内,中国药妆市场的复合年增长率为 6.9%。尽管药妆品一词最近在中国开始流行,但它现在已成为该国最受欢迎的产品类别之一。该国消费者忙碌而紧张的生活方式,以及日益恶化的环境条件,使得寻求嫩肤产品的消费者更加关注皮肤状况。这导致药妆品销量增加。中国的药妆产品消费在中国的一线特大城市最为普遍,而在二线和三线城市的渗透率也不断增加,这些城市正在经历着中国不断壮大的中产阶级和中国药妆消费的增长。尽管部分中国消费者愿意为品牌或优质产品付费,但与美国或欧洲消费者相比,消费者往往对品牌忠诚度较低,对价格更加敏感。

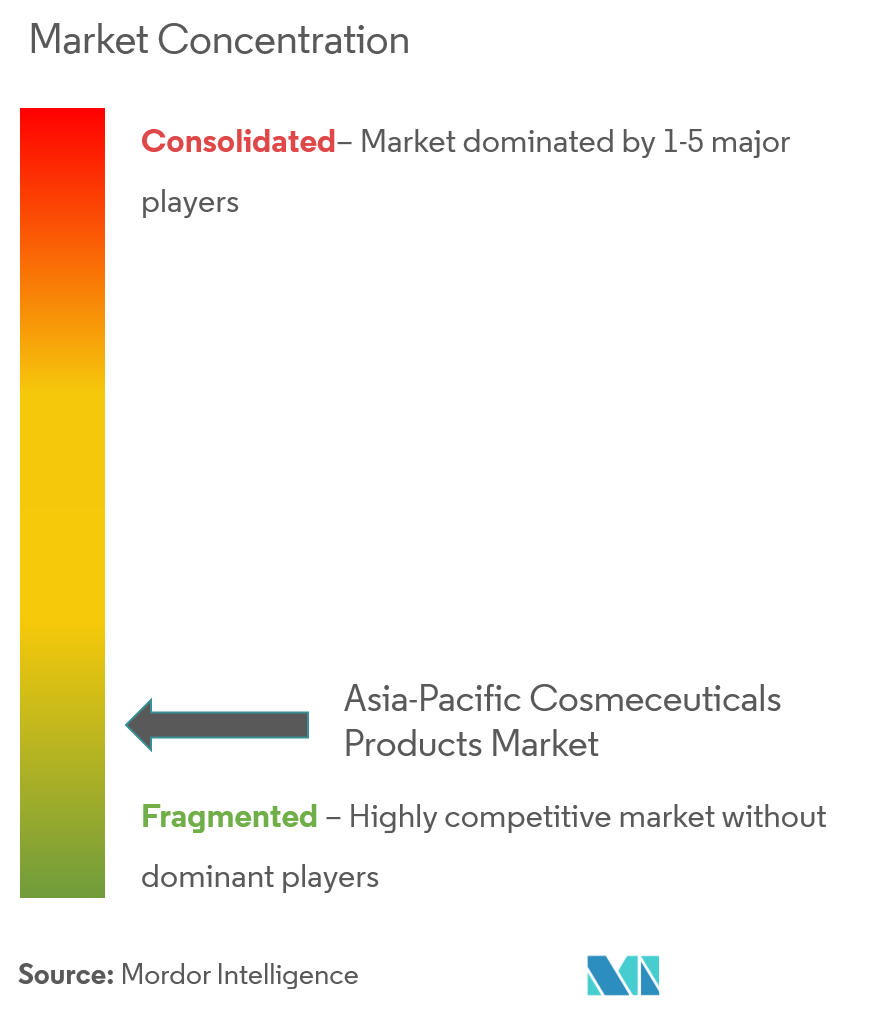

亚太地区药妆行业概况

亚太药妆市场拥有各种全球和区域参与者,包括自有品牌。研究的市场以欧莱雅公司为主导,其次是宝洁公司、雅诗兰黛公司、资生堂集团、联合利华公司、雅芳产品公司和强生公司。市场上的其他知名参与者包括拜尔斯道夫公司、娇韵诗集团、皇家帝斯曼、禾大国际有限公司和露华浓公司等。据观察,知名企业采取了一些针对该地区消费者的主要战略,例如通过强大的数字营销业务打造互联网品牌、吸引消费者注意力的社交媒体活动以及在最发达的地区建立区域中心。该地区的经济体,例如新加坡等东南亚国家。

亚太地区药妆市场领导者

Procter & Gamble Co.

Johnson & Johnson

L'Oreal SA

Unilever Plc

Shiseido Group

- *免责声明:主要玩家排序不分先后

亚太地区药妆行业细分

药妆品是含有生物活性成分的化妆品,据称具有医疗功效。按类型划分,市场分为护肤、护发、唇部护理和口腔卫生领域;按分销渠道划分,市场分为大卖场和超市、便利店、网上和专卖店。护肤品细分市场占据领先份额,护发细分市场紧随其后。在护肤品领域,抗衰老产品最受欢迎,因此总收入最高。目前,专卖店的销售额最大。展望未来,制造商和分销商积极的营销政策将导致全球范围内更多地采用该产品。

| 皮肤护理 | 抗衰老 |

| 抗痘 | |

| 防晒 | |

| 保湿霜 | |

| 其他的 | |

| 头发护理 | 洗发水和护发素 |

| 染发剂和染料 | |

| 其他的 | |

| 唇部护理 | |

| 口腔护理 | |

| 其他的 |

| 大型超市和超级市场 |

| 便利店 |

| 在线的 |

| 专卖店 |

| 其他的 |

| 亚太 | 中国 |

| 日本 | |

| 印度 | |

| 澳大利亚 | |

| 韩国 | |

| 越南 | |

| 亚太其他地区 |

| 按产品类型 | 皮肤护理 | 抗衰老 |

| 抗痘 | ||

| 防晒 | ||

| 保湿霜 | ||

| 其他的 | ||

| 头发护理 | 洗发水和护发素 | |

| 染发剂和染料 | ||

| 其他的 | ||

| 唇部护理 | ||

| 口腔护理 | ||

| 其他的 | ||

| 按分销渠道 | 大型超市和超级市场 | |

| 便利店 | ||

| 在线的 | ||

| 专卖店 | ||

| 其他的 | ||

| 地理 | 亚太 | 中国 |

| 日本 | ||

| 印度 | ||

| 澳大利亚 | ||

| 韩国 | ||

| 越南 | ||

| 亚太其他地区 | ||

亚太地区药妆市场研究常见问题解答

目前亚太地区药妆市场规模有多大?

预计亚太地区药妆市场在预测期内(2024-2029)复合年增长率为 0%

谁是亚太药妆市场的主要参与者?

Procter & Gamble Co.、Johnson & Johnson、L'Oreal SA、Unilever Plc、Shiseido Group是亚太药妆市场的主要运营公司。

亚太药妆市场涵盖哪些年份?

该报告涵盖了亚太地区药妆市场历年市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了亚太地区药妆市场历年规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

亚太地区药妆行业报告

Mordor Intelligence™ 行业报告创建的 2024 年亚太地区药妆市场份额、规模和收入增长率统计数据。亚太地区药妆分析包括 2029 年市场预测展望和历史概览。获取此行业分析的样本(免费下载 PDF 报告)。