摩洛哥瓶装水市场分析

预计摩洛哥瓶装水在预测期内(2020-2025 年)复合年增长率为 2.73%。

- 自2015年以来,摩洛哥瓶装水市场正经历稳定增长,人们对摩洛哥低质量自来水的认识不断增强。但由于 2018 年 4 月对 Sidi Ali 等主要品牌的抵制,预计 2018 年市场瓶装水价格将下降。

- 占据显着市场份额的非饮用水领域将在预测期内继续保持最高的市场份额。由于产品价格较高,贸易销售渠道在摩洛哥瓶装水销售中发挥着重要作用。

摩洛哥瓶装水市场趋势

对静水的需求不断增加

由于健康意识的增强以及与饮用气泡水有关的相关健康问题,预计摩洛哥人民将消耗更多的气泡水,而不是碳酸水。由于摩洛哥人口增长不断增长,预计对静水的需求将持续增长。矿泉水有气泡水和气泡水两种,但由于气泡水价格低廉,且其在家庭中的应用不断增加,消费者更喜欢气泡水。

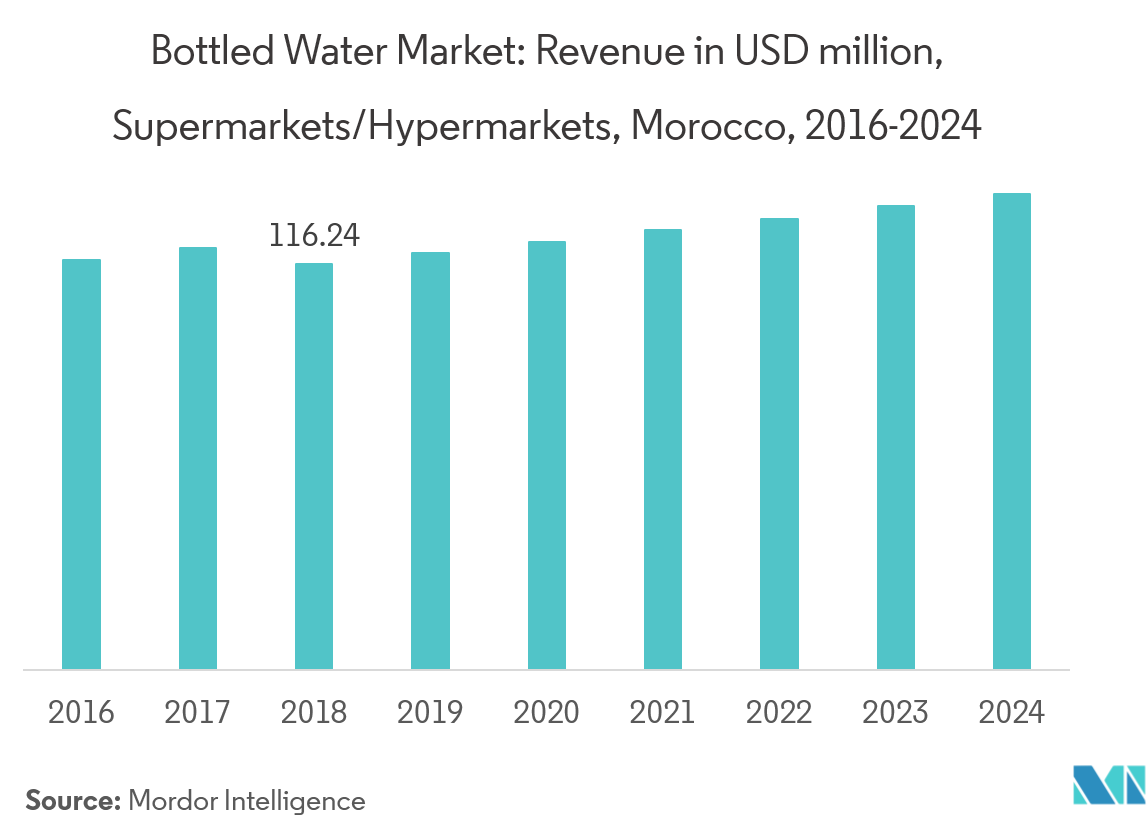

大型超市/超市是增长最快的细分市场

超市和大卖场提供瓶装水,可以实现一站式购物,从而推动了对此类产品的需求。摩洛哥的超市是当地购买瓶装水和其他基本食品的方式。随着摩洛哥超市数量的增加,预计它们将成为瓶装水销售的最大单一市场。在摩洛哥,越来越多的小杂货店正在转型为独立超市和自助便利店,并向公众提供大量瓶装水。

摩洛哥瓶装水行业概况

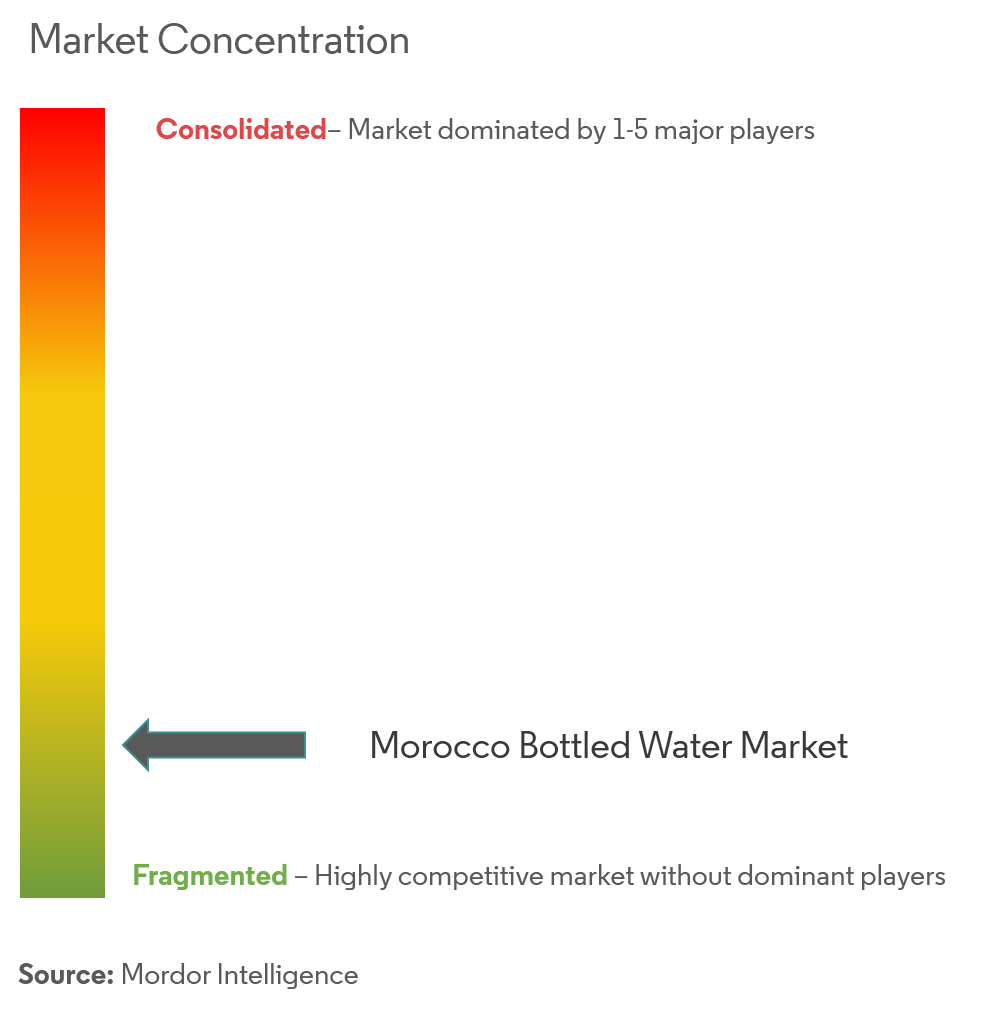

摩洛哥的瓶装水市场是一个适度分散的市场。摩洛哥的一些知名全球企业包括 Oulmes、可口可乐、雀巢、Fiji Water Company LLC。和达能。乌尔姆斯拥有显着的市场份额,其次是其他国际玩家。尽管瓶装水市场没有太多的产品创新,但企业正在尝试推出新产品作为加强其市场主导地位的下一步策略,特别是在风味和功能性瓶装水市场。

摩洛哥瓶装水市场领导者

Oulmes

THE COCA-COLA COMPANY

FIJI Water Company LLC.

Nestle

Danone

- *免责声明:主要玩家排序不分先后

摩洛哥瓶装水行业细分

摩洛哥瓶装水按类型分为纯净水、苏打水、功能水等;按分销渠道分为场内交易、超市/大卖场、在线零售商和便利店。

| 死水 |

| 苏打水 |

| 功能水 |

| 超级市场和大卖场 |

| 便利店 |

| 网上零售商 |

| 场内交易 |

| 其他分销渠道 |

| 类型 | 死水 |

| 苏打水 | |

| 功能水 | |

| 分销渠道 | 超级市场和大卖场 |

| 便利店 | |

| 网上零售商 | |

| 场内交易 | |

| 其他分销渠道 |

摩洛哥瓶装水市场研究常见问题解答

目前摩洛哥瓶装水市场规模有多大?

摩洛哥瓶装水市场预计在预测期内(2024-2029)复合年增长率为 2.73%

谁是摩洛哥瓶装水市场的主要参与者?

Oulmes、THE COCA-COLA COMPANY、FIJI Water Company LLC.、Nestle、Danone 是在摩洛哥瓶装水市场运营的主要公司。

该摩洛哥瓶装水市场覆盖几年?

该报告涵盖了摩洛哥瓶装水市场历年市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了摩洛哥瓶装水市场历年规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

摩洛哥瓶装水行业报告

Mordor Intelligence™ 行业报告创建了 2024 年摩洛哥瓶装水市场份额、规模和收入增长率的统计数据。摩洛哥瓶装水分析包括 2029 年的市场预测展望和历史概述。获取此行业分析的样本(免费下载 PDF 报告)。