亚太地区益生菌市场分析

亚太地区益生菌市场预计未来五年复合年增长率为 9.6%。

该市场主要是由消费者,尤其是年轻一代对益生菌等健康产品的强劲需求推动的。益生菌是功能性食品和饮料的一部分,以改善肠道功能以及增强免疫力等其他益处而闻名。益生菌食品的各种健康益处正在推动该地区的消费者消费此类食品和饮料。益生菌由天然存在于您体内的优质活细菌和/或酵母制成,有助于消化食物、产生维生素、分解和吸收药物等。此外,该地区人们的酸度增加、胃和肠道问题以及消化不良问题正在增加对此类益生菌食品的需求。例如,根据 GOQii 的数据,2021 年在印度进行的一项大规模调查结果显示,约 30% 的女性受访者表示存在胃酸过多和消化不良问题,而当年约 29% 的男性受访者存在肠道相关问题。

此外,该地区越来越多的消费者开始转向不仅仅满足口渴的饮料,除了天然来源、均衡和营养的膳食之外,这也产生了对功能性饮料的强烈需求,以满足他们的需求。这种健康、强化饮料的增长趋势为品牌或初创企业开发滋养、提神和补水的产品创造了新的机会。例如,印度一家名为 Ginger Rage 的新初创公司提供康普茶等益生菌产品,该产品声称热量低,是一种鸡尾酒混合剂,对肠道友好,可增强免疫力。该公司还通过其在线零售商店和其他社交媒体平台提供所有产品。该地区提供的产品的这种创新和多样性预计将在预测期内进一步推动市场的增长。

亚太地区益生菌市场趋势

增强健康意识

益生菌是蓬勃发展的消化保健补充剂市场的关键成分,各个年龄段的消费者都在消耗更多的益生菌。由于多渠道的宣传,人们的健康意识不断增强,极大地影响了他们的消费习惯,因此,千禧一代的消费主体是千禧一代。随着健康问题的日益严重以及早期出现的胃和肠道相关问题,该地区的消费者越来越意识到自己的肠道健康和维持肠道菌群。益生菌是克服或预防此类不良问题的完美解决方案,对此类饮料和食品的需求正在急剧增加。例如,根据韩国食品药品安全部的数据,2021年,益生菌产品约占韩国保健功能食品市场的19%,较上年的15.8%左右大幅增长。同样,Hy Co. Ltd(前身为韩国养乐多)是 2021 年韩国领先的益生菌公司。其益生菌产品销售额约为 2750 亿韩元。因此,该地区对益生菌产品的消费和需求的增长预计将用创新产品填充市场,从而在不久的将来推动益生菌市场的发展。

日本在市场上占有显着份额

在日本,益生菌成分和成品是基于科学证明并以健康要求为支持而开发的。此外,日本益生菌市场主要由日本客户推动,他们特别关心定期更换肠道菌群,并认为益生菌是实现这一目标的最佳方法。与此相一致的是,该国正在开发不同的新技术来生产更有效和可持续的产品,也通过增加消费者基础来支持市场的增长。例如,2021年6月,经过20年的研发,SCIENCE OF PROBIOTICS by TCI JAPAN宣布终于突破现有限制,找到了创造创新益生菌饮料的新方法。 TCI JAPAN 的 SCIENCE OF PROBIOTICS 在业内率先宣布开发出一种新的专利工艺,利用高效发酵技术,将 1000 亿个活益生菌注入到每个微小的玻璃瓶饮料中,约等于益生菌总数10瓶普通乳酸菌饮料中。

此外,利用这样的尖端技术,饮料中可以保持高数量的活菌,有望成为国内高效、速效、长效的益生菌饮料,吸引消费者。值得注意的是,日本品牌养乐多在该国非常受欢迎,收入较高,其产品作为学校午餐的一部分,并由员工送货上门,从而促进了其在该国的增长。例如,根据养乐多本社的数据,2021财年,该公司通过其在日本的乳制品部门实现了近1020亿日元的净销售额,延续了近年来的上升趋势。

亚太地区益生菌行业概况

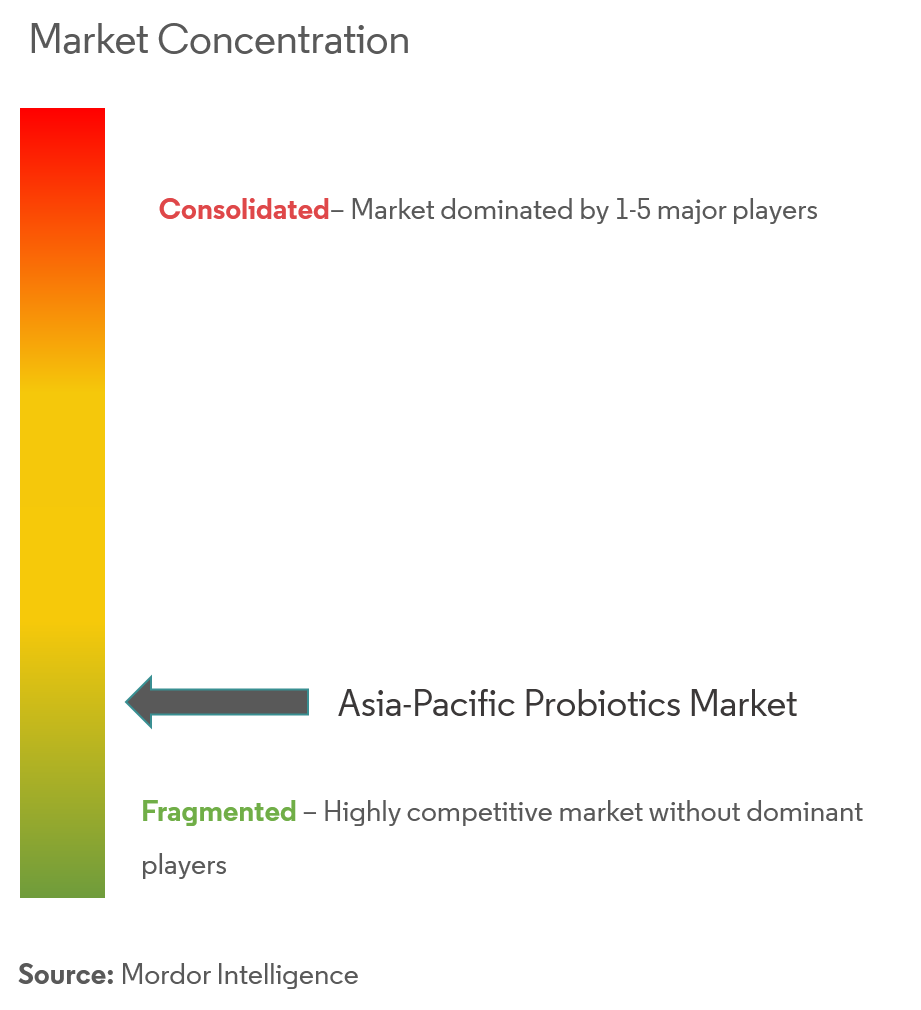

亚太地区益生菌市场较为分散,市场上存在不同的参与者。目前该地区的益生菌食品以乳制品为主,如发酵乳饮料、益生菌酸奶、益生菌酸奶饮料等。市场上的主要参与者有养乐多、达能、森永和雀巢。这些球员近年来进一步巩固了自己的地位。向市场推出新的创新产品是市场参与者为扩大产品组合和消费者基础而采取的主要策略之一。

亚太地区益生菌市场领导者

PepsiCo Inc.

Danone SA

Yakult Honsha Co. Ltd

Nestle SA

Bio-k Plus International

- *免责声明:主要玩家排序不分先后

亚太地区益生菌市场新闻

- 2022年9月:雀巢健康科学旗下益生菌品牌生命花园在中国线下零售市场推出两款针对儿童成长和免疫健康的全新益生菌饮料。

- 2022年1月:蒙牛优益C推出两款益生菌固体饮料,并声称是专为中国人设计的。该公司声称,每日健康饮料添加了中国专利明星菌乳双歧杆菌V9、植物乳杆菌Lp-6、副干酪乳杆菌PC-01。

- 2021年3月:国际领先咖啡品牌之一COSTA与国际知名乳业巨头恒天然旗下原料及解决方案品牌NZMP合作,宣布在中国全部200家门店正式推出桃子益生菌拿铁(益生菌咖啡)。

亚太地区益生菌行业细分

益生菌是有益细菌和酵母的组合,有助于人类和动物维持肠道微生物平衡。

亚太地区益生菌市场按产品类型(益生菌食品、益生菌饮料和膳食补充剂)、分销渠道(超市/大卖场、药房和保健品店、便利店、在线零售店和其他分销渠道)和地理位置进行细分(印度、中国、日本、韩国、澳大利亚、亚太其他地区)。该报告提供了上述细分市场的市场规模和价值(百万美元)。

| 益生菌食品 | 酸奶 |

| 面包店/早餐谷物 | |

| 婴儿食品和婴儿配方奶粉 | |

| 其他益生菌食品 | |

| 益生菌饮料 | 水果益生菌饮料 |

| 乳制品益生菌饮料 | |

| 膳食补充剂 |

| 超市/大卖场 |

| 便利店 |

| 药房和药店 |

| 网上零售店 |

| 其他分销渠道 |

| 中国 |

| 日本 |

| 印度 |

| 韩国 |

| 澳大利亚 |

| 亚太其他地区 |

| 类型 | 益生菌食品 | 酸奶 |

| 面包店/早餐谷物 | ||

| 婴儿食品和婴儿配方奶粉 | ||

| 其他益生菌食品 | ||

| 益生菌饮料 | 水果益生菌饮料 | |

| 乳制品益生菌饮料 | ||

| 膳食补充剂 | ||

| 分销渠道 | 超市/大卖场 | |

| 便利店 | ||

| 药房和药店 | ||

| 网上零售店 | ||

| 其他分销渠道 | ||

| 地理 | 中国 | |

| 日本 | ||

| 印度 | ||

| 韩国 | ||

| 澳大利亚 | ||

| 亚太其他地区 | ||

亚太地区益生菌市场研究常见问题解答

目前亚太地区益生菌市场规模有多大?

亚太地区益生菌市场预计在预测期内(2024-2029)复合年增长率为 9.60%

谁是亚太益生菌市场的主要参与者?

PepsiCo Inc.、Danone SA、Yakult Honsha Co. Ltd、Nestle SA、Bio-k Plus International是亚太益生菌市场的主要运营公司。

亚太益生菌市场涵盖哪些年份?

该报告涵盖了亚太地区益生菌市场的历年市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了亚太地区益生菌市场的历年规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

亚太地区益生菌行业报告

Mordor Intelligence™ 行业报告创建的 2024 年亚太地区益生菌市场份额、规模和收入增长率统计数据。亚太地区益生菌分析包括至 2029 年的市场预测展望和历史回顾。获取此行业分析的样本(免费下载 PDF 报告)。