Diaphragm Valve Market Size and Share

Diaphragm Valve Market Analysis by Mordor Intelligence

The Diaphragm Valve Market is expected to register a CAGR of 7.5% during the forecast period.

- Rising demand for radioactive waste management is driving the market. Here the diaphragm valve is used to prevent any leakage or contamination with foreign material, which is expected to increase the utilization of the component. Many countries are regularly trying to intensify their radioactive waste management to curb the destruction and enhance the efficiency of energy, which will drive the demand in future.

- Increasing demand for safe and reliable production is driving the market. In order to ensure sterile and non-contaminated products it is important to rely on high quality diaphragm valves. In pharma manufacturing process, enabling drug manufacturers to safely control different types of media is essential, which drives the demand of the diaphragm valves.

- Limiting pressure and temperatures and experience erosion is challenging the market. The diaphragm may experience erosion when used extensively in severe throttling service containing impurities, where the valve trim and body are worn by the passage of solid particles.

Global Diaphragm Valve Market Trends and Insights

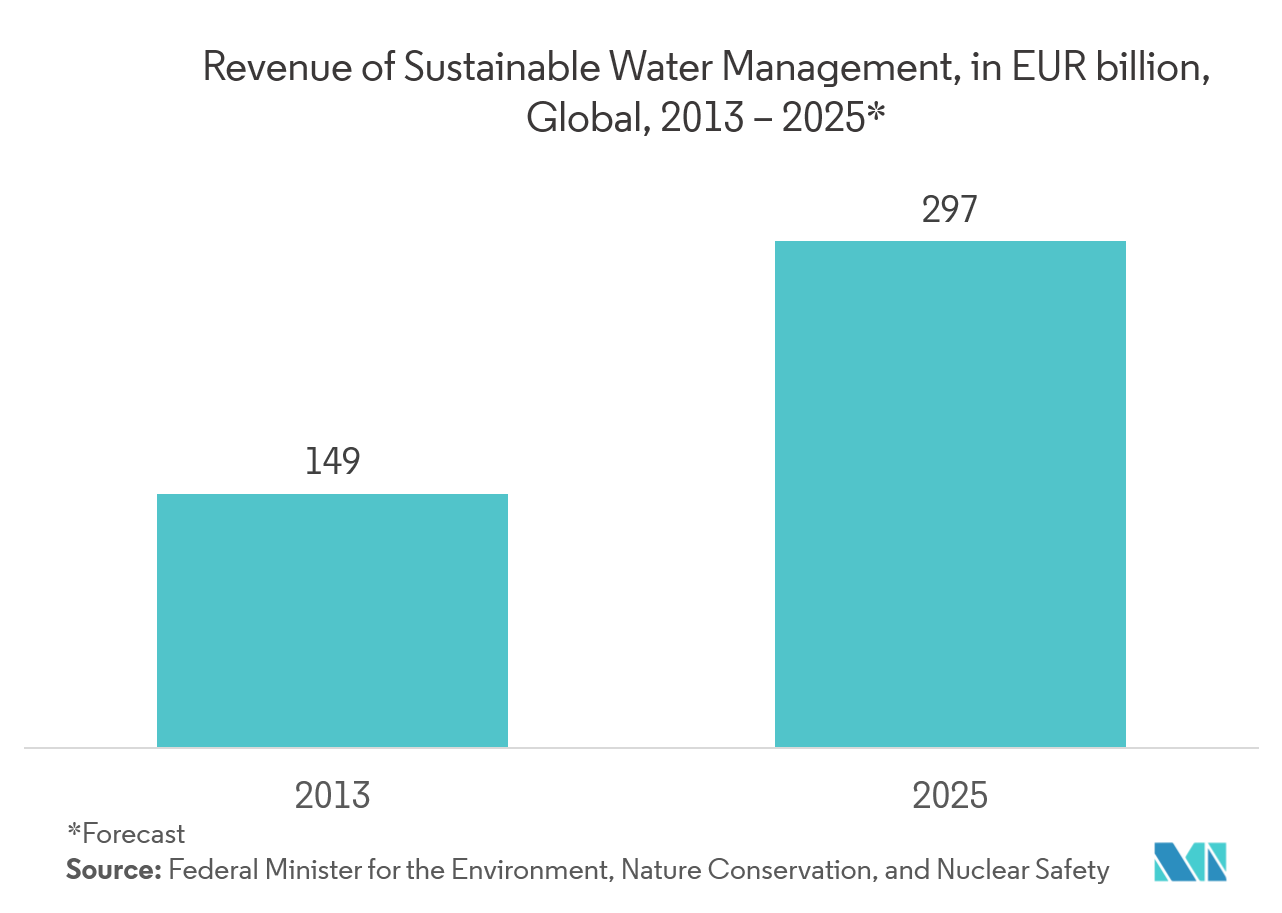

Demand of Water Treatment to Drive the Market Demand

- Water treatment applications are typically high-purity applications requiring minimal contact of the valve body. Diaphragm valves are ideally suited for these applications as these are the ideal solution for applications in conveying corrosive, abrasive media, or media containing solids in suspension or in high-purity applications.

- In many applications of metal processing companies, deionized water (DI-Water) with very low conductivity values is required. With an ion-exchange system, the water can be treated economically for the processes. The company Gross Wassertechnik GmbH, based in Pforzheim, Germany, is a specialist which specializes in industrial water treatment plants and wastewater treatment.

- Solenoid operated diaphragm valves are ideal for handling water both in the intake and treatment process of wastewater, especially in sewage treatment to remove contaminants from wastewater and household sewage.

- Full bore diaphragm valves are primarily used in the fields of water and waste water treatment. It gives an advantage over other conventional shut-off valves, particularly when working with viscous liquids such as slurry and liquids with a high solid or fibre content. The full bore diaphragm valves is the GEMÜ 657 of Gemu company, which gives specific emphasis on achieving the highest Kv values.

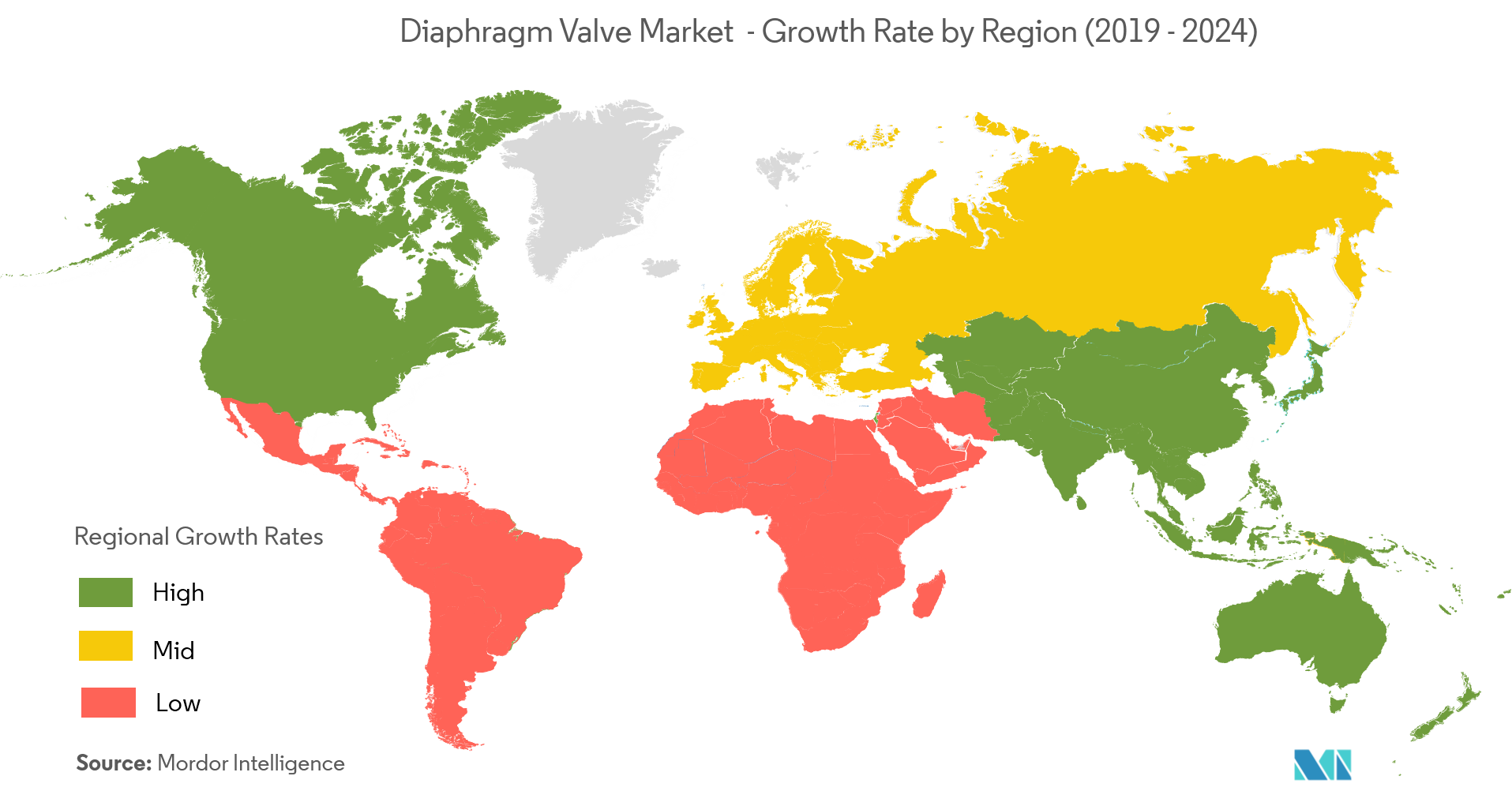

Asia-Pacific is Expected to Witness Highest Growth

- Asia-Pacific is witnessing highest growth due to investment in different industries, including food and beverage, power plants, and chemical.

- Oil & gas application is the largest segment in India because of the pipeline installations, monitoring and controlling, by which the demand of diaphragm valve is growing significantly.

- According to Engineering Export Promotion Council India (Eepc India), in India, Indian industrial valve market expected to reach USD 3 billion by 2023, as the key area of development is 'smart' control valves, to which 90 percent of offshore players are expected to devote research and development resources over the next few years.

- In July 2018, NLC India planned to increase its power generation capacity. Furthermore, chemical companies in the region are investing to expand their facility in the Asia-Pacific region, owing to low-cost labor and rapidly increasing demand of diaphragm valve.

- For instance, in July 2018, BASF signed a MoU to launch its production plant in China, which will be fully-owned by the company. As a result, the utilization and integration of diaphragm valve is expected to increase exponentially in the region, over the forecast period.

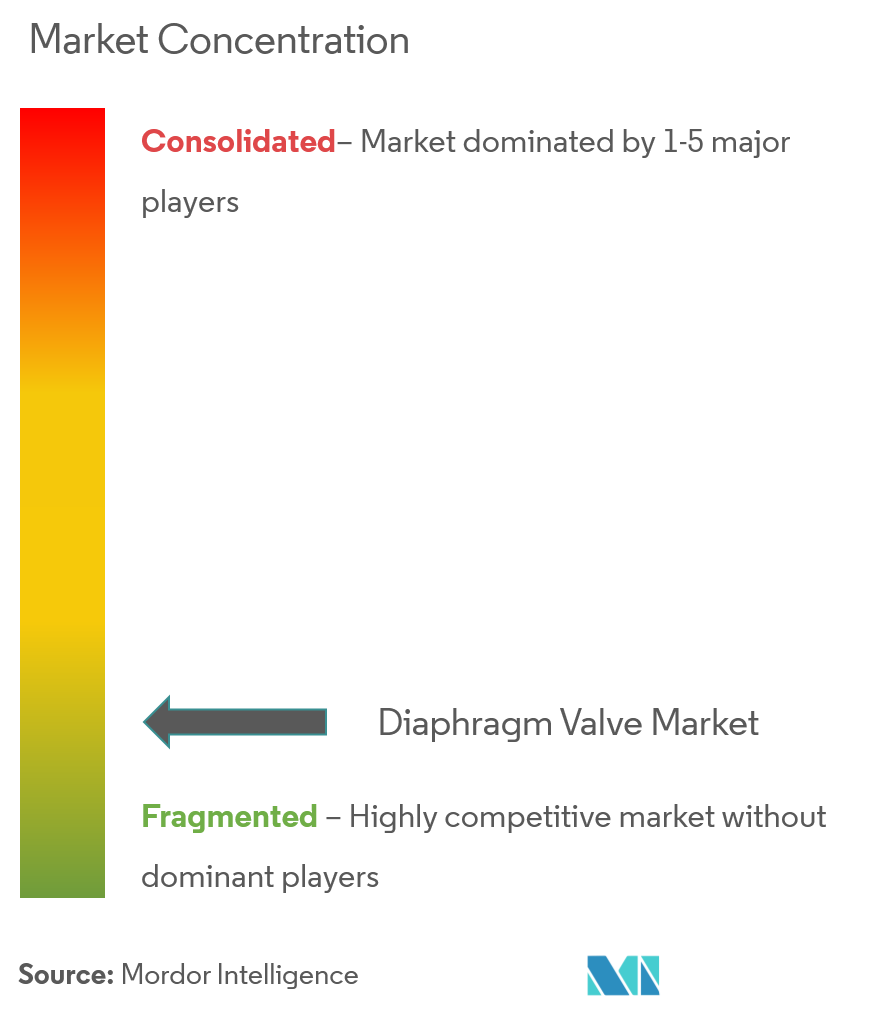

Competitive Landscape

The diaphragm valve market is highly fragmented owing to the presence of a large number of small and medium scale manufacturers offering diaphragmvalves made to requirements of end-user industries, which gives a high rivalry in the market. Key players areGEMÜ Gebr. Müller Apparatebau GmbH & Co. KG,Nippon Daiya Valve Co. Ltd,ITT Inc., etc. Recent developments in the market are -

- May 2019 - Emerson Electric Co. announced the launch of a new manifold product for its Rosemount pressure transmitters, Rosemount R305 Integral Manifolds and Rosemount R306 In-line Manifolds, which will be responsible for shut off activities and equalizing the pressure at the transmitters. This new Pressure-Lock Valve design increases safety, simplifies high-pressure operation, and enhances reliability. This new product will help to enhance the company’s offerings.

- Feb2019 -KSB SE & Co. KGaA launched the New diaphragm valve for drinking water / ISH 2019, SISTO-16TWA valve type series. These new valves are designed for drinking water applications with new materials for wetted components. The company is now able to cater in water treatment industry after this product launch.

Diaphragm Valve Industry Leaders

GEMÜ Gebr. Müller Apparatebau GmbH & Co. KG

Nippon Daiya Valve Co. Ltd

ITT Inc.

Formatura Iniezione Polimeri S.p.A.

CRANE ChemPharma & Energy

- *Disclaimer: Major Players sorted in no particular order

Global Diaphragm Valve Market Report Scope

The diaphragm valve is used to control the flow of gases and liquid and is integrated into diverse industries, such as chemical, water treatment, and power. As a result, it is being used as a significant component, particularly in the manufacturing site. Notably, industries, such as food and beverage and pharmaceutical, which cannot endure contamination, prefer the utilization of diaphragm valve as it does not allow contamination.

| Weir |

| Straight-way |

| Chemical |

| Food and Beverage |

| Water Treatment |

| Power |

| Pharmaceutical |

| Other End-user Verticals |

| North America |

| Europe |

| Asia-Pacific |

| Rest of the World |

| By Product Type | Weir |

| Straight-way | |

| By End-user Vertical | Chemical |

| Food and Beverage | |

| Water Treatment | |

| Power | |

| Pharmaceutical | |

| Other End-user Verticals | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Key Questions Answered in the Report

What is the current Diaphragm Valve Market size?

The Diaphragm Valve Market is projected to register a CAGR of 7.5% during the forecast period (2025-2030)

Who are the key players in Diaphragm Valve Market?

GEMÜ Gebr. Müller Apparatebau GmbH & Co. KG, Nippon Daiya Valve Co. Ltd, ITT Inc., Formatura Iniezione Polimeri S.p.A. and CRANE ChemPharma & Energy are the major companies operating in the Diaphragm Valve Market.

Which is the fastest growing region in Diaphragm Valve Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Diaphragm Valve Market?

In 2025, the North America accounts for the largest market share in Diaphragm Valve Market.

What years does this Diaphragm Valve Market cover?

The report covers the Diaphragm Valve Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Diaphragm Valve Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Diaphragm Valve Market Report

Statistics for the 2025 Diaphragm Valve market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Diaphragm Valve analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.