Biomedical Sensors Market Analysis

The Biomedical Sensors Market is expected to register a CAGR of 6% during the forecast period.

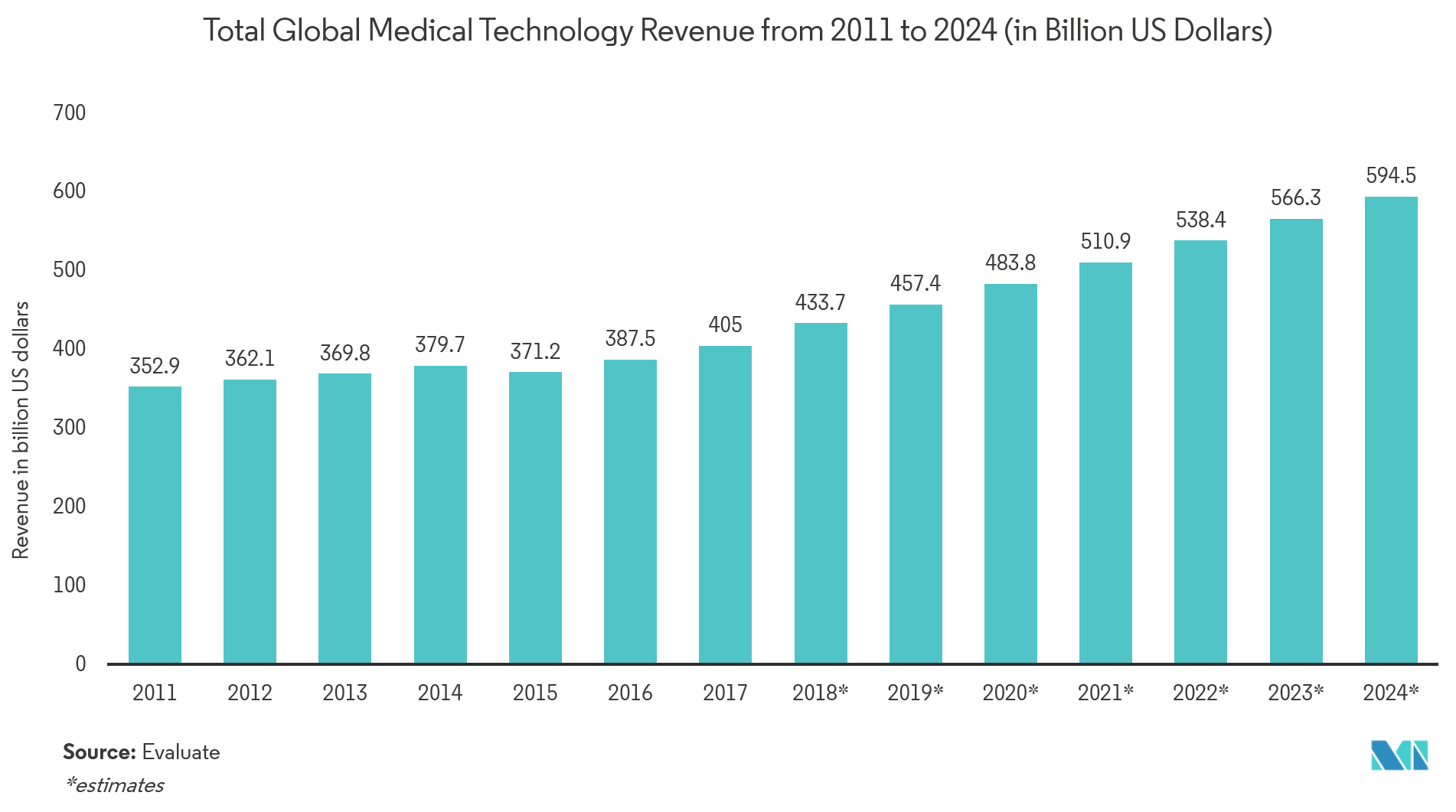

- Increased demand for patient monitoring applications, technological innovations in MEMS enabling the design of low-cost, high-performance sensors, that can be easily integrated into other applications is some of the key drivers for the growth of the market. Further, the increased incidence of lifestyle based diseases, a growing proportion of the aging population and new forms of diseases have also played a significant role in market growth for biomedical sensors globally.

- Emerging applications for biomedical sensors in the field of nanotechnology and continual innovations leading to the development of innovative non-invasive sensor-based medical applications will open up several growth opportunities in this market. However, security concerns related to the use of biomedical sensors, long product development cycles and stringent regulatory procedures required for operating in the medical sector remain major challenges impeding growth in the overall market.

- Even though biomedical sensors are playing a major role in life-saving situations, the market faces certain challenges such as patient's safety and comfort due to strong electromagnetic fields, transferring energy from external to internal parts with high efficiency and high data rates, limited computation and data storage, and ultra-low power consumption.

Biomedical Sensors Market Trends

Healthcare Industry Holds a Substantial Share of Biomedical Sensors Market

- Recently, many healthcare researchers are increasingly focusing on early detection and prevention of illnesses. Infectious diseases are becoming the leading cause of death, especially for people in developing countries, and early detection and accurate diagnosis of these diseases is turning out to be a vital factor driving the market for biomedical sensors.

- Accelerometers are used for measuring heart rate, blood pressure, and levels of glucose and oxygen in the blood. These sensors have major applications in devices such as defibrillators and pacemakers. Hence, the growing awareness concerning healthcare has increased the need for sensor technologies and monitoring devices that are able to sense and provide feedback to the users about the health status for increased safety.

- Medical sensors in healthcare have the capability to bring about a revolution concerning the way a disease is cured or prevented. Advances in engineering, technology, and material sciences have given away for highly sophisticated sensors that can be used in medical research. These kinds of sensors open doors for innovation and may someday lead to thought-controlled prosthetics and other personal assistive devices for people with paralysis, amputated limbs and other movement impairments driving the market.

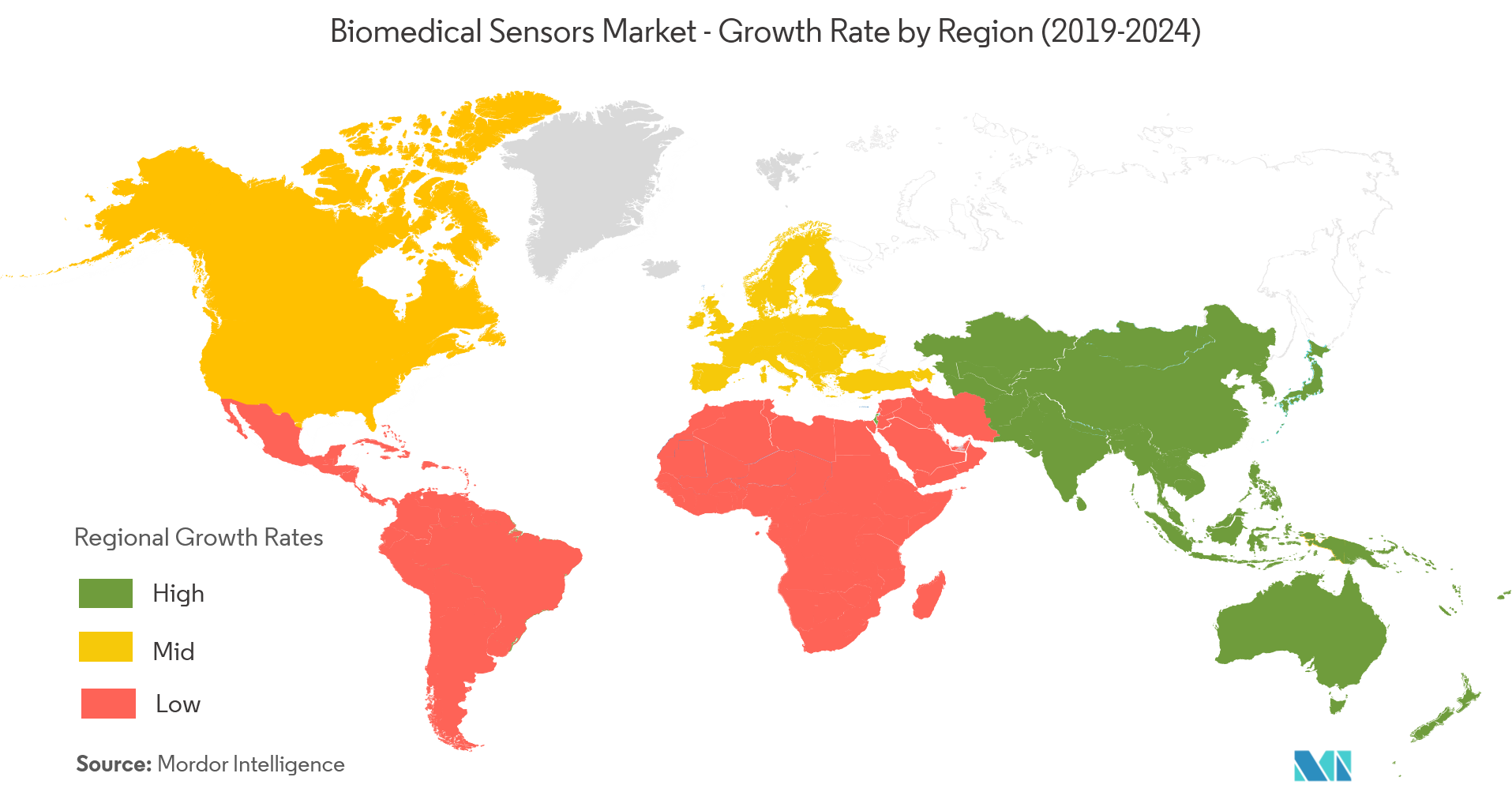

North America Dominates the Global Biosensor Market

- North America is the chief revenue contributor for the biomedical sensor market and is estimated to grow rapidly, owing to the big number of vendors of medical sensors. The chief driving factors for the growth in this market are quickly ageing population and growth of the home healthcare market in North America.

- The Americas ruled the global market in 2018, which is credited to the availability of advanced health care infrastructure in the region and the extraordinary consumption of medical devices. There is a huge scope for expansion of innovative healthcare products due to the convergence of sensors, digital apps, and wireless technologies, demonstrated by the rising number of smartphone and tablet users.

- A large number of businesses are spending in research in these products and augmented funding from government agencies is probably to result in the launch of advanced and innovative biomedical sensors like wearable and implantable sensors in the biomedical sensor market in the future in North America. Also, the growing rate of smartphone usage is powering the market growth in the North America region and the U.S. is ruling the market.

Biomedical Sensors Industry Overview

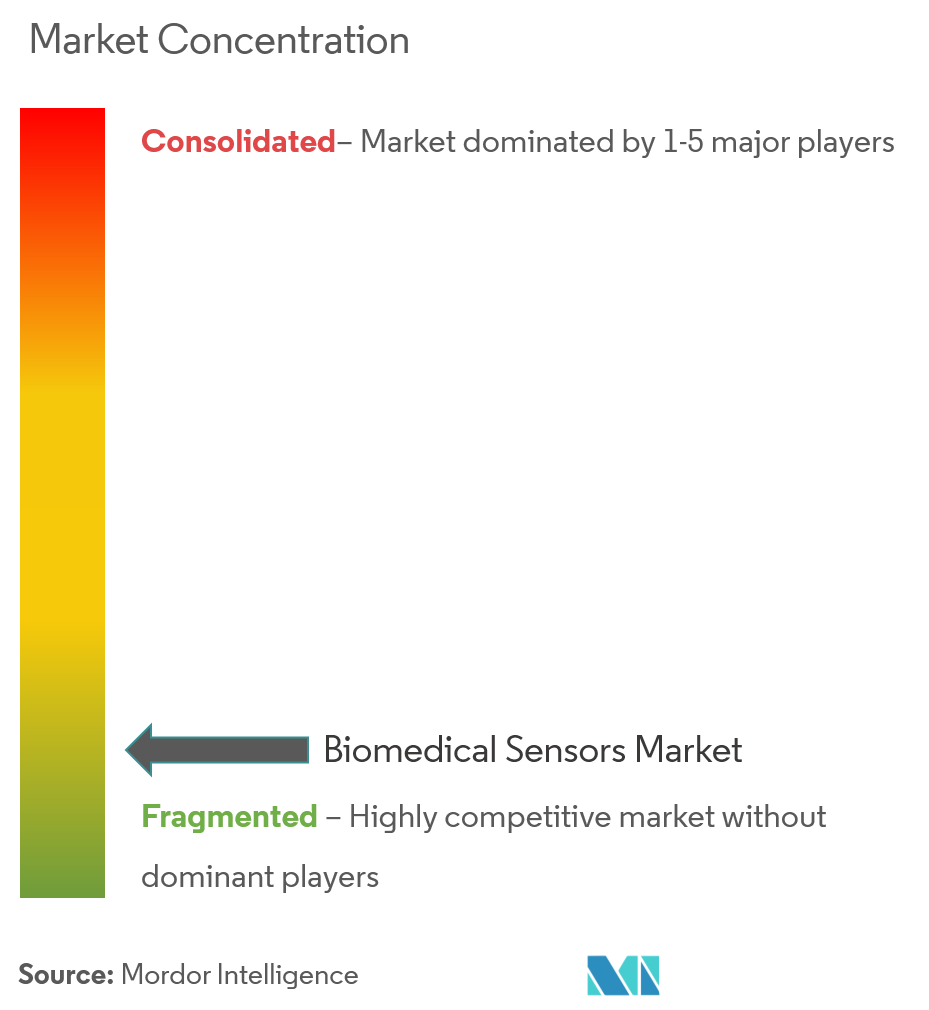

The biomedical sensors market ishighly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. Rising disposable income, rising awareness about devices with sensors and growingcustomer base across the world have led to vast growth opportunities for players in this market. These players are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability.

- February 2019 -Texas Instruments (TI) announced today new bulk acoustic wave (BAW)-based embedded processing and analogue chips for the next generation of connectivity and communications infrastructure. The first two devices developed with TI BAW technology, the SimpleLinkCC2652RB wireless microcontroller (MCU) and the LMK05318 network synchronizer clock will help system designers streamline design logistics for faster time to market, while enabling stable, simplified and high-performance data delivery, which in return, allows for potential overall development and system cost savings.

Biomedical Sensors Market Leaders

-

Analog Devices, Inc.

-

Honeywell International Inc.

-

Stmicroelectronics N.V.

-

GE Healthcare

-

NXP Semiconductor N.V.

- *Disclaimer: Major Players sorted in no particular order

Biomedical Sensors Industry Segmentation

Biomedical sensors are sensors that identify medically relevant parameters, these could array from simple physical parameters like blood pressure or temperature to analyses for which biosensors are appropriate (e.g., blood glucose).

| By Type | Wired | ||

| Wireless | |||

| By Sensor Type | Temperature | ||

| Pressure | |||

| Image Sensors | |||

| Biochemical | |||

| Inertial Sensors | |||

| Motion Sensors | |||

| Electrocardiogram (ECG) | |||

| Other Sensor Types | |||

| By Industry | Pharmaceutical | ||

| Healthcare | |||

| Other Industry Types | |||

| Geography | North America | US | |

| Canada | |||

| Europe | UK | ||

| Germany | |||

| France | |||

| Rest of Europe | |||

| Asia Pacific | China | ||

| India | |||

| Japan | |||

| Rest of Asia-Pacific | |||

| Latin America | Brazil | ||

| Argentina | |||

| Mexico | |||

| Rest of Latin America | |||

| Middle East & Africa | UAE | ||

| Saudi Arabia | |||

| Israel | |||

| Rest of Middle East & Africa | |||

| Wired |

| Wireless |

| Temperature |

| Pressure |

| Image Sensors |

| Biochemical |

| Inertial Sensors |

| Motion Sensors |

| Electrocardiogram (ECG) |

| Other Sensor Types |

| Pharmaceutical |

| Healthcare |

| Other Industry Types |

| North America | US |

| Canada | |

| Europe | UK |

| Germany | |

| France | |

| Rest of Europe | |

| Asia Pacific | China |

| India | |

| Japan | |

| Rest of Asia-Pacific | |

| Latin America | Brazil |

| Argentina | |

| Mexico | |

| Rest of Latin America | |

| Middle East & Africa | UAE |

| Saudi Arabia | |

| Israel | |

| Rest of Middle East & Africa |

Biomedical Sensors Market Research FAQs

What is the current Biomedical Sensors Market size?

The Biomedical Sensors Market is projected to register a CAGR of 6% during the forecast period (2025-2030)

Who are the key players in Biomedical Sensors Market?

Analog Devices, Inc., Honeywell International Inc., Stmicroelectronics N.V., GE Healthcare and NXP Semiconductor N.V. are the major companies operating in the Biomedical Sensors Market.

Which is the fastest growing region in Biomedical Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Biomedical Sensors Market?

In 2025, the North America accounts for the largest market share in Biomedical Sensors Market.

What years does this Biomedical Sensors Market cover?

The report covers the Biomedical Sensors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Biomedical Sensors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on: June 18, 2025

Biomedical Sensors Industry Report

Statistics for the 2025 Biomedical Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Biomedical Sensors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.