Emergency Shutdown Systems Market Size and Share

Emergency Shutdown Systems Market Analysis by Mordor Intelligence

The Emergency Shutdown Systems Market is expected to register a CAGR of 9.29% during the forecast period.

- Owing to increasingly complex manufacturing and industrial applications, there has been a rise in the number of global catastrophic accidents. Further, in multiple cases, security factors are also altering the demand for emergency shutdown systems, especially in the case of the oil and gas industry. For example, in countries such as Mexico where the pipelines are often prone to insurgent attacks and theft, there is a high demand for automated and robust emergency shutdown systems, which support remote operation.

- The initial investments associated with the installation of an emergency shutdown system is very high. The total cost of ownership involves capital costs, such as acquisition and design of machines. Wellhead and process emergency shutdown systems are complex and their design has to rely on knowledge from many different disciplines, which accounts for higher design and development costs.

- Moreover, In Apr 2020, Emerson Industrial Energy consulting team was assigned to assist a Northeastern U.S. specialty chemical manufacturer. The latter required modernizing the controls on two of its 1960's vintage Combustion Engineering 'D' Type process steam boilers. The new boiler controls were built by Emerson using DeltaV SIS (Safety Instrumented System) hardware for safety functionality and DeltaV PAS (Process Automation System) equipment for combustion and process control.

- Multiple organizations across the globe are subsequently experiencing a decline in trading conditions primarily owing to the recent outbreak of the COVID-19, further that are also being impacted by the weakening of oil prices.

- The increase in demand is for energy is resulting in the construction of nuclear power plants. It is estimated that over 450 nuclear power reactors are operating in 30 countries and an additional 50 power reactors are currently being constructed in 15 countries (majorly concentrated in countries like China, India, Russia, and the United Arab Emirates). This is anticipated to increase the need for emergency shutdown systems.

Global Emergency Shutdown Systems Market Trends and Insights

Oil and Gas is Expected to Witness Significant Growth

- Oil and gas is the largest sector for emergency shutdown systems globally. Recovering oil and gas prices and increasing upstream activity are expected to increase the demand for emergency shutdown systems, especially from offshore establishments. Demand for the ESD systems from upstream, midstream, and downstream (oil refineries) activities are taken into account under this segment.

- Regulations like the Bureau of Safety and Environmental Enforcement (BSEE) which enforces safety and environmental protection regulations for offshore oil and natural gas industry in the United States are prevalent across other regions like Europe as well (Europe 4 and 5 standards).To minimize the risk of a major incident, pressure and temperature of the line are closely monitored and that is where the ESD system comes into play.

- With new refinery projects anticipated across regions like India, which is expected to commission the largest green refinery in the world, the demand for the ESD systems is expected to increase over the forecast period. New upcoming oil and gas refinery projects to be commissioned between the timeframe of 2017-2023 across Norway, Denmark, Uzbekistan, Kuwait among others can be potential customers for the ESD systems.

- With the US Department of the Interior planning to allow the offshore exploratory drilling in about 90% of the Outer Continental Shelf (OCS) acreage, under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) planned for 2019-2024, the oil and gas sector in the region is also anticipated to offer new opportunities to the market.

Europe is Expected to Hold a Significant Market Share

- Europe is one of the largest markets for emergency shutdown systems (ESD) in the world. Considerable activity in the downstream oil and gas sector and high industrial activity in the region is one of the most prominent drivers for the ESD systems market in Europe.

- Europe is one of the most advanced and one of the largest crude oil refiners in the world. As of 2017, the region is responsible for 15% of the global oil refining capacity. The low crude oil situation in the recent past has significantly increased the demand for the expansion of existing refineries and the inception of new projects.

- Also, there has been a considerable exploration activity in countries like the United Kingdom that have led to key discoveries such as Glendronach (by Total). It is estimated that Glendronach is the fifth-largest conventional natural gas reserve discovery on the UK Continental Shelf, in the millennium.

- The increased adoption of industrial control systems with advanced technologies across multiple end-user industries is also anticipated to encourage the adoption of the emergency shutdown systems among considerably large, small and medium enterprise across the region. Thus, the region is expected to provide business opportunities for the market players during the forecast period.

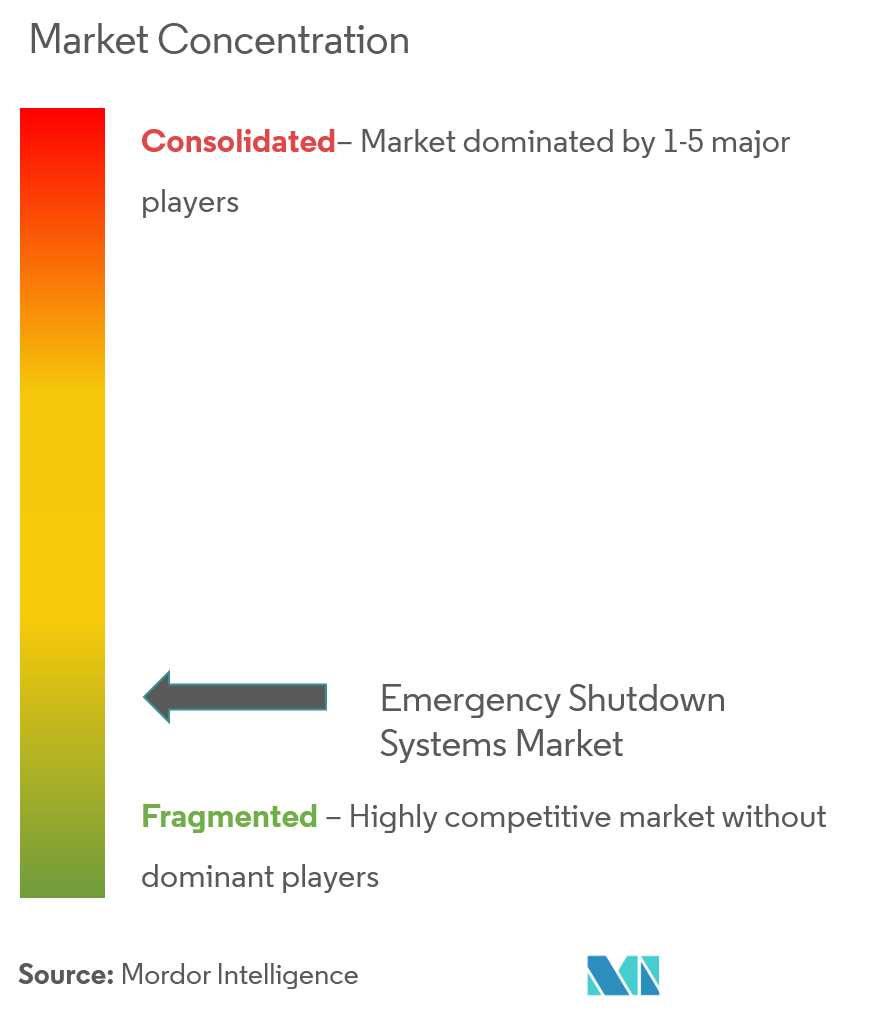

Competitive Landscape

Growing demand for emergency shutdown systems is driving the huge investments in the industry, to develop new technological products. Owing to this, the companies have started adopting, developing new and differentiated products as their core strategy. Large manufacturers, such as Honeywell, Emerson, Rockwell Automation, ABB, Schneider Electric are aggressively pushing to acquire small tech companies and gain sustainable competitive advantage. Some of the key players in Global Emergency Shutdown Systems Market are ABB, Emerson, Honeywell. Some key developments in the Global Emergency Shutdown Systems Market are,

- Apr 2020 - Emerson acquired leading hydroelectric turbine controls company, American Governor Company. The addition of American Governor Company builds on Emerson's technology capabilities and expertise in the renewable and power industry.

- Nov 2019 - Yokogawa Electric Corporation announced the release of ProSafe-RS R4.05.00, which is an enhanced version of the ProSafe-RS safety instrumented system. The ProSafe-RS is a core product of the OpreX Control and Safety System family offered by the company.

Emergency Shutdown Systems Industry Leaders

General Electric Co

Siemens AG

Honeywell International Inc

ABB Ltd

Schneider Electric SE

- *Disclaimer: Major Players sorted in no particular order

Global Emergency Shutdown Systems Market Report Scope

Emergency Shutdown Systems (ESD) ensures priority control of process equipment which is required for switching the process in safe mode.

| Electrical |

| Fiber Optic |

| Pneumatic |

| Hydraulic |

| Other Control Methods |

| Oil and Gas |

| Refining |

| Power Generation |

| Metal and Mining |

| Paper and Pulp |

| Other End-user Verticals |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Control Method | Electrical |

| Fiber Optic | |

| Pneumatic | |

| Hydraulic | |

| Other Control Methods | |

| By End-user Vertical | Oil and Gas |

| Refining | |

| Power Generation | |

| Metal and Mining | |

| Paper and Pulp | |

| Other End-user Verticals | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Emergency Shutdown Systems Market size?

The Emergency Shutdown Systems Market is projected to register a CAGR of 9.29% during the forecast period (2025-2030)

Who are the key players in Emergency Shutdown Systems Market?

General Electric Co, Siemens AG, Honeywell International Inc, ABB Ltd and Schneider Electric SE are the major companies operating in the Emergency Shutdown Systems Market.

Which is the fastest growing region in Emergency Shutdown Systems Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Emergency Shutdown Systems Market?

In 2025, the Europe accounts for the largest market share in Emergency Shutdown Systems Market.

What years does this Emergency Shutdown Systems Market cover?

The report covers the Emergency Shutdown Systems Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Emergency Shutdown Systems Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Emergency Shutdown Systems Market Report

Statistics for the 2025 Emergency Shutdown Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Emergency Shutdown Systems analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.