Asia-Pacific Processed Meat Market Analysis by Mordor Intelligence

The Asia-Pacific Processed Meat Market size is estimated at USD 78.25 billion in 2025, and is expected to reach USD 88.32 billion by 2030, at a CAGR of 2.45% during the forecast period (2025-2030).

Increasing busy urban lifestyles in the Asia-Pacific region have resulted in consumers opting for tasty and healthy convenient foods that do not expend time for cooking or preparation. High meat consumption patterns in most of the countries in the region, like India and China, and rising preference for ready-to-eat meals are supporting the growth of the processed meat products market. For instance, according to OECD, in 2022, the consumption of poultry meat in India was found to be over four million metric tons, accounting for almost 4,253.74 thousand metric tons, which increased from 4,107.12 thousand metric tons in 2021. India is one of the leading producers of poultry meat in the world. The increase in the average income and the urban population has led to a tremendous increase in the demand for processed poultry meat products and a steady increase in consumption over the years. Additionally, the recent trend in India to establish large abattoirs-cum-meat processing plants with the latest technology is expected to further support the manufacturers to address the growing demand effectively. India has already established 10 state-of-art mechanized abattoirs-cum-meat processing plants in various states based on slaughtering buffaloes and sheep.

Moreover, with the world's largest population and a rising craving for meat, countries in the region like India and China are expected to be the biggest sources of increased demand. In addition, the young population in the region is consuming packed and processed meat products owing to their convenience and their sophisticated tastes. To address this growing demand and capture the market share, countries in the region are importing meat and then processing it with required preservatives. For instance, Chinese customs figures show that beef imports from the United States increased to 83,000 tons in the first eight months of 2021, nine times the volume in the same period a year prior, and were projected to reach more than USD 1 billion in 2022. The market is further being led by factors such as technological innovations pertaining to improved shelf lives of frozen meat products, packaging, and a rise in demand from the household and commercial sectors. Hence, the above factors are expected to boost the market's growth at a faster pace during the forecast period.

Asia-Pacific Processed Meat Market Trends and Insights

Growing Demand for Convenience Foods in the Region

The reason for the growth of processed meat in Asia-Pacific can be attributed to shifting consumer trends and the emergence of 'snacking.' Consumers are constantly seeking convenient snacking options with high protein and nutrient content that are being upgraded by significant manufacturers operating in the processed meat market. Due to their busy lifestyles, processed meat products, especially meat snacks, are becoming popular, especially with the working population of the area and the emerging young generation of consumers. For instance, according to USDA Foreign Agricultural Service, in 2021, the sales value of processed meat and seafood in the Indian packaged foods market amounted to USD 281 million. There was a significant rise in the sales value when compared to the previous year, which accounted for about USD 239.6 million in this packaged food segment.

Consumers who work far from home, or have other obligations, tend to opt for a quick, easy, and convenient snack, as opposed to a larger meal that takes time to prepare. The major attributes consumers look for in convenience foods are ease of use, packaging, nutritional value, safety, variety and product appeal. Thus, processed meat product manufacturers are taking strong initiatives to make sure to reach their consumers' expectations by providing nutritional products in safe and convenient packaging. For instance, in July 2022, FreshToHome, the world's largest fully integrated online brand in fresh fish and meat e-commerce, launched India's first clean-label Ready-To-Fry (RTF) meat snacks on its platform. The company claimed that these products take less than 5 minutes to fry and come with no preservatives or artificial additives, offering a quick and guilt-free fix for satiating people's munching needs throughout the day.

China Holds the Largest Share in the Processed Meat Market

China dominates the market as consumers prioritize portability, convenience, and indulgence offered by processed meat products in the country. Additionally, the snacking trend among consumers in the country is an all-day habit, with snacking at least once a day among all age's consumers. For instance, according to OECD, in 2021, the Chinese consumed, on average, 45.1 kilograms of meat per person, an increase of around 44.4 kilograms from the year before. Moreover, with the increasing popularity of meat snacks, producers of dried meat snacks and meals in the country are focusing on offering innovative and new products to attract consumers. For instance, in December 2021, Benwei Xianwu, a high-end meat product brand, released three new pre-prepared dishes: Braised fire Dongpo pork, ham and duck stew, and double pepper stewed sausage. Such developments and innovations being done by the players in the country with different meat products are expected to further boost the market's growth during the forecast period. Players are also concentrating on producing premium products, intending to entice Chinese consumers of the higher income group with their no-preservative and additive products, thus, driving the market.

Competitive Landscape

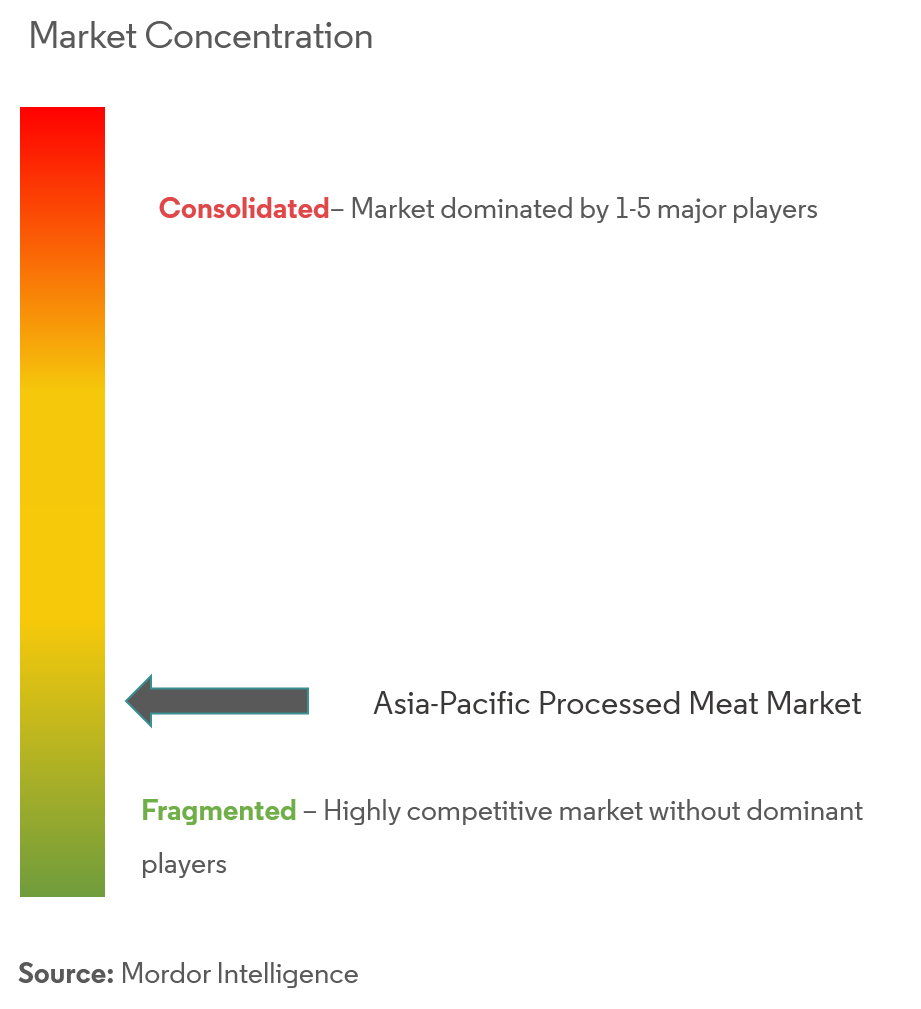

The Asia-Pacific processed meat market is fragmented, with a considerable number of regional small-medium scale players and also key global players. Owing to the rapidly developing market, launching a new product is one of the essential strategies being followed by the players in the region to gain a competitive edge. The players in the market have also been adopting expansion as a critical strategy, followed by mergers and acquisitions. These strategic moves have proven successful for global players seeking to strengthen their presence in the market. Some of the major key players in the processed meat market include BRF SA, Cargill Inc., Cherkizovo Group, Foster Farms, Hormel Foods, Marfrig Group, National Beef, Nippon Meat Packers Inc., Perdue Farms, Pilgrim's Pride, Sadia SA, Sanderson Farms Inc., and Shuanghui International.

Asia-Pacific Processed Meat Industry Leaders

BRF S.A.

Foster Farms

Hormel Foods

Ajinomoto Co., Inc.

Cherkizovo Group

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- Aug 2022: Tyson Foods launched processed meat products under the Tyson brand. There are seven products in the range, namely Tyson Chicken Nugget (600g), Tyson Classic Fried Chicken (600g), Tyson BBQ Roasted Chicken Drumstick (600g), Tyson Chicken Karaage (600g), Tyson Crispy Chicken Stripe (600g), and Tyson Grilled Tender Chicken (600g).

- Jul 2022: FreshToHome, the world's largest fully integrated online brand in fresh fish and meat e-commerce, launched India's first clean-label Ready-To-Fry (RTF) meat snacks on its platform.

- Apr 2022: Prasuma, one of India's leading chilled meat and frozen food brands, announced adding new snacks to its frozen food portfolio. The brand is set to launch frozen Chicken Nuggets, Chicken Mini Samosas, Mutton and Chicken Shammi Kababs, and Mutton and Chicken Seekh Kababs, as well as Bacon, to its frozen portfolio.

Asia-Pacific Processed Meat Market Report Scope

Processed meats are meat products preserved by smoking or salting, curing, or adding chemical preservatives. The Asia-Pacific Processed Meat Market is segmented by Type (Beef, Mutton, Pork, and Poultry), Product Type (Chilled, Frozen, and Canned/Preserved), Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Stores, and Other Distribution Channels), and Country (India, China, Japan, Australia, and Rest of Asia-Pacific). The report offers market size and forecasts for the Asia-Pacific processed meat market in value (USD million) for all the above segments.

| Beef |

| Mutton |

| Pork |

| Poultry |

| Other Types |

| Chilled |

| Frozen |

| Canned/Preserved |

| Hypermarket/Supermarket |

| Convenience Stores |

| Online Stores |

| Other Distribution Channels |

| India |

| China |

| Japan |

| Australia |

| Rest of Asia-Pacific |

| By Type | Beef |

| Mutton | |

| Pork | |

| Poultry | |

| Other Types | |

| By Product Type | Chilled |

| Frozen | |

| Canned/Preserved | |

| By Distribution Channel | Hypermarket/Supermarket |

| Convenience Stores | |

| Online Stores | |

| Other Distribution Channels | |

| By Country | India |

| China | |

| Japan | |

| Australia | |

| Rest of Asia-Pacific |

Key Questions Answered in the Report

How big is the Asia-Pacific Processed Meat Market?

The Asia-Pacific Processed Meat Market size is expected to reach USD 78.25 billion in 2025 and grow at a CAGR of 2.45% to reach USD 88.32 billion by 2030.

What is the current Asia-Pacific Processed Meat Market size?

In 2025, the Asia-Pacific Processed Meat Market size is expected to reach USD 78.25 billion.

Who are the key players in Asia-Pacific Processed Meat Market?

BRF S.A., Foster Farms, Hormel Foods, Ajinomoto Co., Inc. and Cherkizovo Group are the major companies operating in the Asia-Pacific Processed Meat Market.

What years does this Asia-Pacific Processed Meat Market cover, and what was the market size in 2024?

In 2024, the Asia-Pacific Processed Meat Market size was estimated at USD 76.33 billion. The report covers the Asia-Pacific Processed Meat Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Asia-Pacific Processed Meat Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Asia-Pacific Processed Meat Market Report

Statistics for the 2025 Asia-Pacific Processed Meat market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Asia-Pacific Processed Meat analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.