Fixed Satellite Services Market Size and Share

Fixed Satellite Services Market Analysis by Mordor Intelligence

The Fixed Satellite Services Market is expected to register a CAGR of 5.48% during the forecast period.

- The rise of smartphones and heightened internet usage have intensified the need for swift broadband services. Fixed Satellite Services (FSS) is pivotal in delivering this broadband connectivity, particularly in remote and underserved areas lacking terrestrial infrastructure. This demand is further heightened by an increasing number of households embracing HDTV channels and Direct-to-Home (DTH) subscriptions, underscoring the necessity for strong satellite communication services.

- 5G networks, in their deployment, necessitate extensive backhaul support - a service efficiently rendered by FSS. By ensuring smooth communication between various network nodes, FSS bolsters the reliability and efficiency of 5G services, catalyzing their adoption across diverse sectors.

- Enterprises, especially in the oil and gas domain, are turning to FSS for corporate networking and instantaneous data transmission. Moreover, military and defense sectors are channeling investments into satellite communications, aiming to bolster their operational capabilities, which in turn fuels the growth of the FSS market.

- In September 2024, Intelsat, a global satellite player, unveiled a new terminal strategy, positioning itself to be the first in the industry to deliver global multi-orbit solutions across all key verticals by mid-2025. Presently, Intelsat provides multi-orbit solutions through its geostationary satellites and, in collaboration with Eutelsat OneWeb, via LEO satellites. This partnership, bolstered by a USD 500 million deal earlier this year, underscores Intelsat's commitment to expanding its offerings.

- Advancements in satellite technology, such as high-throughput satellites and AI integration for network optimization, are amplifying the efficiency and capacity of FSS. These developments, bolstered by significant investments in satellite infrastructure and services, are driving market growth.

- In conclusion, surging demands for high-speed connectivity, the rollout of 5G networks, increased reliance by enterprises and the military, and relentless technological advancements are propelling the Fixed Satellite Services market toward significant growth. Collectively, these elements highlight the indispensable role of FSS in the global communication arena.

- However, the FSS market contends with challenges. High initial costs tied to satellite launches and infrastructure setup act as a deterrent. Furthermore, the rising prominence of budget-friendly, high-speed alternatives, such as fiber-optic and mobile broadband, is dampening demand in certain regions.

Global Fixed Satellite Services Market Trends and Insights

Increasing 5G Penetration to Stimulate the Market Growth

- The increasing penetration of 5G technology is significantly augmenting the growth of the Fixed Satellite Services (FSS) market. As 5G networks expand, the demand for reliable and high-capacity backhaul solutions intensifies, especially in areas where terrestrial infrastructure is limited or economically unfeasible. FSS provides essential connectivity to bridge these gaps, ensuring seamless communication across diverse geographies.

- One of the critical roles of FSS in the 5G ecosystem is facilitating connectivity in remote and underserved regions. By integrating satellite systems into 5G networks, service providers can extend coverage to areas lacking fiber-optic infrastructure, thereby promoting digital inclusion. According to GSMA Intelligence, by 2025, 21% of global connections are projected to be 5G. North America is anticipated to lead, with 51% of its connections expected to be 5G.

- Furthermore, the collaboration between 5G and satellite communications paves the way for advanced applications demanding high bandwidth and low latency. These include autonomous vehicles, remote healthcare, and augmented reality. FSS guarantees the seamless operation of these applications, no matter where the user is located.

- Technological advancements in satellite systems, including the development of Low Earth Orbit (LEO) satellites, have further enhanced the capabilities of FSS. These innovations reduce latency and increase data throughput, making satellite communication more compatible with the stringent requirements of 5G services.

- In summary, the proliferation of 5G networks is driving the growth of the Fixed Satellite Services market by necessitating robust backhaul solutions, enabling connectivity in challenging terrains, and supporting the deployment of next-generation applications. As 5G continues to evolve, the integration with satellite services will be pivotal in achieving comprehensive and reliable global connectivity.

Asia-Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific's Fixed Satellite Services (FSS) market is on an upward trajectory, fuelled by the region's distinct communication demands and rapid technological progress. Given its vast and varied landscape, the Asia-Pacific region encompasses many remote areas that struggle with unreliable terrestrial communication. FSS is pivotal in bridging this gap, offering vital connectivity for broadband internet, TV broadcasting, and enterprise networking. The surging demand for high-speed internet, particularly in rural locales, propels the FSS market's growth in the region.

- As 5G technology rolls out across Asia-Pacific, there's a pressing need for robust backhaul solutions to meet its high data and low latency demands. FSS emerges as a prime solution, extending 5G coverage to regions where terrestrial infrastructure is either challenging or too costly to deploy. This synergy between satellite services and 5G networks is bolstering the FSS demand in the region.

- Asia-Pacific governments are promoting satellite technology adoption to bolster communication services. For example, nations like China and India have rolled out communication satellites to boost broadband services and widen coverage. Such proactive government measures and supportive policies foster a thriving environment for the FSS market.

- In March 2025, SWISSto12 was selected to manufacture NEASTAR-1, a geostationary satellite, for Astrum Mobile, the dedicated Satellite-to-Device (S2D) company in the Asia-Pacific region. NEASTAR-1 will enable the region’s first 5G Non-Terrestrial Network (NTN) service. This advanced technology will provide direct satellite connectivity to standard smartphones and smart devices, ensuring uninterrupted coverage without dependence on traditional cellular towers.

- New satellite technologies, such as high-throughput satellites (HTS) and low Earth orbit (LEO) constellations, are amplifying FSS capabilities and efficiency. Moreover, newcomers like SpaceX's Starlink eye the Asia-Pacific market, with regulatory nods anticipated in nations like India. These shifts promise heightened competition, spurred innovation, and invigorated market growth.

- In conclusion, the Asia-Pacific FSS market's expansion is driven by rising demands for swift connectivity, 5G network integration, government backing, and technological strides. Together, these elements not only fuel the market's growth but also address the region's varied communication challenges, promoting digital inclusivity.

Competitive Landscape

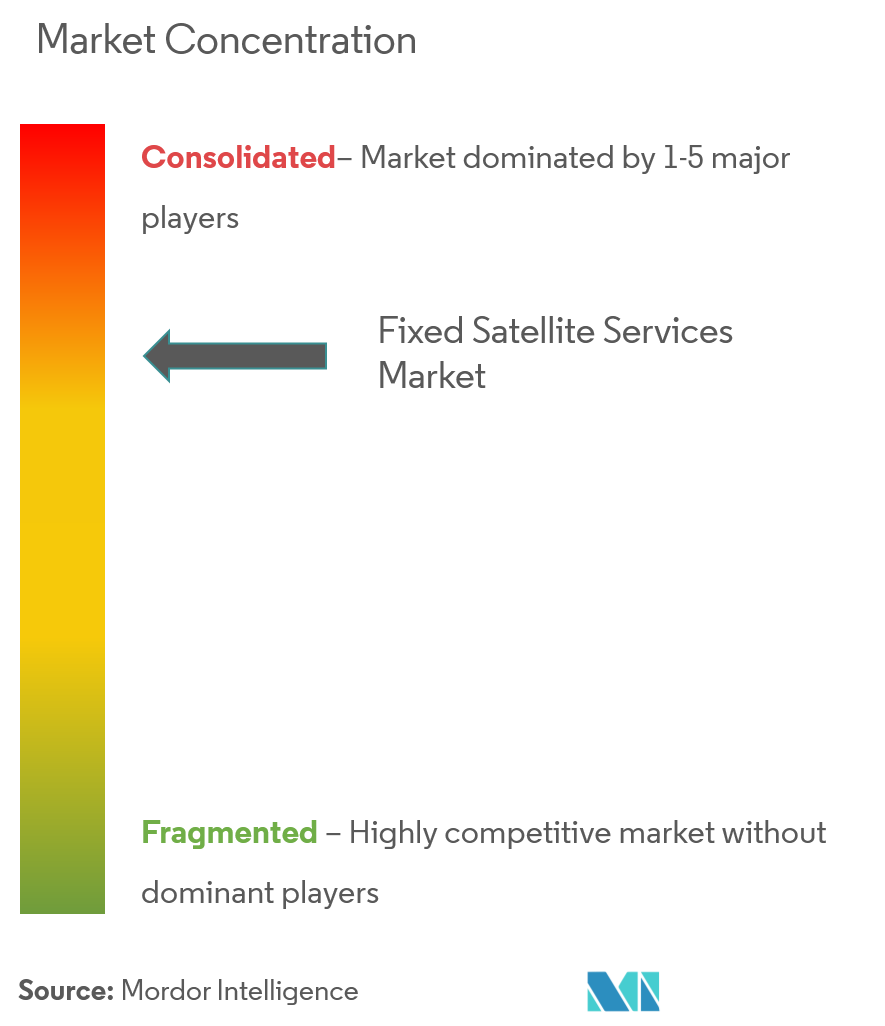

Major players dominate the competitive landscape of the fixed satellite services market. These key players, holding significant market shares, are actively working to broaden their customer base internationally. In their pursuit of growth, these companies are not only entering strategic collaborations but are also acquiring firms specializing in fixed satellite services, bolstering their product offerings. Notable players in this arena include Intelsat SA, Eutelsat Communications, and Singapore Telecommunications Ltd (Singtel), among others.

Fixed Satellite Services Industry Leaders

Eutelsat Communications

Telesat Holdings

Singapore Telecommunications Ltd (Singtel)

SES SA

Intelsat SA

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- November 2024: SpaceX successfully launched the Koreasat-6A satellite, catering to the needs of KT SAT, a satellite operator in South Korea. The Koreasat-6A satellite is set to provide a range of services, including broadcasting and fixed satellite services, across South Korea.

- September 2024: AST SpaceMobile, Inc. has successfully launched its inaugural set of five commercial satellites, dubbed BlueBirds. The company is pioneering the world's first space-based cellular broadband network, which is directly accessible by everyday smartphones, catering to both commercial and government needs.

Global Fixed Satellite Services Market Report Scope

Fixed satellite services (FSS) utilize very small aperture terminal (VSAT) technology to provide high-speed connectivity to end users. Strategically positioned, FSS systems offer coverage extending across several square miles. While these systems are employed in sectors such as aerospace, defense, media, and commercial industries, the telecommunications industry remains the primary user.

The Fixed Satellite Services Market is Segmented by Type of Services (Transponder Agreements, Managed Services), by End User Vertical (Government, Commercial, Aerospace and Defense, Media, and Other End-users Verticals), and Geography (North America, Europe, Asia, Australia, New Zealand, Latin America, Middle East & Africa). The Market Sizes and Forecasts are Provided in Terms of Value (USD Million) for all the Above Segments.

| Transponder Agreements |

| Managed Services |

| Government |

| Commercial |

| Aerospace and Defense |

| Media |

| Other End-users Verticals |

| North America |

| Europe |

| Asia |

| Australia |

| New Zealand |

| Latin America |

| Middle East & Africa |

| By Type of Services | Transponder Agreements |

| Managed Services | |

| By End-user Vertical | Government |

| Commercial | |

| Aerospace and Defense | |

| Media | |

| Other End-users Verticals | |

| By Geography | North America |

| Europe | |

| Asia | |

| Australia | |

| New Zealand | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Fixed Satellite Services Market size?

The Fixed Satellite Services Market is projected to register a CAGR of 5.48% during the forecast period (2025-2030)

Who are the key players in Fixed Satellite Services Market?

Eutelsat Communications, Telesat Holdings, Singapore Telecommunications Ltd (Singtel), SES SA and Intelsat SA are the major companies operating in the Fixed Satellite Services Market.

Which is the fastest growing region in Fixed Satellite Services Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Fixed Satellite Services Market?

In 2025, the North America accounts for the largest market share in Fixed Satellite Services Market.

What years does this Fixed Satellite Services Market cover?

The report covers the Fixed Satellite Services Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Fixed Satellite Services Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Fixed Satellite Services Market Report

Statistics for the 2025 Fixed Satellite Services market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Fixed Satellite Services analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.