UAE Cereal Bar Market Analysis by Mordor Intelligence

The UAE Cereal Bar Market is expected to register a CAGR of 6.5% during the forecast period.

- Increased influence of westernization and demand for on-the-go healthy breakfastare various factors driving the market. Busy lifestyle demanding nutritional packaged products fueled the market demand.

- In the segmentation font,cereal bars made of granola and muesli are observing strong growth over the years, owing to its taste, nutritional value, and functionality. Cereal bars infused with organic ingredients, like dried fruits among others, are observed to be gaining demand during the forecast period.

UAE Cereal Bar Market Trends and Insights

Convenient On-The-Go Breakfast Demand

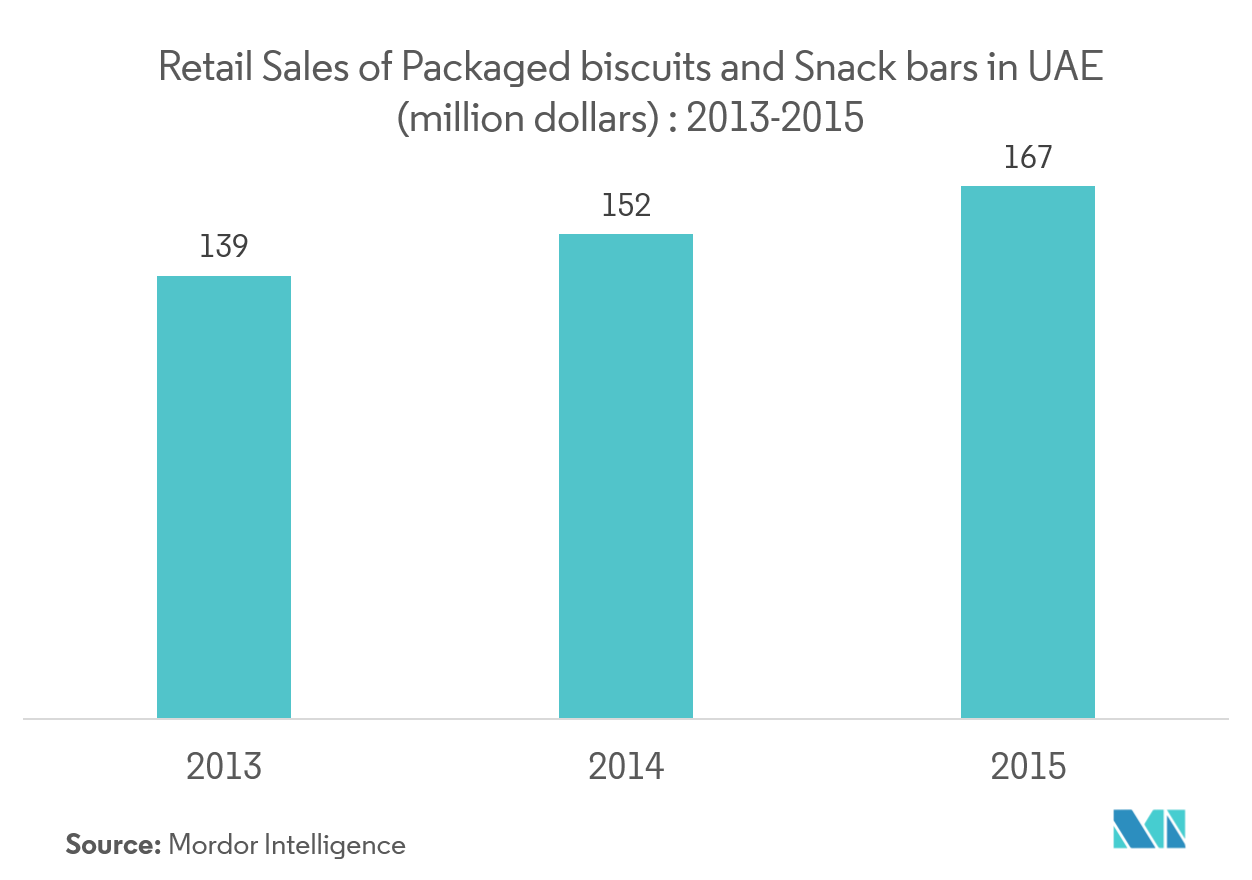

Increased influence of westernization and busy working style, there is a growing demand for on-the-go breakfast snacks. About 50% of the population in UAE are below 30 years age who prefer snack as a healthy and fun option. With the growing demand, sales for packaged biscuits and snack bars is increased in recent years in the country. The sales of cereal bars are going to increase as consumers prefer it as a primary choice among available snack bars like energy bars, protein bars in the market. Innovative flavors, packaging, and convenience for on-the-go breakfast are going to fuel the growth of the market further during the forecast period. Innovative flavors, packaging, and convenience for on-the-go breakfast are going to fuel the growth of the market during the forecast period.

Expanded Retail Channel Drives Impulse Purchase

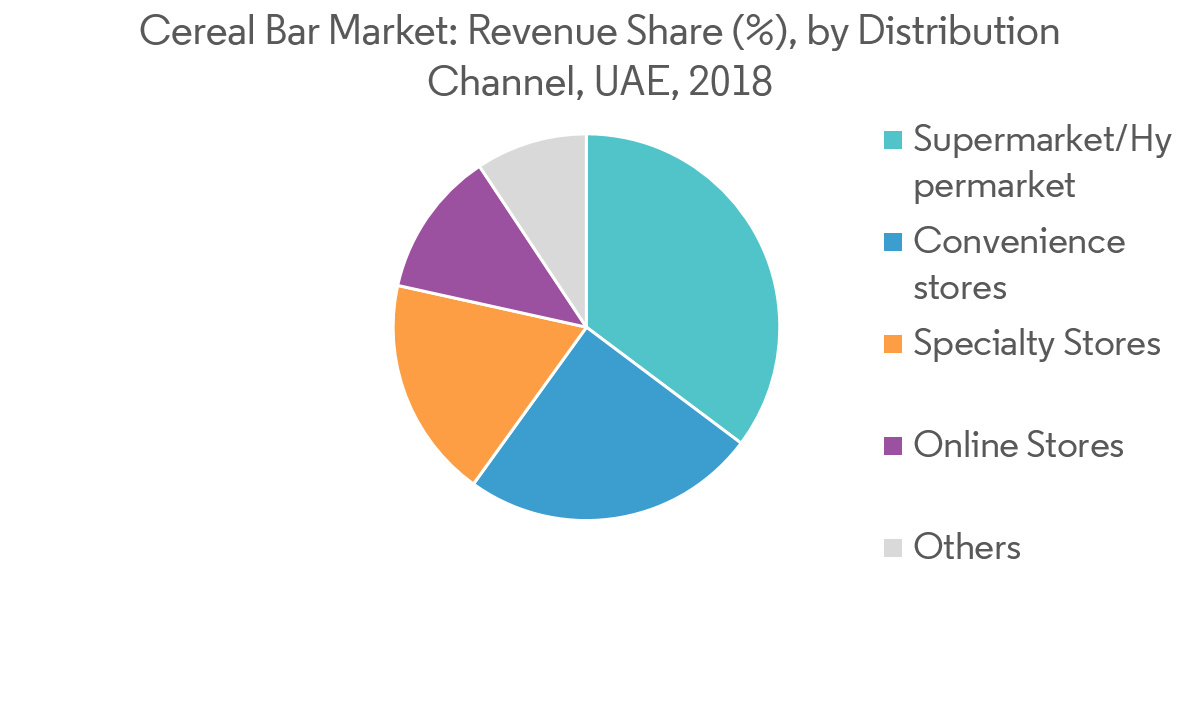

Convenience stores and Supermarkets drive the sale in the distribution channel. Online retail sales of cereal bars recorded an impressive growth rate of 26%, during 2012-2017, in UAE. At present, stores are heavily flooded with all types of snack bars, like protein-rich bars, nutritious bars, gluten, and sugar-free bars, which attract various groups of consumers to convenience stores. Cereal bar addresses the need for on-the-go snack food products, which makes it one of the common items in convenience stores. These factors increase the sales and manufacturers reap the rewards of the same. However, online sales hold around less than 1% of the Cereal Bars sales driven by increased brand availability and convenience. Various international players are entering the Cereal Bar market through online channels mitigating the requirement for physical stores.

Competitive Landscape

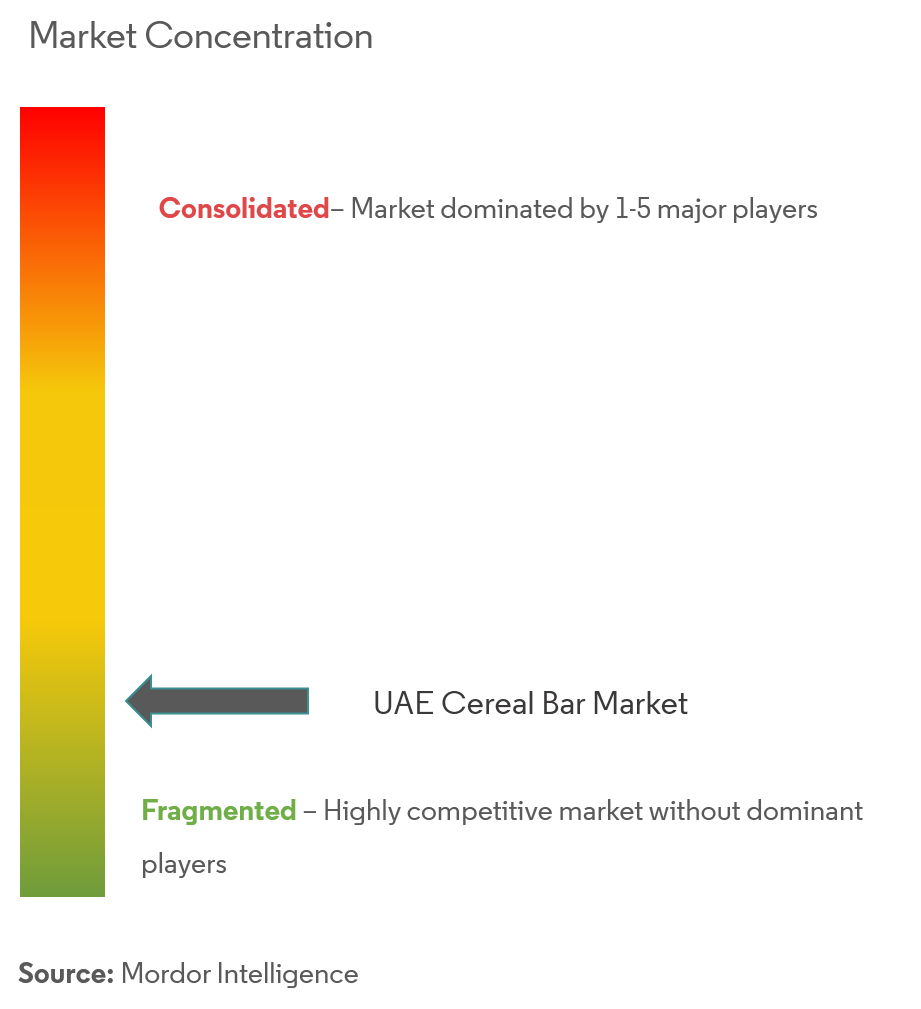

The UAE Cereal Bar market is competitive with many foreign players occupying major share. Innovative product launch and clean label ingredients are the various strategies adopted by these players. Major players includeBe Natural,General Mills, Inc.,The Kellogg Company,Clif Bar & Company,Nestle,Weetabix Food Company andMusclePharm Corporation.

UAE Cereal Bar Industry Leaders

Be Natural

General Mills, Inc.

The Kellogg Company

Clif Bar & Company

Nestle

- *Disclaimer: Major Players sorted in no particular order

UAE Cereal Bar Market Report Scope

The scope of UAE Cereal Bar Market is segmented by Product type (Granola/Muesli Bars, Other Cereal Bars) and by distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers, and Other Distribution Channels).

| Granola/Muesli Bars |

| Other Cereal Bars |

| Supermarkets/Hypermarkets |

| Convenience Stores |

| Specialty Stores |

| Online Retailers |

| Other Distribution Channels |

| By Product Type | Granola/Muesli Bars |

| Other Cereal Bars | |

| By Distribution Channel | Supermarkets/Hypermarkets |

| Convenience Stores | |

| Specialty Stores | |

| Online Retailers | |

| Other Distribution Channels |

Key Questions Answered in the Report

What is the current UAE Cereal Bar Market size?

The UAE Cereal Bar Market is projected to register a CAGR of 6.5% during the forecast period (2025-2030)

Who are the key players in UAE Cereal Bar Market?

Be Natural, General Mills, Inc., The Kellogg Company, Clif Bar & Company and Nestle are the major companies operating in the UAE Cereal Bar Market.

What years does this UAE Cereal Bar Market cover?

The report covers the UAE Cereal Bar Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the UAE Cereal Bar Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

UAE Cereal Bar Market Report

Statistics for the 2025 UAE Cereal Bar market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. UAE Cereal Bar analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.