亚太地区糖果市场规模

| 研究期 | 2019 - 2029 | |

| 估计的基准年 | 2023 | |

| 预测数据期 | 2024 - 2029 | |

| 历史数据期 | 2019 - 2022 | |

| CAGR | 6.20 % | |

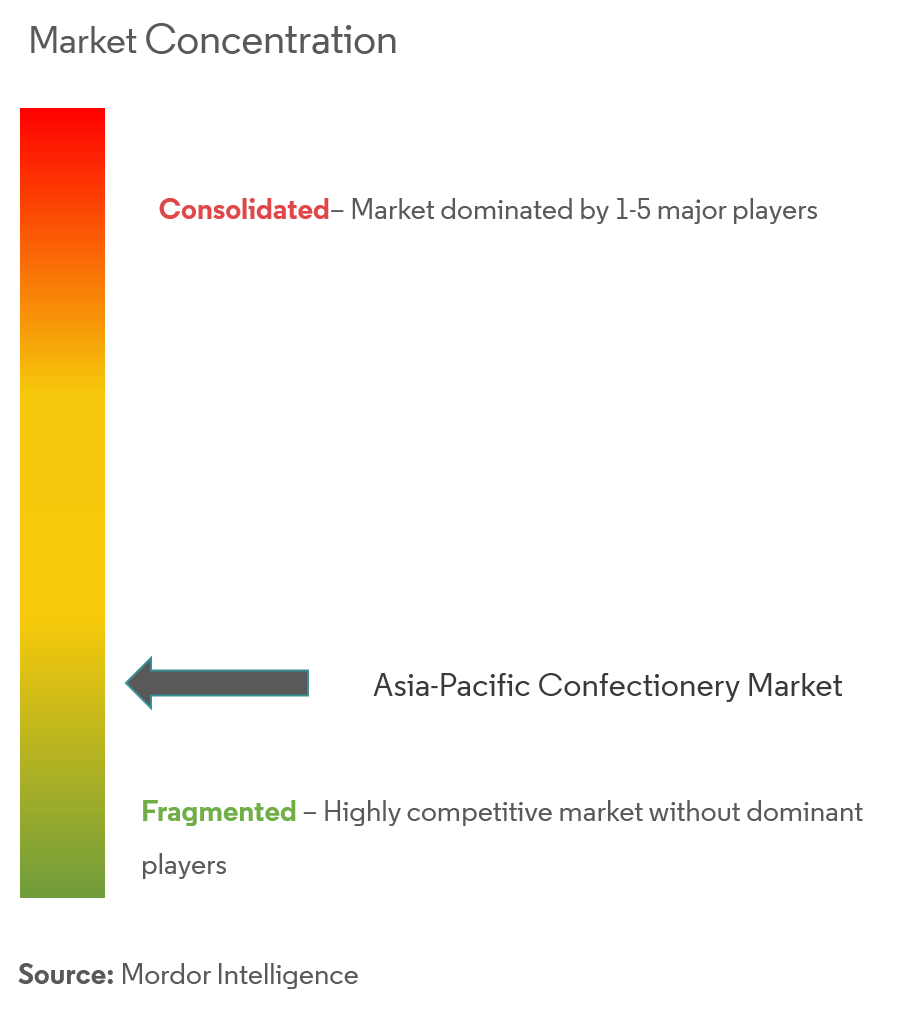

| 市场集中度 | 低的 | |

主要参与者 | ||

*免责声明:主要玩家排序不分先后 |

亚太糖果市场分析

亚太糖果市场预计在预测期内(2020-2025年)复合年增长率为6.2%。

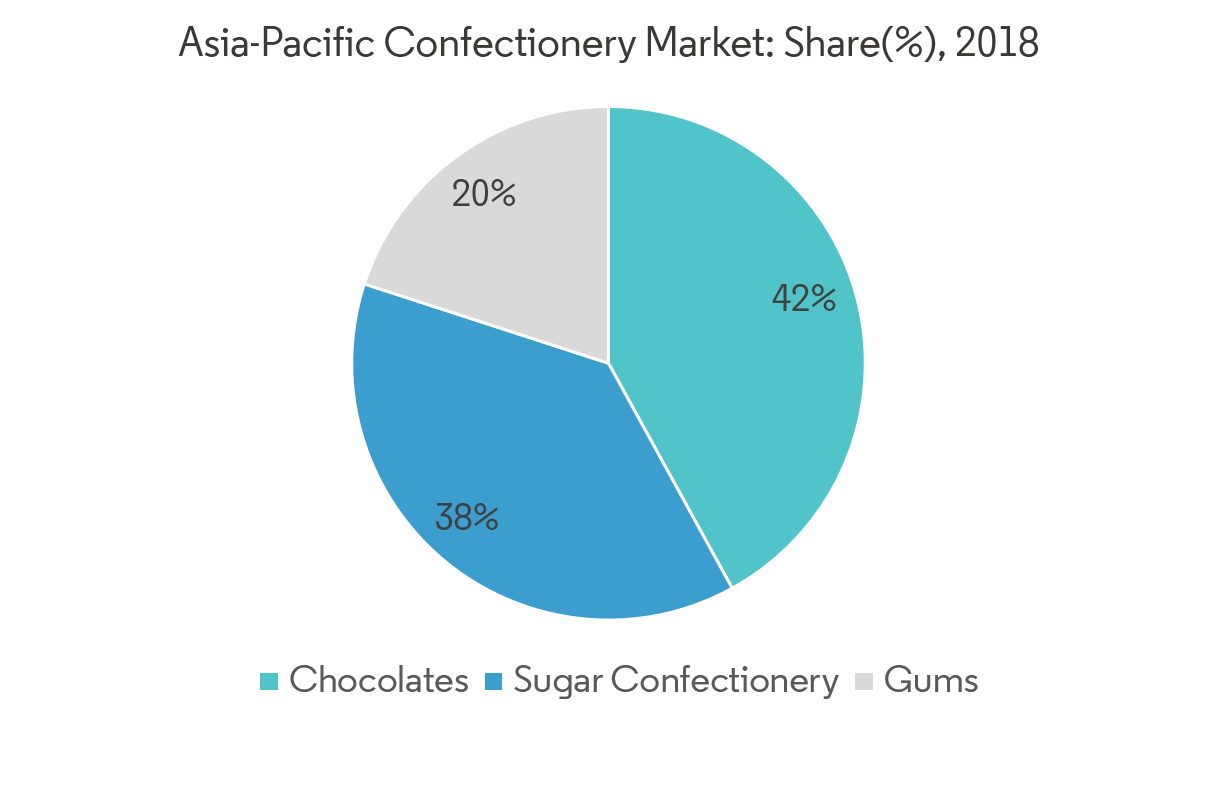

- 由于全球消费量的增加,巧克力是主导市场的最受欢迎的类别,其中亚太地区是一个潜在的市场,因为客户越来越喜欢在这些国家销售和制造的异国情调的糖果产品。

- 亿滋国际 (Mondelēz International) 和费列罗 (Ferrero) 等巧克力公司分别推出了 Lickables 和 Kinder。这些产品的巧克力产品中含有玩具,因此通过包装创新吸引了儿童巧克力产品系列。

巧克力是增长最大的细分市场

亚太地区可支配收入的增加导致亚洲人消费的巧克力多于糖果。这促使制造商通过保持巧克力和巧克力产品中的糖含量来生产健康的巧克力。纯巧克力在亚洲人中越来越受欢迎,因为他们更关心产品的质量。糖果和口香糖作为两餐之间的零食也同样受欢迎。不过,在口香糖领域,最明显的趋势是功能性、草药性和无糖口香糖。此外,未来几年消费者对黑巧克力的偏好将会越来越高。

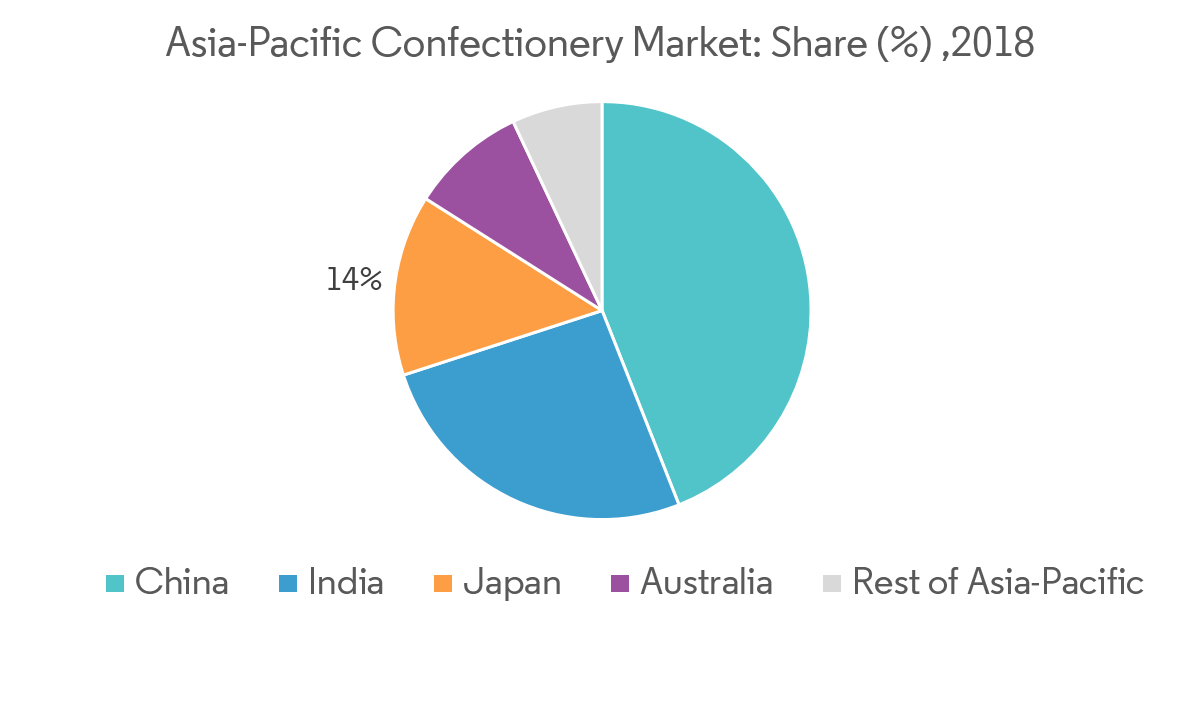

中国主导糖果市场

中国糖果销量的增长主要是由于中国人购买力的上升以及消费者越来越多地使用糖果作为零食。中国推出了许多创新的巧克力产品,使其成为最受欢迎的糖果市场,其次是印度和日本。糖果产品不仅用作礼物,还用作两餐之间的即食零食。中国消费者更喜欢小包装糖果产品,以减少糖的消耗。巧克力也被用作消费者的减压剂。

亚太地区糖果行业概况

亚太糖果市场较为分散,主要参与者包括亿滋国际公司、玛氏公司、雀巢、费列罗等。主要参与者都专注于在线分销渠道,以进行产品的在线营销和品牌推广,以扩大规模他们的地理覆盖范围并增加他们的客户群。玛氏采取了各种战略举措,例如合作伙伴关系和投资,预计将增强其整体业务能力。 2018年2月,该公司的DOVE巧克力扩大了产品范围,在市场上推出了杏仁粉和腰果粉。

亚太糖果市场领导者

Mondeléz International Inc

Mars, Incorporated

Nestle

Ferrero

Meiji Holdings Co., Ltd.

*免责声明:主要玩家排序不分先后

亚太糖果市场报告 - 目录

1. 介绍

- 1.1 研究成果

- 1.2 研究假设

- 1.3 研究范围

2. 研究方法论

3. 执行摘要

- 3.1 市场概况

4. 市场动态

- 4.1 市场驱动因素

- 4.2 市场限制

- 4.3 波特五力分析

- 4.3.1 新进入者的威胁

- 4.3.2 买家/消费者的议价能力

- 4.3.3 供应商的议价能力

- 4.3.4 替代产品的威胁

- 4.3.5 竞争激烈程度

5. 市场细分

- 5.1 类型

- 5.1.1 巧克力糖果

- 5.1.1.1 黑巧克力

- 5.1.1.2 白巧克力和牛奶巧克力

- 5.1.2 糖果

- 5.1.2.1 水煮甜点

- 5.1.2.2 太妃糖、焦糖和牛轧糖

- 5.1.2.3 软糖、口香糖、果冻和咀嚼物

- 5.1.2.4 薄荷糖

- 5.1.2.5 其他的

- 5.1.3 小吃店

- 5.1.3.1 谷物棒

- 5.1.3.2 能量棒

- 5.1.3.3 其他小吃店

- 5.2 分销渠道

- 5.2.1 超市/大卖场

- 5.2.2 便利店

- 5.2.3 专业零售商

- 5.2.4 网上零售

- 5.2.5 其他分销渠道

- 5.3 地理

- 5.3.1 中国

- 5.3.2 日本

- 5.3.3 印度

- 5.3.4 澳大利亚

- 5.3.5 亚太其他地区

6. 竞争格局

- 6.1 市场份额分析

- 6.2 最活跃的公司

- 6.3 最采用的策略

- 6.4 公司简介

- 6.4.1 Mondelez International Inc.

- 6.4.2 Mars, Incorporated

- 6.4.3 Nestle

- 6.4.4 Ferrero

- 6.4.5 Meiji Holdings Co., Ltd.

- 6.4.6 The Hershey Company

- 6.4.7 Lotte Confectionery Co. Ltd

- 6.4.8 Lindt & Sprungli AG

7. 市场机会和未来趋势

亚太地区糖果行业细分

亚太糖果市场按产品类型细分,包括巧克力糖果、糖果和零食棒。巧克力糖果部分进一步细分为黑巧克力、白巧克力和牛奶巧克力。糖果包括硬糖、太妃糖、焦糖和牛轧糖、锭剂、口香糖、果冻和咀嚼物、薄荷糖等。小吃店部分包括谷物棒、能量棒和其他小吃店。根据分销渠道,市场分为超市和大卖场、便利店、专业零售商、网上零售和其他分销渠道。该研究还涉及对中国、日本、印度、澳大利亚和亚太地区其他地区等地区的分析。

| 巧克力糖果 | 黑巧克力 |

| 白巧克力和牛奶巧克力 | |

| 糖果 | 水煮甜点 |

| 太妃糖、焦糖和牛轧糖 | |

| 软糖、口香糖、果冻和咀嚼物 | |

| 薄荷糖 | |

| 其他的 | |

| 小吃店 | 谷物棒 |

| 能量棒 | |

| 其他小吃店 |

| 超市/大卖场 |

| 便利店 |

| 专业零售商 |

| 网上零售 |

| 其他分销渠道 |

| 中国 |

| 日本 |

| 印度 |

| 澳大利亚 |

| 亚太其他地区 |

| 类型 | 巧克力糖果 | 黑巧克力 |

| 白巧克力和牛奶巧克力 | ||

| 糖果 | 水煮甜点 | |

| 太妃糖、焦糖和牛轧糖 | ||

| 软糖、口香糖、果冻和咀嚼物 | ||

| 薄荷糖 | ||

| 其他的 | ||

| 小吃店 | 谷物棒 | |

| 能量棒 | ||

| 其他小吃店 | ||

| 分销渠道 | 超市/大卖场 | |

| 便利店 | ||

| 专业零售商 | ||

| 网上零售 | ||

| 其他分销渠道 | ||

| 地理 | 中国 | |

| 日本 | ||

| 印度 | ||

| 澳大利亚 | ||

| 亚太其他地区 | ||

市场定义

- Vehicle Types - Passenger Vehicles, Commercial Vehicles and Motorcycles are the vehicle types considered under the automotive lubricants market.

- Product Types - For the purpose of this study, lubricant products such as engine oils, transmission oils, greases and hydraulic fluids are taken into consideration.

- Service Refill - Service refill is the primary factor considered while accounting the lubricant consumption for each of the vehicle segments, under the study.

- Factory Fill - First lubricant fill-ups for newly produced vehicles are considered.

研究方法

Mordor Intelligence在所有报告中都遵循四步方法。