3D Virtual Fence Market Size and Share

3D Virtual Fence Market Analysis by Mordor Intelligence

The 3D Virtual Fence Market is expected to register a CAGR of 38.7% during the forecast period.

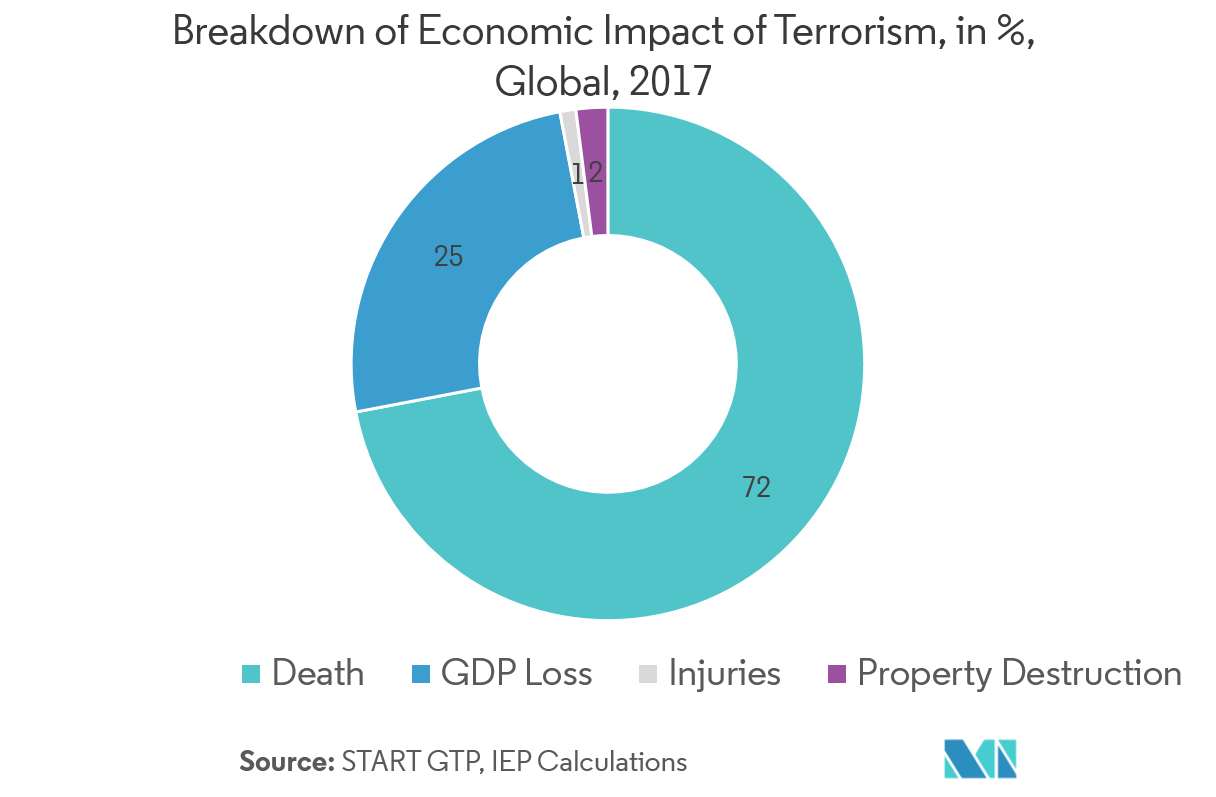

- Increasing risk of terrorism and infiltration is the major market growth driver. For instance, in April 2019, the United States declared Maulana Masood Azhar as a global terrorist after the terror attack on CRPF convoy in Pulwama district of Kashmir. The United States also declared Iran force as a foreign terrorist organization. This points toward the increasing terrorist threat toward the world.

- There have also been government regulations regarding perimeter security. The US government agency called FEMA provides funds to eligible applicants for the installation of perimeter security enhancements that protect employees, visitors, and building functions and services from outside threats. In the United Kingdom, the government developed PAS 68, a publicly available specification for vehicle security barriers, developed in partnership with perimeter security manufacturers. It has become the UK's standard and the security industry's benchmark for hostile vehicle mitigation (HVM) equipment.

- However, high maintenance and restoration costs are the factors which hinder the installation of 3D virtual fences. The US Department of Homeland Security canceled a project to build a virtual fence on the Southwest border, between the United State and Mexico because the project cost escalated from an initial USD 67 million to a final USD 1 billion (albeit for a longer virtual fence).

Global 3D Virtual Fence Market Trends and Insights

Security Sector to Drive the Market Growth

- There has been an increasing need for perimeter security due to the growing number of terrorist attacks. One of the countries affected by terrorism, India, launched "Smart Fence" Project along the Indo-Pak border in 2018, which includes installing sensors, radars, day and night vision cameras

- Sweden also introduced terrorist-proof digital geo-fencing due to the growing threat of radical terrorism and organized crime. The new generation of sensors being used in the pilot project is capable of picking up and identifying the location of sounds, such as gunshots, explosions and breaking glass, and reporting them to central police monitoring stations in real time.

- Moreover, attacks like Ester bombings in Sri Lanka in 2019 and open gunfire at Christmas market in Strasbourg, France in 2018 indicate that new faces of terrorism are surfacing, which require advanced technologies for tackling them, thereby driving the need for a smart and virtual fence.

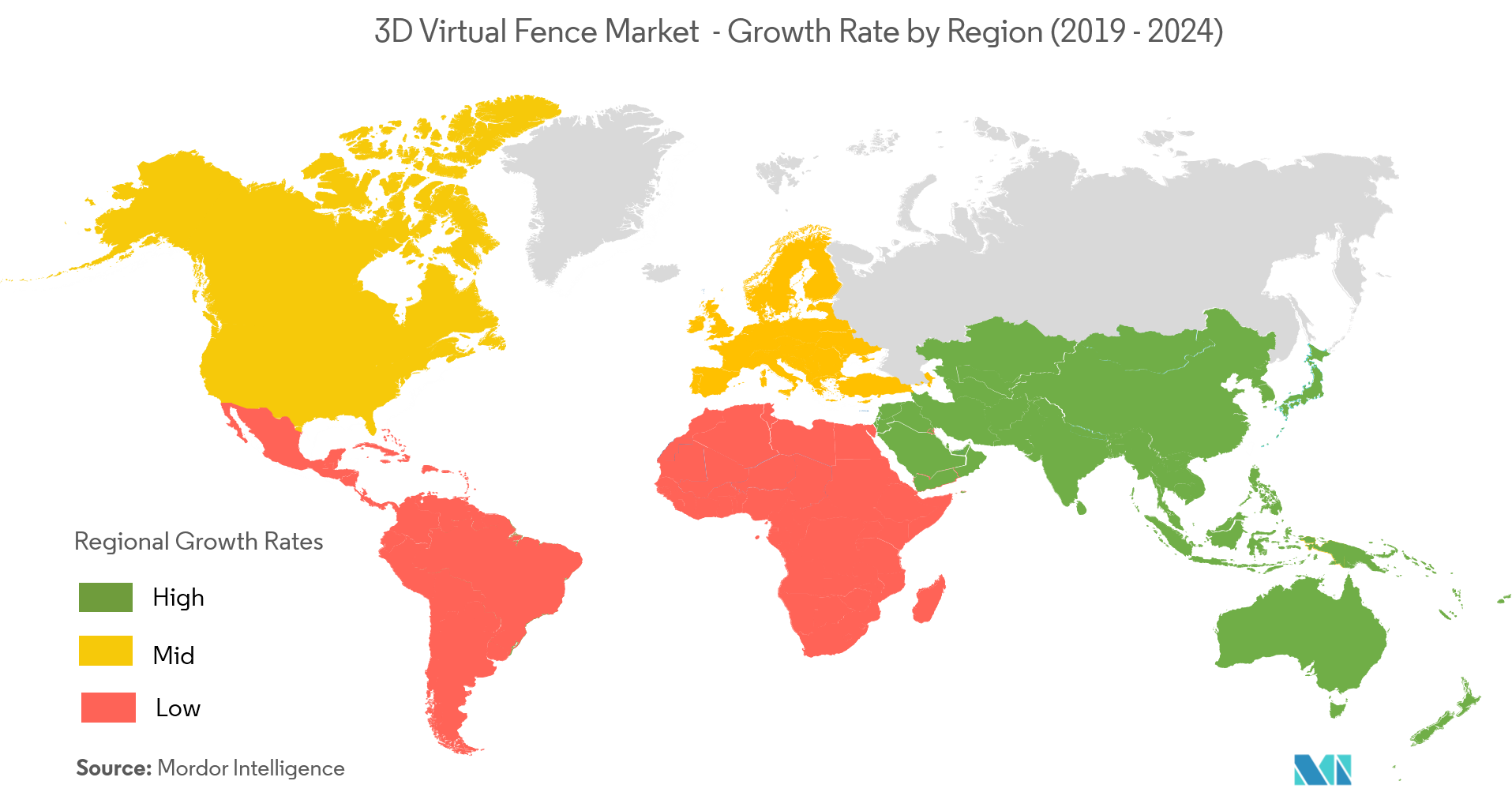

Asia-Pacific to Witness the Highest Growth

- According to the Australian Strategic Policy Institute, while global deaths from terrorism fell by 27% in 2018, they rose by 30% in the Asia-Pacific. The increase has been centered in three countries: the Philippines, Myanmar, and Thailand have together experienced nearly 4,000 attacks over the past five years.

- This rise has broadly corresponded with the expansion of transnational terrorist franchises, such as al-Qaeda and Islamic State, into the region.

- The involvement of absolutist religious elements makes these groups difficult to eliminate. Therefore, the countries in the region are significantly investing in border and country security.

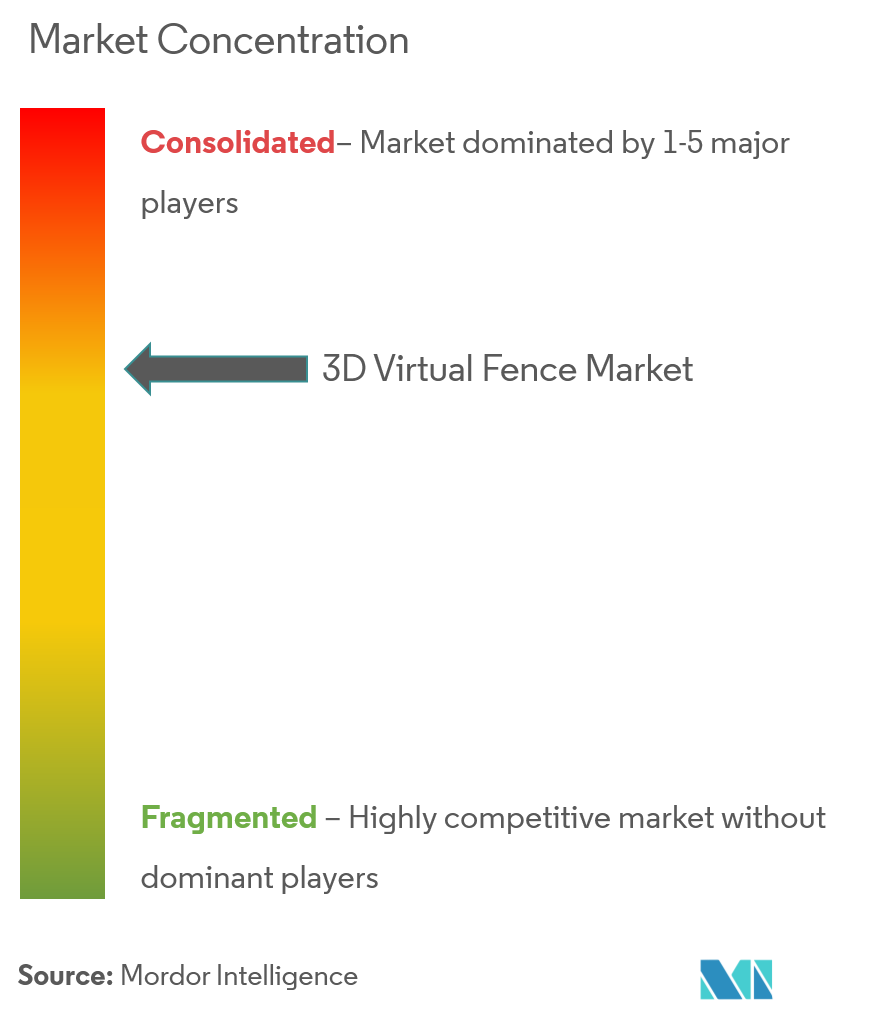

Competitive Landscape

The market for 3D virtual fencing is emerging with the majority of players bringingnew technologies to cater to various segments. Vendors likeCONTROP Precision Technologies Ltd. andG&A Surveillance offer limited services which are much demanded.

- Mar2019 - Agersens andThe Ohio State Universityhave signed a memorandum of understanding (MoU) that paves the way for the two organizations to implement research trials to determine the efficacy and economics of the eShepherd system for local conditions. eShepherdis a smart collar system for livestock, enabling cattle producers to create “virtual fences”

- Oct2018 - Nofence releasedvirtual fencing system to help keep animals inside a defined pasture, with the help of a solar-powered collor.

3D Virtual Fence Industry Leaders

CONTROP Precision Technologies Ltd.

G&A Surveillance

Agersens Pty Ltd

Huper Laboratories Co. Ltd

RBtec Perimeter Security Systems

- *Disclaimer: Major Players sorted in no particular order

Global 3D Virtual Fence Market Report Scope

| 3D Video Motion Detection System |

| 3D Virtual Cameras |

| Logistics | Warehouse Logistics |

| Transportation Based Logistics | |

| Agriculture | |

| Banking | |

| Security | |

| Construction |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Type | 3D Video Motion Detection System | |

| 3D Virtual Cameras | ||

| By End-user Industry | Logistics | Warehouse Logistics |

| Transportation Based Logistics | ||

| Agriculture | ||

| Banking | ||

| Security | ||

| Construction | ||

| Geography | North America | |

| Europe | ||

| Asia-Pacific | ||

| Latin America | ||

| Middle East & Africa | ||

Key Questions Answered in the Report

What is the current 3D Virtual Fence Market size?

The 3D Virtual Fence Market is projected to register a CAGR of 38.7% during the forecast period (2025-2030)

Who are the key players in 3D Virtual Fence Market?

CONTROP Precision Technologies Ltd., G&A Surveillance, Agersens Pty Ltd, Huper Laboratories Co. Ltd and RBtec Perimeter Security Systems are the major companies operating in the 3D Virtual Fence Market.

Which is the fastest growing region in 3D Virtual Fence Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in 3D Virtual Fence Market?

In 2025, the North America accounts for the largest market share in 3D Virtual Fence Market.

What years does this 3D Virtual Fence Market cover?

The report covers the 3D Virtual Fence Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the 3D Virtual Fence Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

3D Virtual Fence Market Report

Statistics for the 2025 3D Virtual Fence market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. 3D Virtual Fence analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.