啤酒花麦芽提取物市场分析

预计在预测期内(2020 - 2025 年),啤酒花麦芽提取物市场的复合年增长率为 4.8%。

- 该市场是由啤酒行业不断增长的需求推动的,尤其是精酿啤酒的生产。此外,它在非酒精饮料加工中的不断增加的应用也促进了市场的增长。此外,根据研究,它提供的主要机会是其在烘焙、早餐麦片、糖果和其他食品应用中的应用,尽管到目前为止它还没有被大量使用,但预计它将在预测期内推动市场增长。

- 然而,对啤酒花麦芽提取物广泛应用的认识不足以及原材料供应不足是限制市场的几个主要因素。

啤酒花麦芽提取物市场趋势

精酿啤酒越来越受欢迎

过去几年,精酿啤酒和蒸馏行业的需求经历了显着增长。世界各地的消费者都在寻求独特、美味的啤酒,这推动了啤酒花麦芽提取物在啤酒市场领域的发展。此外,小型啤酒厂的不断发展和精酿啤酒产量的不断增长导致对特种麦芽的需求不断增长。美国酿酒商协会透露,截至2018年1月,美国精酿啤酒商的麦芽消耗量约占美国所有啤酒商麦芽消耗总量的40%。

欧洲和北美将推动市场

欧洲和北美地区的英国、德国和美国等国家由于这些地区对啤酒的需求不断增长而在市场上占据主导地位。此外,政府合并新啤酒厂的举措也促进了市场增长。这些导致美国在 2017 年之前实现了两位数的增长,根据啤酒协会公布的数据,小型独立啤酒厂、微型啤酒厂和自酿啤酒吧的数量在 2018 年增加到 7,346 家。此外,根据欧洲酿酒商贸易组织的一份报告,2017年欧洲的小型啤酒厂数量达到9500多家。

啤酒花麦芽提取物行业概述

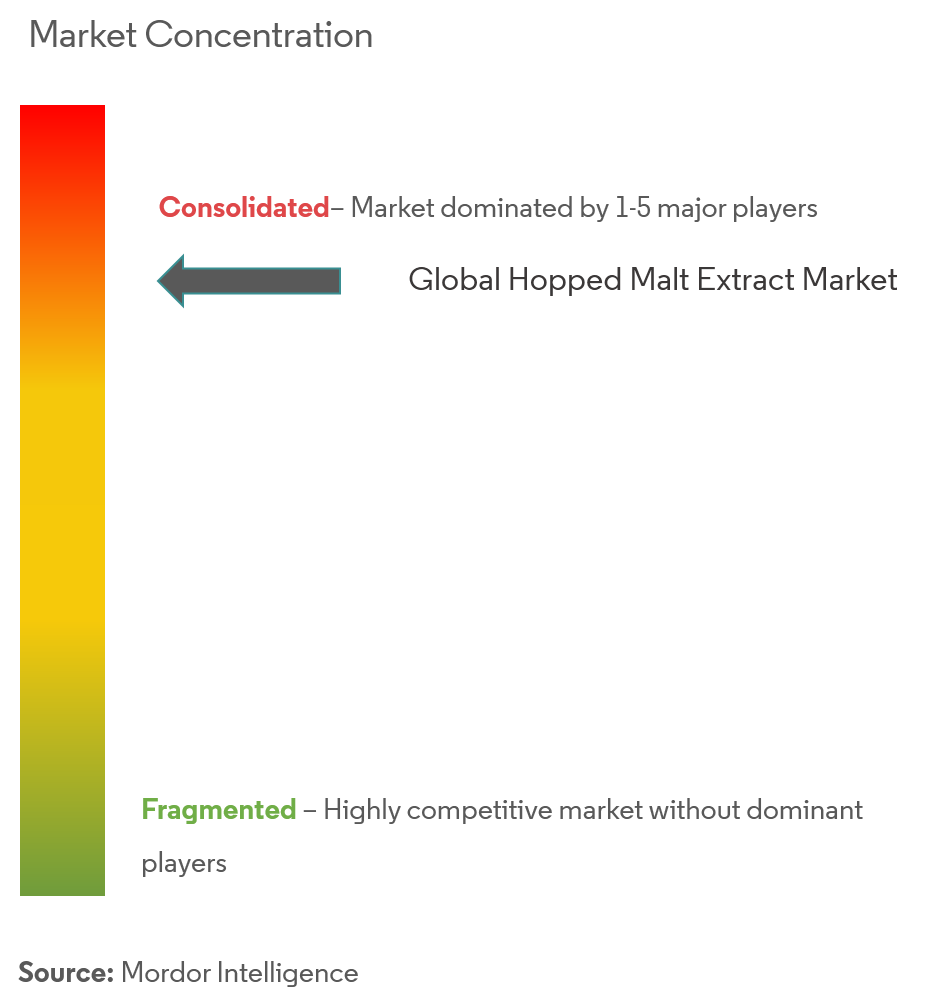

啤酒花麦芽提取物市场本质上是整合的,有一些国内和跨国企业争夺市场份额。公司专注于推出具有更健康成分/有机声明的新产品,并将收购、合并、合作和扩张作为其关键营销策略。例如,Baladin 和 Malt 先生合作推出了一款供家庭酿酒商使用的啤酒花麦芽提取物套件,其中包含一袋阿马里洛美国啤酒花颗粒 - 粉碎和压制的啤酒花小圆柱体。

啤酒花麦芽提取物市场领导者

P.A.B. srl - Mr. Malt

Hambleton Bard Ltd

CereX B.V.

Brewtec Bulk Malt

BrewOf Brewing Ingredient Supply

- *免责声明:主要玩家排序不分先后

啤酒花麦芽提取物行业细分

啤酒花麦芽提取物市场按应用细分为食品和饮料、药品、化妆品和个人护理以及动物饲料。食品和饮料细分市场进一步分为酒精饮料、非酒精饮料和面包店。此外,该研究还对全球新兴和成熟市场的啤酒花麦芽提取物市场进行了分析,包括北美、欧洲、亚太地区、南美以及中东和非洲。

| 食品和饮料 | 含酒精的饮料 |

| 不含酒精的饮料 | |

| 焙烤食品 | |

| 药品 | |

| 化妆品和个人护理 | |

| 动物饲料 |

| 北美 | 美国 |

| 加拿大 | |

| 墨西哥 | |

| 北美其他地区 | |

| 欧洲 | 西班牙 |

| 英国 | |

| 德国 | |

| 法国 | |

| 意大利 | |

| 俄罗斯 | |

| 欧洲其他地区 | |

| 亚太 | 中国 |

| 日本 | |

| 印度 | |

| 澳大利亚 | |

| 亚太其他地区 | |

| 南美洲 | 巴西 |

| 阿根廷 | |

| 南美洲其他地区 | |

| 中东和非洲 | 南非 |

| 沙特阿拉伯 | |

| 中东和非洲其他地区 |

| 应用 | 食品和饮料 | 含酒精的饮料 |

| 不含酒精的饮料 | ||

| 焙烤食品 | ||

| 药品 | ||

| 化妆品和个人护理 | ||

| 动物饲料 | ||

| 按地理 | 北美 | 美国 |

| 加拿大 | ||

| 墨西哥 | ||

| 北美其他地区 | ||

| 欧洲 | 西班牙 | |

| 英国 | ||

| 德国 | ||

| 法国 | ||

| 意大利 | ||

| 俄罗斯 | ||

| 欧洲其他地区 | ||

| 亚太 | 中国 | |

| 日本 | ||

| 印度 | ||

| 澳大利亚 | ||

| 亚太其他地区 | ||

| 南美洲 | 巴西 | |

| 阿根廷 | ||

| 南美洲其他地区 | ||

| 中东和非洲 | 南非 | |

| 沙特阿拉伯 | ||

| 中东和非洲其他地区 | ||

啤酒花麦芽提取物市场研究常见问题解答

目前啤酒花麦芽提取物市场规模有多大?

啤酒花麦芽提取物市场预计在预测期内(2024-2029)复合年增长率为 4.80%

谁是啤酒花麦芽提取物市场的主要参与者?

P.A.B. srl - Mr. Malt、Hambleton Bard Ltd、CereX B.V.、Brewtec Bulk Malt、BrewOf Brewing Ingredient Supply 是啤酒花麦芽提取物市场的主要公司。

哪个是啤酒花麦芽提取物市场增长最快的地区?

预计亚太地区在预测期内(2024-2029 年)复合年增长率最高。

哪个地区在啤酒花麦芽提取物市场中占有最大份额?

2024年,北美在啤酒花麦芽提取物市场中占据最大的市场份额。

该啤酒花麦芽提取物市场涵盖哪些年份?

该报告涵盖了啤酒花麦芽提取物市场多年的历史市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了啤酒花麦芽提取物市场多年的规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

啤酒花麦芽提取物行业报告

Mordor Intelligence™ 行业报告创建的 2024 年啤酒花麦芽提取物市场份额、规模和收入增长率统计数据。啤酒花麦芽提取物分析包括 2029 年的市场预测展望和历史概述。获取此行业分析的样本(免费下载 PDF 报告)。