Retail Sourcing and Procurement Market Size and Share

Retail Sourcing and Procurement Market Analysis by Mordor Intelligence

The Retail Sourcing and Procurement Market is expected to register a CAGR of 13% during the forecast period.

- Companies across retail sector are repetitively trying to find out the new areas through which they can reduce their total operational costs. Implementing new advanced technologies, such as artificial intelligence, deep learning and blockchain will help to automate the sourcing procurement activities in a better way. For instance, RFID chips can be placed on every product to provide a way for the business owners to track their inventory easily.

- Once implemented, it is very time consuming and cost intensive to reverse the sourcing method or put into practice another technology. Thus it requires sufficient planning to select and execute the sourcing and procurement methods.

Global Retail Sourcing and Procurement Market Trends and Insights

Contract Management to Dominate the Market

- Today’s retailers compete in a highly fluid market with tight margins. In order to compete, companies must have full visibility into supplier relationships and sales performance to reduce leakage and optimize operations. Contracts are key to meeting these challenges.

- In the retail industry, paperwork is done daily for a large number of cashier operations With the right cloud-based contract management solution, it can be faster, cheaper, and safer to manage a company’s contract portfolio.

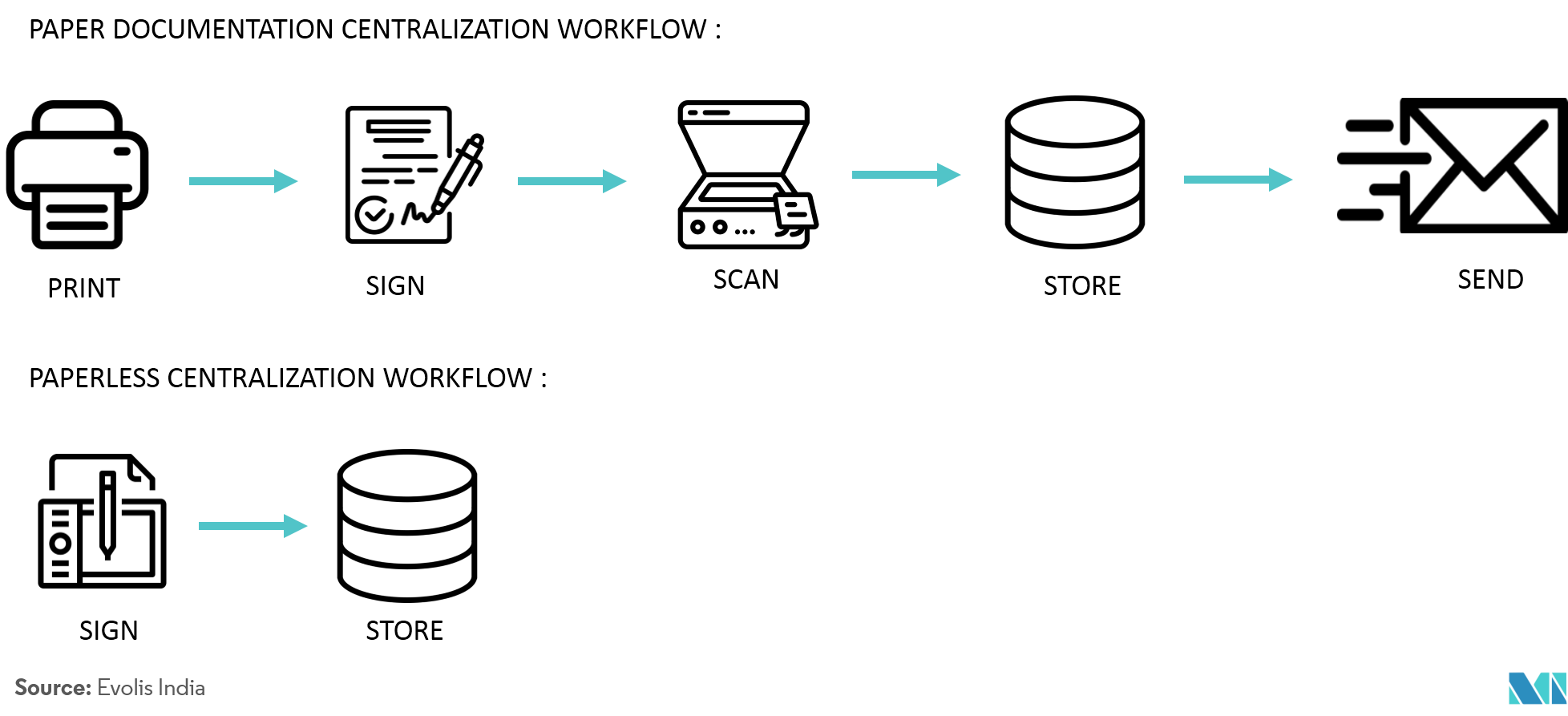

- This traditional paper process leads to significant costs (consumables, printing and sometimes sending) and generates some delays. There is a need for efficient centralization of contract documents by printing, signing, scanning and storing them.

- The latest trend pertaining to contract management is electronic hand signatures. Signature pads are the best choice for capturing electronic handwritten signatures at teller and counter locations. These reliable devices guarantee a low total cost of ownership (TCO).

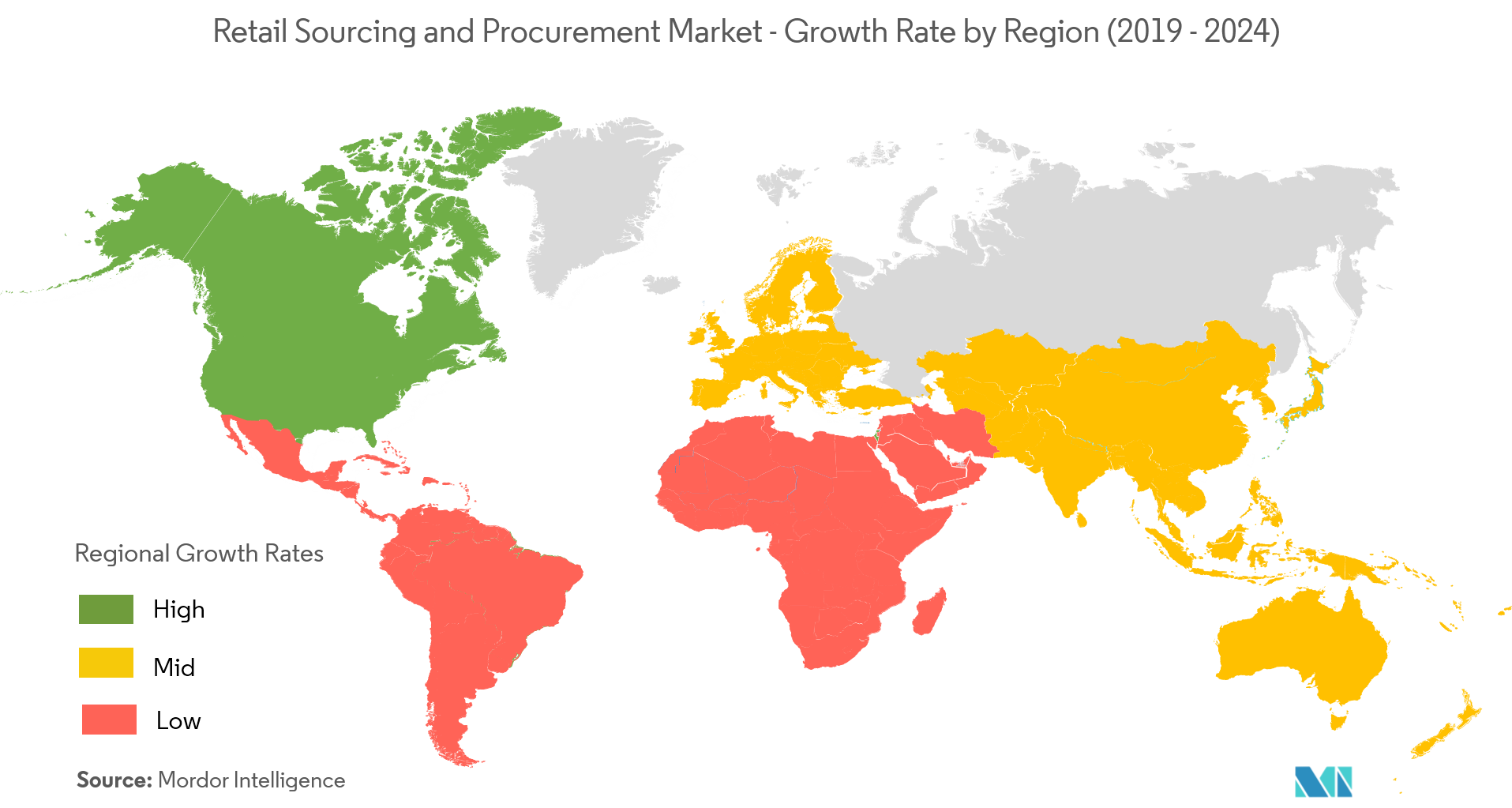

North America to Occupy Major Share

- According to Business.org, the top 20 startups of ecosystems are located in North America, for instance, Austin and Texas have more than 5,500 start-ups, as well as big- tech giant firms, like Facebook, Google, and Apple.

- Owing to this, Retail Enterprises (SMEs and Large) are investing heavily in the North America region and aiding the significant demand for retail sourcing and procurement.

- Furthermore, factors, such as the diverse packaging that increases demand for better network infrastructure, digital penetration in logistics and support, technological advancements are also aiding the market to grow in the region.

- Improved technology and streamlined global supply chains/ logistics have unchained the United States manufacturing from the limitations of geography.

Competitive Landscape

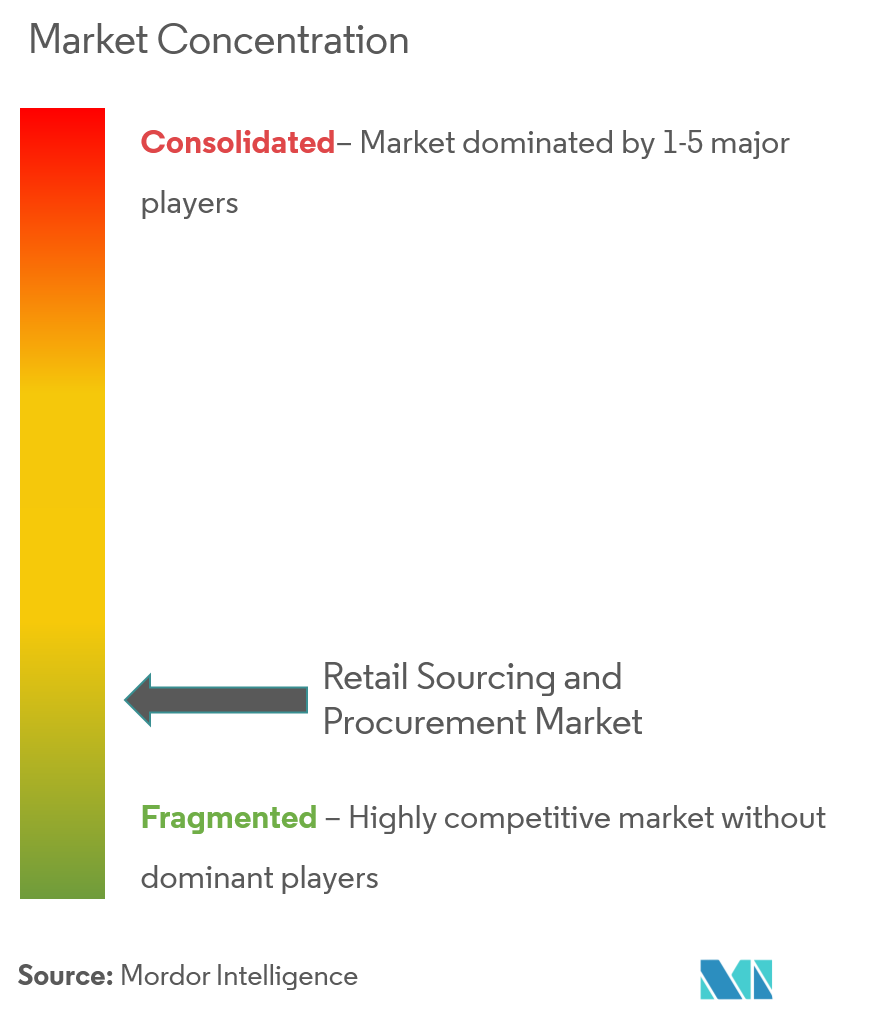

To drivean increase in the need for retail sourcing and procurements software and solutions, different vendors are forming the strategic partnerships with different technology leaders to combine their products with the latest technologies or some automation in the retail sourcing and procurements.

- June 2019 -Inforannounced a new partnership withLinklogis, which will leverage theInfor Nexusplatform to power a suite of financial service solutions designed to reinforce the supply chains of small and medium-sized upstream suppliers that are traditionally underfunded and overlooked.

- June 2019 - HighJump, a global provider of supply chain solutions, announces its selection by Mexican design furniture omnichannel retailerGAIA. GAIA exemplifies HighJump’s growing global footprint and capabilities to meet the unique needs of retailers throughout Latin America with the connected, automated supply chain of the future.

Retail Sourcing and Procurement Industry Leaders

Kinaxis

Proactis Holdings Plc.

Coupa Software

HighJump Software

Basware Corporation

- *Disclaimer: Major Players sorted in no particular order

Global Retail Sourcing and Procurement Market Report Scope

With increasing globalization and growing business complexities, the need for efficient and effective sourcing and procurement solutions is increasing year-over-year. The retail industry has always been prone to constant changes owing to shifting customer preferences. Thus there is a need for implementation of a streamlined process in the retail supply chain.

| On-Premise |

| Cloud |

| Strategic Sourcing |

| Supplier Management |

| Contract Management |

| Procure-to-pay |

| Spend Analysis |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Deployment Type | On-Premise |

| Cloud | |

| By Solution Type | Strategic Sourcing |

| Supplier Management | |

| Contract Management | |

| Procure-to-pay | |

| Spend Analysis | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Retail Sourcing and Procurement Market size?

The Retail Sourcing and Procurement Market is projected to register a CAGR of 13% during the forecast period (2025-2030)

Who are the key players in Retail Sourcing and Procurement Market?

Kinaxis, Proactis Holdings Plc., Coupa Software, HighJump Software and Basware Corporation are the major companies operating in the Retail Sourcing and Procurement Market.

Which is the fastest growing region in Retail Sourcing and Procurement Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Retail Sourcing and Procurement Market?

In 2025, the North America accounts for the largest market share in Retail Sourcing and Procurement Market.

What years does this Retail Sourcing and Procurement Market cover?

The report covers the Retail Sourcing and Procurement Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Retail Sourcing and Procurement Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Retail Sourcing and Procurement Market Report

Statistics for the 2025 Retail Sourcing and Procurement market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Retail Sourcing and Procurement analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.