Biometric Scan Software Market Size and Share

Biometric Scan Software Market Analysis by Mordor Intelligence

The Biometric Scan Software Market is expected to register a CAGR of 10.48% during the forecast period.

- The growth in the study of biometrics has instigated better security authentication technology, compared to other security methods. The growing need for stringent security regulations in many sectors of the society has generated tremendous interest in biometrics that has raised the expectations from biometric scanning technologies.

- Biometric scanning technologies are fueling developments and improvements in the care delivery system in the healthcare sector. Moreover, incremental innovations in the field of communication have led to the use of IoT, thus, improving the healthcare management system. This factor has created an immense demand for biometric scan software in the current market scenario.

- The emergence of mobile identification solutions for providing access to invaluable information, such as positive identity verification, benefits verification, arrest records, restraining orders, and wants and warrants has been critical in new demand generation. The ability to use the existing smartphones as the enabling device has pushed innovations in the market.

Global Biometric Scan Software Market Trends and Insights

Healthcare Sector Expected to Hold Major Share

- In terms of the end-user industries, the healthcare sector is expected to drive technological transformation within the market. Biometric solutions in hospitals provide secure access to information and meaningful cost savings through fraud reduction. For instance, it cuts the cost associated with duplication of patient medical records, and thus, enhances the data security.

- Biometric scanning technologies are fueling developments and improvements in the care delivery system in the healthcare sector. Moreover, incremental innovations in the field of communication have led to the use of IoT, thus, improving the healthcare management system. This factor has created an immense demand for biometric scan software in the current market scenario.

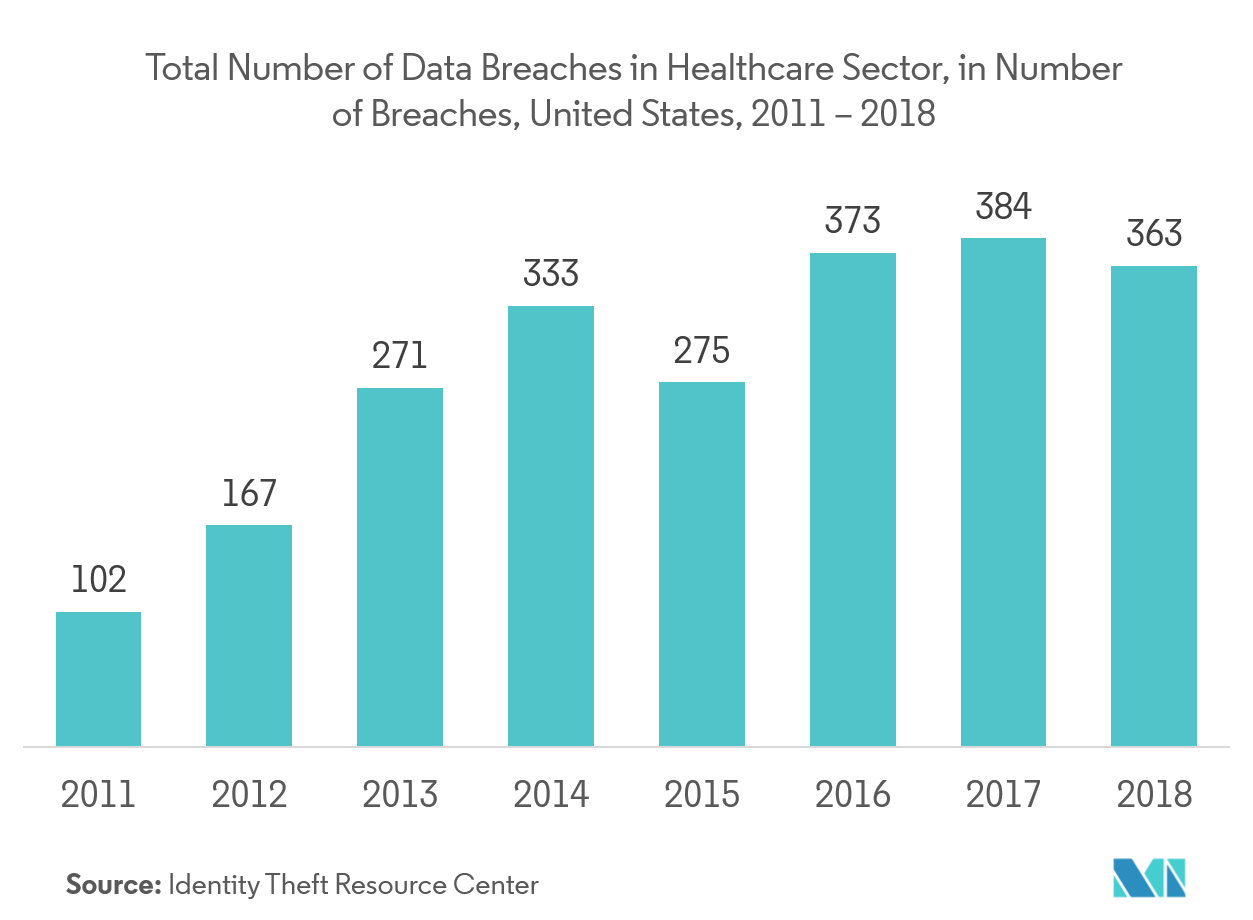

- The increasing number of data breaches in the healthcare industry, giving rise to the adoption of biometric scan software. In 2018, multiple US-based companies involved themselves in the healthcare sector, including Arm, ForgeRock, Philips, Qualcomm Life, Sparsa, and US TrustedCare announced that they had banded together to establish “OpenMedReady“, a standards body focused on ensuring that the patient data used by healthcare practitioners is accurate. They indicated that smartphone-based fingerprint recognition will be a key element in their framework, as a means of tying medical data directly to patients.

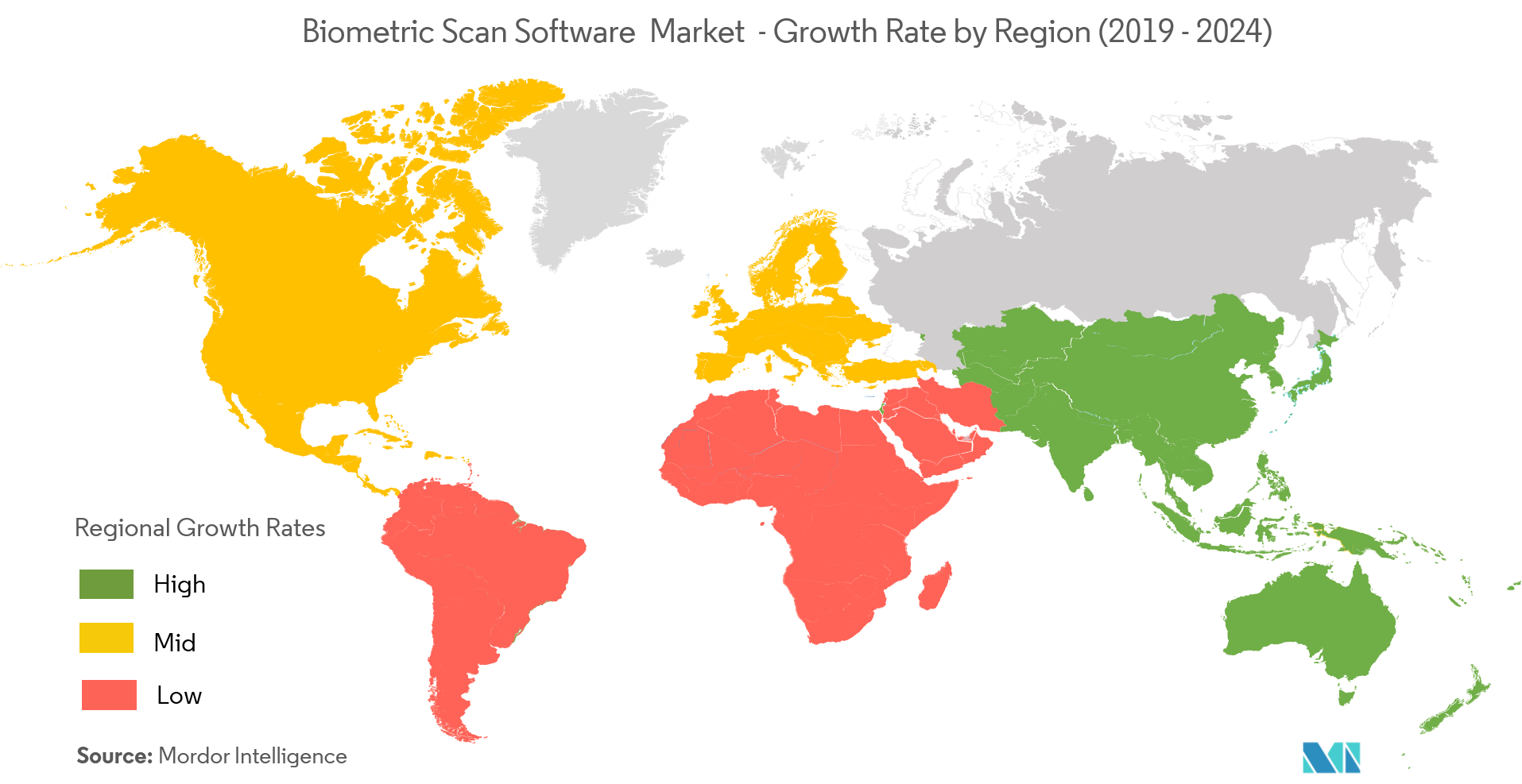

North America to Account for the Major Market Share

- North America is one of the largest markets for biometric scan software and is largely driven by the swift market penetration and presence of large companies working on the technology.

- Stricter regulations for fraud detection and risk analysis are the driving factors for its paced adoption in the BFSI segments. The adoption of the security-related infrastructure in North America is profoundly impacted by the presence of regulatory, as well as corporate policies of the businesses.

- A recent report by Spiceworks, an online IT community, on the adoption and security of biometric authentication technology in the corporate workplace showed that 62% of organizations in North America currently use some sort of biometric authentication technology. The community surveyed 492 professionals from North America and Europe in February 2018.

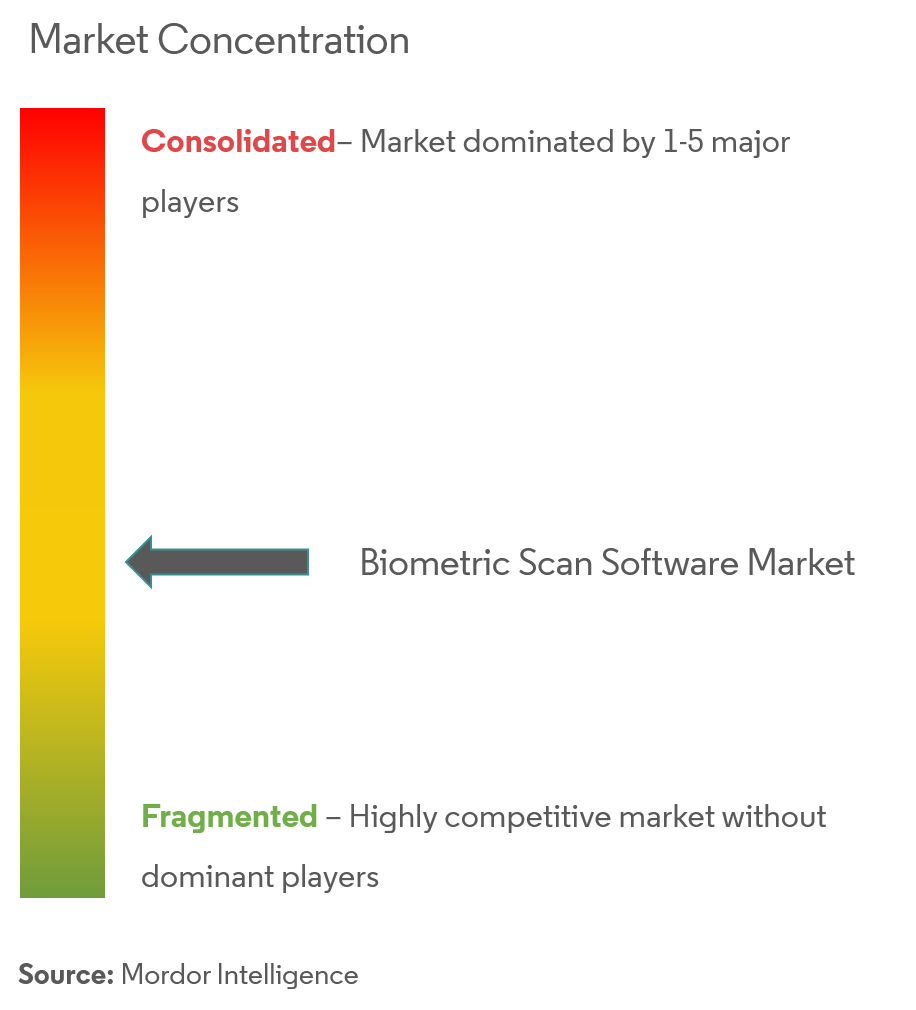

Competitive Landscape

The biometric scan software market is fragmented.The emergence of mobile identification solutions for providing access to invaluable information, such as positive identity verification, benefits verification, arrest records, restraining orders, and wants and warrants has penetrated the demand for biometric scan software.Overall, the competitive rivalry among existing competitors is high. Moving forward, acquisitions and collaboration of large companies are focused toward innovation. Some of the key developments in the area are:

- Aug 2018- NECCorporationinvested in Tascent, a U.S.-based provider of biometric identification solutions. Tascent’s technologies include optical control technology to remotely capture an accurate, high-quality iris image at high speed, and a user interface technology that guides users in support of capturing accurate biometric information.

- Jun 2019 - NEC Corporationsubmitted a proposal to take charge of Malaysia’s digital identification project, as the government prepares to introduce biometric identities for all of its 32 million citizens. The finalized details of the project has not been revealed yet.

Biometric Scan Software Industry Leaders

Corvus Integration Inc.

ImageWare Systems Inc.

Aware Inc.

Gemalto NV (Thales Group)

NEC Corporation

- *Disclaimer: Major Players sorted in no particular order

Global Biometric Scan Software Market Report Scope

Biometrics scan software is used during enrollment procedure when a physical characteristic such as fingerprint, palm print, facial image, and iris,that is supposed to examine, is usually mapped to a username.

The study encompasses major Biometric types being utilized such as Fingerprint, Palm print, among others. The market is further segmented into leading end-user industries such as Government & Defense, Healthcare, IT & Telecom, and BFSI.

| Fingerprint |

| Palm print |

| Facial Image |

| Iris |

| Government and Defense |

| Healthcare |

| IT and Telecom |

| BFSI |

| Other End-user Industries |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Biometric Type | Fingerprint |

| Palm print | |

| Facial Image | |

| Iris | |

| By End-user Industry | Government and Defense |

| Healthcare | |

| IT and Telecom | |

| BFSI | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Biometric Scan Software Market size?

The Biometric Scan Software Market is projected to register a CAGR of 10.48% during the forecast period (2025-2030)

Who are the key players in Biometric Scan Software Market?

Corvus Integration Inc., ImageWare Systems Inc., Aware Inc., Gemalto NV (Thales Group) and NEC Corporation are the major companies operating in the Biometric Scan Software Market.

Which is the fastest growing region in Biometric Scan Software Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Biometric Scan Software Market?

In 2025, the North America accounts for the largest market share in Biometric Scan Software Market.

What years does this Biometric Scan Software Market cover?

The report covers the Biometric Scan Software Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Biometric Scan Software Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Biometric Scan Software Market Report

Statistics for the 2025 Biometric Scan Software market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Biometric Scan Software analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.