Aramid Prepreg Market Size and Share

Aramid Prepreg Market Analysis by Mordor Intelligence

The Aramid Prepreg Market is expected to register a CAGR of greater than 5% during the forecast period.

- High cost of production and investments in R&D are likely to hinder the market’s growth.

- Substitution of Asbestos is expected to act as an opportunity for the market.

Global Aramid Prepreg Market Trends and Insights

Increasing Applications in the Automotive Industry

- Prepregs are increasingly being used to replace their metal counterparts, to manufacture interior and exterior structures, as the specific strength and modulus of the former are higher than most metallic alloys.

- Owing to their superior strength-to-weight ratio, aramid prepregs are being increasingly used in the automotive industry.

- In automotive industry, aramid prepregs are used in various applications, such as automotive hoses, diaphragms, railroad car connection membranes, anti-lock braking systems, and wheel wells.

- The global automotive industry has witnessed growth in the past few years. However, in recent past, the global automotive industry witnessed a decline of about 1.1% in production. During the years, about 95.63 million cars were produced globally.

- Besides, the automotive production is further declining due to low demand, commencement of transition toward electric vehicles, and growing concerns related to emissions from vehicles.

- Asia-Pacific is one the fastest-growing markets for the automotive sector. India and China are the two fastest-growing markets in the Asia-Pacific region. However, the region has also been witnessing a slump in the automotive production and sales at present, which is likely to have a negative impact on the market studied.

- The industry experts anticipates this slowdown in the automotive industry to persist till the second half of 2020. Hence, such anticipation is likely to affect the increase in demand for aramid prepreg from automotive industry in the early years of the forecast period.

Germany Country to Dominate the European Region

- The German economy is the largest in the European region and the fourth largest in the world.

- The economic growth of the country is affected by factors, such as trade tensions leading to reduced exports and tariff disputes triggered by the US government. However, the country is expected to rise from such fluctuations in economic performance over the forecast period.

- Germany leads the European automotive market with 41 assembly and engine production plants that contribute to one-third of the total automobile production in Europe. Germany, being one of the leading manufacturing bases for the aircraft industry, is the home to manufacturers from different segments, such as equipment manufacturers, material and component suppliers, engine producers, and whole system integrators.

- In the recent past, the German automotive production recorded a slump of approximately 9.3%. However, in Europe, Germany accounts for approximately 30% of the total passenger car manufacturing. About 21 of the world’s top-100 automotive suppliers are German companies. The automotive production in the country has been declining over the past few years due to the high cost and shifting of production to other countries, like China.

- The aerospace industry is one of the most innovative and best-performing industries in Germany.

- The German aerospace manufacturing and supplier industry includes more than 2,300 firms, located all around the country, with northern Germany having a higher concentration of firms.

- Hence, all such trends in the country’s end-user industries are anticipated to drive the demand for the market studied over the forecast period.

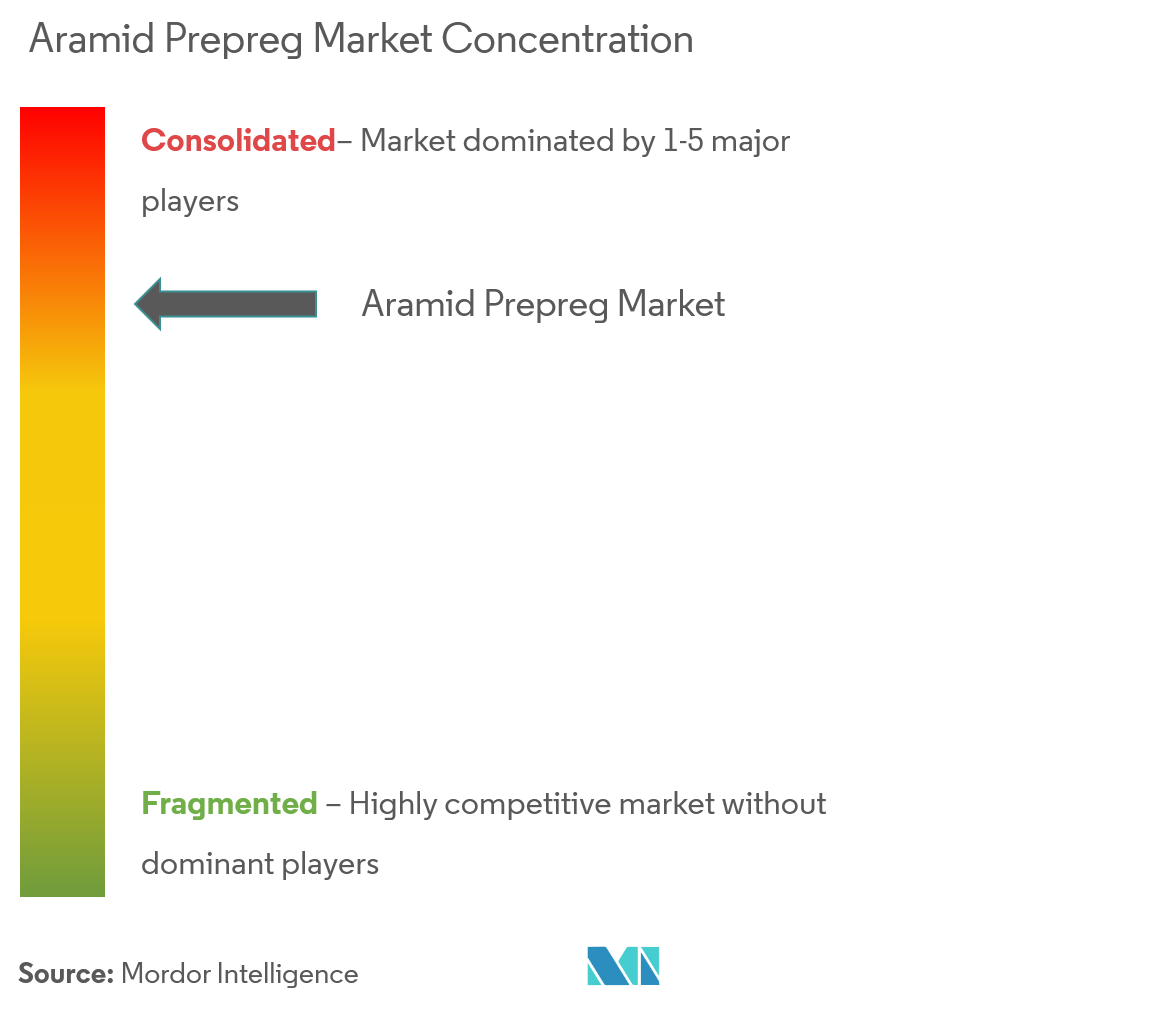

Competitive Landscape

The aramid prepreg market is partially consolidated, with few players holding the major share in the market. Key players in the aramid prepreg market include Hexcel Corporation, Mitsubishi Chemical Carbon Fiber and Composites, Inc., DuPont, ACP, and TORAY INDUSTRIES, INC., among others.

Aramid Prepreg Industry Leaders

Hexcel Corporation

Mitsubishi Chemical Carbon Fiber and Composites, Inc.

ACP

TORAY INDUSTRIES, INC.

DuPont

- *Disclaimer: Major Players sorted in no particular order

Global Aramid Prepreg Market Report Scope

The aramid prepreg market report includes:

| Para-aramid |

| Meta-aramid |

| Aerospace and Defense |

| Automotive |

| Electrical and Electronics |

| Sports and Leisure |

| Other End-user Industries |

| Asia-Pacific | China |

| India | |

| Japan | |

| South Korea | |

| Rest of Asia-Pacific | |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| Italy | |

| France | |

| Rest of Europe | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle-East and Africa | Saudi Arabia |

| South Africa | |

| Rest of Middle-East and Africa |

| Type | Para-aramid | |

| Meta-aramid | ||

| End-user Industry | Aerospace and Defense | |

| Automotive | ||

| Electrical and Electronics | ||

| Sports and Leisure | ||

| Other End-user Industries | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| North America | United States | |

| Canada | ||

| Mexico | ||

| Europe | Germany | |

| United Kingdom | ||

| Italy | ||

| France | ||

| Rest of Europe | ||

| South America | Brazil | |

| Argentina | ||

| Rest of South America | ||

| Middle-East and Africa | Saudi Arabia | |

| South Africa | ||

| Rest of Middle-East and Africa | ||

Key Questions Answered in the Report

What is the current Aramid Prepreg Market size?

The Aramid Prepreg Market is projected to register a CAGR of greater than 5% during the forecast period (2025-2030)

Who are the key players in Aramid Prepreg Market?

Hexcel Corporation, Mitsubishi Chemical Carbon Fiber and Composites, Inc., ACP, TORAY INDUSTRIES, INC. and DuPont are the major companies operating in the Aramid Prepreg Market.

Which is the fastest growing region in Aramid Prepreg Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Aramid Prepreg Market?

In 2025, the Asia Pacific accounts for the largest market share in Aramid Prepreg Market.

What years does this Aramid Prepreg Market cover?

The report covers the Aramid Prepreg Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Aramid Prepreg Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Aramid Prepreg Market Report

Statistics for the 2025 Aramid Prepreg market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Aramid Prepreg analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.