亚太地区运动饮料市场分析

预计亚太地区运动饮料市场在预测期内(2020-2025年)复合年增长率为9.6%。

- 亚太地区的饮料公司正在通过受欢迎的运动员和名人的各种代言、促销活动和活动等,集中精力增加对其运动饮料细分市场的需求。此外,运动饮料公司被观察为对产品进行重大开发,并专注于饮料的健康方面。

- 亚太运动饮料市场尚未发挥其实际潜力,因为该产品在许多国家的消费者中的受欢迎程度仍然较低。

亚太地区运动饮料市场趋势

健身管理计划越来越受欢迎

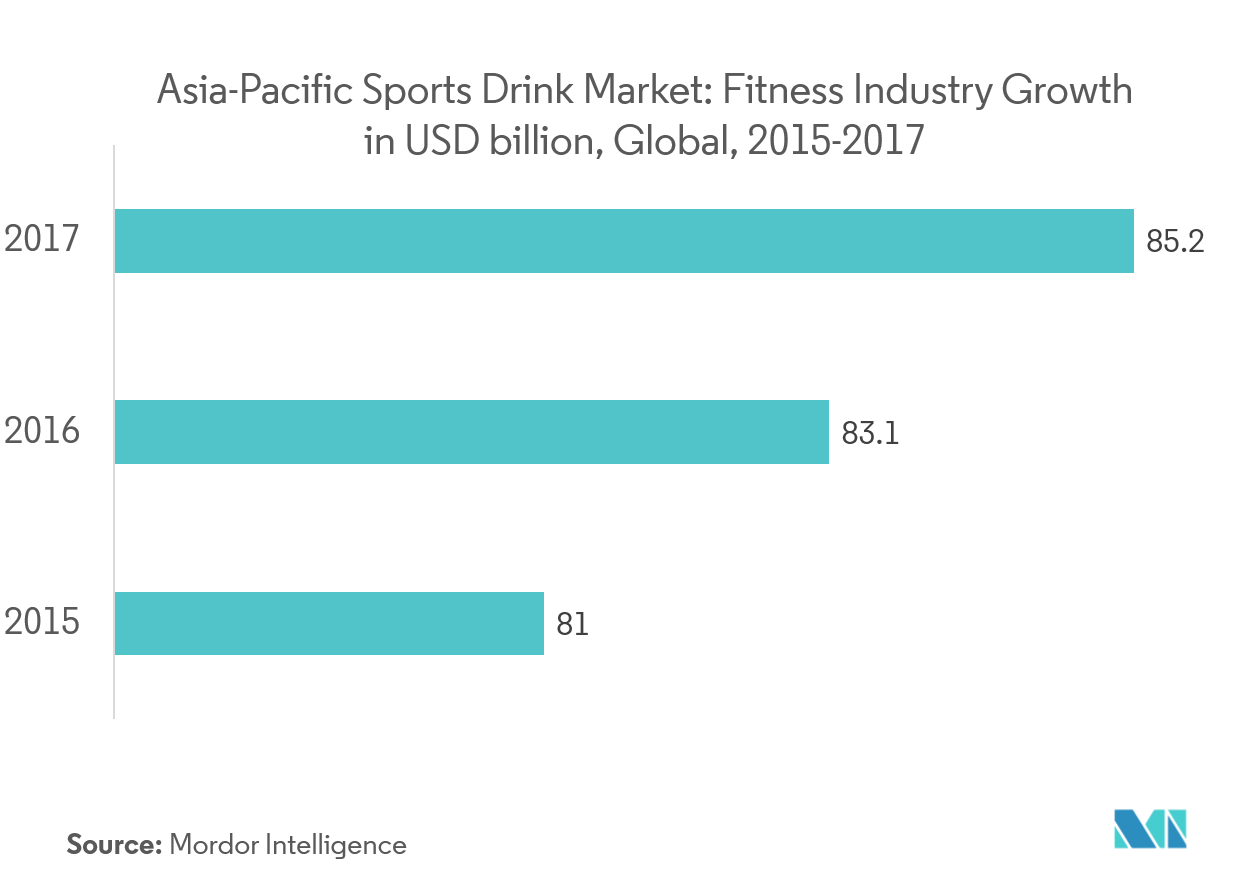

随着健身计划的日益普及和人们对健康生活方式的日益重视,运动饮料的消费量大幅增加,因为它有助于身体补充水分。例如,新加坡每年举办100多项本地和国际体育赛事,其中包括马拉松、铁人三项和世界锦标赛决赛。运动饮料的消费便利性,例如具有可识别成分和先进配方的即饮产品,是该地区发展景观成功的关键。此外,据观察,公司自己组织了一些健身计划,例如马拉松,以推销他们的运动饮料。例如,可口可乐在马尔代夫组织了 2018 年 LONG RUN 马拉松比赛。

印度是增长最快的市场

运动饮料的概念对于印度消费者来说相对较新,但随着其认知度和可用性的逐渐提高,运动饮料行业近年来在价值和数量上都出现了高速增长。运动饮料需求增加的原因是小型独立便利店中存在产品。百事可乐公司是运动饮料市场的主要参与者之一,在该国拥有相当大的消费者基础。该公司的强势地位可归功于其旗舰品牌佳得乐(Gatorade),由于其先发优势,该品牌目前在印度可与运动饮料互换使用。总体而言,在新产品创新和新兴健身趋势的推动下,印度运动饮料市场为潜在参与者提供了利润丰厚的机会。

亚太地区运动饮料行业概况

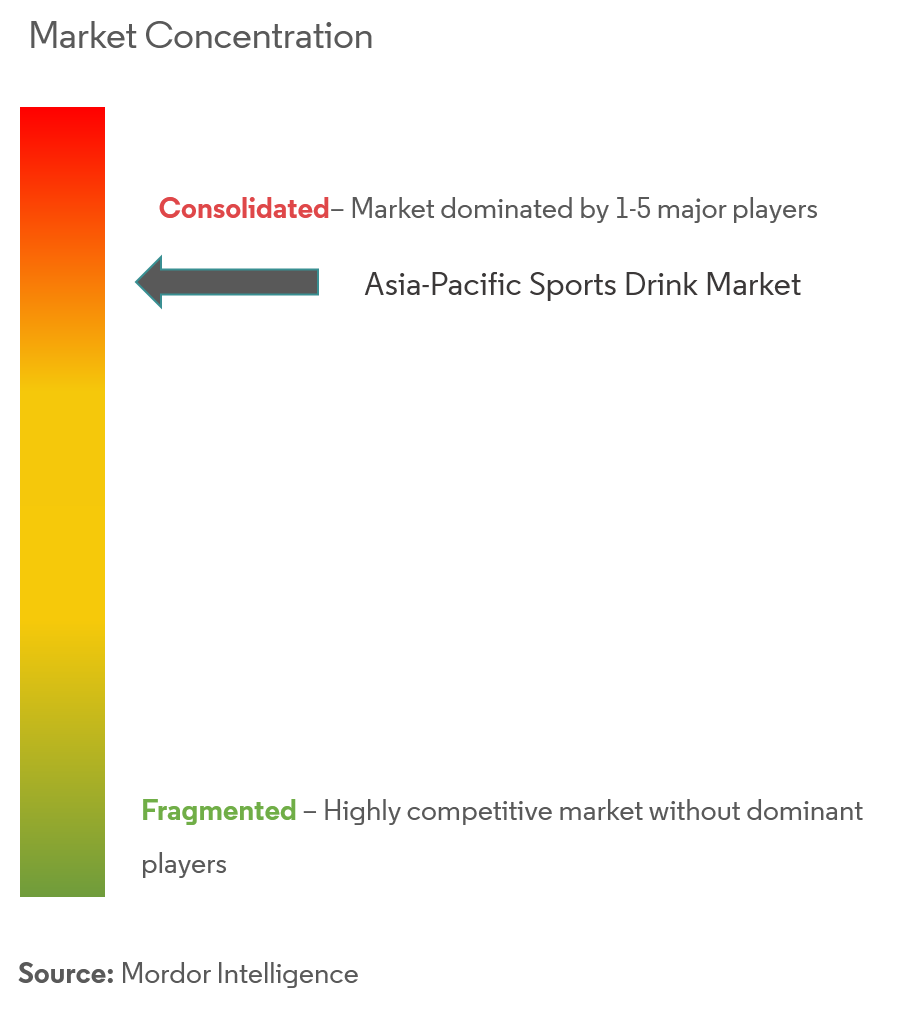

亚太运动饮料市场包括 AJE Group、PepSico Inc、Asociación Familiar Mulliez、Lucozade Ribena Suntory Limited、Staminade、Otsuka Pharmaceutical Co. Ltd、Pure Sports Nutrition 和可口可乐公司的公司简介。 2019年4月——可口可乐公司宣布将在印度推出运动饮料Powerade,与百事可乐佳得乐运动饮料竞争。 Powerade 目前在印度通过进口销售,该公司计划在印度推出本地制造的版本。

亚太地区运动饮料市场领导者

Pepsico Inc

Woodbolt Distribution LLC

Otsuka Pharmaceutical Co. Ltd

Asociación Familiar Mulliez

- *免责声明:主要玩家排序不分先后

亚太地区运动饮料行业细分

亚太运动饮料市场范围按PET瓶和罐装进行细分;并按分销渠道分为超市/大卖场、便利店、网上零售渠道及其他分销渠道。此外,该研究还对亚太地区新兴和成熟市场的运动饮料市场进行了分析,包括中国、日本、印度、澳大利亚和亚太其他国家。

| 宠物瓶 |

| 罐头 |

| 超市/大卖场 |

| 便利店 |

| 线上零售渠道 |

| 其他分销渠道 |

| 印度 |

| 中国 |

| 澳大利亚 |

| 日本 |

| 亚太其他地区 |

| 按包装 | 宠物瓶 |

| 罐头 | |

| 按分销渠道 | 超市/大卖场 |

| 便利店 | |

| 线上零售渠道 | |

| 其他分销渠道 | |

| 按国家/地区 | 印度 |

| 中国 | |

| 澳大利亚 | |

| 日本 | |

| 亚太其他地区 |

亚太地区运动饮料市场研究常见问题解答

目前亚太运动饮料市场规模有多大?

亚太运动饮料市场预计在预测期内(2024-2029)复合年增长率为 9.60%

谁是亚太运动饮料市场的主要参与者?

百事公司、Woodbolt Distribution LLC、大冢制药有限公司和 Asociación Familiar Mulliez 是亚太运动饮料市场的主要公司。

亚太运动饮料市场涵盖哪些年份?

该报告涵盖了亚太地区运动饮料市场的历史市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了亚太地区运动饮料市场的规模:2024年、2025年、2026年、2027年、2028年和 2029 年。

页面最后更新于:

亚太运动饮料行业报告

Mordor Intelligence™ 行业报告创建的 2024 年亚太运动饮料市场份额、规模和收入增长率统计数据。亚太地区运动饮料分析包括对 2029 年的市场预测展望和历史回顾。获取此行业分析的样本(免费下载 PDF 报告)。