Tube & Stick Packaging Market Size and Share

Tube & Stick Packaging Market Analysis by Mordor Intelligence

The Tube & Stick Packaging Market is expected to register a CAGR of 5.6% during the forecast period.

- The use of multilayered laminated tubes and stick packaging has increased for the use in packaging of skincare, pharmaceutical products, food packaging, and others. Companies are investing in R&D for advanced packaging solutions, which are more naturally made.

- The application in the pharmaceutical industry is driving the growth of the market, especially medicines that are used in Dermatology, where tube packing is extensively used. Global pharmaceutical sales globally in 2018 were 110 billion USD, according to AstraZeneca, pharmaceutical and biopharmaceutical company. Further the future growth of the pharmaceutical sector will drive the demand especially for tubes and stick packaging.

- Furthermore, the increases in strict government regulations for the secure usage of the plastic packaging for various applications might challenge the market growth of tube & stick packaging. However, the increasing investments made by the packaging vendors might result in the improvement of the manufacturing process and coming out with better innovations for the tube & stick packaging materials.

Global Tube & Stick Packaging Market Trends and Insights

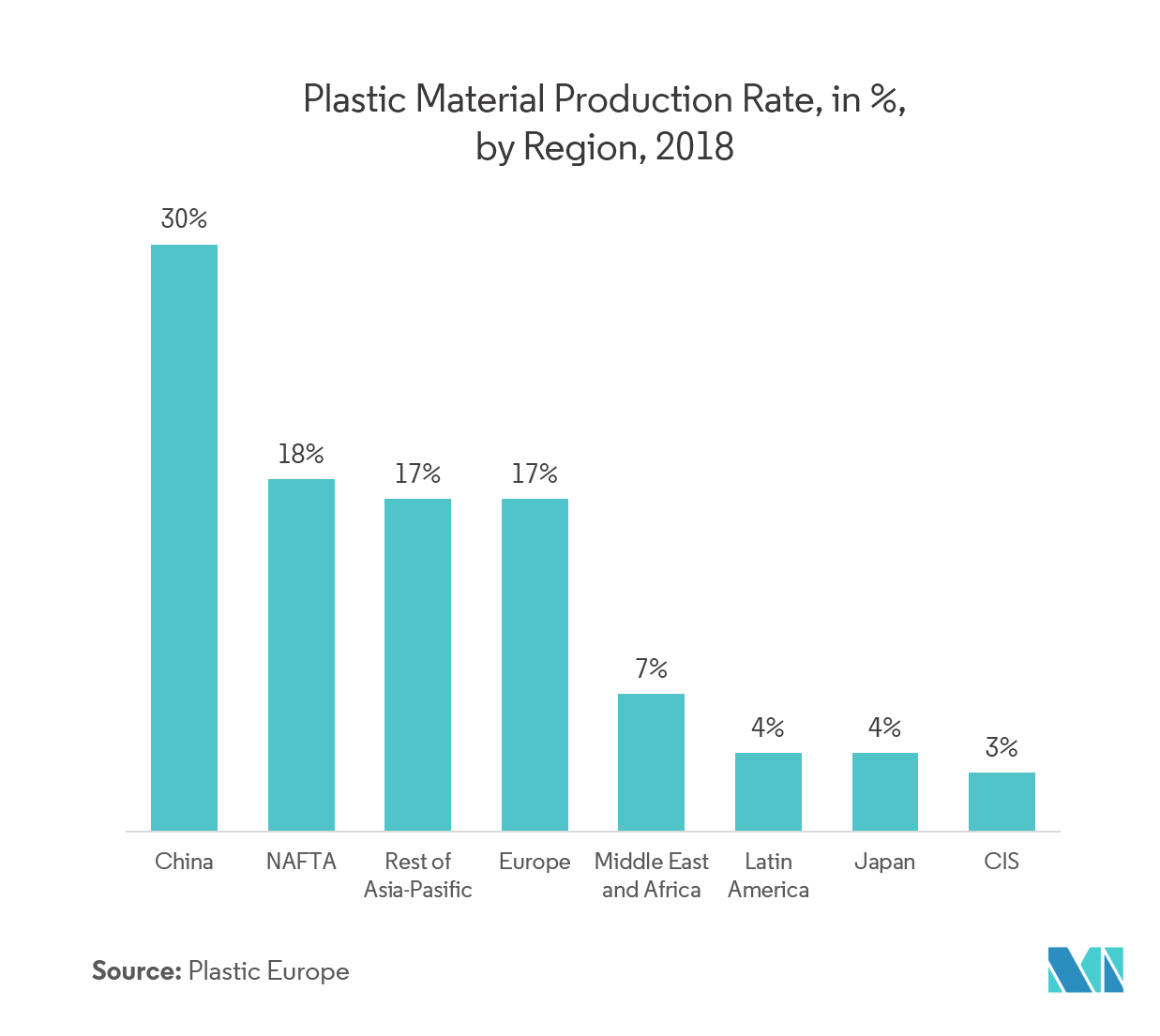

Plastic Packaging is Expected to Continue Significant Demand

- Plastic is the material that is used the most in the production of tube & stick packaging due to its ability to be lightweight, flexible, durable, and other plastic properties. The manufacturing cost is low; besides, it is odor-free, can be transparent, and can have a pleasant demeanor.

- As convenience and regimen are gaining influence beyond regions, the demand for plastic tubes is thrusting, particularly in the cosmetic industry.

- However, over the last decade, the environmental consequences of plastic have transpired in a retardation of the segment. Nevertheless, sustainable packaging has ensured notable amounts of plastic recycling and innovations in material technology that have enabled the development of environment-friendly plastic packaging solutions.

- Furthermore, increased focus and developments in recycled plastic are overruling the drawbacks of plastics.

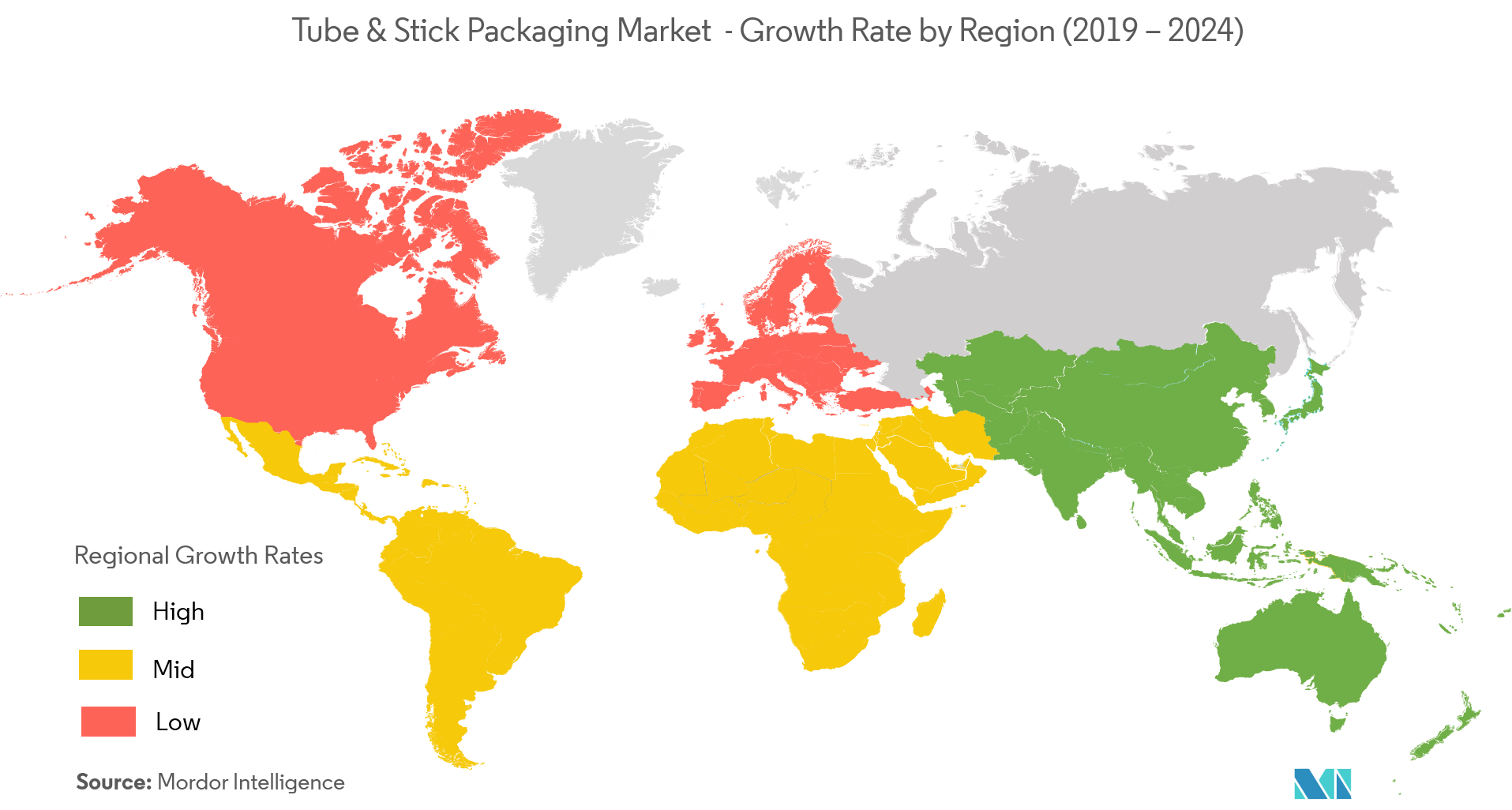

Asia-Pacific Expected to Hold a Significant Market Share

- Strong population and improvements in the lifestyle and living standards evident across the Asia-Pacific region, which are driving the demand for consumer products such as food and cosmetic. Further, increasing awareness for health and hygiene, are driving the market for pharmaceuitical products in the region. Therefore substantiating the high demand for packaging products.

- The region is also a strong export nation in terms of cosmetic products. The increase in the export of cosmetic products to the United States is likely to spur demand in the region. According to the International Trade Administration, over 20% of the US Global exports are via Asian countries.

- In China, with a population of 1.37 billion, the oral disease has a significant burden on the government healthcare system and is an even more significant economic burden on individuals. Therefore the demand for healthcare and hygiene in the country is also high. Furthermore, periodontal diseases are common in regions such as India. These factors have resulted in an increased demand for toothpaste and other oral care products that use a tube and stick packaging.

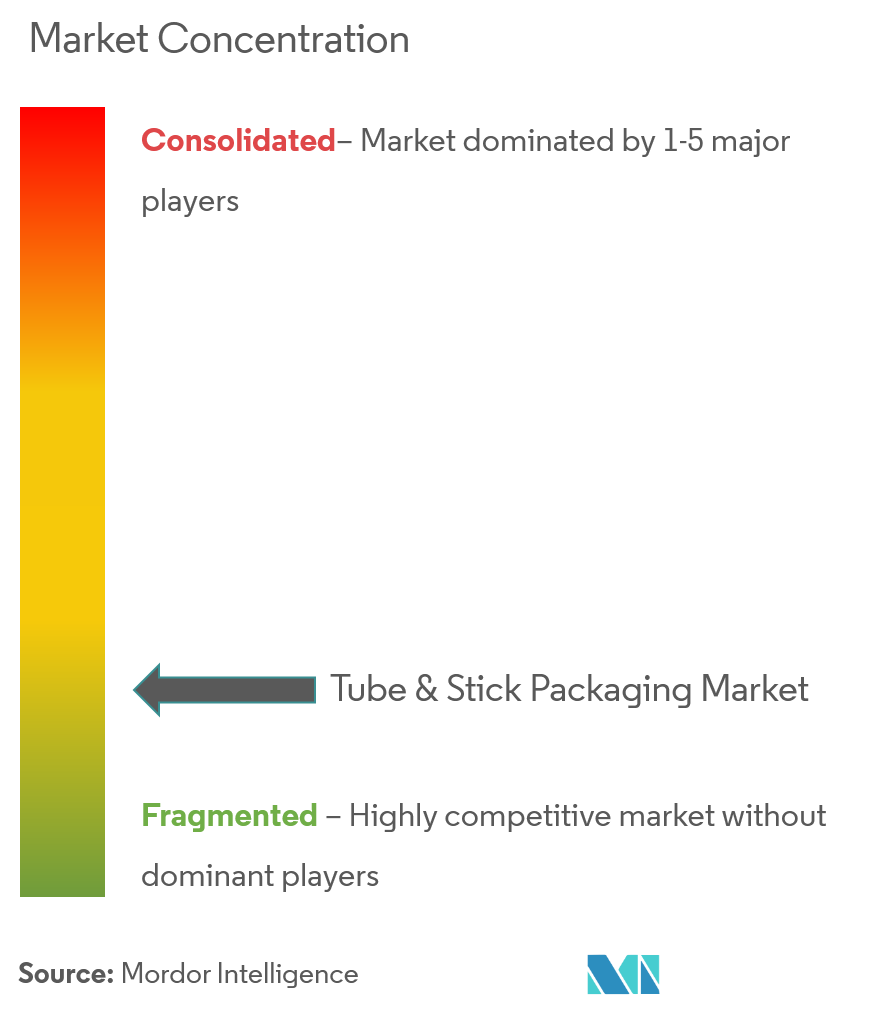

Competitive Landscape

Thetube and stick packaging market is highly fragmented due to the presence of a multiple players across regions. Sustainable competitive advantage can be gained through innovation in the material used to make products as in design, technology, and application.Some key market players in the market are Amcor, Berry, Sonoco, Printpack, among others.Some key recent developments in the market include:

- June 2019 - Amcor acquired Bemis. The acquisition of Bemis by Amcor brings additionalcapabilities that will strengthen Amcor’s industry-leading value proposition and generate significant value for shareholders. Also, thisacquisition will bringother additional range, capabilities that will enhance Amcor’s industry-leading in terms of a value proposition.

- March 2018 -Packaging companies, Amcor and SIG, partnered for aluminum sourcing. The collaboration aimedat ensuring the supply chain of aluminum material meets the statutes of the Aluminum Stewardship Initiative (ASI).

Tube & Stick Packaging Industry Leaders

Berry Global Inc.

Amcor PLC

Constantia Flexibles Group GmbH

Albae S.A.

Essel Propack Limited

- *Disclaimer: Major Players sorted in no particular order

Global Tube & Stick Packaging Market Report Scope

The tube & stick packaging market study coversapplications in personal care,like creams, ointments, gels, and even thick liquids, eatables, pharma products, etc. A variety of packing products like squeeze, twist, stick, and are primarily made up of plastic, paper, and aluminum, etc., were analyzed as a part of the study.

| Squeeze |

| Twist |

| Cartridge |

| Other Packaging Types |

| Plastic |

| Paper |

| Aluminium |

| Other Materials |

| Personal Care |

| Healthcare |

| Food |

| Homecare |

| Other Applications |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Packaging Type | Squeeze |

| Twist | |

| Cartridge | |

| Other Packaging Types | |

| By Material Type | Plastic |

| Paper | |

| Aluminium | |

| Other Materials | |

| By Application | Personal Care |

| Healthcare | |

| Food | |

| Homecare | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Tube & Stick Packaging Market size?

The Tube & Stick Packaging Market is projected to register a CAGR of 5.6% during the forecast period (2025-2030)

Who are the key players in Tube & Stick Packaging Market?

Berry Global Inc., Amcor PLC, Constantia Flexibles Group GmbH, Albae S.A. and Essel Propack Limited are the major companies operating in the Tube & Stick Packaging Market.

Which is the fastest growing region in Tube & Stick Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Tube & Stick Packaging Market?

In 2025, the Asia Pacific accounts for the largest market share in Tube & Stick Packaging Market.

What years does this Tube & Stick Packaging Market cover?

The report covers the Tube & Stick Packaging Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Tube & Stick Packaging Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Tube & Stick Packaging Market Report

Statistics for the 2025 Tube & Stick Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Tube & Stick Packaging analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.