Confectionery Processing Equipment Market Size and Share

Confectionery Processing Equipment Market Analysis by Mordor Intelligence

The Confectionery Processing Equipment Market is expected to register a CAGR of 6.2% during the forecast period.

- Increasing demand for confectionaries through retail outlets and independent confectionerychains supported by a strong penetration of confectionery players across the globe is anticipated to drive the demand for equipment over the coming years.

- The demand in terms of sweet indulgence is likely to stay prevalent across all age groups, where, on the other hand, the popularity of gifting cultures will also drive the demand for confectioneries thereby escalating the growth of processing equipment altogether.

Global Confectionery Processing Equipment Market Trends and Insights

A strong indulgence towards sweet-tooth

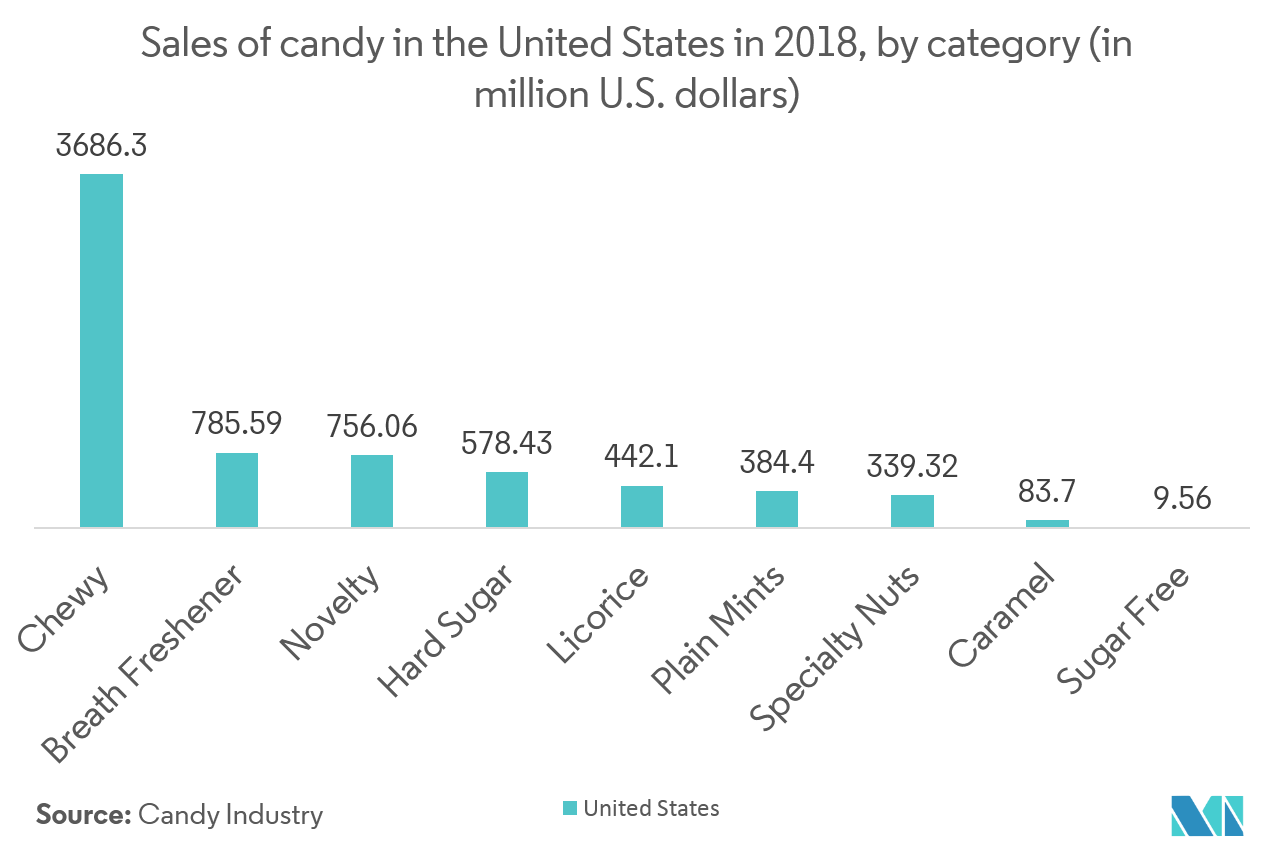

The prevalence of confectionery consumption in regards to its consideration as a treat, with a meal or as a meal replacement, has led to a notion of regularity among most of the consumers across developed countries. This being said, the patterns of consumption of confectionery have also changed wherein, in Europe, the per capita consumption of confectionery is nearly more than seven kilograms, whereas in the US the candy consumption will go beyond three kilograms per person. Although, regulations such as sugar reduction programs in the U.K., have led the confectionery market to shrink a bit, however, manufacturers move towards incorporating natural sweetening agents as a replacement have again added momentum to the existing flow. On the other hand, the existence of such products is likely to remain limited over the forecast period, as more of the consumers will tend to look after the mouthfeel at first, rather than health concerns.

Europe leading the bandwagon

The European food processing equipment sector has witnessed significant progress over the past years, wherein, most of the imports come from within the region which is 2015, amounted to Euro 1.5 billion. On the other hand, citing the fact that the processing equipment sector demand to be high in the European region, the exports from developing countries have started to gain momentum lately.

Countries such as Germany, Netherlands, the United Kingdom among others, are avid consumers of confectionery products and have held the top spots in terms of consumption & confectionary exports. However, lately, the emergence of international brands in the market and an unachieved liberalization of European Agricultural markets has led to the shrinking of the European confectionery market alone, leading to a dwindling scenario in terms of industry competitiveness. Furthermore, as we move forward, the demand for European confectionery is expected to perform well in third world countries, where the population growth along with the factors of sweet indulgence, is anticipated to deliver positive extension in the region's confectionary equipment market.

Competitive Landscape

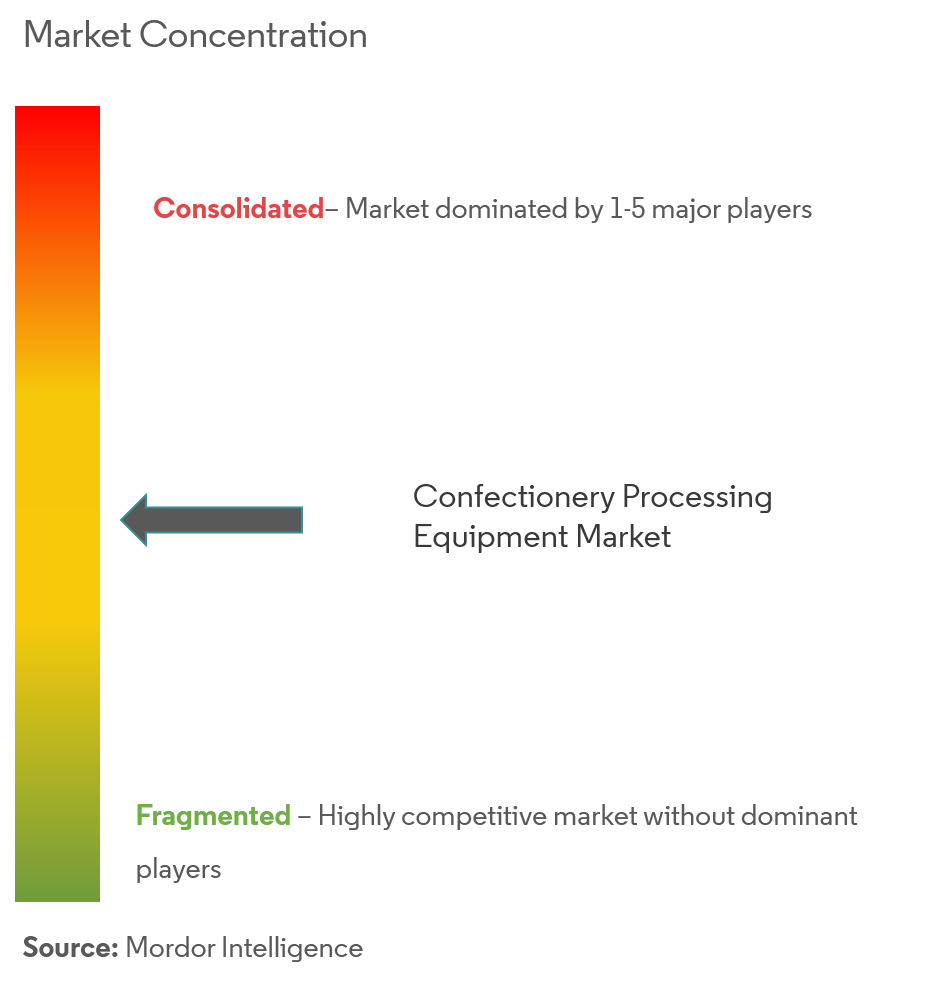

The global market for confectionery processing equipment is fragmented and highly competitive. Major players operating in the segment are embarking for major market share and small regional players catering to their domestic demands. Players in the confectionery processing equipment segments are relying on providing customized solutions for confectionery manufacturers to stay ahead in the competition. The key global players are based in North America and Europe, while various small players are based in Asia-Pacific, South America, and Eastern Europe. The key strategies adopted by the players in the market are expansions, innovations, and new product launches.

Confectionery Processing Equipment Industry Leaders

Robert Bosch GmbH

Bühler Holding AG

Alfa Laval AB

JBT Corporation

Baker Perkins

- *Disclaimer: Major Players sorted in no particular order

Global Confectionery Processing Equipment Market Report Scope

The Global confectionery processing equipment market is segmented in terms of type, product, and geography. By type, the market is segmented based on thermal equipment, extrusion equipment, mixer, blender and cutters, cooling equipment, coating equipment, and others. In terms of product, the market is segmented into soft confectionery, hard candies, chewing gums, gummies & jellies, and others. By geography, the market is further segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa, withan extensivestudy of countries specific to every region.

| Thermal Equipment |

| Extrusion Equipment |

| Mixer, Blenders & Cutters |

| Cooling Equipment |

| Coating Equipment |

| Others |

| Soft Confectionary |

| Hard Candies |

| Chewing gums |

| Gummies & Jellies |

| Others |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | Spain |

| United Kingdom | |

| Germany | |

| France | |

| Italy | |

| Rest of Europe | |

| Asia Pacific | China |

| Japan | |

| India | |

| Rest of Asia-Pacific | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle East and Africa | South Africa |

| Rest of Middle East and Africa |

| By Type | Thermal Equipment | |

| Extrusion Equipment | ||

| Mixer, Blenders & Cutters | ||

| Cooling Equipment | ||

| Coating Equipment | ||

| Others | ||

| By Product | Soft Confectionary | |

| Hard Candies | ||

| Chewing gums | ||

| Gummies & Jellies | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Europe | Spain | |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Asia Pacific | China | |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| South America | Brazil | |

| Argentina | ||

| Rest of South America | ||

| Middle East and Africa | South Africa | |

| Rest of Middle East and Africa | ||

Key Questions Answered in the Report

What is the current Confectionery Processing Equipment Market size?

The Confectionery Processing Equipment Market is projected to register a CAGR of 6.2% during the forecast period (2025-2030)

Who are the key players in Confectionery Processing Equipment Market?

Robert Bosch GmbH, Bühler Holding AG, Alfa Laval AB, JBT Corporation and Baker Perkins are the major companies operating in the Confectionery Processing Equipment Market.

Which is the fastest growing region in Confectionery Processing Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Confectionery Processing Equipment Market?

In 2025, the Europe accounts for the largest market share in Confectionery Processing Equipment Market.

What years does this Confectionery Processing Equipment Market cover?

The report covers the Confectionery Processing Equipment Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Confectionery Processing Equipment Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Confectionery Processing Equipment Market Report

Statistics for the 2025 Confectionery Processing Equipment market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Confectionery Processing Equipment analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.