北美食品甜味剂市场分析

北美食品甜味剂市场预计在预测期内复合年增长率为 1.22%。

- 北美对天然甜味剂的需求主要是由于健康食品的趋势。人们对过量食糖有害影响的认识不断提高,正在促进市场的增长。

- 然而,人们越来越认识到糖对消费者健康的负面影响,这可能会阻碍市场增长,为低热量甜味剂提供更多机会,特别是在饮料、烘焙和乳制品领域。

- 饮料类别占据主导地位,其次是烘焙食品、糖果和乳制品。根据类型,甜叶菊和木糖醇预计将出现高增长率。

北美食品甜味剂市场趋势

对低热量糖替代品的需求

随着清洁标签趋势的不断增长,低热量甜味剂 (LCS) 被用于各种饮料和食品中,如冷冻甜点、酸奶、糖果、烘焙食品、口香糖、早餐麦片、明胶和布丁。含有低热量甜味剂的食品和饮料带有无糖或减肥标签。美国食品和药物管理局 (USDA) 已将六种 LCS 列为公认安全 (GRAS)。 Equal®、NutraSweet®、Sugar Twin®、Splenda® 等品牌属于 GRAS 类别。

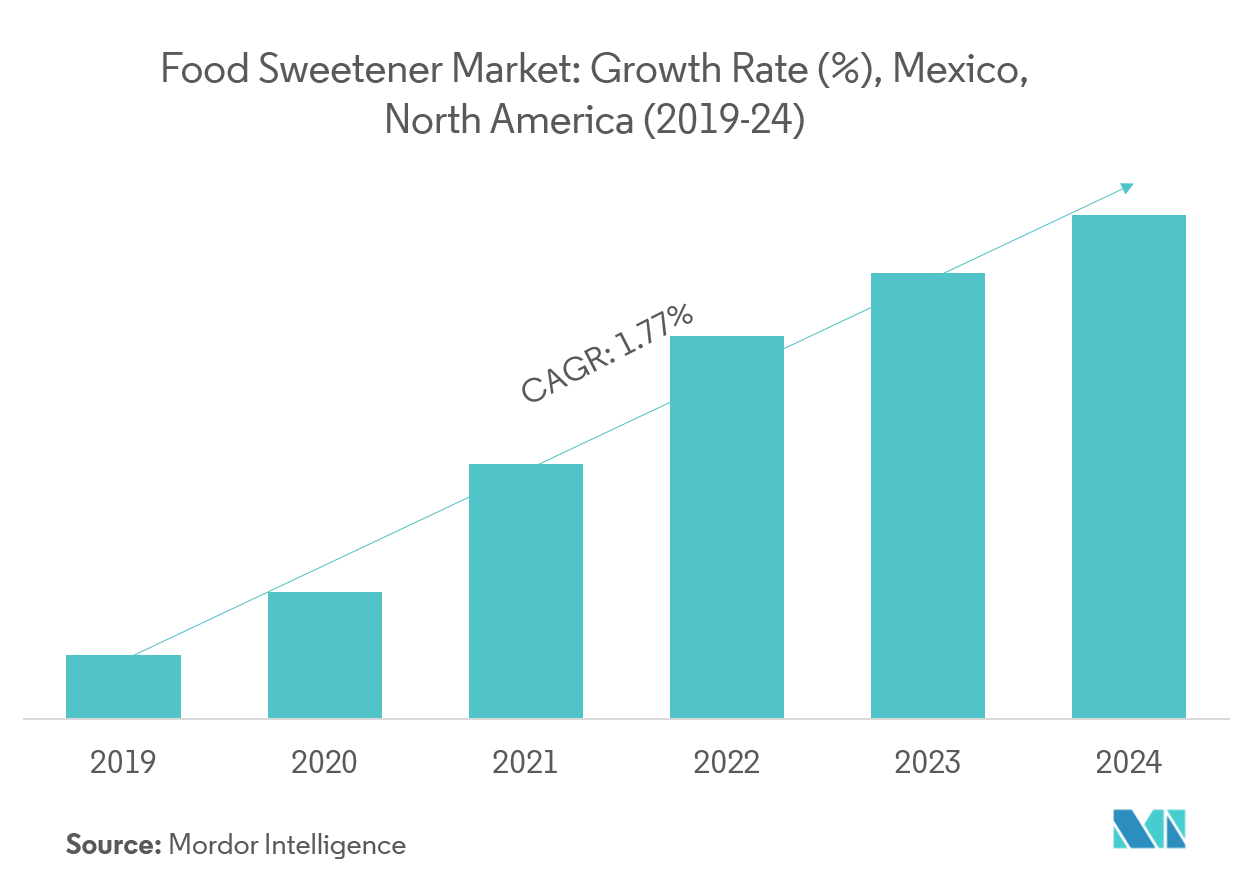

墨西哥仍然是增长最快的市场

墨西哥是天然和人造甜味剂产品的高潜力市场。该国肥胖人口比例很高。墨西哥政府决定将含糖饮料税提高10%,凸显其减少糖消费的认真意图。购买力预计将随着经济和城市住宅数量的增长而增加。在发展中国家,对人造甜味剂的需求与这些因素密切相关。因此,墨西哥有望成为甜味剂产品的有吸引力的目的地。在该国,在审查期间,糖消费受到政府大力宣传的不利影响,主要是为了提高人们对肥胖有害影响的认识。

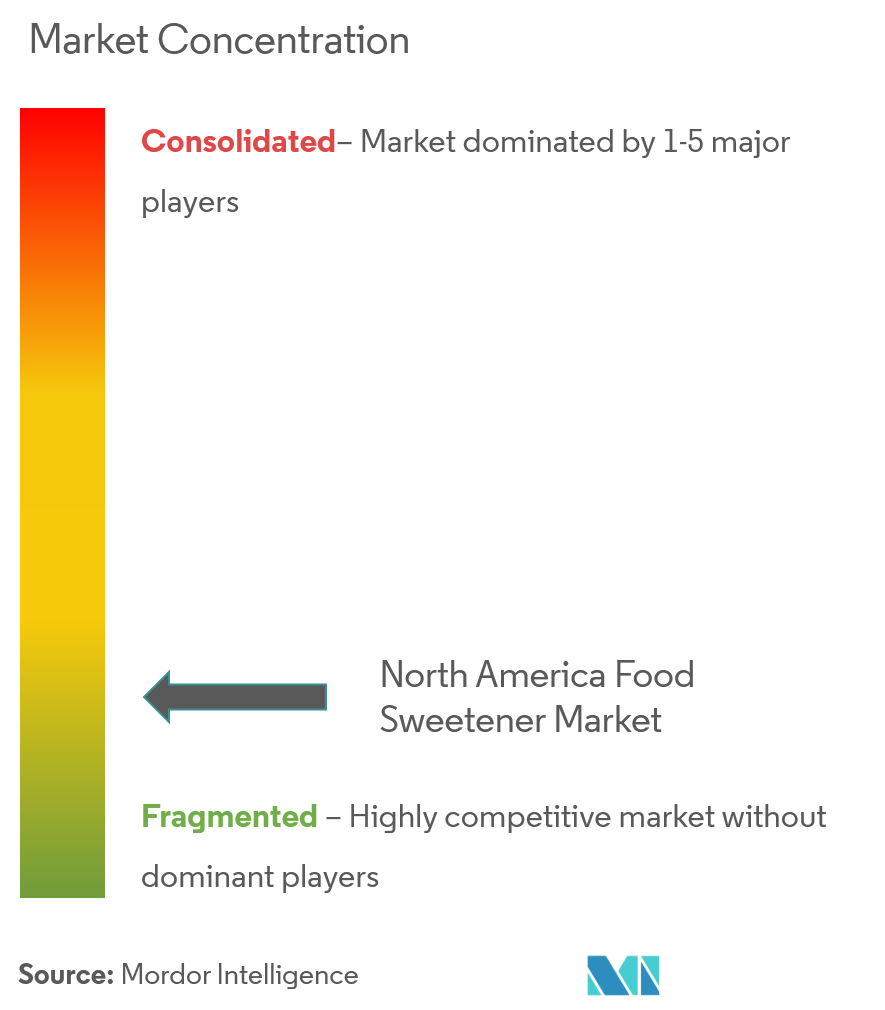

北美食品甜味剂行业概况

北美食品甜味剂市场由大量知名企业推动。目前,该行业有多家活跃参与者,例如嘉吉公司、泰莱公司、凯里集团和安瑞安等。收购、新产品发布、合资和扩张是最受欢迎的增长策略。

北美食品甜味剂市场领导者

Cargill, Incorporated

Archer Daniels Midland Company

Stevia First Corporation

Tate & Lyle

Ingredion Incorporated

- *免责声明:主要玩家排序不分先后

北美食品甜味剂行业细分

北美食品甜味剂市场按类型细分为蔗糖、淀粉甜味剂和糖醇、高强度甜味剂(HIS)。淀粉甜味剂和糖醇包括葡萄糖、HFCS、麦芽糖糊精、山梨糖醇、木糖醇等。其他淀粉甜味剂和糖醇包括葡萄糖浆、葡萄糖-果糖糖浆、果糖-葡萄糖浆、异葡萄糖、果糖、甘露醇、麦芽糖醇、赤藓糖醇、乳糖醇、异麦芽酮糖醇。高强度甜味剂包括三氯蔗糖、阿斯巴甜、糖精、甜蜜素、ace-k、纽甜、甜叶菊等。其他HIS包括甘草酸、罗汉果甙V、罗汉果、索马甜、莫纳甜。应用为乳制品、面包店、饮料、糖果、汤、酱汁和调料等。

| 蔗糖 | |

| 淀粉甜味剂和糖醇 | 葡萄糖 |

| 高果糖玉米糖浆 (HFCS) | |

| 麦芽糖糊精 | |

| 山梨醇 | |

| 木糖醇 | |

| 其他的 | |

| 高强度甜味剂 (HIS) | 三氯蔗糖 |

| 阿斯巴甜 | |

| 糖精 | |

| 甜蜜素 | |

| ACE-K | |

| 纽甜 | |

| 甜叶菊 | |

| 其他的 |

| 奶制品 |

| 面包店 |

| 汤、酱汁和调料 |

| 糖果 |

| 饮料 |

| 其他的 |

| 北美 | 美国 |

| 加拿大 | |

| 墨西哥 | |

| 北美其他地区 |

| 按产品类型 | 蔗糖 | |

| 淀粉甜味剂和糖醇 | 葡萄糖 | |

| 高果糖玉米糖浆 (HFCS) | ||

| 麦芽糖糊精 | ||

| 山梨醇 | ||

| 木糖醇 | ||

| 其他的 | ||

| 高强度甜味剂 (HIS) | 三氯蔗糖 | |

| 阿斯巴甜 | ||

| 糖精 | ||

| 甜蜜素 | ||

| ACE-K | ||

| 纽甜 | ||

| 甜叶菊 | ||

| 其他的 | ||

| 按申请 | 奶制品 | |

| 面包店 | ||

| 汤、酱汁和调料 | ||

| 糖果 | ||

| 饮料 | ||

| 其他的 | ||

| 地理 | 北美 | 美国 |

| 加拿大 | ||

| 墨西哥 | ||

| 北美其他地区 | ||

北美食品甜味剂市场研究常见问题解答

目前北美食品甜味剂市场规模有多大?

北美食品甜味剂市场预计在预测期内(2024-2029)复合年增长率为 1.22%

谁是北美食品甜味剂市场的主要参与者?

Cargill, Incorporated、Archer Daniels Midland Company、Stevia First Corporation、Tate & Lyle、Ingredion Incorporated 是北美食品甜味剂市场的主要公司。

这个北美食品甜味剂市场涵盖几年?

该报告涵盖了北美食品甜味剂市场的历史市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了北美食品甜味剂市场的规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

北美食品甜味剂行业报告

Mordor Intelligence™ 行业报告创建的 2024 年北美食品甜味剂市场份额、规模和收入增长率统计数据。北美食品甜味剂分析包括 2029 年的市场预测展望和历史概述。获取此行业分析的样本(免费下载 PDF 报告)。