Agricultural Robots and Mechatronics Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 20.40 % |

| Fastest Growing Market | Europe |

| Largest Market | North America |

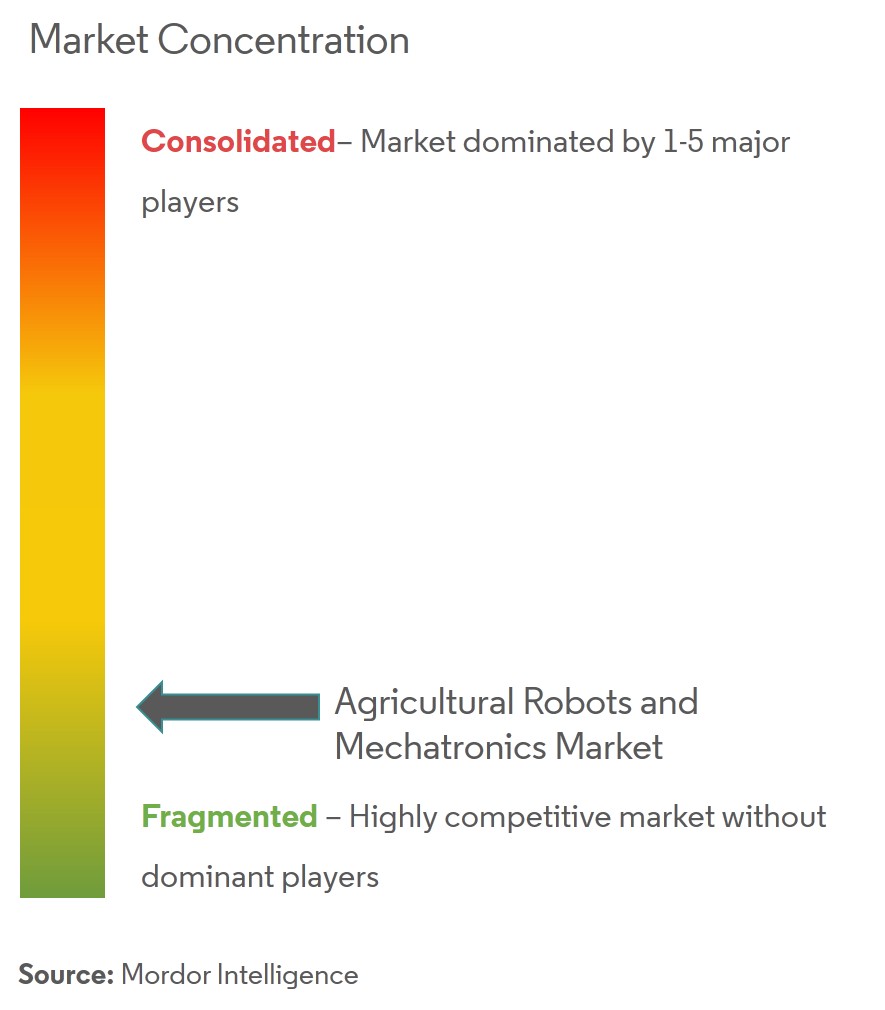

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Agricultural Robots and Mechatronics Market Analysis

The global agricultural robots and mechatronics market are anticipated to grow at a CAGR of 20.4% during the forecast period.

- Robotics will bring the agricultural revolution. However, it would be interesting to see how the farmers, agri-businessmen, and consumers will utilize the power of robotics and digital mechanization to shape the future of this industry. The growing demand for food and increasing urbanization are among the major growth drivers of the global agricultural robot market. Governments have launched several beneficial policies globally to improve awareness and enhance yields. For instance, the European Union has funded projects to replace labor-intensive tasks with advanced automated technologies. This is likely to drive the agricultural robots and mechatronics market to an extent.

- Mobile robots will replace semi-skilled workers. However, there is never going to be an automated farm. There is still a need for farmers, farm managers, and agronomists people to make decisions. On the other hand, some agricultural tasks are better suited for machines. So we will require an increased workforce quality to deal with high-tech machines. In Japan, The government there is investing a lot of money in agricultural robotics to increase the workers' skill level. This, in turn, increases the workers' pay and the quality of life in rural areas.

- The key factors propelling this market's growth are labor shortage, increasing labor cost, increasing demand for food and agriculture supply, the efficiency of work, adoption of emerging technologies, and increasing research on different applications to make human life easier with perfect end results. This will anticipate the growth of the market during the coming years.

Agricultural Robots and Mechatronics Market Trends

This section covers the major market trends shaping the Agricultural Robots & Mechatronics Market according to our research experts:

Shortage and Cost of Labor is Driving the Market

Agricultural robots are autonomous machines used to improve crop quality and efficiency, minimize reliance on manual labor and increase overall productivity. For example, workers on robotic platforms in horticulture and fruit picking are twice as efficient as workers using ladders. The shortage of pickers is already causing more than 10% of fruits and vegetables worldwide to be left unpicked in fields and orchards. This is equivalent to annual consumption in the European Union. Robots may be a viable solution for an industry frequently impacted by labor availability, and they will create different employment opportunities in a modern workforce. According to International Labor Organization(ILO), the agricultural labor percentage of the workforce declined from 81% to 48.2% in developing countries. Also, developed countries are not an exception in such a huge decline.

The World Government Summit launched a report called Agriculture 4.0 - The Future of Farming Technology in collaboration with Oliver Wyman. The report states that meeting these challenges will require a concerted effort by governments, investors, and innovative agricultural technologies. Agriculture 4.0 will no longer depend on applying water, fertilizers, and pesticides uniformly across entire fields. Instead, farmers, agricultural operations will run on sensors, devices, machines, and information technology. Future agriculture will use sophisticated technologies such as robots, temperature and moisture sensors, aerial images, and GPS technology. These advanced devices, precision agriculture, and robotic systems will allow farms to be more profitable, efficient, safe, and environmentally friendly. This will boost the growth of the market during the forecast period.

In 2022, BT unveiled a new robotics platform and management system to automate the agricultural industry and drive sustainability and operational efficiencies to develop novel ways of automating the soft fruit farming industry in ways that will cut costs and labor while promoting robotic and autonomous solutions and offers features sensor technology to monitor crop health and forecast potential issues, helping farmers to intervene before a problem arises, and avoid food waste and unnecessary labor further down the line and which will drive the market in coming years. Owing to the above factors, the market for agricultural robotics and mechatronics is expected to boom during the forecast period.

North America Dominates the Global Market

North America has this position mostly as a result of the US drone market. Currently, the United States is the country that has adopted drones the most in the agricultural industry. Farms are already using drones in the United States for various agricultural tasks, such as pesticide spraying, crop monitoring, sowing, irrigation control, and more. In terms of the deployment of drones and autonomous cars, they are at the forefront of the sector. Robotics is being used in an increasing number of applications in the agricultural space. As such, technological advances are driving growth in the global agricultural robot market.

Robotics is driving the world forward in ways previously unimaginable. In the past decade, advances in robotic tools have enabled less invasive surgical procedures, exploration robots have enhanced human presence in planetary systems, robotic vehicles have autonomously driven millions of miles, and manufacturing robotics have positioned the United States as a leader in advanced manufacturing. The Federal government has a vested interest in the future of the US robotics industry as it will greatly affect the overall US economy to ensure proper workforce transition, including in STEM education, training programs, and re-skilling current workers, so they are prepared to meet future workforce needs.

In 2022, Naio Technologies introduced a new Orio agricultural robot alternative to herbicides that respects soils, improves working conditions, and collects data for smart farming by combining high-edge technology in robotics and AI. Orio can also have a standard three-point attachment and carry any implement at the robot's rear. For instance, high-accuracy seeding is an additional service Orio provides to growers allowing enhanced results when combined with weeding. The company recently released its vineyard robot Ted during CES 2022.

The major factors driving the market studied in North America are large-scale farming operations, the decline in labor, and the need to enhance the productivity of agriculture. In countries like Canada, major driving factors are cost savings achieved through efficient utilization of technology and modern equipment, leading to an overall increase in yield and quality of the crops.

Agricultural Robots and Mechatronics Industry Overview

The global agricultural robots and mechatronics market is moderately fragmented, with the top nine companies accounting for less than 30-35%. In contrast, the rest of the companies account for the remaining share. The major players in the market are Yamaha Motor Company, GEA Group Aktiengesellschaft, DeLaval Inc., Deere and Company (US), and AGCO Corporation, among others. Several companies are rapidly expanding their market presence.

Agricultural Robots and Mechatronics Market Leaders

DeLaval Inc.

GEA Group Aktiengesellschaft

Yamaha Motor Company

Deere and Company (US)

AGCO Corporation (US)

*Disclaimer: Major Players sorted in no particular order

Agricultural Robots and Mechatronics Market News

- February 2023: Yamaha Motor Co., Ltd has announced that it has established a new company in Singapore aimed at expanding its business in Southeast Asia and India, where demand for robots is growing, and intends to secure new clients, as well as provide high-quality after-sales services in line with international standards. The Company will also strengthen its distributor support system while working to expand its distributor network.

- October 2022: Yamaha Motor Co., Ltd has announced that the company has developed a new product, the FAZER R AP, which adds an automatic flight function to the FAZER R industrial unmanned helicopter used for agricultural applications and to help further improve spraying efficiency.

- September 2022: GEA has launched GEA Dairy Feed F4500, an autonomously driving feeding robot that has been designed to take on this task independently and can handle herds of up to 300 cows. At the same time, it uses innovative sensor technology to reduce feed waste to a minimum saving time, money, and natural resources. The GEA Dairy Feed F4500 will initially be available in Germany, Austria, Switzerland, France, and Sweden.

Agricultural Robots and Mechatronics Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions & Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints

4.4 Porter's Five Force Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers/Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products

4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 Type

5.1.1 Autonomous Tractors

5.1.2 Unmanned Aerial Vehicles (UAVs)

5.1.3 Milking Robots

5.1.4 Other Types

5.2 Application

5.2.1 Crop Production

5.2.2 Animal Husbandry

5.2.3 Forest Control

5.2.4 Other Applications

5.3 Geography

5.3.1 North America

5.3.1.1 United States

5.3.1.2 Canada

5.3.1.3 Mexico

5.3.1.4 Rest of North America

5.3.2 Europe

5.3.2.1 Spain

5.3.2.2 United Kingdom

5.3.2.3 France

5.3.2.4 Germany

5.3.2.5 Russia

5.3.2.6 Italy

5.3.2.7 Rest of Europe

5.3.3 Asia-Pacific

5.3.3.1 China

5.3.3.2 India

5.3.3.3 Japan

5.3.3.4 Australia

5.3.3.5 Rest of Asia-Pacific

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle East and Africa

5.3.5.1 South Africa

5.3.5.2 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

6.1 Most Adopted Strategies

6.2 Market Share Analysis

6.3 Company Profiles

6.3.1 AgEagle Aerial Systems

6.3.2 Autonomous Solutions (ASI)

6.3.3 Autonomous Tractor Corporation

6.3.4 AutoProbe Technologies

6.3.5 BouMatic Robotics

6.3.6 Clearpath Robotics Inc.

6.3.7 Conic System

6.3.8 Tetra Laval(DeLaval Inc.)

6.3.9 EcoRobotix Ltd

6.3.10 GEA Group Aktiengesellschaft

6.3.11 Harvest Automation Inc.

6.3.12 Deere & Company

6.3.13 Lely Industries N.V.

6.3.14 Naio Technologies

6.3.15 PrecisionHawk

6.3.16 A/S S. A. Christensen & Co. (SAC Milking)

6.3.17 SenseFly

6.3.18 Vision Robotics Corporation

6.3.19 Vitirover

6.3.20 Wall-Ye

6.3.21 Yamaha Motor Co. Ltd

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Agricultural Robots and Mechatronics Industry Segmentation

Agricultural robots and mechatronics support farmers by performing agricultural operations, such as crop and animal sensing, weeding and drilling, integrating autonomous systems technologies into existing farm operational equipment such as tractors and robotic systems to harvest crops, and conducting complex dexterous operations and allied industry operations. The global agricultural robots and mechatronics market is segmented by type (autonomous tractors, unmanned aerial vehicles (UAVs), milking robots and other types) and application (crop production, animal husbandry, forest control, and other applications). The report offers market sizing and forecasts in terms of value (USD million) for all the above segments.

| Type | |

| Autonomous Tractors | |

| Unmanned Aerial Vehicles (UAVs) | |

| Milking Robots | |

| Other Types |

| Application | |

| Crop Production | |

| Animal Husbandry | |

| Forest Control | |

| Other Applications |

| Geography | |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

|

Agricultural Robots and Mechatronics Market Research FAQs

What is the current Agricultural Robots and Mechatronics Market size?

The Agricultural Robots and Mechatronics Market is projected to register a CAGR of 20.40% during the forecast period (2024-2029)

Who are the key players in Agricultural Robots and Mechatronics Market?

DeLaval Inc., GEA Group Aktiengesellschaft, Yamaha Motor Company, Deere and Company (US) and AGCO Corporation (US) are the major companies operating in the Agricultural Robots and Mechatronics Market.

Which is the fastest growing region in Agricultural Robots and Mechatronics Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Agricultural Robots and Mechatronics Market?

In 2024, the North America accounts for the largest market share in Agricultural Robots and Mechatronics Market.

What years does this Agricultural Robots and Mechatronics Market cover?

The report covers the Agricultural Robots and Mechatronics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Agricultural Robots and Mechatronics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Farming Robots and Mechatronics Industry Report

Statistics for the 2024 Farming Robots and Mechatronics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Farming Robots and Mechatronics analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.