Cloud Robotics Market Size and Share

Cloud Robotics Market Analysis by Mordor Intelligence

The Cloud Robotics Market is expected to register a CAGR of 24.8% during the forecast period.

- The cloud-based AI and connectivity are likely to significantly shape the cloud robotics market's development over the forecast period. Many technology giants have developed AI-based systems that are being widely used. Hence, the investment by these vendors in the robotics market will also innovate new solutions for cloud robotics.

- The convergence of robots, teleoperation, MEC, and core cloud technologies is poised to alter enterprise operations, industrial processes, and consumer services across various industry verticals. Cloud operations and terrestrial and aerial robots will significantly assist the purpose-built and general-purpose robotics segments. In the latter instance, mass consumerization will occur when end-users acclimate to autonomous and remote-control robots for a wide range of personal services tasks.

- The cloud robotics market will give birth to a greater range of robotics services. This is due to various variables, including significantly more flexible service execution, lower operational friction (due to fewer proprietary interfaces), and improved economics via robotics-as-a-service in a cloud-based application paradigm. Initially, industrial and government clients will profit the most, followed by enterprises in specific leading industry sectors. The cloud robotics market will eventually become available to customers in a limited capacity.

- Robotics businesses are working to improve their technology's ability to sense and understand their work settings and cultivate the ability to adjust to dynamic operational conditions on the go. This situational awareness is made possible by integrating sensors and machine learning.

- Increasing adoption of smart devices, the evolution of bandwidth, and rising cloud streaming services are also owing to the growth of the connected-robots market. The GSMA predicted that by 2025, there would be around 25.1 billion IoT-connected devices, which was 7.5 billion in 2017. This offers a massive opportunity for connected robots and their platform market.

- The key market players are globally coming up with new solutions, which enhance the future growth opportunities for the Cloud Robotic market. For instance, in February 2021, HPE announced the HPE Open RAN Solution Stack, enabling the commercial implementation of Open RAN at scale in global 5G networks. The HPE Open RAN Solution Stack contains orchestration and automation tools from HPE, RAN-specific infrastructure designs, and telco-optimized equipment.

- Lockdowns reduced the number of workforces in numerous businesses, which increased demand for cloud robotics as more and more companies need centralized monitoring to take control of diverse industrial instruments. Thus, growing industrialization and an increase in automation requirements increased the demand for cloud robotics. Furthermore, the growing need for manufacturing industries, as well as the spike in demand for robotics and automation solutions in the healthcare and chemical industries, fuel market expansion.

Global Cloud Robotics Market Trends and Insights

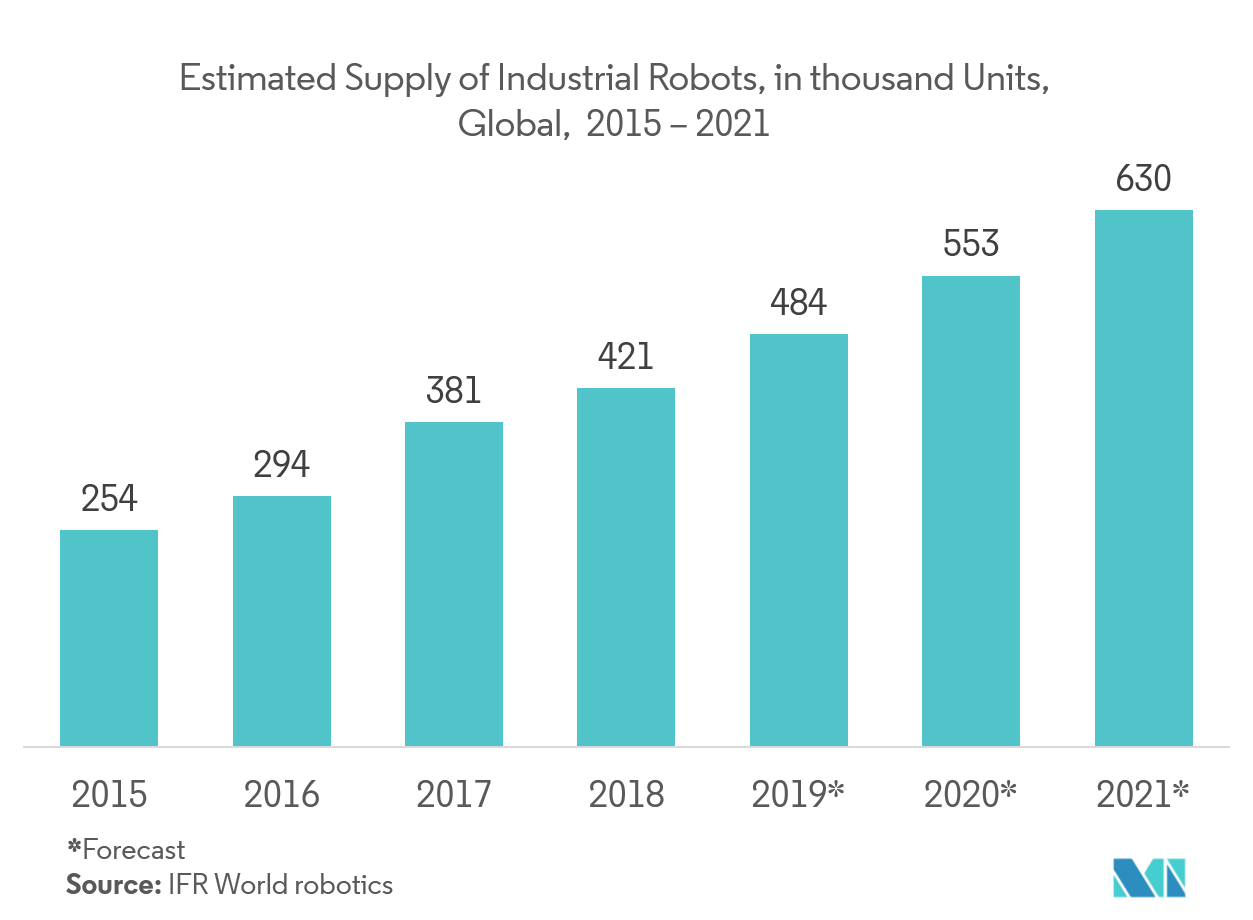

Rising Demand for Industrial Robotics to Augment the Market Growth

- With the development of cloud computing, big data, and other emerging technologies, the integration of cloud technology and robotic systems allows for designing multi-robot systems with high performance and high complexity. Growing penetration of the IoT and investments in robotics have been the major contributors to the growth of industrial robotics.

- According to the International Federation of Robotics, robot installations worldwide have recovered rapidly, making 2021 the most successful year in the robotics industry's history (IFR). "Demand reached high levels across industries due to the ongoing trend toward automation and continued technological innovation." Even the pre-pandemic record of 422,000 installations per year in 2018 was broken in 2021."

- Furthermore, Industrial robot sales have made a significant comeback. A new high of 486,800 units was shipped globally, a 27% increase over the previous year. Asia/Australia witnessed the greatest increase in demand, with installations increasing 33% to 354,500 units. With 49,400 units sold, the Americas climbed by 27%. With 78,000 units installed, Europe had a double-digit increase of 15%.

- Industrial robotics have been witnessing a huge demand over the past decade, owing to the adoption of smart factory systems. With the development of industrial robots, programmed robots have reached high-performance levels in real-time applications, accuracy, robustness, and compatibility.

- The availability of small-capacity and cost-effective solutions from small-and medium-sized industries is influencing the adoption of industrial automation. Apart from this, connecting robots, machines, and automation equipment to the cloud allow manufacturers to unlock the highest levels of performance and uptime from their automation systems.

Asia-Pacific to Witness a Significant Growth

- The market in Asia-Pacific is driven by the growing penetration of cloud computing, coupled with the incorporation of robotics and automation among the end-users. The automation adoption rate in this region, especially in China, India, and Japan, is the highest globally.

- China is the biggest spender on public cloud in the Asia-Pacific region. The local IaaS market is the first choice for small- and medium-enterprises for IT resources construction in games, video, and mobile internet.

- Industrial robots are predicted to increase rapidly in China as the downstream manufacturing sector recovers and the production of lithium batteries, new energy vehicles, and other industries expand.

- For the past eight years, China has been the world's largest market for industrial robots. According to a five-year plan released by the Ministry of Industry and Information Technology, China's robotics industry's operating revenue is predicted to rise at a 20 percent annual pace from 2021 to 2025.

- The growing demand for advanced automotive manufacturing drives robotics partnerships between the United States and Chinese companies. This may help China advance cloud services, which will likely further develop the Asia-Pacific cloud robotics market.

- The key players in this region are investing in developing robotic cloud solutions. For instance, In April 2021, CloudMinds Technology Inc. announced a Series B+ round of funding totaling more than USD 153 million. According to the Shanghai-based service robotics company, it will continue to develop humanoid models for residential use.

- It also stated that CloudMinds develops service robots for retail, education, healthcare, and hospitality that employ cloud computing. Its products include the wheeled humanoid XR-1 Service Robot, the Cloud Patrol security robot, and Cloud Pepper, a SoftBank Robotics humanoid. It has made them available through a robotics-as-a-service (RaaS) paradigm.

- Furthermore, ASORO labs of Singapore built a cloud computing infrastructure to generate a 3D model of the environment. This allows robots to perform simultaneous localization and mapping much faster than the labs' computers.

Competitive Landscape

The Cloud Robotics market is fragmented. Overall, the competitive rivalry among existing competitors is moderate. Moreover, acquisitions and collaboration of large companies with startups are expected, focusing on innovation.

- November 2021 - Datamatics, a global Intelligent Automation Products, Digital Solutions, Technology, and Business Process Management (BPM) Company, announced the successful adoption of its Datamatics TruBot Robotic Process Automation (RPA) Solution at Western Bainoona Group (WBG). WBG is a prominent engineering and construction firm in the Middle East and Africa (MEA). Four important activities were digitalized during the initial stage of RPA and Internet of Things (IoT) implementation to ensure a smooth and error-free data and payment processing flow.

- June 2021 - Hewlett Packard Enterprise has announced the acquisition of Determined AI. This San Francisco-based business provides a powerful and resilient software stack for training AI models at any scale using its open-source machine learning (ML) platform. HPE will combine Determined AI's unique software solution with its world-leading AI and high-performance computing (HPC) services to enable ML engineers in practically every industry to develop and train machine learning models to generate faster and more accurate insights from their data.

Cloud Robotics Industry Leaders

Hit Robot Group Co. Ltd

ABB Ltd

inVia Robotics, Inc.

C2RO Cloud Robotics

CloudMinds Technologies Co. Ltd

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- August 2022 - Zoho Corp. announced an INR 20 crore investment in Genrobotics, an Indian startup that develops robotics and AI-powered solutions for social issues such as hazardous working conditions. According to a business release, Zoho's investment would help Genrobotics in its objective to eliminate manual scavenging in India and offer safety and dignity to workers in the sanitation and oil and gas industries.

- June 2022 - Hewlett Packard Enterprise unveiled a new 5G software solution that expands HPE's existing 5G portfolio with fully integrated automated management. The solution combines HPE 5G Automated Assurance and a further 5G feature for HPE Service Director, simplifying 5G network management and decreasing deployment risks via a zero-touch, closed-loop system. The new automation software monitors and orchestrates network activities, infrastructure, slices, and services, automatically resolving issues to ensure service continuity.

- April 2022 - Foxconn Industrial Internet (FII) announced a USD 30 million investment in Agile Robots AG, a Munich and Beijing-based automation firm. It is the company's second strategic investment in Agile Robots.

Global Cloud Robotics Market Report Scope

Cloud robotics is the use of remote computing resources to enable greater memory, computational power, collective learning, and interconnectivity for robotics applications. It allows robots to benefit from the powerful computational, storage, and communications resources of modern data centers. Logistics, security and surveillance, personal assistance and care, guidance and education, entertainment, and companionship are some of the emerging sectors, which are witnessing the rise in the adoption of cloud robotics.

| Software |

| Service |

| Industrial Robot |

| Service Robot |

| Manufacturing |

| Military and Defense |

| Retail and E-commerce |

| Healthcare and Life Sciences |

| Other End-user Industries |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Offering | Software |

| Service | |

| By Application | Industrial Robot |

| Service Robot | |

| By End-user Industry | Manufacturing |

| Military and Defense | |

| Retail and E-commerce | |

| Healthcare and Life Sciences | |

| Other End-user Industries | |

| By Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Cloud Robotics Market size?

The Cloud Robotics Market is projected to register a CAGR of 24.8% during the forecast period (2025-2030)

Who are the key players in Cloud Robotics Market?

Hit Robot Group Co. Ltd, ABB Ltd, inVia Robotics, Inc., C2RO Cloud Robotics and CloudMinds Technologies Co. Ltd are the major companies operating in the Cloud Robotics Market.

Which is the fastest growing region in Cloud Robotics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Cloud Robotics Market?

In 2025, the North America accounts for the largest market share in Cloud Robotics Market.

What years does this Cloud Robotics Market cover?

The report covers the Cloud Robotics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Cloud Robotics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Cloud Robotics Market Report

Statistics for the 2025 Cloud Robotics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cloud Robotics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.