亚太地区加工肉类市场分析

亚太加工肉类市场预计未来五年复合年增长率为11.19%。

亚太地区日益繁忙的城市生活方式导致消费者选择美味健康的方便食品,这些食品不需要花费时间烹饪或准备。印度和中国等该地区大多数国家的高肉类消费模式以及对即食食品的日益偏好正在支撑加工肉制品市场的增长。例如,根据经合组织的数据,2022年印度禽肉消费量将超过400万吨,近425.374万吨,较2021年的410.712万吨有所增加。印度是世界上禽肉消费量最大的国家之一。世界领先的禽肉生产商。平均收入和城市人口的增加导致加工禽肉产品的需求大幅增加,消费量多年来稳步增长。此外,印度最近建立采用最新技术的大型屠宰场兼肉类加工厂的趋势预计将进一步支持制造商有效满足不断增长的需求。印度已在各邦建立了10个最先进的机械化屠宰场兼肉类加工厂,以屠宰水牛和羊为基础。

此外,由于拥有世界上最多的人口和对肉类的日益增长的需求,印度和中国等该地区的国家预计将成为需求增长的最大来源。此外,该地区的年轻人正在消费包装和加工的肉类产品,因为它们方便且口味精致。为了满足这种不断增长的需求并占领市场份额,该地区的国家正在进口肉类,然后使用所需的防腐剂进行加工。例如,中国海关数据显示,2021年前8个月,中国从美国的牛肉进口量增至8.3万吨,是去年同期的9倍,预计2022年将超过10亿美元市场进一步受到诸如冷冻肉产品保质期延长、包装方面的技术创新以及家庭和商业部门需求增长等因素的推动。因此,预计上述因素将在预测期内推动市场以更快的速度增长。

亚太地区加工肉类市场趋势

该地区对方便食品的需求不断增长

亚太地区加工肉类的增长可归因于消费趋势的转变和零食的出现。消费者不断寻求具有高蛋白质和营养成分的方便零食选择,加工肉类市场上的重要制造商正在对这些零食进行升级。由于忙碌的生活方式,加工肉类产品,特别是肉类零食越来越受欢迎,尤其受到该地区的工作人口和新兴的年轻一代消费者的欢迎。例如,根据美国农业部对外农业服务局的数据,2021年,印度包装食品市场的加工肉类和海鲜销售额达2.81亿美元。包装食品领域的销售额较上年大幅增长,约占2.396亿美元。

远离家乡工作或有其他义务的消费者倾向于选择快速、简单和方便的零食,而不是需要时间准备的大餐。消费者在方便食品中寻找的主要属性是易用性、包装、营养价值、安全性、多样性和产品吸引力。因此,加工肉类产品制造商正在采取强有力的举措,通过提供安全、方便的包装的营养产品来确保满足消费者的期望。例如,2022年7月,全球最大的生鲜鱼肉电商综合在线品牌FreshToHome在其平台上推出了印度首款清洁标签即炸(RTF)肉类零食。该公司声称,这些产品的油炸时间不到 5 分钟,并且不含防腐剂或人工添加剂,可以快速且无负罪感地满足人们全天的咀嚼需求。

中国在加工肉类市场中占有最大份额

中国在市场上占据主导地位,因为消费者优先考虑加工肉类产品的便携性、便利性和享受性。此外,该国消费者的零食趋势是一种全天的习惯,所有年龄段的消费者每天至少吃一次零食。例如,根据经合组织的数据,2021年,中国人均肉类消费量为45.1公斤,比上年增加约44.4公斤。此外,随着肉类零食越来越受欢迎,该国的肉干零食和膳食生产商正致力于提供创新的新产品来吸引消费者。例如,2021年12月,高端肉制品品牌本味鲜物推出三款预调菜新品:红烧东坡肉、火腿炖鸭、双椒炖肠。该国不同肉类产品的参与者所进行的此类开发和创新预计将在预测期内进一步推动市场的增长。企业还专注于生产优质产品,旨在通过不含防腐剂和添加剂的产品来吸引中国高收入群体的消费者,从而推动市场发展。

亚太地区加工肉类行业概览

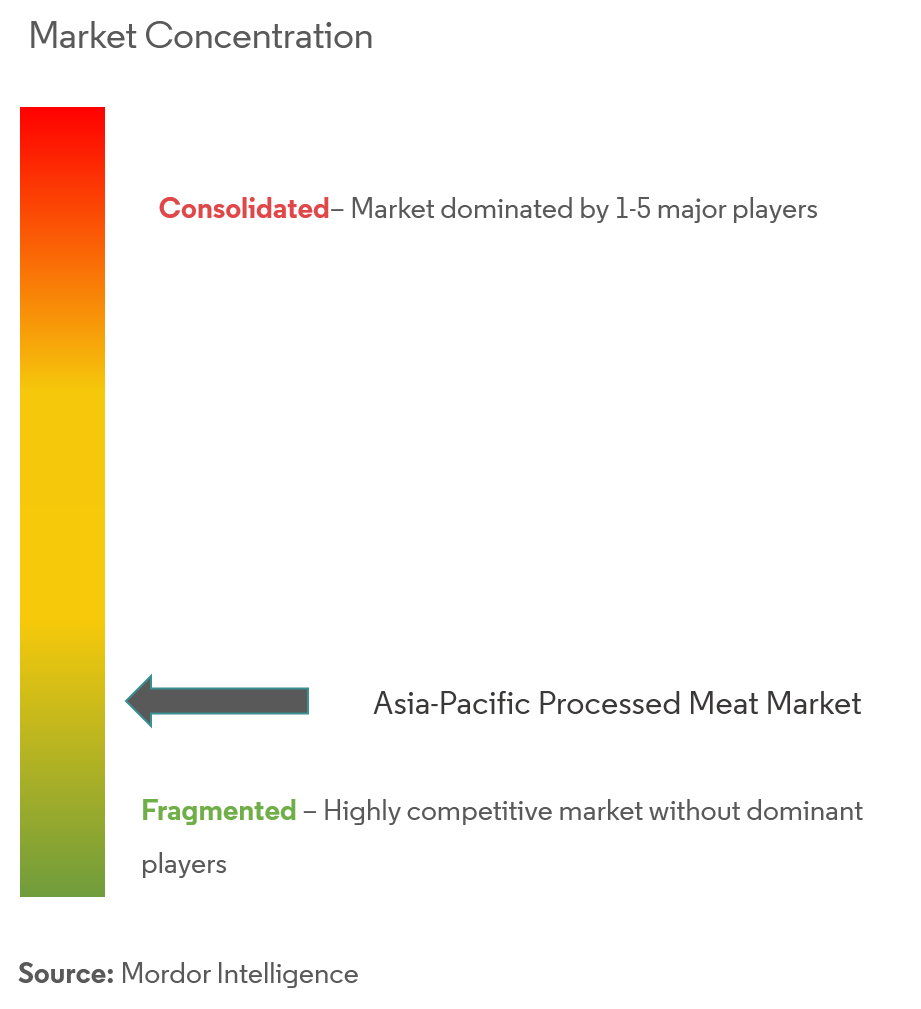

亚太加工肉类市场较为分散,有相当数量的区域中小型企业以及全球主要企业。由于市场的快速发展,推出新产品是该地区参与者获得竞争优势的基本策略之一。市场参与者也一直将扩张作为重要战略,其次是并购。事实证明,这些战略举措对于寻求加强市场影响力的全球企业来说是成功的。加工肉类市场的一些主要参与者包括 BRF SA、嘉吉公司、Cherkizovo Group、Foster Farms、Hormel Foods、Marfrig Group、National Beef、Nippon Meat Packers Inc.、Perdue Farms、Pilgrim's Pride、Sadia SA、Sanderson Farms Inc.和双汇国际。

亚太地区加工肉类市场领导者

BRF S.A.

Foster Farms

Hormel Foods

Ajinomoto Co., Inc.

Cherkizovo Group

- *免责声明:主要玩家排序不分先后

亚太地区加工肉类市场新闻

- 2022 年 8 月:泰森食品以泰森品牌推出加工肉制品。该系列共有七种产品,分别是泰森鸡块(600克)、泰森经典炸鸡(600克)、泰森烧烤鸡腿(600克)、泰森炸鸡块(600克)、泰森脆皮鸡条(600克)和泰森烤嫩鸡(600克)。

- 2022 年 7 月:全球最大的生鲜鱼肉电商综合在线品牌 FreshToHome 在其平台上推出印度首款清洁标签即炸(RTF)肉类零食。

- 2022 年 4 月:印度领先的冰鲜肉和冷冻食品品牌之一 Prasuma 宣布在其冷冻食品产品组合中添加新零食。该品牌将在其冷冻产品组合中推出冷冻鸡块、迷你鸡肉三角饺、羊肉和鸡肉沙米烤肉串、羊肉和鸡肉 Seekh 烤肉串以及培根。

亚太地区加工肉类行业细分

加工肉类是通过熏制或盐腌、腌制或添加化学防腐剂保存的肉制品。亚太加工肉类市场按类型(牛肉、羊肉、猪肉和家禽)、产品类型(冷藏、冷冻和罐装/腌制)、分销渠道(超市/大卖场、便利店、网上商店等)细分分销渠道)和国家/地区(印度、中国、日本、澳大利亚和亚太其他地区)。该报告提供了亚太加工肉类市场所有上述细分市场的市场规模和价值预测(百万美元)。

| 牛肉 |

| 羊肉 |

| 猪肉 |

| 家禽 |

| 其他类型 |

| 冷藏 |

| 冷冻 |

| 罐头/腌制 |

| 大型超市/超市 |

| 便利店 |

| 网上商店 |

| 其他分销渠道 |

| 印度 |

| 中国 |

| 日本 |

| 澳大利亚 |

| 亚太其他地区 |

| 按类型 | 牛肉 |

| 羊肉 | |

| 猪肉 | |

| 家禽 | |

| 其他类型 | |

| 按产品类型 | 冷藏 |

| 冷冻 | |

| 罐头/腌制 | |

| 按分销渠道 | 大型超市/超市 |

| 便利店 | |

| 网上商店 | |

| 其他分销渠道 | |

| 按国家/地区 | 印度 |

| 中国 | |

| 日本 | |

| 澳大利亚 | |

| 亚太其他地区 |

亚太地区加工肉类市场研究常见问题解答

目前亚太加工肉类市场规模有多大?

亚太加工肉类市场预计在预测期内(2024-2029年)复合年增长率为11.19%

谁是亚太加工肉类市场的主要参与者?

BRF S.A.、Foster Farms、Hormel Foods、Ajinomoto Co., Inc.、Cherkizovo Group 是亚太加工肉类市场的主要公司。

亚太加工肉类市场涵盖哪些年份?

该报告涵盖了亚太加工肉类市场历年市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了亚太地区加工肉类市场历年规模:2024年、2025年、2026年、2027年、2028年和 2029 年。

页面最后更新于:

亚太加工肉类行业报告

Mordor Intelligence™ 行业报告创建的 2024 年亚太加工肉类市场份额、规模和收入增长率统计数据。亚太加工肉类分析包括 2029 年市场预测展望和历史回顾。获取此行业分析的样本(免费下载 PDF 报告)。