Europe Food Flavor and Enhancer Market Analysis by Mordor Intelligence

The Europe Food Flavor and Enhancer Market is expected to register a CAGR of 4.5% during the forecast period.

- The synthetic flavor segment helda major share of the market. The natural flavor segment is anticipated to record the highest growth rate during the forecast period.

- Food flavoring and enhancing industry is highly dependent on the easy availability of raw materials, the market players have set up production bases in the local market, to get easy access to the same, which has intensified the competition in the local market.

Europe Food Flavor and Enhancer Market Trends and Insights

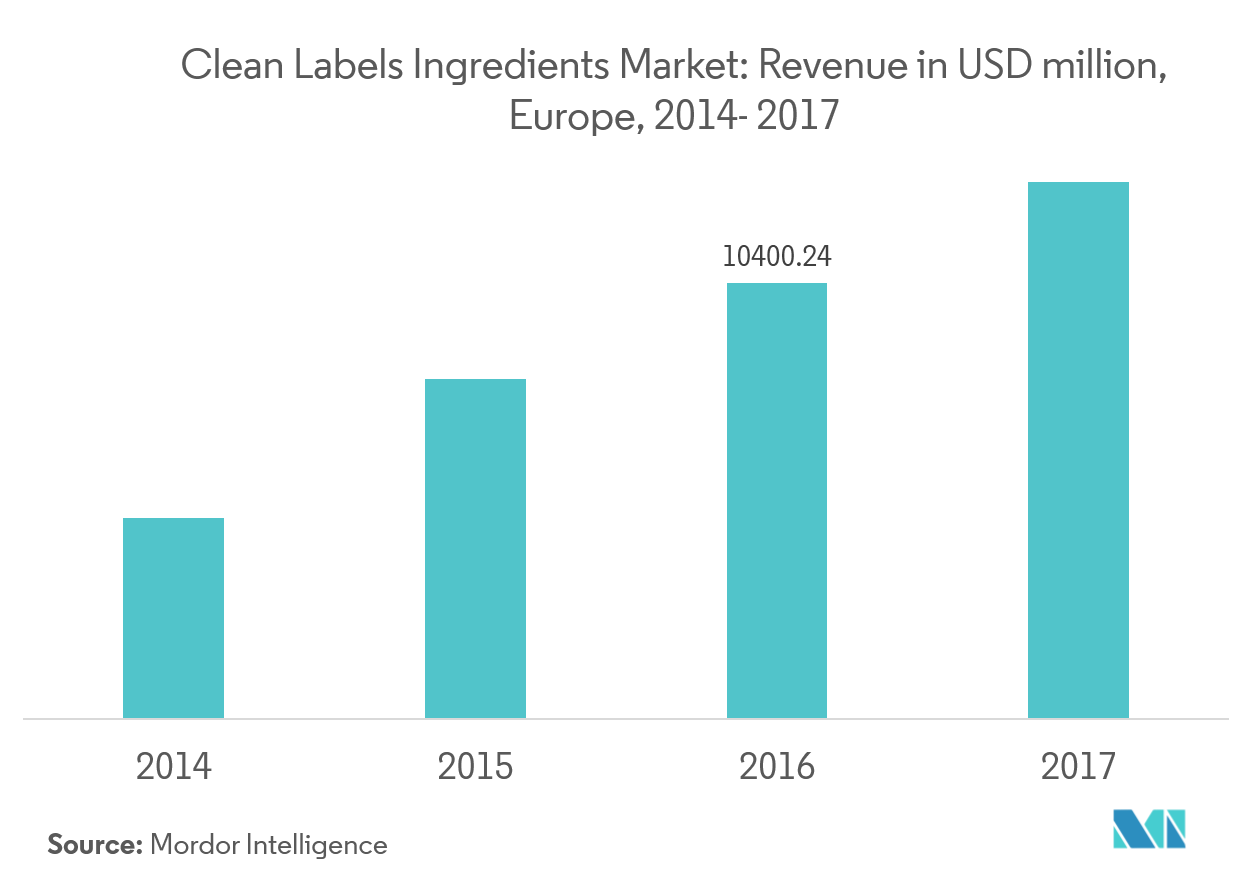

Growing Inclination towards Clean-Label Ingredients

The trend of naturally sourced ingredients has been spreading across the European region, especially in countries like Germany, France, and Spain. Food and beverage companies have been largely affected with almost all international and local players forced to remove artificial flavors and additives from their product lines. In parallel, clean label has affected the global flavor market, wherein producers have responded with high innovation and investments in R&D activities. Consumers are highly skeptical about artificial additives. Rise in consumers concern on usage of food additives and preservatives have led to the demand growth for transparency and clean labels, thus, hindering the artificial flavor and additive market.

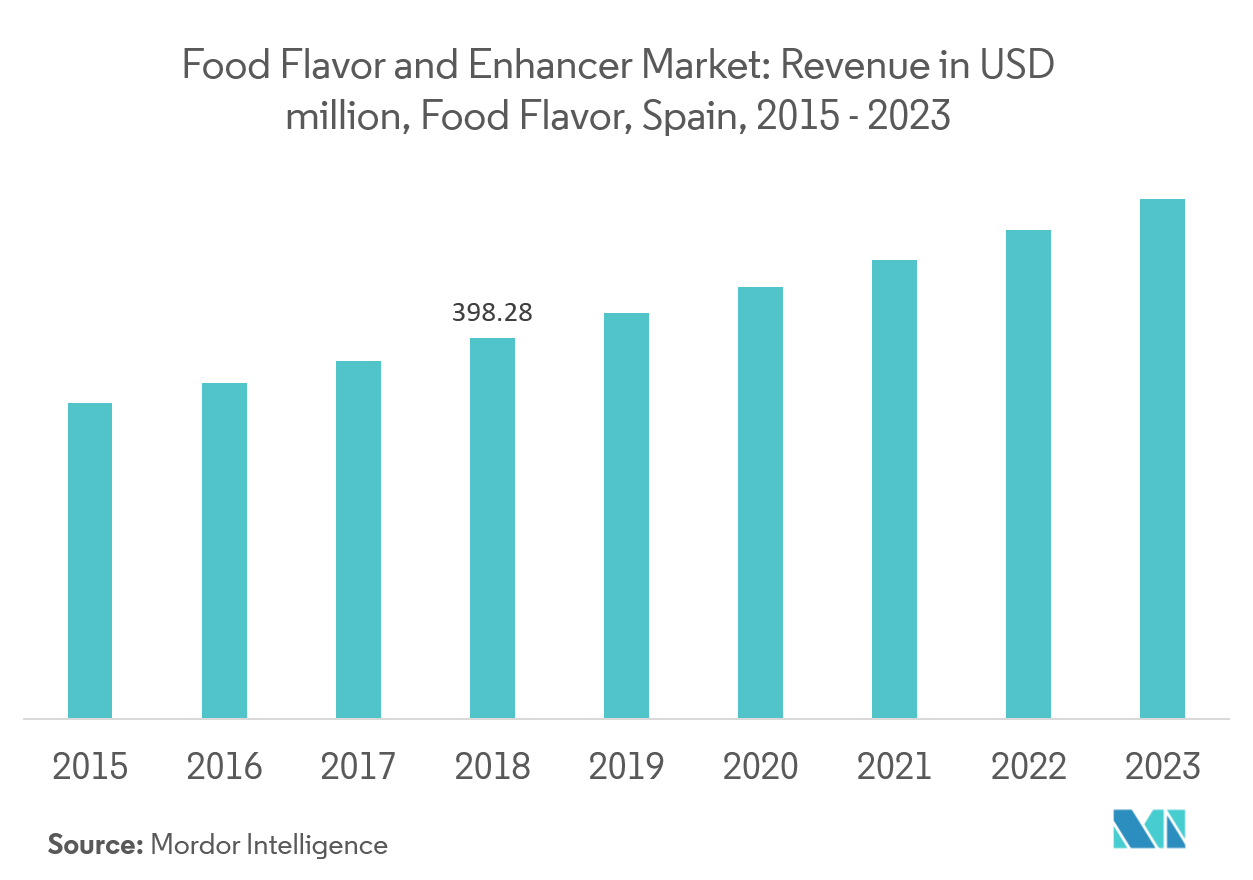

Spain is the Fastest Growing Country

Spain is the sixth highest food and drinks exporter in the EU and the tenth highest globally. This growth of the food and beverage industry is driving the demand for various food flavors. In Spain, natural food flavors derived from spices and herbs are in huge demand and it will witness significant growth in upcoming years. In Spain, natural food flavors derived from spices and herbs are in huge demand and it will witness significant growth in upcoming years. While Spanish consumers are seeking healthier food ingredients, natural food flavors have experienced little growth in the domestic market, although production and exports remain largest in Spain.

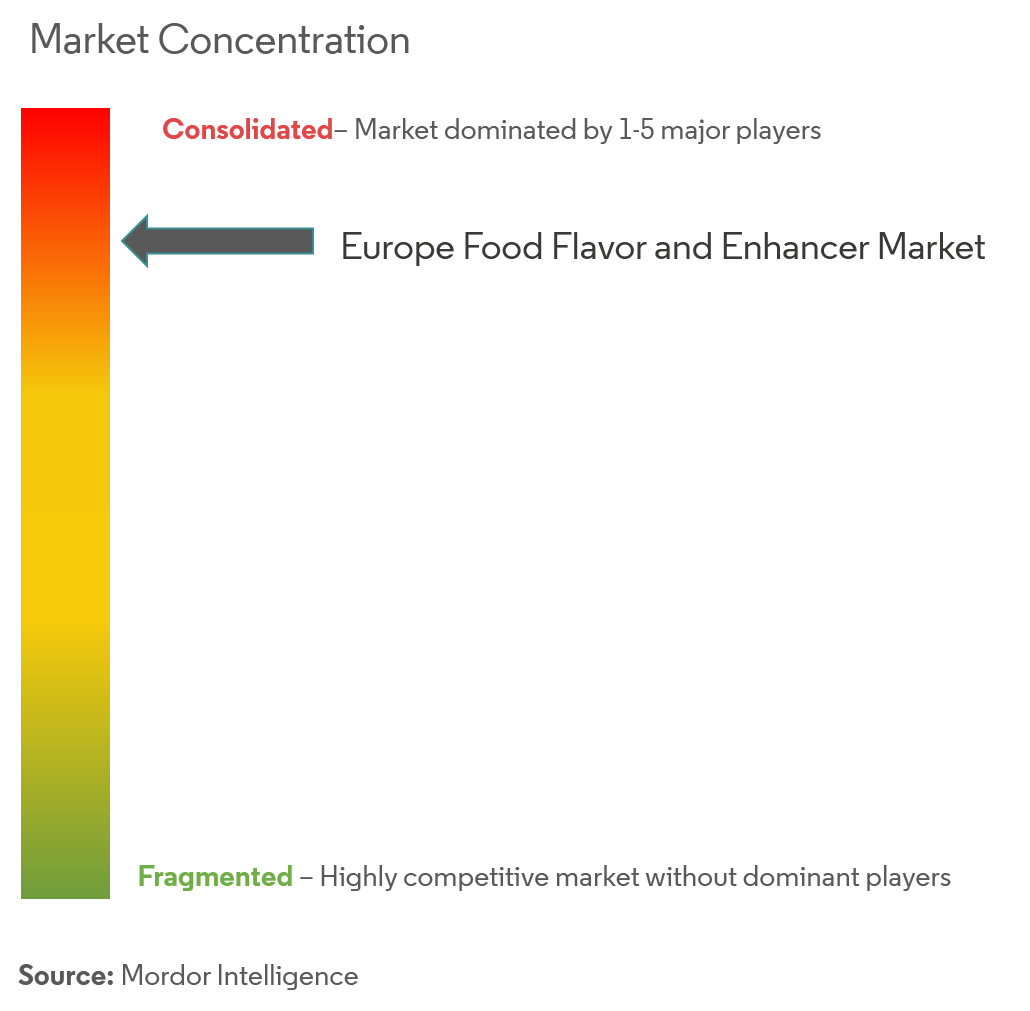

Competitive Landscape

The European food flavor and enhancer market is dominated by players like European Flavours & Fragrances PLC, Givaudan, Firmenich, European Flavours and Fragrances and Kerry group.The European food flavor and enhancer market is dominated by players like European Flavours & Fragrances PLC, Givaudan, Firmenich, IFF, Symrise, Cargil Inc., and Kerry group, accounting for a share of more than 41% in the local market.Manufacturers in the local market continue to expand the portfolio of specialty natural products that are being offered by companies to the consumers through internal R&D, achieved by collaborations with universities and research institutes.

Europe Food Flavor and Enhancer Industry Leaders

Givaudan

Kerry Group plc

European Flavours and Fragrances

BASF

Firmenich

- *Disclaimer: Major Players sorted in no particular order

Europe Food Flavor and Enhancer Market Report Scope

Europe Food Flavor and Enhancer Market is segmented by type into Food Flavors ( Natural, Synthetic and Natural Identical Flavors) and Enhancers; by end user into Bakery, Confectionery, Processed Food, Beverage, Dairy Products and Geography.

| Food Flavors | Natural Flavors |

| Synthetic Flavors | |

| Nature Identical Flavors | |

| Enhancers |

| Dairy |

| Bakery |

| Confectionery |

| Processed Food |

| Beverage |

| Others |

| Europe | Spain |

| United Kingdom | |

| Germany | |

| France | |

| Italy | |

| Russia | |

| Rest of Europe |

| By Type | Food Flavors | Natural Flavors |

| Synthetic Flavors | ||

| Nature Identical Flavors | ||

| Enhancers | ||

| By Application | Dairy | |

| Bakery | ||

| Confectionery | ||

| Processed Food | ||

| Beverage | ||

| Others | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

Key Questions Answered in the Report

What is the current Europe Food Flavor and Enhancer Market size?

The Europe Food Flavor and Enhancer Market is projected to register a CAGR of 4.5% during the forecast period (2025-2030)

Who are the key players in Europe Food Flavor and Enhancer Market?

Givaudan, Kerry Group plc, European Flavours and Fragrances, BASF and Firmenich are the major companies operating in the Europe Food Flavor and Enhancer Market.

What years does this Europe Food Flavor and Enhancer Market cover?

The report covers the Europe Food Flavor and Enhancer Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Food Flavor and Enhancer Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Europe Food Flavor and Enhancer Market Report

Statistics for the 2025 Europe Food Flavor and Enhancer market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Food Flavor and Enhancer analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.