India Electro Hydraulic Power Steering Market Analysis by Mordor Intelligence

The India Electro Hydraulic Power Steering Market is expected to register a CAGR of less than 10% during the forecast period.

- The Indian economy is growing, and the disposable incomes of the middle-class consumers are also increasing. This, in turn, reflects positively on the rising demand for vehicles. Over the past five years, owing to the low production costs in the country, vehicle production has gone up drastically. Due to the hike in vehicle production, the electro-hydraulic power steering market also experienced growth.

- Launch of new vehicles are also expected to drive the growth of the automotive electro-hydraulic power steering market in India. However, the introduction of electric power steering technology in luxury cars can result in a decrease in revenue generated from electro-hydraulic power steering systems in India, over the next decade.

India Electro Hydraulic Power Steering Market Trends and Insights

Electric Power Steering (Eps) Technology Phasing Out the Electro-Hydraulic System

Failure of power steering systems in vehicles, such as Ford Focus (2008) and Mercury Mariner SUV, helped bring significant changes in electric power steering (EPS) technologies, driven by the improvements and advancements of steering sensors. An electric power steering (EPS) does not use any form of hydraulic pressure to provide steering assistance. This technology is fully electronic and uses an electric motor to provide direct assistance. Since there is no power lost in generating and transmitting the hydraulic power, these systems are typically more efficient than the conventional hydraulic or electro-hydraulic steering systems. Furthermore, EPS systems are less complex than hydraulic systems. Hence, they are easier to manufacture. Moreover, car owners find it easier to maintain these systems, as there are less fluids and oils involved. Many auto manufacturers and OEMs, such as Bosch, Nexteer, Ford, and Nissan, are increasingly researching and adopting EPS in their upcoming vehicles, which may deter the growth of electro-hydraulic systems. For instance, Ford integrated a pull-drift steering compensation as an additional feature to its new EPS system. The company acknowledges EPS with pull-drift as an improvement in the sensor system, which helps to constantly measure the driver’s steering torque. It also helps in adapting to the changing road conditions and adjustment to the slightest of steering changes.

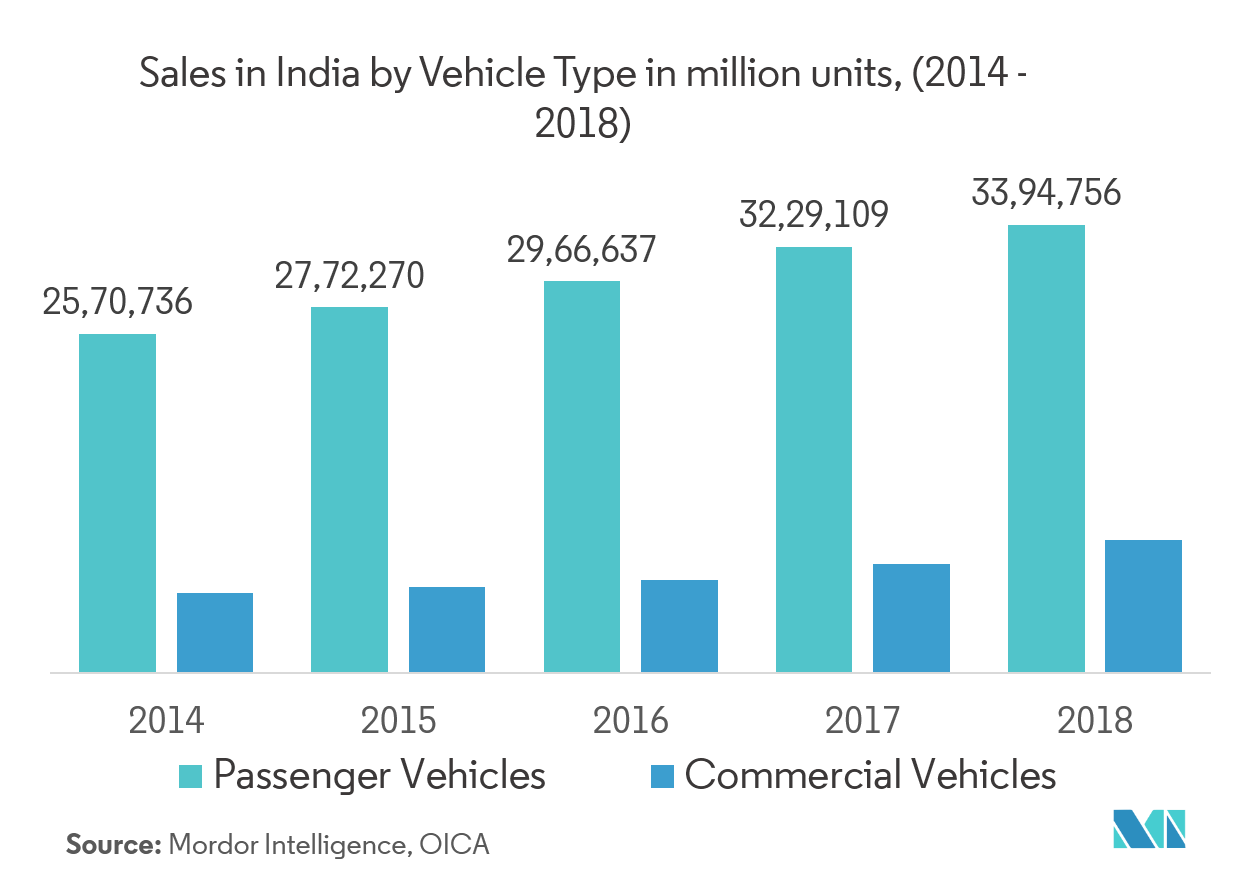

The Passenger Vehicles Segment Accounted for the Highest Market Share in 2018

The Indian automotive industry has been experiencing steady growth in the demand for and sales of passenger cars, owing to improvement in economic conditions and a rise in the consumers’ disposable incomes. The country witnessed a gradual shift from transportation to comfortable/convenient transportation and from convenient transportation to luxurious and safe transportation. With the growing presence of international automobile manufacturers and brands in the country, and the consumers’ ability to purchase new cars and maintain them, consumers are now willing to buy more than one passenger car to suit their various daily needs and travel purposes. Additionally, a consistent rise in population has been a major factor responsible for the rise in the automotive industry’s revenue, both for commercial vehicles and passenger cars, over the past decade. The Indian automotive industry is shifting from just being a component manufacturer to an assembler and manufacturer of complete vehicles, including passenger cars. Companies, like Hyundai and SAIC Motor, have planned significant investments in India by 2020. Since electro-hydraulic power steering is found in the majority of passenger cars, the increasing sales of passenger cars will also drive the market for an automotive electro-hydraulic power steering system in India.

Competitive Landscape

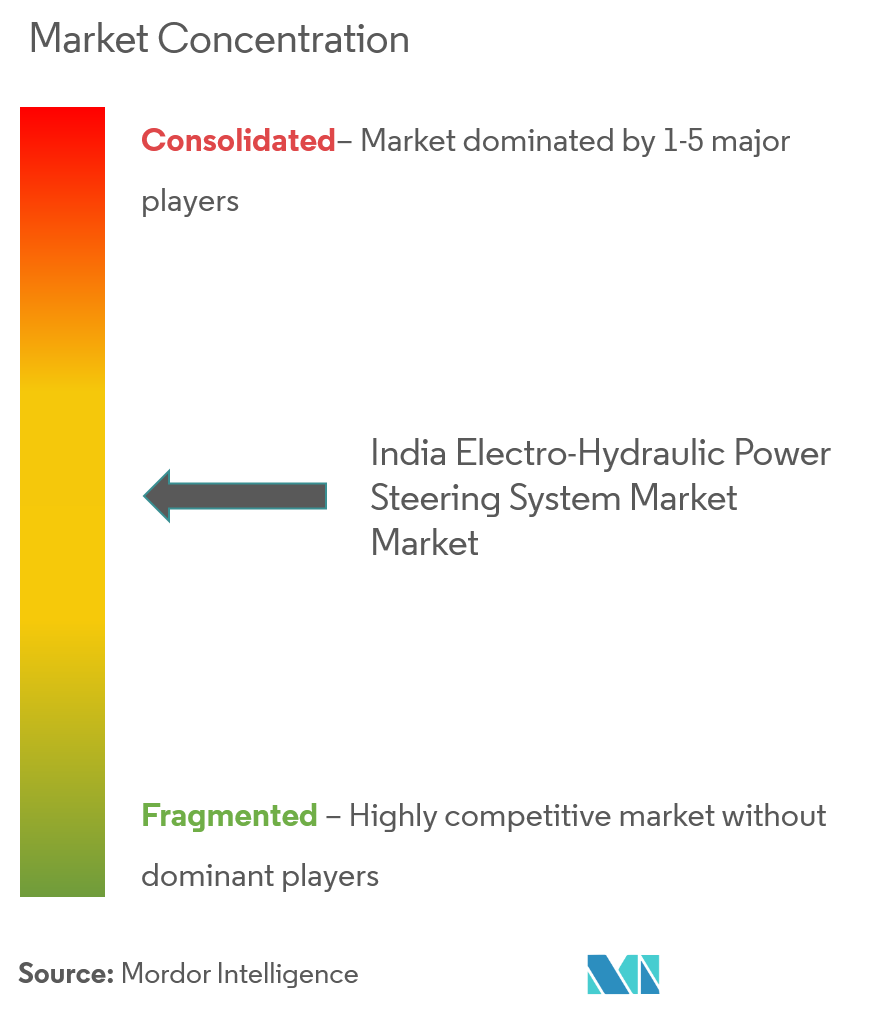

The electro-hydraulic power steering market in India is highly competitive, with several automotive component suppliers trying to enter into the highly potential Indian automotive market. The prominent players in the market are JTEKT Corporation, Hitachi Automotive SystemsLtd., and ZF TRW Automotive Holdings Corp.. Recently, JTEKT Corp. merged its two local units in India to increase its revenue share from India. JTEKT India started manufacturing automotive steering systems with India’s Sona Group in 1985 ,and it was one of the first component suppliers to Maruti Suzuki India Ltd. Automakers in India have shifted their focus towards R&D andurged their suppliers to increase their investment in R&D to keep pace with the changes in the automotive industry.

India Electro Hydraulic Power Steering Industry Leaders

JTEKT Corporation

Hitachi Automotive Systems Ltd

ZF TRW Automotive Holdings Corp.

Danfoss

Denso Corporation

- *Disclaimer: Major Players sorted in no particular order

India Electro Hydraulic Power Steering Market Report Scope

The market is segmented by various component types and applications in vehicles. Electro-hydraulic power steering optimizes the flow of hydraulic fluids, and it is popular in budget segment cars and commercial vehicles.

| Hybrid |

| Steering Column |

| Motor and Pump Unit |

| Other Components |

| Passenger Vehicles |

| Commercial Vehicles |

| By Component Type | Hybrid |

| Steering Column | |

| Motor and Pump Unit | |

| Other Components | |

| By Vehicle Type | Passenger Vehicles |

| Commercial Vehicles |

Key Questions Answered in the Report

What is the current India Electro Hydraulic Power Steering Market size?

The India Electro Hydraulic Power Steering Market is projected to register a CAGR of less than 10% during the forecast period (2025-2030)

Who are the key players in India Electro Hydraulic Power Steering Market?

JTEKT Corporation, Hitachi Automotive Systems Ltd, ZF TRW Automotive Holdings Corp., Danfoss and Denso Corporation are the major companies operating in the India Electro Hydraulic Power Steering Market.

What years does this India Electro Hydraulic Power Steering Market cover?

The report covers the India Electro Hydraulic Power Steering Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the India Electro Hydraulic Power Steering Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

India Electro Hydraulic Power Steering Market Report

Statistics for the 2025 India Electro Hydraulic Power Steering market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. India Electro Hydraulic Power Steering analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.