Ultra-Portable Internet Devices Market Size and Share

Ultra-Portable Internet Devices Market Analysis by Mordor Intelligence

The Ultra-Portable Internet Devices Market is expected to register a CAGR of 7.05% during the forecast period.

- The ultra-portable internet device market is anticipated to grow with the growing adoption of IoT devices. The adoption of smart home devices has been aiding the development of portable internet devices. The growth in the sale of IoT and connected devices is driven by emerging applications and business models supported by falling device costs and standardization. According to Ericsson's mobility report, out of the projected 29 billion connected devices by 2022, 18 billion were expected to be related to IoT.

- The constantly changing criteria for better routers is one of the elements driving the demand for portable internet devices. Throughout the last decade, portable internet devices have grown steadily, keeping up with developments in standards set by the Institute of Electrical and Electronics Engineers. These specifications are continually updated to improve network throughput in terms of maximum speeds and transmission capacities. Ultra-portable mobile devices provide greater portability and access to cloud-based content. As a result, low-weight, advanced, consumer-friendly computer gadgets have emerged, boosting the market's growth.

- According to a survey conducted by the World Advertising Research Center (WARC) utilizing statistics from the mobile trade association GSMA, it is expected that over 1.3 billion people will access the internet via smartphone and PC by 2025. Furthermore, 69 million people are predicted to access the internet solely through a PC. According to WARC, approximately 2 billion individuals currently access the internet through smartphones, accounting for 51% of the global base of 3.9 mobile users. This is expected to hinder the market's growth.

- Severe macroeconomic vulnerabilities were exposed to the public in many countries due to the global financial crisis and the accompanying euro area crisis. The issues covered various macroeconomic imbalances unrelated to the public sector's excessive debt. House prices, loans, and wages all grew wildly in several nations. These internal imbalances frequently coexisted with escalating current account deficits, declining export performance, and continuous cost and pricing competitiveness declines. At the same time, policymakers did not create enough fiscal safety nets. In addition, a lack of structural changes left most of these economies with severe rigidities preventing efficient resource allocation. These will show a negative effect on the customer purchase power, affecting the market studied.

- Working from home has become standard these days. The speed of the shift to large-scale remote work has resulted in the use of personal devices, including mobile phones, laptops, tablets, and desktops. Employees are also observed using personal internet connections to access the corporate network. According to Eurostat, during the pandemic, a considerable increase was observed in the proportion of employed people in Europe who could work from home, reaching 29.4%in France, 22.8% in Germany, 15.1% in Spain, and 13.6% in Italy.

Global Ultra-Portable Internet Devices Market Trends and Insights

Increasing Demand for Portable Gadgets and Improved Internet Connectivity

- According to the International Telecommunication Union, global bandwidth use increased from 719 Tbit/s in 2020 to 932 Tbit/s in 2021. This represents a 30% gain and follows a rise similar to the one from the previous year. The Asia-Pacific region has the greatest regional total for the use of international bandwidth at over 400 Tbit/s, which is twice as high as that of Europe (204 Tbit/s) or the Americas (180 Tbit/s).

- Verizon expects to have incremental 5G bandwidth via the latest spectrum available to 100 million people in the starting 46 markets. Over 2022 and 2023, coverage is likely to increase to more than 175 million people. By 2024, when the remaining C-Band is cleared, greater than 250 million people are expected to access Verizon's 5G connection on the C-Band spectrum. Low latency in 5G connection drives the market as latency is when it clutches for data from one device to be uploaded and reaches its target. With 4G networks, the user looks at an average latency of around 50 ms, dropping to 1 ms with 5G technology.

- In December 2022, to improve internet connectivity in distant areas of the country, the UK government tested Elon Musk's Starlink, which employs satellites to beam a broadband signal to Earth. According to the government, the recent test showed that Starlink satellites could give internet rates of up to 200 megabits per second in many regions, four times faster than the UK average broadband speed of over 50 Mbps. The government continued to evaluate the system's capability and other solutions and services from various vendors.

- According to Cisco Systems, from 2020 to 2023, fixed broadband internet speeds are predicted to improve by nearly 50 Mbps, finally reaching 110.4 Mbps. During the entire period from 2018 to 2023, the compound annual growth rate is expected to reach 20%. The average speed in 2020 was 50.8 Mbps, representing a nearly 40% increase over 2019. It was predicted to rise by 16% from 2020 to 58.9 Mbps in 2021.

- The rising demand for portable electronics such as smartphones, laptops, tablets, and wearable gadgets propels the industry forward. These devices provide more convenience, portability, and connectivity, making them crucial to many people's everyday lives. Furthermore, technological improvements have led to the development of more sophisticated and user-friendly devices, which has increased the demand for portable electronics. The rise of online services such as cloud computing and e-commerce has also led to the increased use of mobile devices, which allow users to access these services at any time and from any location.

Asia-Pacific to Witness the Fastest Growth

- According to the Economic Survey of India 2021-22 published by the Ministry of Finance, Government of India, the country's internet user base crossed 830 million in 2021, growing by over 530 million in the six years since 2015. India's total volume of wireless internet data usage surged over 7x to 32,397 petabytes in 2021 from around 4,200 petabytes in 2018. A huge internet base would create an opportunity for the market studied to grow by developing new products to capture the market share.

- Furthermore, the government's drive to digitize their country's education system is functioning as a spur for the ultra-portable internet gadget industry. For example, the Indian government launched the 'Kaushal Bharat, Kushal Bharat' project. With this effort, the government has set a goal of training 400 million persons by 2022 so that they can find work. These new initiatives include the Pradhan Mantri Kaushal Vikas Yojana (PMKVY), the National Strategy for Skill Development and Entrepreneurship 2015, the Skill Loan Scheme, and the National Skill Development Mission. Such government initiatives necessitate a computerized education system, which will generate a demand for ultra-portable internet devices over the forecast period.

- Moreover, the market for ultra-portable internet devices in China is witnessing new product launches. For instance, Quectel Wireless Solutions, a global supplier of IoT modules, recently partnered with China Mobile and Dianyi to demonstrate a 5G USB dongle based on Quectel 5G module RG500Q at the 25th GTI Workshop. Compliant with 3GPP Release 15 specifications and capable of both 5G standalone (SA) and non-standalone (NSA) modes of operation, the newly launched 5G device is designed for industrial IoT, smart city, smart home, training and education, and intelligent logistics applications.

- The region is witnessing huge investments in 5G implementation. For instance, the Australian government invested USD 14.3 million in grants to support various enterprises integrating 5G technologies. Also, the Singaporean government invested SGD 25 billion (USD18.1 billion) in R&D funding until 2025 to drive transformative technologies supporting efforts to maximize the benefits of digitalization. This may drive the demand for 5G ultra-portable internet devices over the forecasted period.

- In addition, in modern educational institutions, wireless connectivity is becoming as essential as pen and paper. Reliable, fast, secure, and convenient internet allows teachers to access resources that promote more effective learning and development. Moreover, it also provides students unlimited access to information to enrich their education. Such factors further boost the demand for wireless routers in education institutions to create internet-enabled campuses that allow students and teachers to access a great amount of information over the internet.

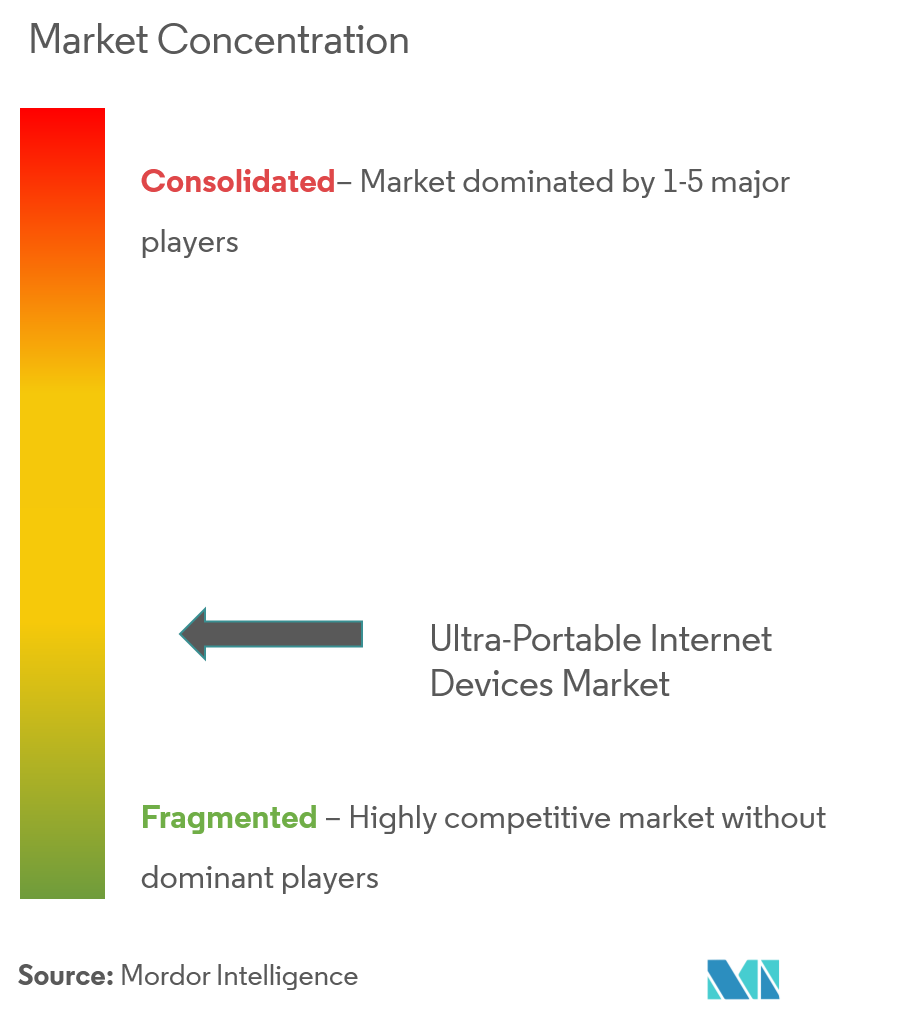

Competitive Landscape

The competitive landscape of the ultra-portable internet devices market is fragmented due to the presence of major international key players. Some of the key companies operating in the global market include Apple Inc., Microsoft Corporation, Intel Corporation, and Samsung Electronics Corporation. Various companies invest heavily in research and development (R&D) to launch a new category of products. Some of the recent developments in this field are:

- In November 2022, in collaboration with Thales, Ericsson's Internet of Things (IoT) division launched IoT Accelerator Device Connect, a service that offers generic eSIMs unbundled from pre-selected service providers. For the first time, organizations may easily and rapidly select one or more service providers during device activation. This new business model significantly reduces organizations' time to market for IoT investments.

- In March 2022, Vodafone Idea announced the release of Vi MiFi, a pocket-size 4G router that supports speeds of up to 150 Mbps and allows users to connect up to ten WiFi-enabled devices. The company claims it has a 2700 mAh battery that may last up to 5 hours on a single charge.

Ultra-Portable Internet Devices Industry Leaders

D-Link Corporation

Google LLC

TP-Link Technologies Co. Limited

Huawei Technologies Co. Limited

Xiaomi Inc.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- January 2023: Tecno introduced its first 4G portable Wi-Fi hotspot gadget, TR109, in India. Users can connect to the internet using a 4G-enabled SIM card with the new portable Wi-Fi hotspot device. The Tecno Portable Wi-Fi Hotspot TR109 allows for up to 16 simultaneous connections and maintains a reliable connection among several users. Also, the newly introduced service removes concerns such as connection delays caused by several connected devices.

- December 2022: Qualcomm Technologies Inc. launched the Qualcomm Wi-Fi 7 Immersive Home Platform, its newest high-performance network product for the home. The Qualcomm Wi-Fi 7 Immersive Platform, designed to support the latest high-speed broadband connections and an array of high-performance devices populating today's hyper-connected homes, delivers more than 20 Gbps of total system capacity in a compact, power-efficient, cost-effective network chipset architecture.

Global Ultra-Portable Internet Devices Market Report Scope

Ultra-portable internet devices are devices that include mobile internet devices (MID), such as internet dongles and Wi-Fi hotspots.

The ultra-portable internet devices market is segmented by application (personal use and commercial use) and geography (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa).

The market sizes and forecasts are provided in terms of value in USD for all the above-mentioned segments.

| Personal Use |

| Commercial Use |

| North America | United States |

| Canada | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Rest of Europe | |

| Asia Pacific | China |

| Japan | |

| India | |

| Rest of Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

| By Application | Personal Use | |

| Commercial Use | ||

| By Geography | North America | United States |

| Canada | ||

| Europe | Germany | |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Asia Pacific | China | |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Latin America | ||

| Middle East and Africa | ||

Key Questions Answered in the Report

What is the current Ultra-Portable Internet Devices Market size?

The Ultra-Portable Internet Devices Market is projected to register a CAGR of 7.05% during the forecast period (2025-2030)

Who are the key players in Ultra-Portable Internet Devices Market?

D-Link Corporation, Google LLC, TP-Link Technologies Co. Limited, Huawei Technologies Co. Limited and Xiaomi Inc. are the major companies operating in the Ultra-Portable Internet Devices Market.

Which is the fastest growing region in Ultra-Portable Internet Devices Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Ultra-Portable Internet Devices Market?

In 2025, the North America accounts for the largest market share in Ultra-Portable Internet Devices Market.

What years does this Ultra-Portable Internet Devices Market cover?

The report covers the Ultra-Portable Internet Devices Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Ultra-Portable Internet Devices Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on: