Vietnam Food Sweetener Market Analysis by Mordor Intelligence

The Vietnam Food Sweetener Market is expected to register a CAGR of 2.24% during the forecast period.

- Vietnam market is driven by the growing economy and stable financial conditions. This has led to the increase indisposable income and spending patterns.

- Increased demand of natural, non-caloric sweeteners, and high demand for sweeteners in various applications, such as processed food and beverages from emerging economies, are the major factors driving the market growth.

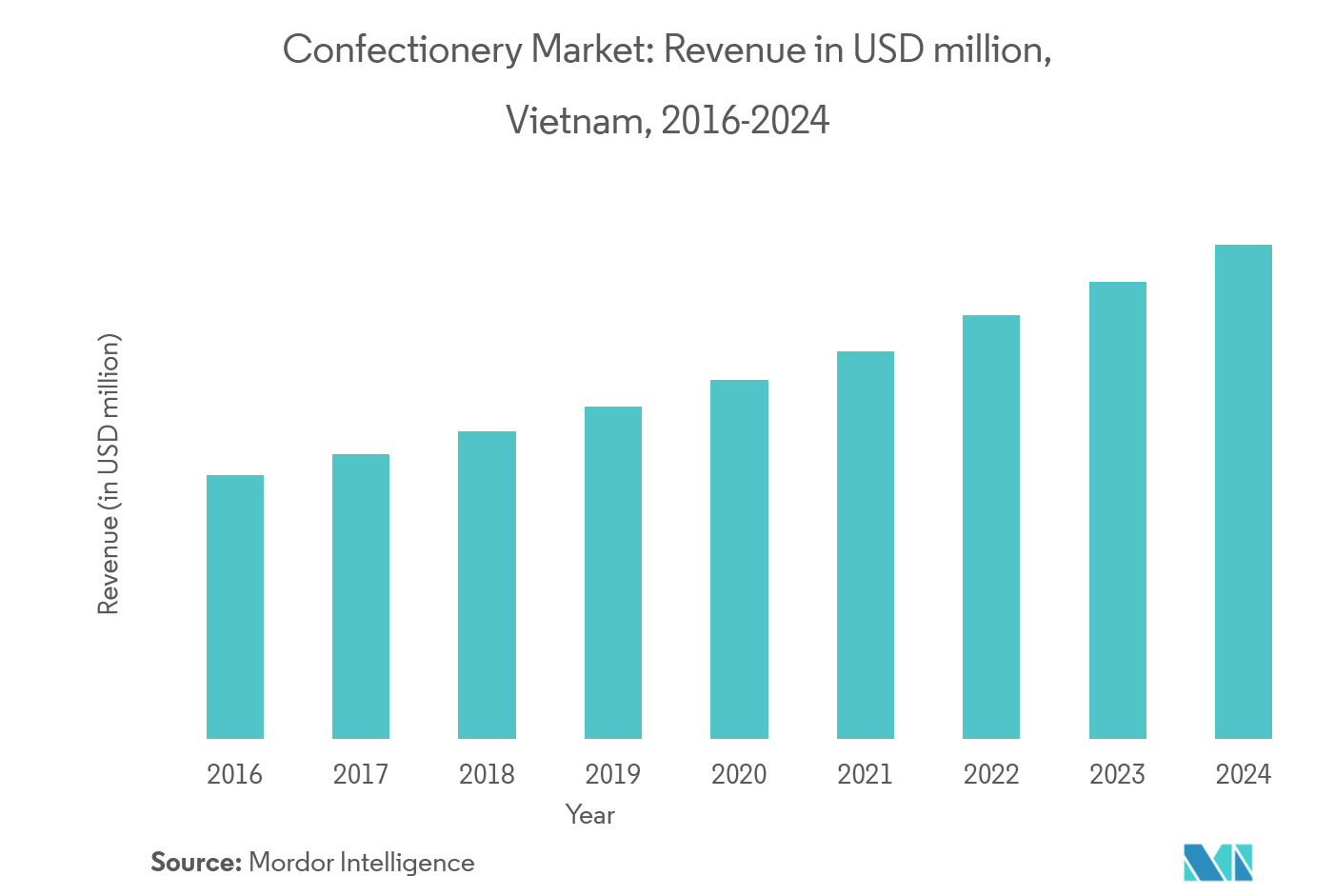

- The increase in confectionary sector of the country has also led to the growth of sweetener market in the nation.

Vietnam Food Sweetener Market Trends and Insights

Growing Confectionery Sector

The confectionery market in Vietnam is driven by the increase in demand for premium chocolates, along with innovation in packaging and several product launches. Additionally, gifting of chocolates has been a key trend in Vietnam for premium chocolate confectionery, as consumers see these items as luxury products. The high content of sugar in chocolates and candies is likely to hamper market. The health-conscious consumers have turned to snack bars and other categories of snacks that are perceived to be healthier and part of low-caloric diet, which opens an opportunity for the sweetener market.

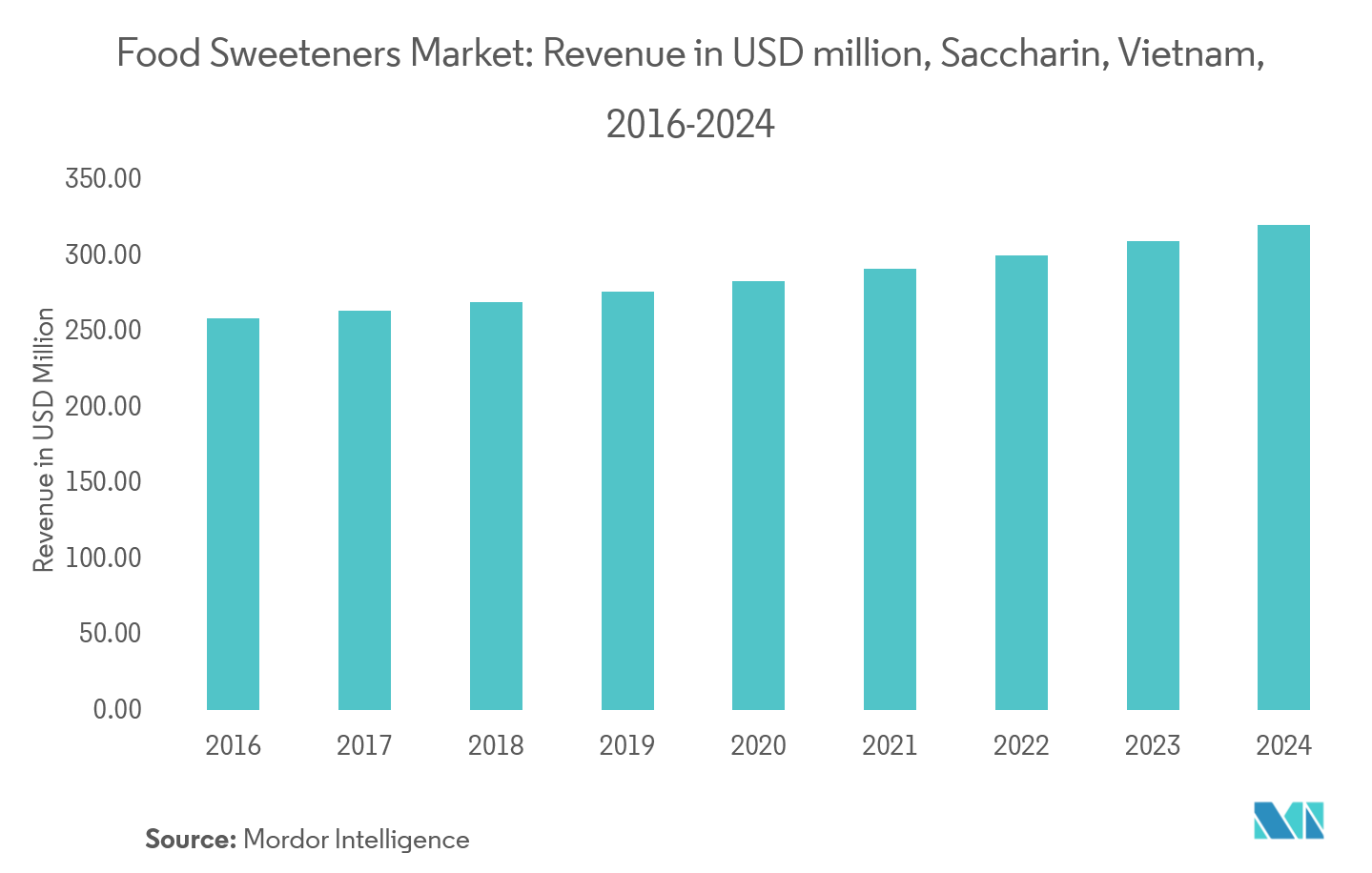

Saccharine Is A Major Sweetener In The Region

Saccharin, is the oldest low-calorie sugar substitute, is 300 times sweeter than sugar, and provides no calories. It is available in the form of sweet and low or sugar-free brands. Saccharin finds its usage in confectionery industry for the manufacture of mints and candies. It is largely used in sugar-free cakes and in packaged desserts, as it is not affected by heat. The number of elderly is growing and this upward trend will clearly continue in the near future, this leads to the increasing demand of low sugar and low calorie foods.

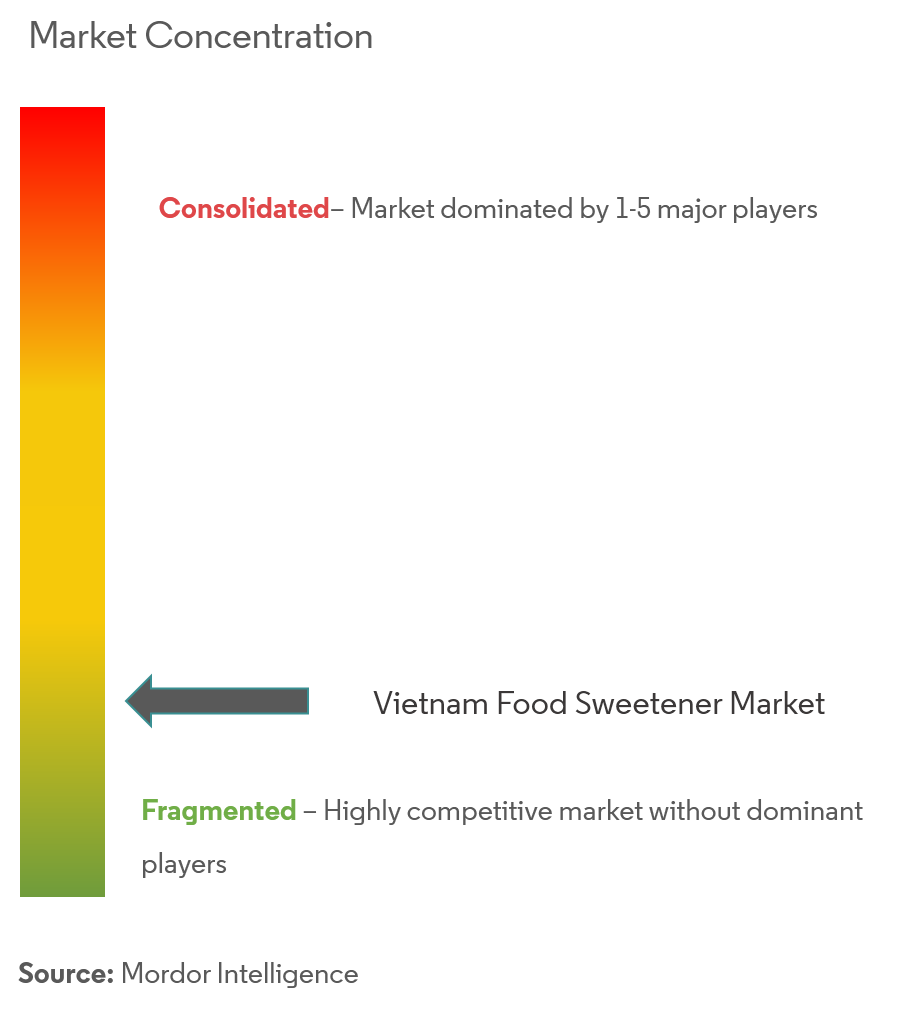

Competitive Landscape

Vietnam food sweetener market is a fragmented market with the presence of various local and major players. The major players are investing in the development of new products. To expand their presence in the market, strategies such as acquiring smaller production units and mergers with the already existing players are being adopted. The leading players in this segment are Cargill, Kerry Group, Stevia First Corporation, and Tate and Lyle Plc.

Vietnam Food Sweetener Industry Leaders

Cargill

Tate & Lyle

Ingredion

PureCircle

- *Disclaimer: Major Players sorted in no particular order

Vietnam Food Sweetener Market Report Scope

Vietnam Food Sweetener Market is segmented by Type into Sucrose, Starch Sweeteners and Sugar Alcohols and High Intensity Sweeteners. The market is segmented by Application into Dairy, Bakery, Beverages, Soups, Sauces and Dressings, Confectionery and Others.

| Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose |

| High Fructose Corn Syrup (HFCS) | |

| Maltodextrin | |

| Sorbitol | |

| Xylitol | |

| Others | |

| High Intensity Sweeteners (HIS) | Sucralose |

| Aspartame | |

| Saccharin | |

| Cyclamate | |

| Ace-K | |

| Neotame | |

| Stevia | |

| Others |

| Dairy |

| Bakery |

| Soups, Sauces and Dressings |

| Confectionery |

| Beverages |

| Others |

| By Product Type | Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose | |

| High Fructose Corn Syrup (HFCS) | ||

| Maltodextrin | ||

| Sorbitol | ||

| Xylitol | ||

| Others | ||

| High Intensity Sweeteners (HIS) | Sucralose | |

| Aspartame | ||

| Saccharin | ||

| Cyclamate | ||

| Ace-K | ||

| Neotame | ||

| Stevia | ||

| Others | ||

| By Application | Dairy | |

| Bakery | ||

| Soups, Sauces and Dressings | ||

| Confectionery | ||

| Beverages | ||

| Others | ||

Key Questions Answered in the Report

What is the current Vietnam Food Sweetener Market size?

The Vietnam Food Sweetener Market is projected to register a CAGR of 2.24% during the forecast period (2025-2030)

Who are the key players in Vietnam Food Sweetener Market?

Cargill, Tate & Lyle, Ingredion and PureCircle are the major companies operating in the Vietnam Food Sweetener Market.

What years does this Vietnam Food Sweetener Market cover?

The report covers the Vietnam Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Vietnam Food Sweetener Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Vietnam Food Sweetener Market Report

Statistics for the 2025 Vietnam Food Sweetener market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Vietnam Food Sweetener analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.