North America Soy Beverages Market Analysis by Mordor Intelligence

The North America Soy Beverages Market is expected to register a CAGR of 6.14% during the forecast period.

- The popularity of soy beverages can be attributed to their increased availability and scientific facts that prove health benefits associated with soy; these include lowering of blood cholesterol and reduction of risk of cancers.

- The growing demand for thirst-quenching products, health and hygiene concerns, multiple market distribution channels and social acceptance of soy are expected to help the market grow at a good pace.

North America Soy Beverages Market Trends and Insights

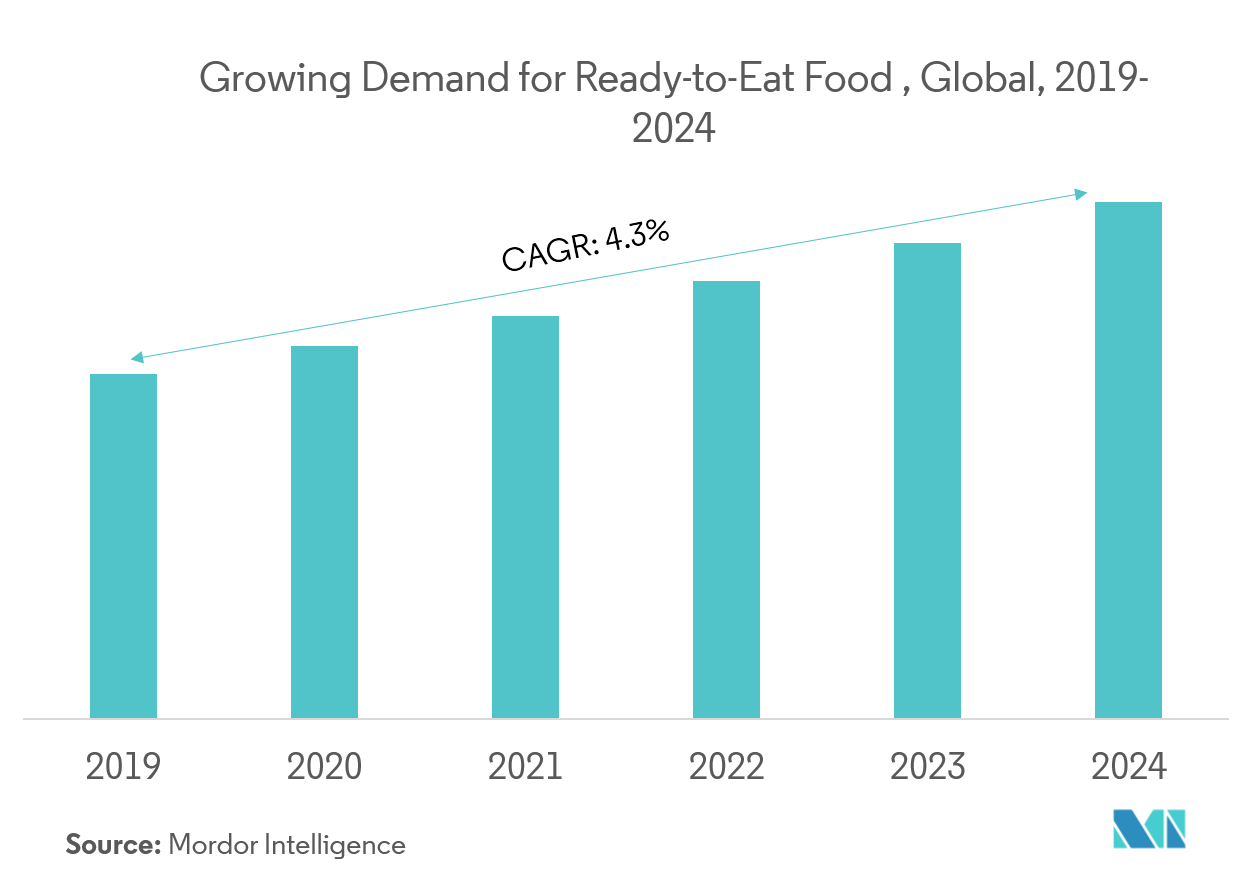

Growing Consumption of Processed Foods and Beverages

The demand for processed foods, such as ready-to-eat, ready-to-cook, canned foods and bottled beverages, among others, is very high in the North America, with the increasing adoption rate of advanced food processing technologies. The rapidly-changing consumer lifestyle is the primary factor driving the processed food market. The demand for convenience foods has grown among working women population. The rising emphasis on healthy snacks and beverages, increase in disposable incomes, ever-growing population and demand for better quality are some other major factors affecting the soy beverage market.

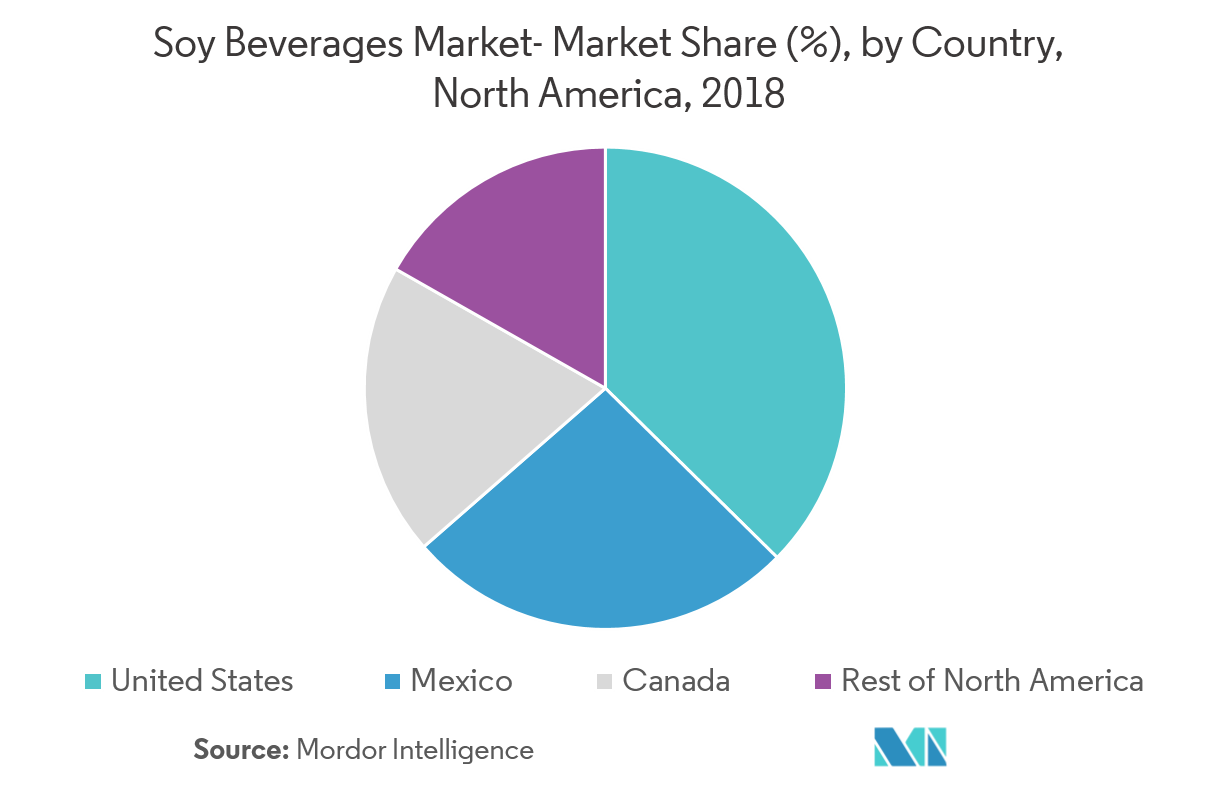

United States Holds the Major Share in Soy Beverage Market

North America is a fast-growing market, with the United States holds the largest market share in soy beverage market. The US has the highest projected growth rate, followed by Canada and Mexico. The popularity of soy beverages in North America can be attributed to their increased availability and scientific facts that prove health benefits associated with soy; these include lowering of blood cholesterol and reduction of risk of cancers. Soybean-based food, apart from being complete source of protein, also contains other important nutrients, such as fiber, B vitamins and Omega3 fatty acids.

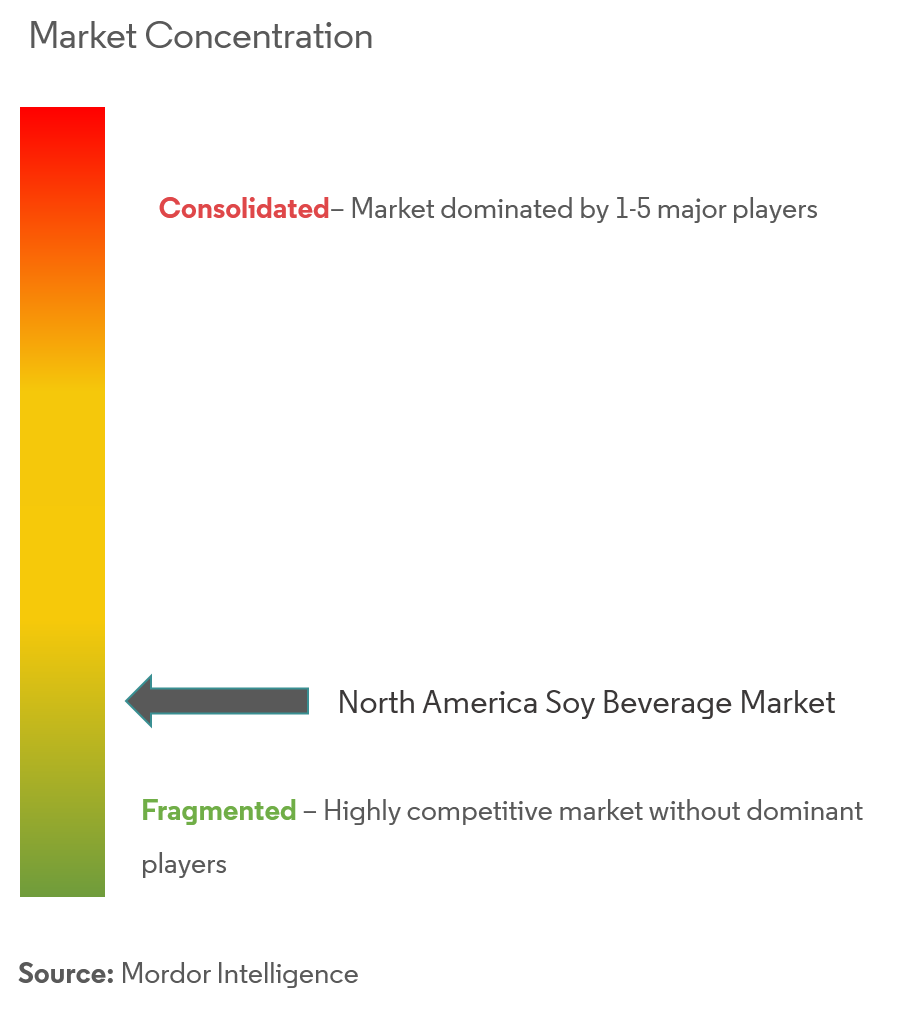

Competitive Landscape

Some of the major key players in soy beverage market, in North America are Danone Kikkoman Pearl Soy Milk, Hain Celestial, ZenSoy, Trader Joe's, and Vitasoy, among others. The players are coming up with various innovations in their product in order to capture the potential market of vegan concept.

North America Soy Beverages Industry Leaders

Danone

Kikkoman Pearl Soy Milk

Hain Celestial

Hershey’s

Trader Joe's

- *Disclaimer: Major Players sorted in no particular order

North America Soy Beverages Market Report Scope

North America soy beverage market is segmented by product type such as soy milk and yogurt smoothies. On the basis of distribution channel, the market is segmented into supermarkets/hypermarkets, convenience stores, online retailers, drug store, and others. Also, the study provides an analysis of the soy beverages in the emerging and established markets across the region, including United States, Mexico, Canada, and rest of the North America.

| Soy Milk |

| Soy-Based Drinkable Yogurt |

| Plain Soy Beverages |

| Flavored Soy Beverages |

| Supermarkets/Hypermarkets |

| Pharmacies/Drug Stores |

| Retail Stores |

| Convenience Stores |

| Others |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America |

| By Product Type | Soy Milk | |

| Soy-Based Drinkable Yogurt | ||

| By Flavor | Plain Soy Beverages | |

| Flavored Soy Beverages | ||

| By Distribution Channel | Supermarkets/Hypermarkets | |

| Pharmacies/Drug Stores | ||

| Retail Stores | ||

| Convenience Stores | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

Key Questions Answered in the Report

What is the current North America Soy Beverages Market size?

The North America Soy Beverages Market is projected to register a CAGR of 6.14% during the forecast period (2025-2030)

Who are the key players in North America Soy Beverages Market?

Danone, Kikkoman Pearl Soy Milk, Hain Celestial, Hershey’s and Trader Joe's are the major companies operating in the North America Soy Beverages Market.

Which region has the biggest share in North America Soy Beverages Market?

In 2025, the North America accounts for the largest market share in North America Soy Beverages Market.

What years does this North America Soy Beverages Market cover?

The report covers the North America Soy Beverages Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the North America Soy Beverages Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

North America Soy Beverages Market Report

Statistics for the 2025 North America Soy Beverages market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Soy Beverages analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.