Italy Food Sweetener Market Analysis by Mordor Intelligence

The Italy Food Sweetener Market is expected to register a CAGR of 0.72% during the forecast period.

- The usage of sweeteners in various energy drinks is a major growth driver, primarily due to the high consumption of sports drinks by adults.Dairy products, such as sweetened yogurt, and dairy beverages are also popular categories in the country.

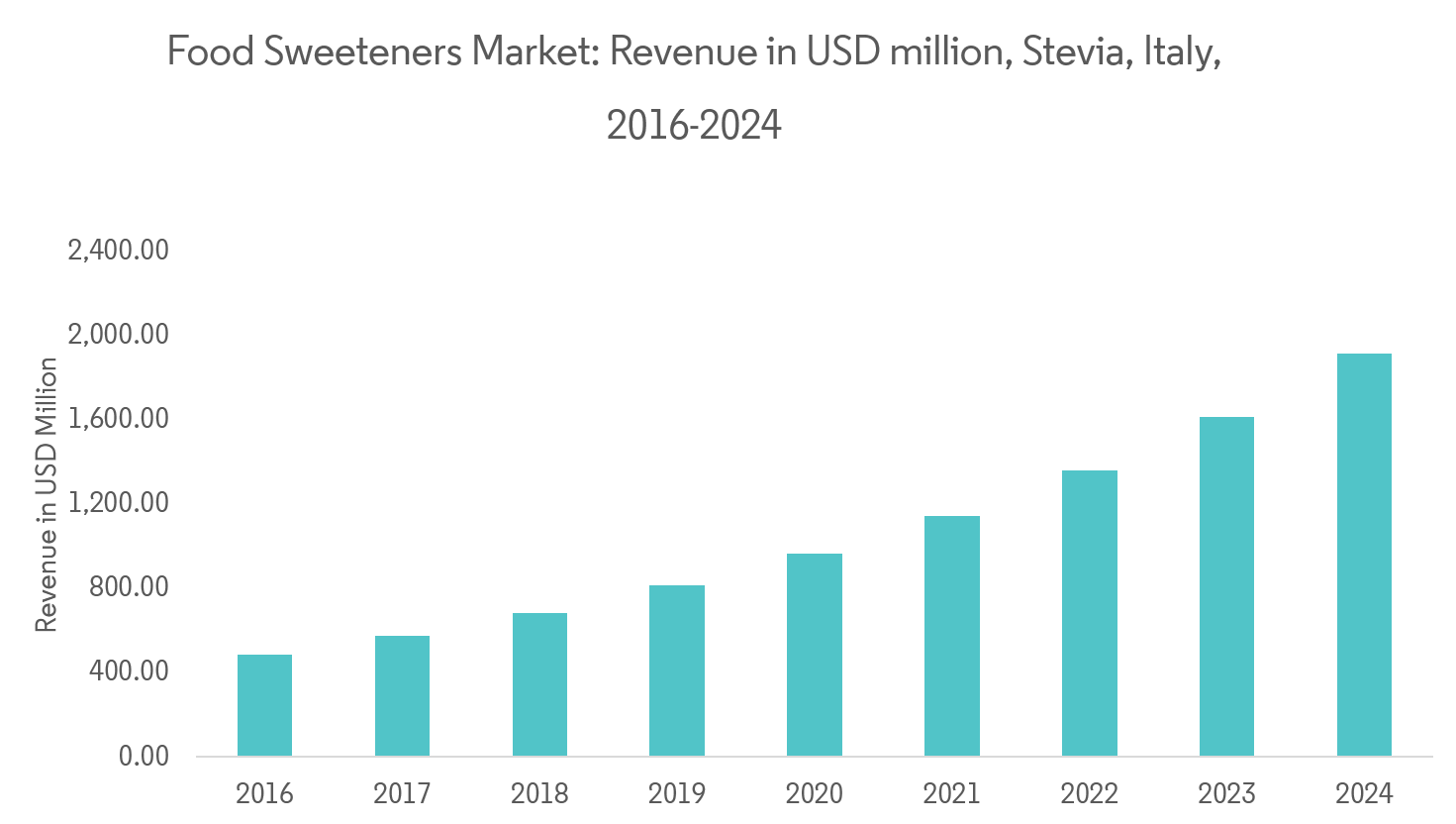

- Sugar and sweetener categories continued to benefit from Italy’s economic recovery and the positive development of fresh ground coffee pods, along with the evolution of cane and organic sugar and stevia-based sweeteners.

- In Italy, stevia is expected to witness steady growth in the near future. This category is witnessing high demand from the food and beverage industry.

Italy Food Sweetener Market Trends and Insights

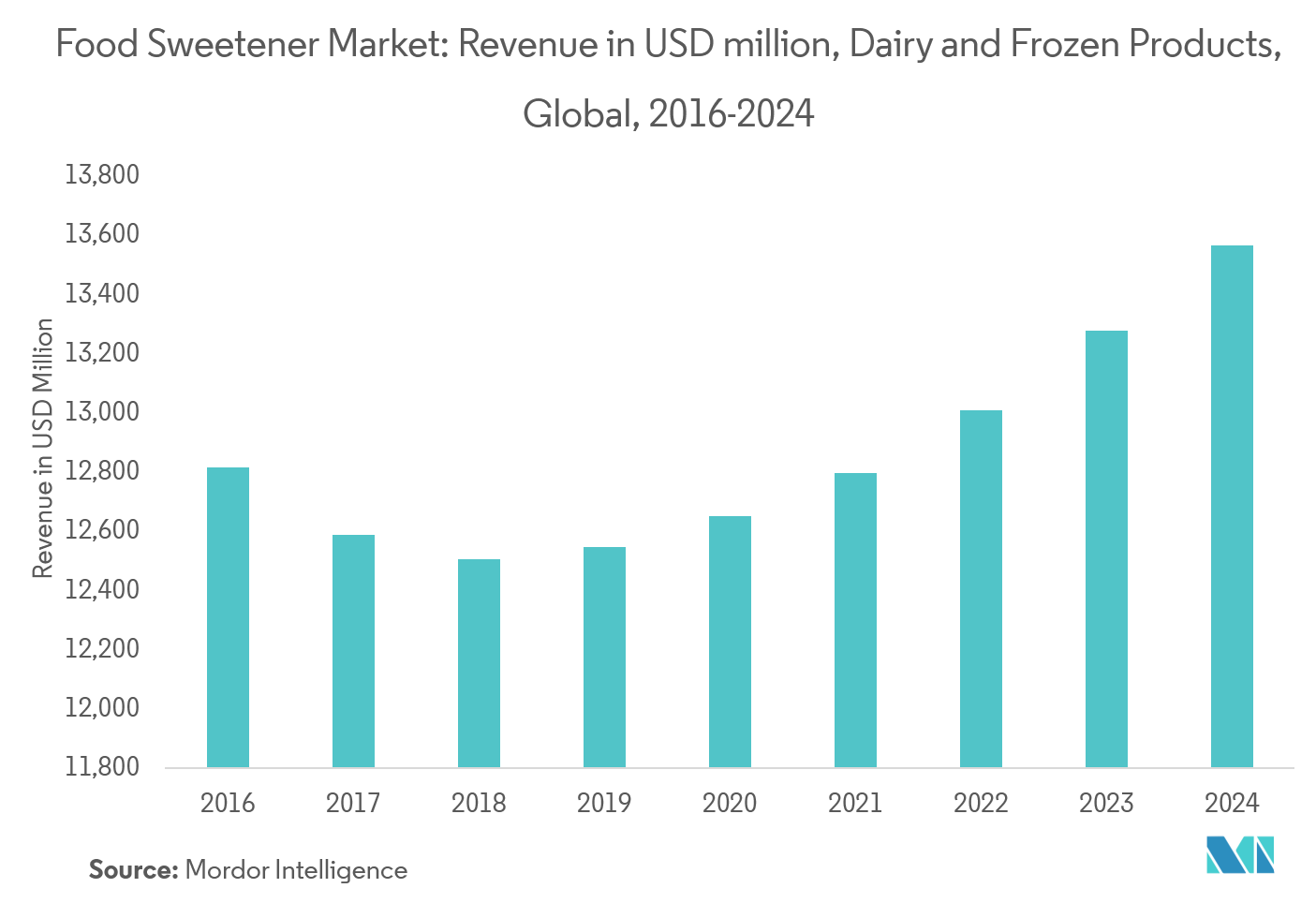

Dairy Segment Has The Major Application Of Sweetener

By incorporating sweeteners in dairy and frozen products, one can easily reduce added sugars and lower calories, making them even more attractive to label-reading consumers. There is an increasing awareness among consumers to closely pay attention to the level and types of sweeteners being employed in such products. Thus, it has become more important for food manufacturers to provide transparent information regarding sweetener systems. In dairy products, functional properties of sugar include mouthfeel, taste, reduction of freezing point, and water-binding. Sugar is also a key component to the firmness of dairy products, impacting the flow and thermal characteristics (viscosity, osmolality, water mobility, freezing point depression, etc.) during and after processing.

Stevia Is Gaining Popularity

Stevia is a plant sugar and it is gaining popularity as a natural sweetener as the demand for natural and organic labelled products are rapidly growing. In the late 2008, the FDA declared that the sweetener stevia is "generally recognized as safe," and the product quickly was assimilated into the food industry as an alternative sweetener or sugar substitute. According the World Health Organization (WHO), global stevia consumption could eventually replace 20% to 30% of all dietary sweeteners in the next few years.

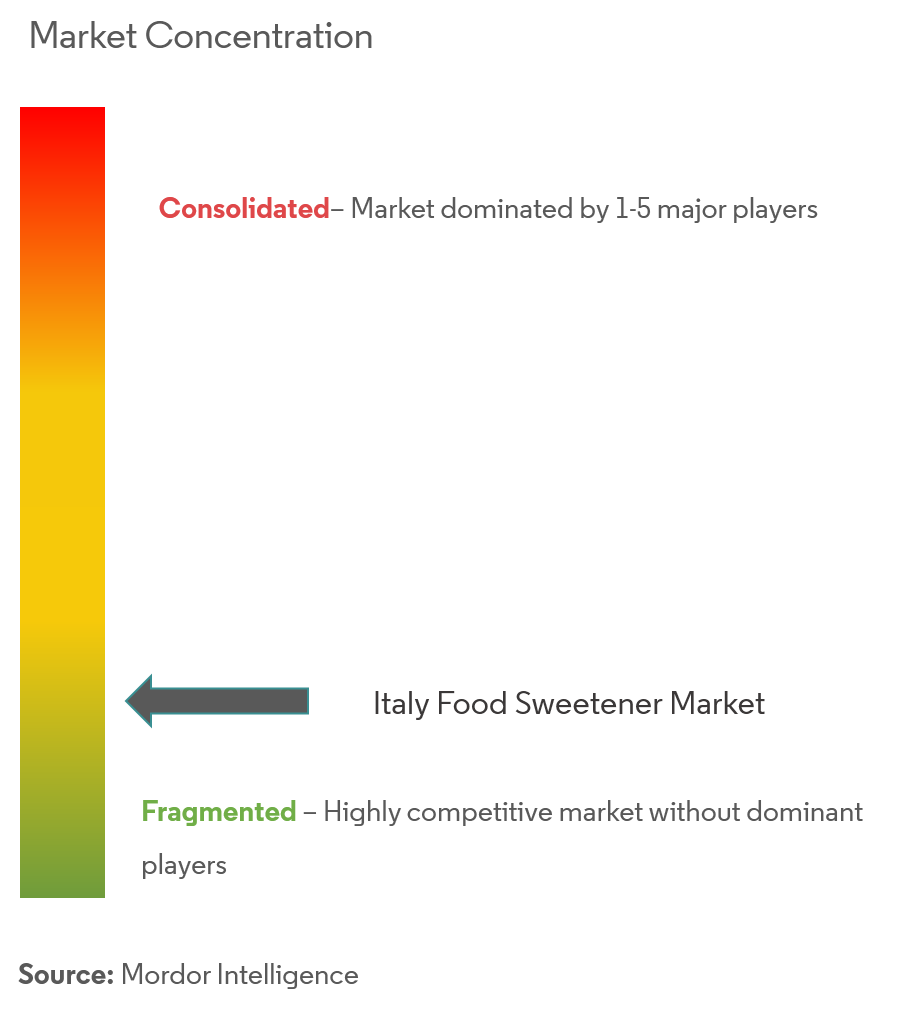

Competitive Landscape

Italy Food Sweetener Market is a fragmented market with the presence of various players. Major players are bringing innovatoions in their products and are expanding their product portfolio to maintain the position in the market. Players are also focusing on natural and clean label products since consumers are becoming more health conscious.

Italy Food Sweetener Industry Leaders

Cargill

Tate & Lyle

Ingredion

Tereos S.A

- *Disclaimer: Major Players sorted in no particular order

Italy Food Sweetener Market Report Scope

Italy Food Sweeteners Market is segmented by Type into Sucrose, Starch Sweeteners, and Sugar Alcohols and High-Intensity Sweeteners. By Application, the market is divided into Dairy, Bakery, Beverages, Soups, Sauces and Dressings, Confectionery and Others.

| Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose |

| High Fructose Corn Syrup (HFCS) | |

| Maltodextrin | |

| Sorbitol | |

| Xylitol | |

| Others | |

| High Intensity Sweeteners (HIS) | Sucralose |

| Aspartame | |

| Saccharin | |

| Cyclamate | |

| Ace-K | |

| Neotame | |

| Stevia | |

| Others |

| Dairy |

| Bakery |

| Soups, Sauces and Dressings |

| Confectionery |

| Beverages |

| Others |

| By Product Type | Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose | |

| High Fructose Corn Syrup (HFCS) | ||

| Maltodextrin | ||

| Sorbitol | ||

| Xylitol | ||

| Others | ||

| High Intensity Sweeteners (HIS) | Sucralose | |

| Aspartame | ||

| Saccharin | ||

| Cyclamate | ||

| Ace-K | ||

| Neotame | ||

| Stevia | ||

| Others | ||

| By Application | Dairy | |

| Bakery | ||

| Soups, Sauces and Dressings | ||

| Confectionery | ||

| Beverages | ||

| Others | ||

Key Questions Answered in the Report

What is the current Italy Food Sweetener Market size?

The Italy Food Sweetener Market is projected to register a CAGR of 0.72% during the forecast period (2025-2030)

Who are the key players in Italy Food Sweetener Market?

Cargill, Tate & Lyle, Ingredion and Tereos S.A are the major companies operating in the Italy Food Sweetener Market.

What years does this Italy Food Sweetener Market cover?

The report covers the Italy Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Italy Food Sweetener Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Italy Food Sweetener Market Report

Statistics for the 2025 Italy Food Sweetener market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Italy Food Sweetener analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.