China AMH Market Analysis by Mordor Intelligence

The China AMH Market is expected to register a CAGR of 15.8% during the forecast period.

- China has been the largest market for the robotics industry since 2012, and the country shows no signs of a slowdown. The country is on the exact path of becoming a leader in technology and automation by 2020, as targeted by the country's 'Made in China 2025' policies.

- By adopting automation in manufacturing, China is expected to cut manufacturing costs by 30% by 2025. According to the National Bureau of Statistics China, the country has more than 29.85 million of the population aged above 60 years in 2020. It is further anticipated that by 2050, 330 million Chinese will be over age 65. This would result in a dearth of skilled labor, which would require job activities to be eased to maintain productivity at work, which will boost the growth of the market studied.

- In the next four years, the current investments being made in foreign technology companies are expected to be diverted toward R&D activities in the country itself. The Chinese government is taking the necessary steps to strictly control the flow of capital abroad and approve plans to establish a National Robotics Innovation Center. This proves the diversion of investments.

- The forecast from the International Federation of Robotics indicates that 950,300 industrial robots will be operational in the country in 2020. Thus, the automated material handling market in the country is expected to experience favorable growth over the forecast period.

China AMH Market Trends and Insights

AGV to Register Highest CAGR

- AGVs in China are being used across automotive, food and beverage, pharmaceutical, retail, electronics, and manufacturing industries. The automotive and general manufacturing industry in China is expected to gain traction in the future, owing to industrial developments with IoT as a mediator.

- Several government initiatives support the change; for example, Made in China 2025 (China) was introduced to promote the future of productivity and growth in manufacturing industries. Due to these strategies, the Chinese Central Government expects China’s automobile output to reach 30 million units by 2020 and 35 million by 2025.

- In addition, the IoT has ramped up logistics into high gear in China, which has encouraged sales of various retail and e-commerce companies. Billions of connected objects have the potential to support direct customer interaction and automate sales and ordering processes.

- Hence, several leading players are offerings advanced AGVs for the market. For instance, in December 2020, Toyota Forklift has unveiled two new autonomous warehouse vehicles, developed in partnership with Bastian Solutions, a Toyota Advanced Logistics company.

General Manufacturing is expected to hold the highest growth rate

- Manufacturing is one of the pillars of the Chinese economy and is undergoing a rapid transformation. It is reported that low-end manufacturing firms are moving to Southeast Asia to cut costs, which include automotive and electronics manufacturing companies. It is estimated that the automotive industry will expand by 6-7% annually in the next five years.

- China is the world's largest manufacturing economy and is also considered to be one of the most competitive nations globally. The effort to maintain its core low-cost production base and cost advantage without compromising on building complex capabilities is contributing to the success of the economy. Manufacturing is one of the prominent features of China's economy, and it is undergoing a rapid transformation. This large-scale transformation has aided the country in being a leading nation in the manufacturing market globally.

- According to the National Development and Reform Commission (NDRC), China's investment in the high-tech manufacturing industry expanded by 12% year-on-year in FY 2020.

- Moreover, According to the Ministry of Industry and Information Technology, China added more than 100 smart manufacturing pilot projects till 2020. As per the 13th Five-Year Plan of Smart Manufacturing, China aims to establish its intelligent manufacturing system and transform key industries by 2025.

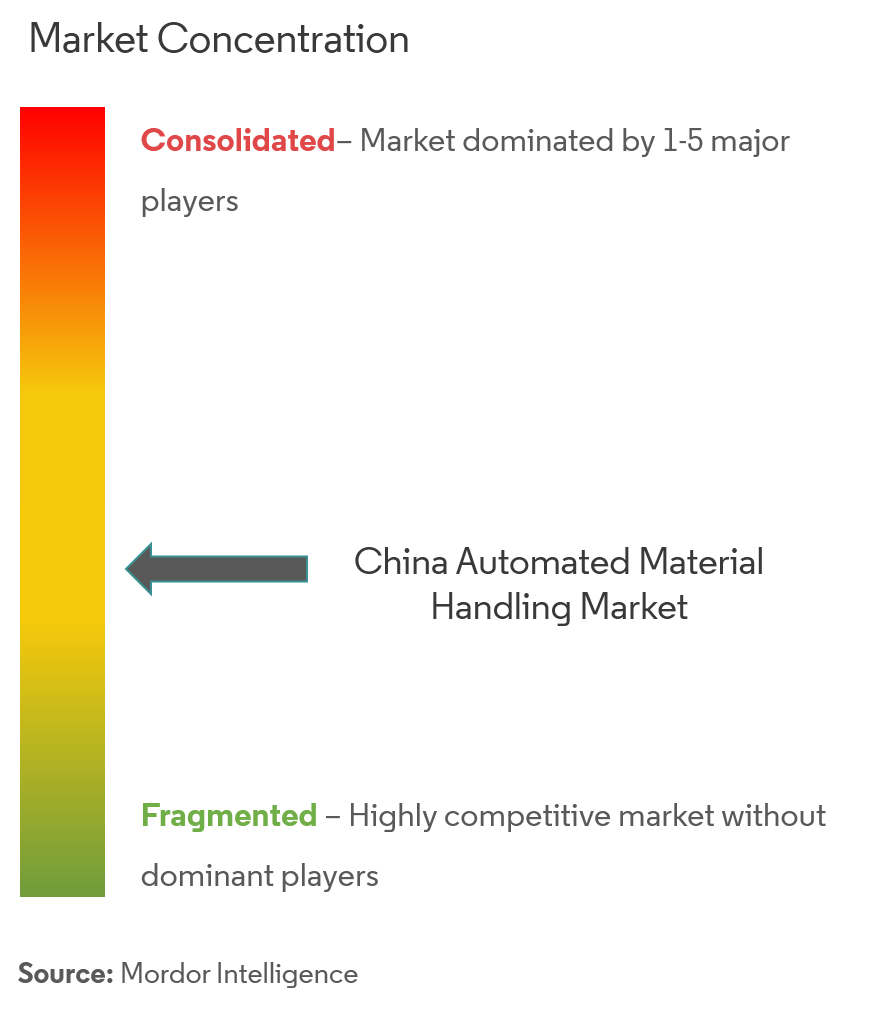

Competitive Landscape

The China automated material handling market is fragmented and highly competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- September 2021 - A Tianjin-based maker has received tax breaks and government-guaranteed loans to build products that modernize China's vast factory sector and advance its technological expertise.

China AMH Industry Leaders

Guangzhou Sinorobot Technology Co. Ltd

Siasun Robot & Automation Co. Ltd.

Noblelift Intelligent Equipment Co. Ltd.

Shanghai Triowin Automation Machinery Co. Ltd.

Shenzhen Casun Intelligent Robot Co.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- November 2020 - A Chinese 32,000-square-foot warehouse belonging to e-commerce giant Alibaba successfully increased its production rate by 300 percent by incorporating robots into the workflow. These artificially intelligent indoor driving robots were made by Quicktron, a Shanghai-based startup founded in 2014.

- January 2021 - Japan's Yaskawa Electric invested YEN 4 billion to YEN 5 billion to build a plant on a 90,000-sq.-meter plot in Changzhou, Jiangsu Province, where it plans to start making servomotors and controllers for industrial robots in fiscal 2022.

China AMH Market Report Scope

Automated material handling equipment eliminates the need for human interference in a material handling process. Continuous rise in demand for automation with the advent of technologies such as robotics, wireless technologies, and driverless vehicles in different industries like food and beverages, retail, general manufacturing, pharmaceuticals, and post & parcel has revolutionized the adoption of automated material handling the equipment. Type of equipment such as AS/RS, AGV, conveyor, palletizer, and sortation systems are considered under the scope of the market.

| Hardware |

| Software |

| Services |

| Mobile Robots | Automated Guided Vehicle (AGV) | Automated Forklift |

| Automated Tow/Tractor/Tug | ||

| Unit Load | ||

| Assembly Line | ||

| Special Purpose | ||

| Autonomous Mobile Robots (AMR) | ||

| Laser Guided Vehicle | ||

| Automated Storage and Retrieval System (ASRS) | Fixed Aisle (Stacker Crane + Shuttle System) | |

| Carousel (Horizontal Carousel + Vertical Carousel) | ||

| Vertical Lift Module | ||

| Automated Conveyor | Belt | |

| Roller | ||

| Pallet | ||

| Overhead | ||

| Palletizer | Conventional (High Level + Low Level) | |

| Robotic | ||

| Sortation System |

| Airport |

| Automotive |

| Food and Beverage |

| Retail/Warehousing/ Distribution Centers/Logistic Centers |

| General Manufacturing |

| Pharmaceuticals |

| Post and Parcel |

| Other End-Users |

| By Product Type | Hardware | ||

| Software | |||

| Services | |||

| By Equipment Type | Mobile Robots | Automated Guided Vehicle (AGV) | Automated Forklift |

| Automated Tow/Tractor/Tug | |||

| Unit Load | |||

| Assembly Line | |||

| Special Purpose | |||

| Autonomous Mobile Robots (AMR) | |||

| Laser Guided Vehicle | |||

| Automated Storage and Retrieval System (ASRS) | Fixed Aisle (Stacker Crane + Shuttle System) | ||

| Carousel (Horizontal Carousel + Vertical Carousel) | |||

| Vertical Lift Module | |||

| Automated Conveyor | Belt | ||

| Roller | |||

| Pallet | |||

| Overhead | |||

| Palletizer | Conventional (High Level + Low Level) | ||

| Robotic | |||

| Sortation System | |||

| By End-user Vertical | Airport | ||

| Automotive | |||

| Food and Beverage | |||

| Retail/Warehousing/ Distribution Centers/Logistic Centers | |||

| General Manufacturing | |||

| Pharmaceuticals | |||

| Post and Parcel | |||

| Other End-Users | |||

Key Questions Answered in the Report

What is the current China AMH Market size?

The China AMH Market is projected to register a CAGR of 15.8% during the forecast period (2025-2030)

Who are the key players in China AMH Market?

Guangzhou Sinorobot Technology Co. Ltd, Siasun Robot & Automation Co. Ltd., Noblelift Intelligent Equipment Co. Ltd., Shanghai Triowin Automation Machinery Co. Ltd. and Shenzhen Casun Intelligent Robot Co. are the major companies operating in the China AMH Market.

What years does this China AMH Market cover?

The report covers the China AMH Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the China AMH Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

China AMH Market Report

Statistics for the 2025 China AMH market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. China AMH analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.