Automotive MEMS Sensors Market Size and Share

Automotive MEMS Sensors Market Analysis by Mordor Intelligence

The Automotive MEMS Sensors Market is expected to register a CAGR of 7.2% during the forecast period.

- MEMS sensors contribute to numerous advancements in the automotive sector. The world over, vehicle safety has grown to be a serious problem. In addition to in-vehicle navigation systems, rollover detection, and crash detection, MEMS sensors could be incorporated into several other applications. Automotive MEMS sensors are anticipated to have an impact on manufacturers of electronic components, producers of auto parts, and end users. The development of standards and laws for the market for automotive MEMS sensors is of great interest to the governments of various countries.

- The MEMS sensor market for automotive provides various advantages of high efficiency, small size, and low cost. The growing demand for safety and security in automobiles is one of the main factors that has played a vital role in the growth of the market studied. MEMS sensors are also known as micromachines because they make use of the same technology as tiny devices.

- The demand for automotive MEMS sensors has increased due to the growing need for safety and security in automotive applications. The market for automotive MEMS sensors is expanding as a result of rising IoT technology demand and the widespread adoption of connected devices. As a result of MEMS accelerometers' low cost and rigorous self-testing capabilities, g-switches are no longer used in the production of automobiles for airbag control. The drivers influencing the growth of this market are the rise in smart connected device adoption, including connected cars.

- Currently, the two significant trends in the automotive industry are electrification and automation. There has been a rapid integration of high-value sensing modules, like RADAR, LIDAR, and imaging, in automotive systems. As a result, the MEMS sensor's sales volume growth is expected to be significant during the forecast period. The market investigated would create a substantial opportunity for IMU-powered MEMS sensors related to acceleration, LiDAR, and motion detection systems as the premium automakers would approach L5 autonomous driving in the following few years.

- Additionally, the industry's transition to electric vehicles (EVs) has significantly impacted the distribution and demand for pressure and magnetic sensors. It is anticipated that this trend will continue in the long run. As the number of electric vehicle sales rises, the demand for sensors also escalates. There is an increase in sensors for used battery monitoring and various positioning and detection of moving automotive parts.

- However, the COVID-19 pandemic has increased pressure on automakers across the globe to close down their factories after the federal, state, and local governments began advising citizens to spend as much time as possible at home. Various industries have experienced supply chain disruptions as a result of this. For instance, Ford and General Motors halted production at their respective North American manufacturing facilities due to the coronavirus outbreak.

- An automotive MEMS sensor system is typically made up of mechanical and electronic components that work in tandem. Perfect integration of these components is a significant challenge, which can create a challenge for the growth of the automotive MEMS sensor market.

Global Automotive MEMS Sensors Market Trends and Insights

Gyroscope to Witness Significant Growth

- Due to growing concerns about safety, comfort, performance, and stability, OEMs have been attempting to incorporate advanced vehicle features. As a result of this development, the convenience of mechanical components has decreased across the automotive industry while the growth of electronics has accelerated. The gyroscope maintains a higher level of accuracy needed for sophisticated navigation systems embedded in it and the dependability of motion-controlled functionalities because it offers superior stability over time and temperature.

- A gyroscope in automotive has been allowed to measure or maintain the vehicle's orientation and angular velocity. The MEMS-based gyroscope in the ESP (Electronic Stability Control Program) is a widely accepted and powerful safety system in the automotive industry. The ESP system depends on the angular rate sensors to stabilize the car. It detects the vehicle's angular rate around its axis and creates the essential input to the systems that enable the driver to keep the vehicle on track.

- Further, in the rollover detection of the vehicle, a gyroscope is applied to read the roll rate. But as only the roll angle of the vehicle is not sufficient to detect whether the vehicle is going to roll over, a low-g accelerometer is used to read vertical acceleration (Z-axis). The gyroscope used for roll overdetection is almost half the magnitude required in the VDC system but requires excellent rejection of external shock and vibration.

- To enable high-precision data processing and acquisition, semiconductors, passives, and interconnects have all undergone continuous improvement in recent years. Due to the demand for sensors that can withstand temperatures higher than 175 degrees, MEMS sensors are widely accepted. MEMS gyroscopes are used because of their small size, high-temperature tolerance, and low maintenance costs.

North America to Register Significant Growth

- The United States is one of the largest automotive manufacturing hubs in the world. The region's economic growth posed an impact on the sale of passenger and commercial vehicles. According to the American Automotive Policy Council, over the past five years, the exports from the automotive sector were valued at USD 692.0 billion, and the automotive sector alone contributes to 3% of the region's GDP, effectively contributing to the growth of the market studied.

- With changing dynamics in the industry, automotive manufacturers are moving toward electric vehicles and autonomous vehicles to meet the needs of next-generation consumers. Electric vehicle use in the United States has risen rapidly, with an estimated 1.0% of automotive sales in the United States market coming from electric vehicles. According to Governor Newsom, California dominates the United States market regarding electric vehicle (EVs) sales. Its zero-emission vehicle (ZEV) program is driving the demand for EVs by requiring automakers in the state to sell a certain percentage of electric cars.

- In February 2022, California's booming zero-emission vehicle (ZEV) market continued to lead the country. Governor Gavin Newsom praised the state for selling more plug-in electric cars, motorcycles, pickup trucks, SUVs, and SUVs than the combined sales of the following ten states. Such factors will boost the demand for MEMS sensors in Electric Vehicles.

- The preference for electric vehicles is steadily replacing conventional vehicles in North America. Sensors and MEMS-based components are crucial components of the electronic control system in cars. The on-board computer system of contemporary cars, including hybrid electric vehicles and plug-in hybrid vehicles (PHEV), uses data from numerous sensors to inform thousands of decisions. Since the sensors can function under challenging circumstances like extreme temperatures, vibrations, and exposure to environmental contaminants, they are used for security purposes in automobiles.

- Additionally, the region is also expected to be one of the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. In addition, with the increased usage of location services for turn-by-turn navigation, the importance of not losing GPS or GNSS signal due to environments like tunnels, parking garages, and urban canyons has gained more prominence. Thus, many sensor solution companies have been working toward addressing this issue. This is anticipated to augment the demand for automotive MEMS sensors in the region.

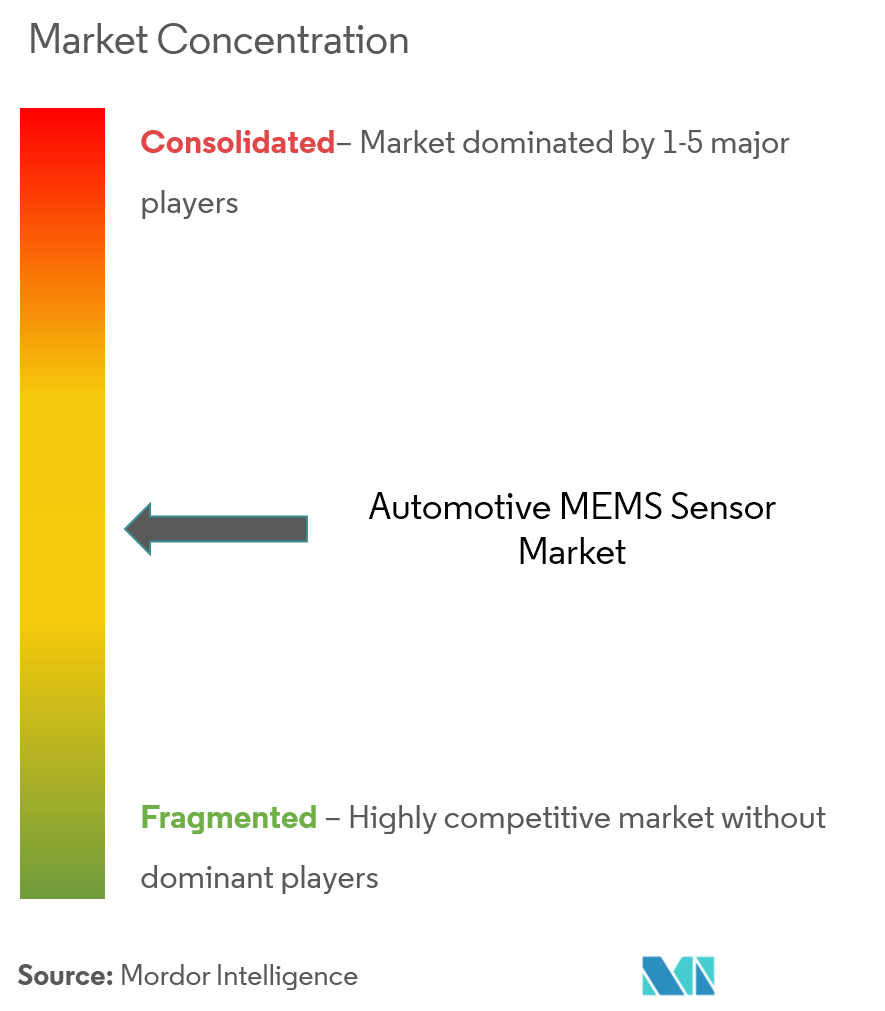

Competitive Landscape

The automotive MEMS sensors market is highly competitive and consists of several major players. In terms of market share, a few of the major players currently dominate the market. These major players, with a prominent market share, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. In October 2022, STMicroelectronics will enable quieter cabins for the electric-vehicle age with an advanced vibration sensor to eliminate road noise. The company announced its AIS25BA, a best-in-class automotive MEMS accelerometer for accurately controlling and quieting the in-cabin acoustic environment. The sensor has the lowest electrical noise in the market, which helps vehicle engineers achieve the calmest possible in-car environment. In September 2022, SiTime Corporation, a leader in precision timing, released a new family of automotive oscillators based on SiTime's cutting-edge MEMS technology. The new differential oscillators are 10 times more durable and guarantee dependable ADAS operation in all weather and road conditions. The AEC-Q100 SiT9396/7 automotive oscillator's introduction increases the SiTime served available market's (SAM) size by USD 50 million.

Automotive MEMS Sensors Industry Leaders

Analog Devices Inc.

Denso Corporation

General Electric Co.

Infineon Technologies AG

Robert Bosch GmbH

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- October 2022: MicroVision, Inc., a leader in MEMS-based solid-state automotive lidar and advanced driver-assistance systems (ADAS) solutions, announced that the MAVIN DR dynamic view lidar system is supported by the NVIDIA DRIVE AGX platform. In order to achieve superior highway pilot functionality with low latency and high performance, MicroVision's solution utilizes high-fidelity lidar sensors and unique perception software.

- February 2022: High-performance MEMS sensors for both automotive and industrial applications will be long-term available thanks to TDK Corporation's InvenSense Product Longevity Program (PLP). All recently introduced Smart Automotive components, as well as all Smart Industrial components, are covered by this program. It aims at sectors with lengthy design cycles and operational lifespans, and it provides OEMs with assurances regarding the long-term sustainability of their product manufacturing.

Global Automotive MEMS Sensors Market Report Scope

Microelectromechanical systems (MEMS) technology is used in various modern automotive sensors. The small size of MEMS sensors provides a quicker response to rapid changes in the measured parameter, and because of the extremely low cost, their use has been extensive. One of the most well-known MEMS devices for automotive applications is inertial and pressure sensors.

The Automotive MEMS Sensors Market is segmented by Type (Tire Pressure Sensors, Engine Oil Sensors, Combustion Sensors, Fuel Injection and Fuel Pump Sensors, Air Bag Deployment Sensors, Gyroscopes, Fuel Rail Pressure Sensors) and Region. The market sizes and forecasts are provided in terms of value (USD million) for all the above segments. The market also assesses the impact of COVID-19 on the market.

| Tire Pressure Sensors |

| Engine Oil Sensors |

| Combustion Sensors |

| Fuel Injection and Fuel Pump Sensors |

| Air Bag Deployment Sensors |

| Gyroscopes |

| Fuel Rail Pressure Sensors |

| Other Types (Airflow Control, Crank Shaft Position Sensors, Roll-over Detection Sensors, and Automatic Door Lock Sensors) |

| North America | United States |

| Canada | |

| Europe | Germany |

| UK | |

| France | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| Rest of Asia-Pacific | |

| Rest of World |

| By Type | Tire Pressure Sensors | |

| Engine Oil Sensors | ||

| Combustion Sensors | ||

| Fuel Injection and Fuel Pump Sensors | ||

| Air Bag Deployment Sensors | ||

| Gyroscopes | ||

| Fuel Rail Pressure Sensors | ||

| Other Types (Airflow Control, Crank Shaft Position Sensors, Roll-over Detection Sensors, and Automatic Door Lock Sensors) | ||

| Geography | North America | United States |

| Canada | ||

| Europe | Germany | |

| UK | ||

| France | ||

| Rest of Europe | ||

| Asia-Pacific | China | |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Rest of World | ||

Key Questions Answered in the Report

What is the current Automotive MEMS Sensors Market size?

The Automotive MEMS Sensors Market is projected to register a CAGR of 7.2% during the forecast period (2025-2030)

Who are the key players in Automotive MEMS Sensors Market?

Analog Devices Inc., Denso Corporation, General Electric Co., Infineon Technologies AG and Robert Bosch GmbH are the major companies operating in the Automotive MEMS Sensors Market.

Which is the fastest growing region in Automotive MEMS Sensors Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Automotive MEMS Sensors Market?

In 2025, the North America accounts for the largest market share in Automotive MEMS Sensors Market.

What years does this Automotive MEMS Sensors Market cover?

The report covers the Automotive MEMS Sensors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Automotive MEMS Sensors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Automotive MEMS Sensors Market Report

Statistics for the 2025 Automotive MEMS Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automotive MEMS Sensors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.