High Fructose Corn Syrup (HFCS) Market Size

High Fructose Corn Syrup (HFCS) Market Analysis

The High-fructose Corn Syrup Market size is estimated at USD 9.46 billion in 2025, and is expected to reach USD 10.25 billion by 2030, at a CAGR of 1.62% during the forecast period (2025-2030).

The high fructose corn syrup industry continues to evolve amid changing consumer preferences and technological advancements. Leading high fructose corn syrup manufacturers are increasingly focusing on research and development initiatives to develop superior quality and cost-effective products. The industry has witnessed significant investments in advanced technologies for production optimization and quality enhancement, with companies like Japan Corn Starch Co. Ltd developing and obtaining patents for innovative products like "HFCS 70," specifically designed for soft drink applications. This emphasis on innovation reflects the industry's commitment to meeting evolving market demands while maintaining competitive pricing structures.

The shift toward convenience and processed food consumption has emerged as a significant trend shaping the HFCS market landscape. In Canada, various processed food categories have shown notable growth potential, with sweet biscuits, snack bars, and fruit snacks projected to grow by 19.8%, while spreads and edible oils segments are expected to grow by 15.8% and 13.8%, respectively. This trend is particularly pronounced in urban areas where busy lifestyles and increasing disposable incomes drive demand for ready-to-eat foods and beverages. The versatility of high fructose corn syrup in various applications, from beverages to baked goods, has made it an essential ingredient in the food processing industry.

The pharmaceutical and nutraceutical sectors represent growing application areas for HFCS, driven by its functional properties as a humectant and bulk sweetener. Companies like Roquette Frères are capitalizing on this trend by offering specialized products like HI-SWEET 55 High Fructose Syrup, specifically designed for pharmaceutical applications including syrups, suspensions, and liquids. The ingredient's ability to enhance stability, improve flavor, and provide consistent texture has made it particularly valuable in medicinal formulations and dietary supplements, leading to increased adoption across the healthcare sector.

Supply chain optimization and strategic partnerships have become crucial factors in the HFCS industry's development. Major industry players are establishing regional production facilities and forming strategic alliances to strengthen their market presence. For instance, Cargill and ARASCO's joint venture in Saudi Arabia, called Middle East for Food Solutions Co (MEFSCO), has significantly enhanced production capabilities to meet growing regional demand across confectionery, juice, bakery, and catering segments. These strategic initiatives demonstrate the industry's focus on improving operational efficiency and ensuring stable supply chains while maintaining competitive pricing structures in key markets.

High Fructose Corn Syrup (HFCS) Market Trends

Growing Demand for Convenience and Processed Foods

The increasing demand for convenience and processed food products, particularly sweet/sugar-based ready-to-eat foods, ready-to-drink beverages, snacks, and frozen meals, has emerged as a significant driver for the high fructose corn syrup production market. Rising urbanization, a growing middle-class population, an increasing number of working women, and rising disposable incomes have collectively fueled the consumption of processed and packaged foods, which in turn drives the demand for HFCS as a key ingredient. This trend has prompted food manufacturers to incorporate HFCS in various products due to its ability to enhance flavor profiles while maintaining product stability.

The versatility of HFCS in food applications has made it an indispensable ingredient in the food processing industry. Beyond its sweetening properties, HFCS serves multiple functional purposes: it helps maintain product freshness, lowers freezing points, retains moisture in bran cereals and breakfast bars, enhances fruit and spice flavors, promotes surface browning, and provides fermentability. These attributes have made HFCS particularly valuable in products like breads, cakes, cookies, and other baked goods, where it contributes to improved shelf life and optimal moisture binding compared to traditional sugar.

Cost-Effectiveness and Production Efficiency

The competitive pricing of HFCS compared to other sweetener categories has established it as a preferred choice among manufacturers, enabling them to reduce end-product costs while maintaining profit margins. This cost advantage has been further reinforced by significant investments in production infrastructure. For instance, in August 2022, Cargill made a substantial investment of USD 50 million to construct a corn syrup manufacturers refinery in Fort Dodge, Iowa, demonstrating the industry's commitment to meeting growing demand through efficient production methods. Similarly, Ingredion's USD 30 million investment in its San Juan del Rio manufacturing facility in Mexico exemplifies the industry's focus on expanding production capabilities.

The manufacturing process of HFCS has proven to be more manageable and cost-effective compared to traditional table sugar production, making it an economically viable option for large-scale food and beverage manufacturing. Government support, particularly in major producing countries through corn subsidies and favorable import-export policies, has further enhanced the cost-effectiveness of HFCS production. The U.S. Food and Drug Administration's designation of HFCS as a safe ingredient for food and beverage manufacturing has also contributed to its widespread adoption, while the European Starch Industry Association's recognition of significant sweetener production from corn starches has reinforced its position as a cost-effective sweetening solution.

Versatile Applications and Enhanced Product Functionality

The extensive range of applications for HFCS across various industries has significantly driven its market growth. In the beverage sector, HFCS demonstrates superior solubility and the ability to remain in solution, making it particularly valuable for manufacturers of soft drinks, fruit drinks, and other sweetened beverages. The availability of different HFCS variants, such as HFCS 42, HFCS 55, and HFCS 90, allows manufacturers to choose the most suitable option for their specific applications, whether in beverages, processed foods, cereals, baked goods, or filling jellies.

The functional benefits of HFCS extend beyond simple sweetening, providing manufacturers with multiple advantages in a single ingredient. For instance, in baked goods, HFCS contributes to optimal moisture retention and surface browning, while in frozen products, it helps prevent crystallization and maintains product quality. The ingredient's ability to enhance fruit and spice flavors, improve texture, and provide consistent quality in various food applications has made it an essential component in modern food processing. These functional attributes, combined with its stability and preservation properties, have established HFCS as a versatile ingredient that meets both technical and commercial requirements across the food and beverage industry. The high fructose corn syrup price remains competitive, ensuring its continued use in diverse applications.

Segment Analysis: By Application

Food and Beverage Segment in High-Fructose Corn Syrup Market

The Food and Beverage segment dominates the global high-fructose corn syrup market, accounting for approximately 79% of the total market share in 2024. This segment's prominence is primarily driven by the extensive use of HFCS in various food and beverage applications, including bakery products, confectionery items, dairy products, and beverages. The beverage industry, in particular, represents a significant portion of this segment, as HFCS serves as a crucial sweetening agent in soft drinks, carbonated beverages, and fruit drinks. The ingredient's versatility in food applications is attributed to its ability to enhance flavor, maintain moisture in baked goods, improve texture, and extend shelf life, making it an indispensable component in food processing.

Animal Feed Segment in High-Fructose Corn Syrup Market

The Animal Feed segment is emerging as the fastest-growing segment in the corn sweetener market, projected to expand at approximately 2% CAGR from 2024 to 2029. This growth is primarily driven by the increasing adoption of HFCS in various animal feed applications, particularly in dairy cow feed, where it has shown potential to enhance meat and milk production quality. The segment's growth is further supported by HFCS's advantages as a cost-effective alternative sweetener that maintains binding effects while improving palatability and aroma in animal feed. Additionally, its incorporation in mash feeds and its aflatoxin-free nature make it an attractive option for livestock farmers looking to optimize feed efficiency and animal performance.

Remaining Segments in High-Fructose Corn Syrup Market by Application

The Pharmaceuticals segment plays a vital role in the glucose fructose market, serving as a crucial ingredient in various medicinal formulations. In the pharmaceutical industry, HFCS is valued for its functionality as a humectant and bulk sweetener, particularly in oral dosage forms. The ingredient's ability to mask active medical ingredient flavors without compromising product effectiveness makes it especially valuable in children-specific OTC products. The pharmaceutical applications of HFCS continue to evolve as manufacturers explore new formulations and delivery systems that capitalize on its unique properties.

High-fructose Corn Syrup (HFCS) Market Geography Segment Analysis

High-Fructose Corn Syrup Market in North America

North America represents the dominant region in the global high-fructose corn syrup market, with extensive production and consumption across the United States, Canada, and Mexico. The region's market is characterized by well-established food and beverage industries, particularly in the soft drinks and processed foods sectors. The presence of major manufacturers and favorable corn subsidies in certain countries has helped maintain the region's leading position. The market is influenced by changing consumer preferences, increasing health consciousness, and regulatory policies regarding sweetener usage in food products.

High-Fructose Corn Syrup Market in the United States

The United States dominates the North American high-fructose corn syrup market, holding approximately 74% of the regional market share in 2024. The country's leadership position is supported by its extensive corn production capabilities and established corn processing infrastructure. The food and beverage industry, particularly the soft drink manufacturing sector, remains the primary consumer of HFCS. The market is characterized by the presence of major manufacturers who have invested significantly in production facilities and distribution networks. The country's competitive pricing structure and efficient supply chain management continue to support market growth, despite increasing consumer awareness about health implications.

High-Fructose Corn Syrup Market in Canada

Canada emerges as the fastest-growing market in North America, with a projected growth rate of approximately 3% during 2024-2029. The growth is driven by increasing demand from the food processing industry and expanding applications in various sectors. The country's market is characterized by strong regulatory frameworks and quality standards for food ingredients. Canadian manufacturers are increasingly focusing on product innovations and quality improvements to meet evolving consumer preferences. The market is also benefiting from the country's robust distribution networks and growing export opportunities to neighboring countries.

High-Fructose Corn Syrup Market in Europe

The European high-fructose corn syrup market demonstrates a diverse landscape across multiple countries including the United Kingdom, Germany, France, Russia, Italy, and Spain. The market is characterized by stringent regulations regarding sweetener usage and production quotas specific to the European Union. The region's food and beverage industry continues to be the primary consumer of HFCS, with varying adoption rates across different countries. Market dynamics are influenced by changing consumer preferences, health consciousness, and the strong presence of alternative sweeteners. The European HFCS market is adapting to these changes, with manufacturers exploring innovative solutions to align with consumer demands.

High-Fructose Corn Syrup Market in France

France leads the European high-fructose corn syrup market, commanding approximately 12% of the regional market share in 2024. The country's dominant position is supported by its strong food and beverage industry, particularly in the alcoholic beverage and baking sectors. French manufacturers have established sophisticated production processes and quality control measures, ensuring consistent product quality. The market benefits from well-developed distribution networks and strong relationships between suppliers and end-users. The country's food processing industry continues to be a major driver for HFCS consumption.

High-Fructose Corn Syrup Market in Russia

Russia demonstrates the highest growth potential in the European market, with a projected growth rate of approximately 3% during 2024-2029. The country's market is experiencing significant development in its food processing sector, driving increased demand for HFCS. Russian manufacturers are investing in modern production facilities and expanding their product portfolios to meet growing domestic demand. The market is benefiting from improving distribution infrastructure and increasing adoption of HFCS in various food and beverage applications. The country's expanding retail sector and changing consumer preferences are creating new opportunities for market growth.

High-Fructose Corn Syrup Market in Asia-Pacific

The Asia-Pacific region represents a significant market for high-fructose corn syrup, encompassing diverse markets including India, China, Japan, and Australia. The region's market is characterized by rapid industrialization, expanding food and beverage sectors, and increasing adoption of Western dietary patterns. Each country presents unique market dynamics, influenced by local food preferences, regulatory environments, and economic conditions. The market is driven by the growing processed food industry and increasing urbanization across the region.

High-Fructose Corn Syrup Market in China

China dominates the Asia-Pacific high-fructose corn syrup market, supported by its large food processing industry and extensive manufacturing capabilities. The country's market benefits from strong domestic corn production and well-established processing infrastructure. Chinese manufacturers have been investing in technological advancements and capacity expansion to meet growing demand. The market is characterized by strong integration between corn processors and end-user industries, creating efficient supply chains. The country's large population and growing consumption of processed foods continue to drive market growth.

High-Fructose Corn Syrup Market in India

India emerges as the fastest-growing market in the Asia-Pacific region, driven by rapid urbanization and an expanding food processing industry. The country's market is experiencing significant developments in terms of production capabilities and distribution networks. Indian manufacturers are increasingly adopting modern technologies and quality standards to meet international requirements. The market is benefiting from growing domestic demand and increasing investments in food processing infrastructure. The country's evolving retail landscape and changing consumer preferences are creating new opportunities for market expansion. Notably, corn syrup manufacturers in India are focusing on enhancing production efficiency to cater to the rising demand for high-fructose corn syrup foods in India.

High-Fructose Corn Syrup Market in South America

The South American high-fructose corn syrup market, primarily represented by Brazil and Argentina, shows distinct characteristics influenced by regional agricultural policies and sugar production capabilities. Brazil emerges as the largest market in the region, while Argentina demonstrates the fastest growth potential. The market is characterized by strong competition from traditional sugar production, which has historically dominated the sweetener market in the region. The adoption of HFCS is gradually increasing, driven by the expanding processed food and beverage industry, particularly in urban areas.

High-Fructose Corn Syrup Market in Middle East & Africa

The Middle East & Africa market for high-fructose corn syrup, encompassing countries like South Africa and Saudi Arabia, presents unique opportunities and challenges. Saudi Arabia represents the largest market in the region, while South Africa shows the fastest growth potential. The market is characterized by increasing investments in food processing infrastructure and growing demand for processed foods and beverages. Regional dynamics are influenced by varying levels of economic development, dietary preferences, and regulatory frameworks across different countries. The presence of corn syrup in South Africa highlights the region's potential for further market expansion.

High Fructose Corn Syrup (HFCS) Industry Overview

Top Companies in High-Fructose Corn Syrup Market

The high-fructose corn syrup market features prominent players like Cargill Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, and Tate & Lyle PLC leading the industry through various strategic initiatives. These corn syrup manufacturers are increasingly focusing on research and development to introduce innovative product formulations that cater to evolving consumer preferences and application requirements. Operational excellence is being achieved through the modernization of manufacturing facilities and the implementation of advanced processing technologies. Strategic partnerships and joint ventures, particularly in emerging markets, have become a key trend to expand geographical presence and strengthen distribution networks. Market leaders are also investing in capacity expansion projects, especially in regions like Asia-Pacific and the Middle East, to meet the growing demand and establish stronger regional footprints.

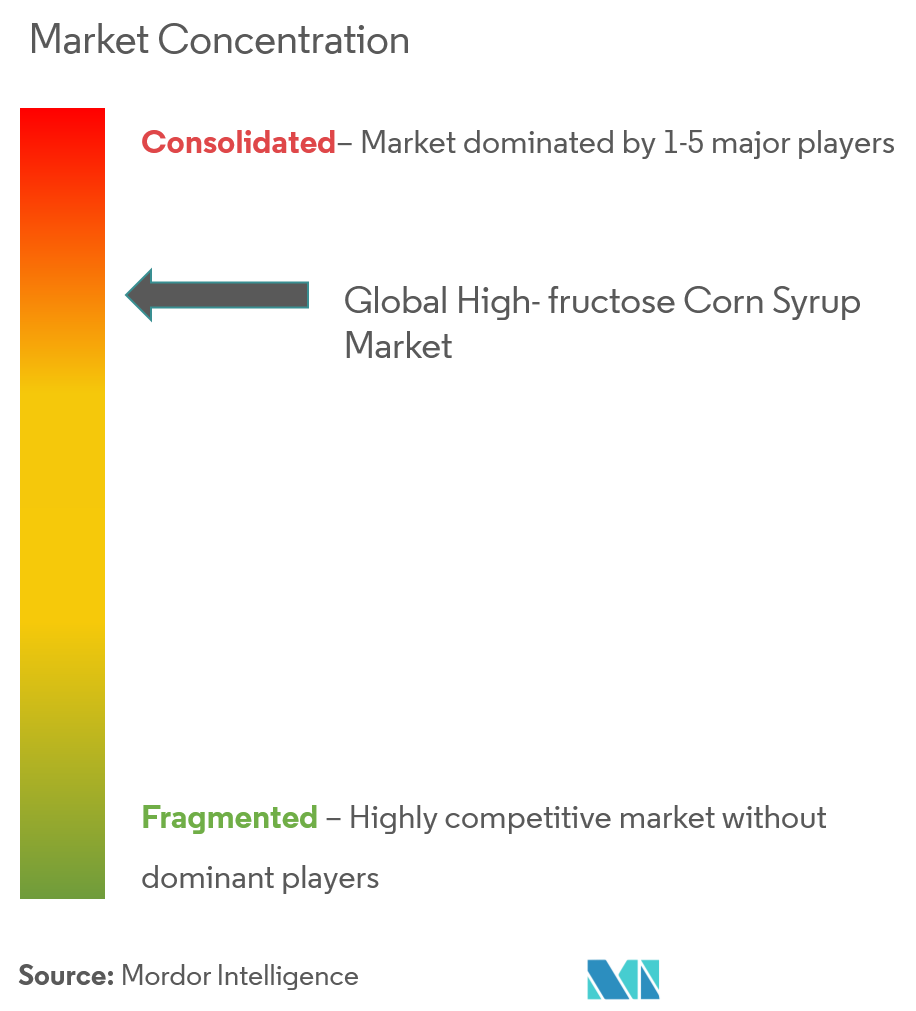

Consolidated Market with Strong Regional Players

The high-fructose corn syrup market exhibits a relatively consolidated structure dominated by large multinational corporations with integrated supply chains, though regional players maintain a significant presence in their respective territories. These major corn syrup producers benefit from their extensive manufacturing capabilities, established distribution networks, and strong relationships with food and beverage manufacturers. The market is characterized by high entry barriers due to the capital-intensive nature of operations, regulatory requirements, and the need for specialized technical expertise. Mergers and acquisitions have been instrumental in helping companies expand their product portfolios, access new markets, and achieve economies of scale.

The competitive dynamics vary significantly across regions, with North American and European markets being more consolidated compared to the relatively fragmented Asian market. Local players in emerging markets are increasingly forming strategic alliances with global leaders to enhance their technological capabilities and market reach. The industry has witnessed several strategic investments in corn processing facilities and distribution infrastructure, particularly in developing economies where demand growth is robust. Companies are also focusing on backward integration to secure raw material supplies and maintain cost competitiveness.

Innovation and Sustainability Drive Future Growth

Success in the high-fructose corn syrup market increasingly depends on companies' ability to innovate while maintaining cost efficiency and ensuring sustainable operations. Market leaders are investing in research and development to develop new product variants that meet specific application requirements and align with clean label trends. Building strong relationships with food and beverage manufacturers through customized solutions and technical support has become crucial for maintaining market position. Companies are also focusing on sustainable sourcing practices and environmental stewardship to address growing consumer concerns and regulatory requirements.

For new entrants and smaller players, specialization in specific applications or regional markets offers opportunities for growth. Success factors include developing efficient production processes, establishing strong local distribution networks, and maintaining high-quality standards. The increasing concentration of buying power among large food and beverage manufacturers necessitates strong customer relationship management and reliable supply capabilities. Regulatory compliance, particularly regarding food safety and labeling requirements, remains a critical factor for all market participants. Companies must also address the growing competition from alternative sweeteners by highlighting the functional benefits and cost advantages of high-fructose corn syrup companies.

High Fructose Corn Syrup (HFCS) Market Leaders

-

Cargill, Incorporated

-

Ingredion Incorporated

-

Tate & Lyle PLC

-

Global Sweeteners Holdings Limited

-

Archer Daniels Midland Company

- *Disclaimer: Major Players sorted in no particular order

High Fructose Corn Syrup (HFCS) Market News

September 2022: Ingredion established a sustainable state-of-the-art starch manufacturing plant in China. With this new plant for specialty starches, Ingredion advances sustainable production and improves supply to the global F&B supply chain while supporting local farmers.

August 2022: Cargill spent around USD 50 million to build a corn syrup refinery in Fort Dodge, Iowa, which expanded the company's ability to meet the growing demand for the ingredient more sustainably.

July 2021: As the demand for reduced-sugar products grew, Cargill invested USD 45 million (EUR 38 million) to add soluble fibers to its European portfolio of starches, sweeteners, and texturizers.

High Fructose Corn Syrup (HFCS) Industry Segmentation

High-fructose corn syrup is a sweetener made from corn flour. Some of its glucose is converted to fructose, used in commercially produced foods and soft drinks as a cheaper alternative to sucrose.

The high-fructose corn syrup market is segmented by application and by geography. By application is segmented into food and beverage, pharmaceuticals, and animal feed. The food and beverage segment is further bifurcated into bakery, confectionery, dairy and desserts, beverages, and other food and beverage applications. Also, the study analyzes the HFCS market in emerging and established markets across the world, including North America, Europe, Asia-Pacific, South America, and Middle-East & Africa.

For each segment, the market sizing and forecasts have been done based on value (in USD million).

| By Application | Food and Beverages | Bakery | |

| Confectionery | |||

| Dairy and Desserts | |||

| Beverages | |||

| Other Food and Beverages Applications | |||

| Pharmaceuticals | |||

| Animal Feed | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Russia | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | India | ||

| China | |||

| Japan | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle-East and Africa | South Africa | ||

| Saudi Arabia | |||

| Rest of Middle-East and Africa | |||

| Food and Beverages | Bakery |

| Confectionery | |

| Dairy and Desserts | |

| Beverages | |

| Other Food and Beverages Applications | |

| Pharmaceuticals | |

| Animal Feed |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Russia | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia-Pacific | India |

| China | |

| Japan | |

| Australia | |

| Rest of Asia-Pacific | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle-East and Africa | South Africa |

| Saudi Arabia | |

| Rest of Middle-East and Africa |

High Fructose Corn Syrup (HFCS) Market Research FAQs

How big is the High-fructose Corn Syrup (HFCS) Market?

The High-fructose Corn Syrup (HFCS) Market size is expected to reach USD 9.46 billion in 2025 and grow at a CAGR of 1.62% to reach USD 10.25 billion by 2030.

What is the current High-fructose Corn Syrup (HFCS) Market size?

In 2025, the High-fructose Corn Syrup (HFCS) Market size is expected to reach USD 9.46 billion.

Who are the key players in High-fructose Corn Syrup (HFCS) Market?

Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Global Sweeteners Holdings Limited and Archer Daniels Midland Company are the major companies operating in the High-fructose Corn Syrup (HFCS) Market.

Which is the fastest growing region in High-fructose Corn Syrup (HFCS) Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in High-fructose Corn Syrup (HFCS) Market?

In 2025, the North America accounts for the largest market share in High-fructose Corn Syrup (HFCS) Market.

What years does this High-fructose Corn Syrup (HFCS) Market cover, and what was the market size in 2024?

In 2024, the High-fructose Corn Syrup (HFCS) Market size was estimated at USD 9.31 billion. The report covers the High-fructose Corn Syrup (HFCS) Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the High-fructose Corn Syrup (HFCS) Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.