Scale-Out NAS Market Size and Share

Scale-Out NAS Market Analysis by Mordor Intelligence

The Scale-Out NAS Market is expected to register a CAGR of 21% during the forecast period.

- Rising demand for high throughput rate, increased I/O (Input/output) capacity, and low latency is driving the market. Users administer the cluster as a single system and manage the data through a global namespace or distributed file system. Within a cluster array, files can be distributed and data can be clear across nodes for improved throughput. For instance, the three-strong Dell EMC X-Series scales up to 20PB with 144 nodes, with capacities from 12TB to 144TB per node and a claimed throughput of up to 200GBps. These features provide high processing which limit the usage of traditional storage solution.

- Big Data Analytics drives the growth of Advanced Parallel Storage Platforms. The vast quantity of big data has no value unless it is tagged or analyzed. According to the Accenture study, 79% of enterprise executives agree that companies that do not embrace Big Data will lose their competitive position and could face extinction. So, a software component designed to store data across multiple networked servers and to facilitate high-performance access through simultaneous, coordinated input/output operations (IOPS) between clients and storage nodes is needed across industries.

- For instance, Flytxt's big data analytics platform follows a hybrid architecture combining scale-out clusters running Hadoop with RDBMS and an in-memory database for real-time transactional data processing.

- However, scale-out NAS systems carry fairly substantial licensing fees that are tacked onto the incremental costs associated with adding networking equipment. Also, there is a higher utility cost (Electricity and cooling) by which many enterprises hesitate to replace a substitute for traditional storage systems. Plus, scale-out systems tend to lack the functionality of well-established scale-up NAS systems which restraints the growth of the market.

Global Scale-Out NAS Market Trends and Insights

Cloud Deployment Holds the Significant Share in The Market

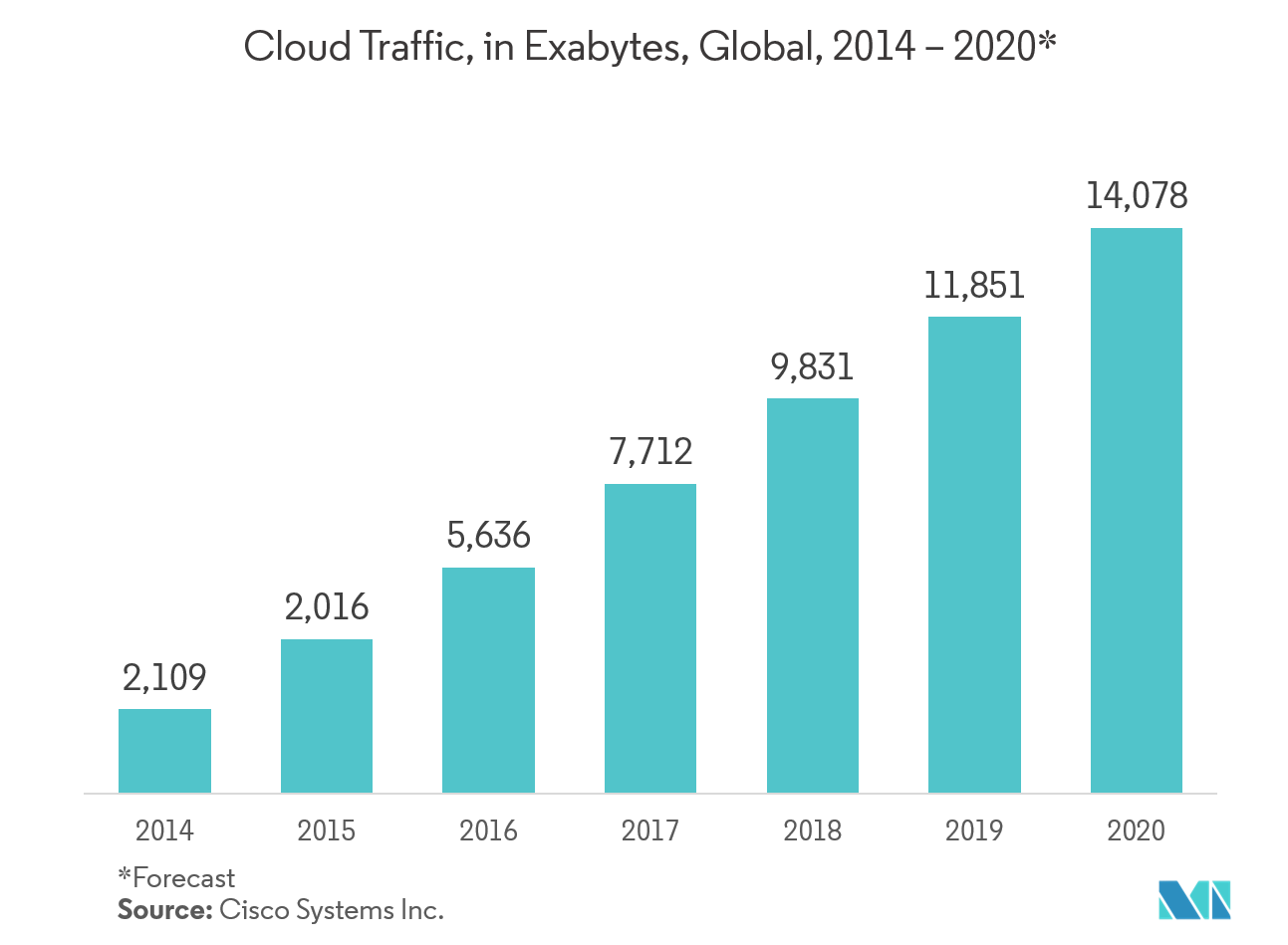

- Enterprises persistently struggle to stay ahead of a growing need for data storage, especially unstructured data. Scale-out NAS systems are an increasingly important tool in this battle. Among scale-out products from the big five storage vendors, hardware offerings are the cornerstone with the use of the cloud.

- For instance, top vendor Dell, offer Dell EMC’s scale-out NAS systems supporting CloudPools. This is the supplier’s cloud tiering system, which supports private clouds on Isilon or Dell EMC ECS, as well as Dell EMC’s own Virtustream, AWS S3, Google Cloud Platform, and Microsoft Azure.

- Various firms are innovating a new solution to easily integrate with the cloud platform. For instance, in Oct 2019, Cohesity revealed Cohesity SmartFiles, an intelligent NAS solution designed for web-scale, that goes beyond traditional scale-out NAS (network-attached storage) capabilities. It delivers transparent data tiering both on-premises and to the cloud. With SmartFiles, it is simple to create an automated policy to tier select data from an existing NetApp, Isilon, Pure Storage device or any other storage system to SmartFiles, as well as to archive even colder data to the cloud. This initiative approach is the way that storage needs to evolve to support today’s increasingly complex, multi-cloud data management requirements.

- Many times customers have been forced to choose between capacity versus entry point, performance versus price, or scale versus incremental cost, especially in small/medium-scale businesses. Companies are constantly improving and enhancing its software to deliver more performance and capacity per dollar for its customers across industries.

- For instance, in April 2019, Qumulo introduces a new hybrid storage platform, and advanced file system features that accelerate momentum in Media and Entertainment Storage Market. The introduction of C-72T delivers a 200 percent increase in reading performance over previous entry-level nodes and a 300 percent increase in storage density over a previous high-performance hybrid node. It expands support for legacy scale-out NAS While enabling powerful hybrid cloud capabilities.

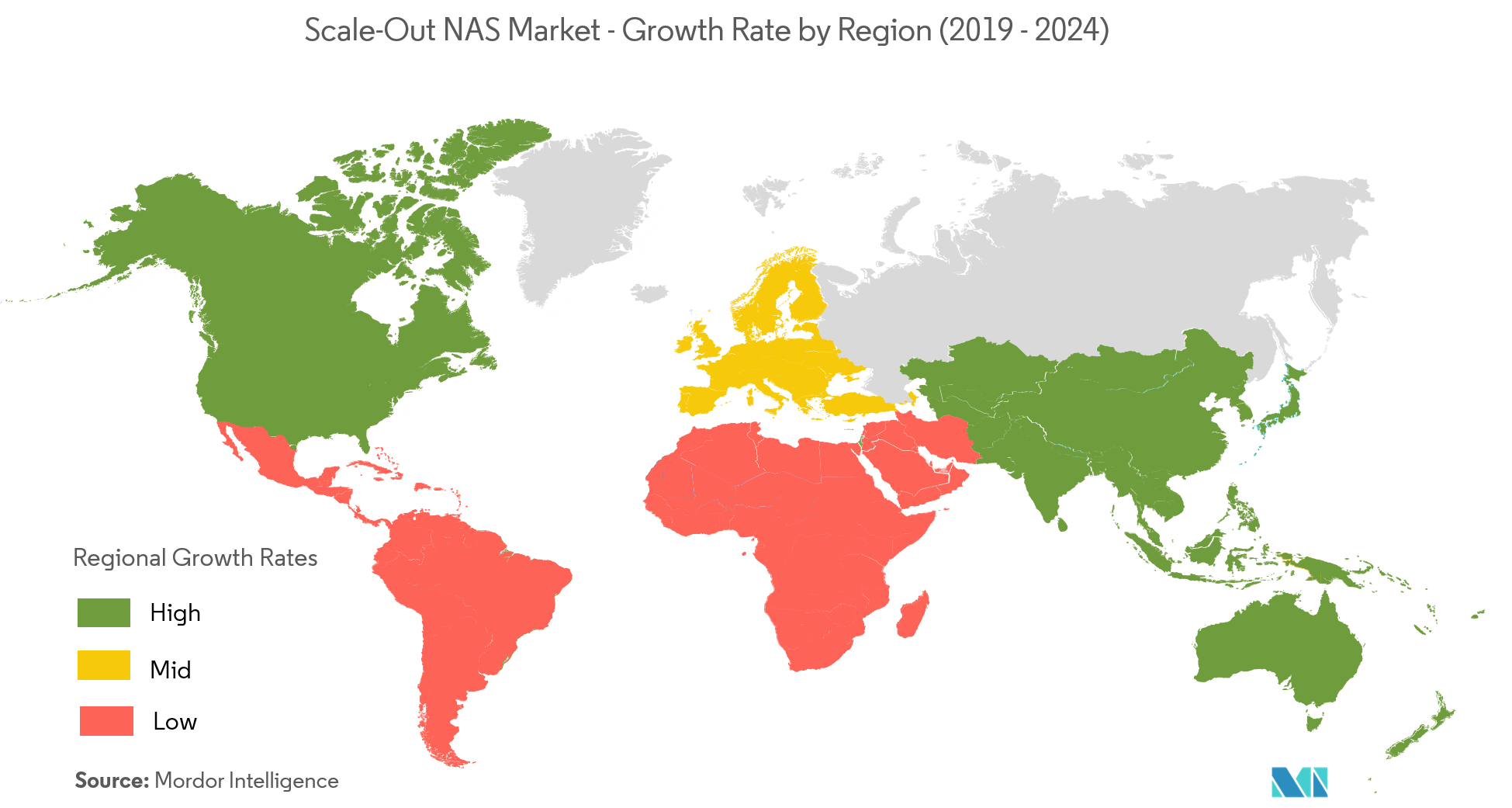

North America to Hold Highest Share in the Market

- North America grasp the largest market share due to its early adoption of advanced analytics solutions involving huge data storage requirements. According to Forbes, 55 percent of North American businesses have adopted big data analytics. Moreover, usage of digital solutions in sectors such as professional services and manufacturing sector has resulted in the generation of significant amounts of unstructured data.

- The presence of market incumbents, such as Dell Emc, IBM Corporation, HP Development Company, and Seagate Technology, in the storage segment, is another factor that is expected to promote the growth of the scale-out NAS market. Moreover, many other companies are expanding their distribution in North America region.

- For instance, StorONE, which offers low-cost storage and works with any protocol or use case especially with scale-out NAS, came to market initially through a limited channel and is now broadening out further with more distribution channel. On April 2019, StorONE announced that it is now expanding with a distribution deal with Tech Data, which will see StorONE products available through Tech Data first in North America, and eventually, globally.

- Moreover, various global players are involved in enhancing storage, data management and data protection solutions that directly affect an organization's data capital. For instance, to help customers keep pace with the data deluge in AI use cases like autonomous driving and in key industries including media and entertainment as well as healthcare, on April 2019, Dell EMC announced to boost the capabilities of its industry-leading Isilon scale-out NAS family. The latest Isilon release provides massive scalability, enhanced cloud integration and security to support the most demanding file workloads. This risen scalability will assist this region's business in various industries to enhance their productivity effectively.

Competitive Landscape

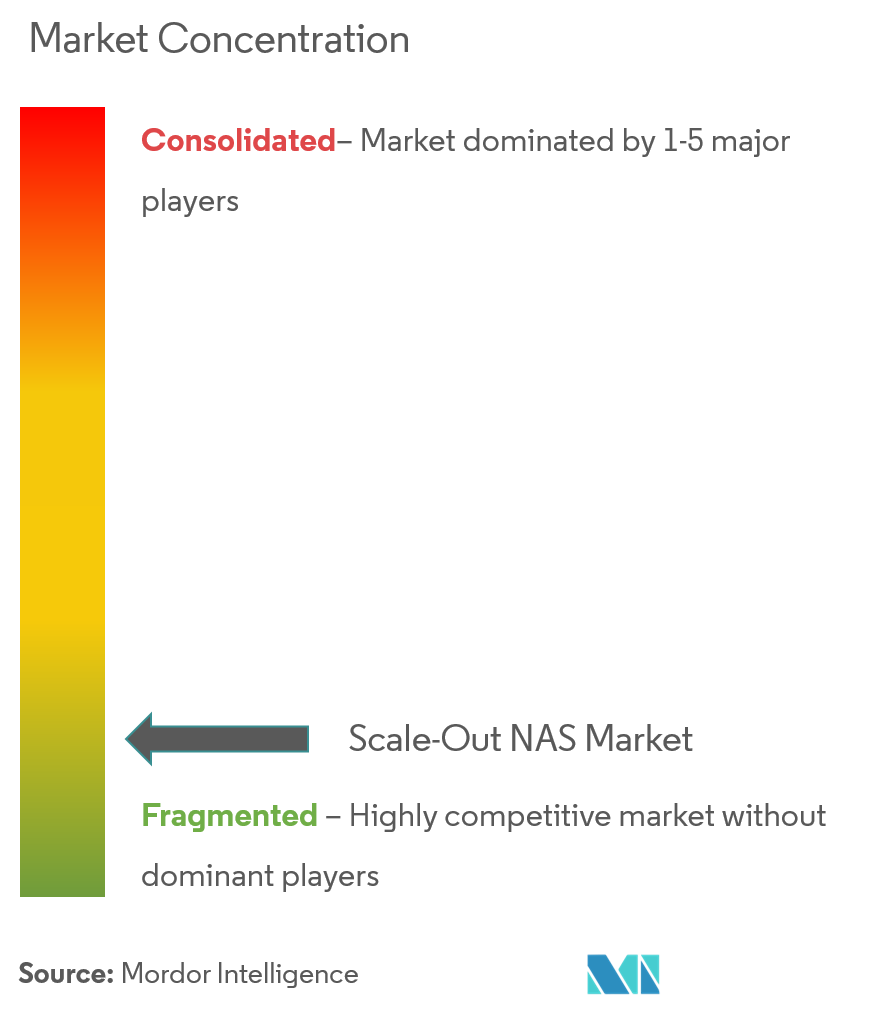

The scale-out NASmarket is fragmented in nature. The globalplayers has dominated themarket, however, the growing demand from enterprises for data storage is also attracting many new players into the market making the market competitive. Key players are Dell EMC, Hewlett-Packard Enterprise, etc. Recent developments in the market are -

- Nov 2019 - IBM introduces itsinnovation in Elastic Storage 3000 that comes with the use of NVMe and the addition of IBM’sSpectrum Scale parallel file system (formerly GPFS)to create a massively performant scale-out NAS product aimed at leading cases based around unstructured data.

- Jun 2019 -WekaIO announced the addition of enterprise features to itsscale-out network-attached storage(NAS) product that includeLightweight Directory Access Protocol(LDAP)access control and encryption. The company views these as vital additions to itsparallel file systemthat can span on-premise and cloud locations and scale to trillions of files.

Scale-Out NAS Industry Leaders

Dell EMC

Hewlett Packard Enterprise

Nasuni Corporation

NetApp, Inc.

IBM Corporation

- *Disclaimer: Major Players sorted in no particular order

Global Scale-Out NAS Market Report Scope

Scale-out NAS market has been broadening from small enterprises to large businesses with the need for petabytes of storage that have been able to afford based on the requirement for specialized appliances deploying for narrow purpose missions. The deployment is mostly based on cloud and on-premise segments among industries such as BFSI, Healthcare, etc.

| On-Premise |

| Cloud |

| Large Enterprises |

| Small & Medium Enterprises |

| BFSI |

| Healthcare |

| IT & Telecom |

| Retail |

| Media and Entertainment |

| Other End-user Industries |

| North America |

| Europe |

| Asia-Pacific |

| Rest of the World |

| By Deployment | On-Premise |

| Cloud | |

| By Organization Size | Large Enterprises |

| Small & Medium Enterprises | |

| By End-user Industry | BFSI |

| Healthcare | |

| IT & Telecom | |

| Retail | |

| Media and Entertainment | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Key Questions Answered in the Report

What is the current Scale-Out NAS Market size?

The Scale-Out NAS Market is projected to register a CAGR of 21% during the forecast period (2025-2030)

Who are the key players in Scale-Out NAS Market?

Dell EMC, Hewlett Packard Enterprise, Nasuni Corporation, NetApp, Inc. and IBM Corporation are the major companies operating in the Scale-Out NAS Market.

Which is the fastest growing region in Scale-Out NAS Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Scale-Out NAS Market?

In 2025, the North America accounts for the largest market share in Scale-Out NAS Market.

What years does this Scale-Out NAS Market cover?

The report covers the Scale-Out NAS Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Scale-Out NAS Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Scale-Out NAS Market Report

Statistics for the 2025 Scale-Out NAS market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Scale-Out NAS analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.