欧洲能量棒市场分析

欧洲能量棒市场预计在预测期内(2020-2025 年)复合年增长率为 4.8%。

- 对有机零食、放纵零食、代餐、随身零食的需求不断增长,是推动能量棒市场增长的各种因素。消费者在两餐之间吃东西时越来越注重健康。

- 具有健康益处、便利性和营养成分的特点,而随身携带的零食则推动了营养棒市场的发展。消费者正在寻找清洁标签和不含任何成分的产品,越来越多的公司发布新产品,使消费者对清洁标签产品的兴趣与日俱增。

欧洲能量棒市场趋势

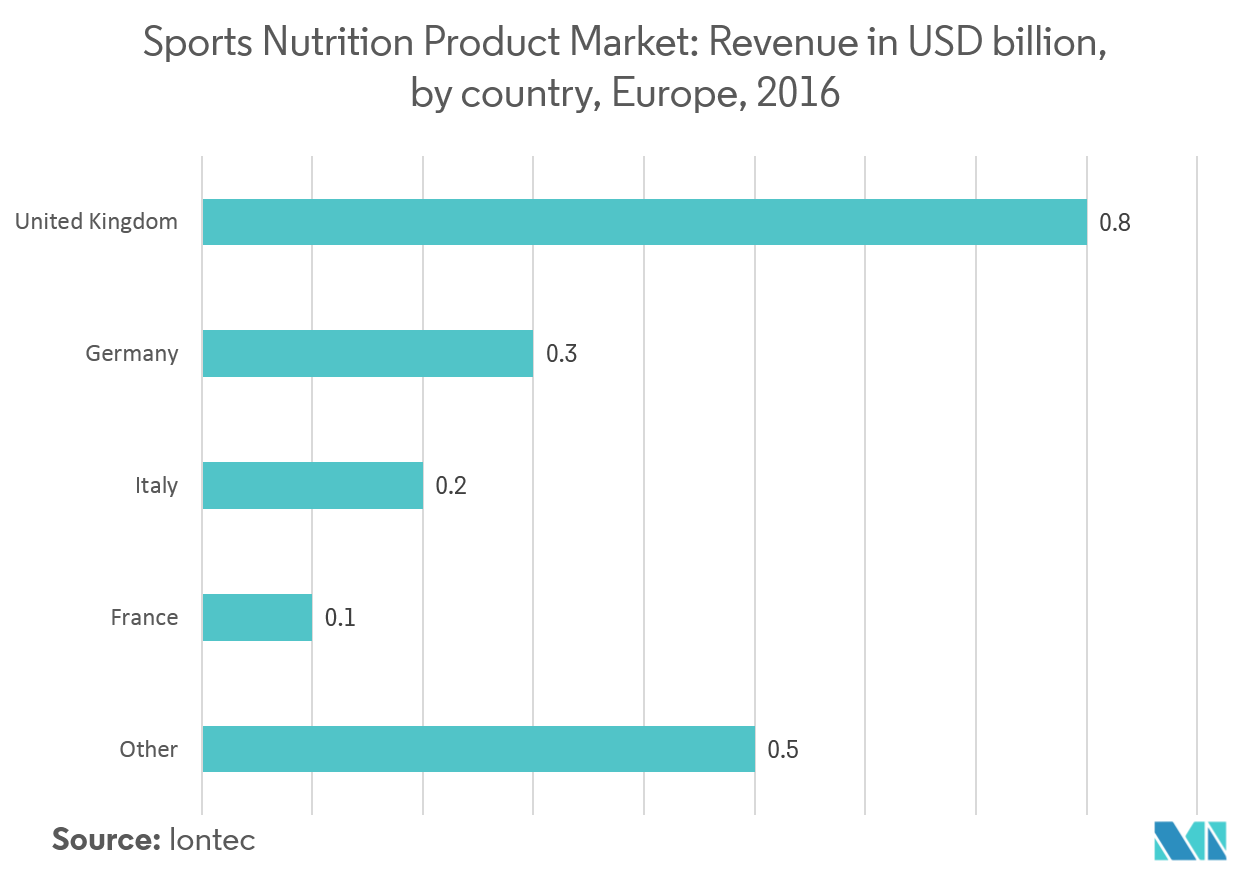

英国主导市场

随着人们健康意识的增强以及去健身中心和健身房的锻炼,英国对能量棒的需求不断增加。健美运动员和运动员是运动营养产品的主要消费者。运动爱好者越来越多地使用运动营养产品刺激了市场需求,这可能为零食棒制造商创造新的市场机会。

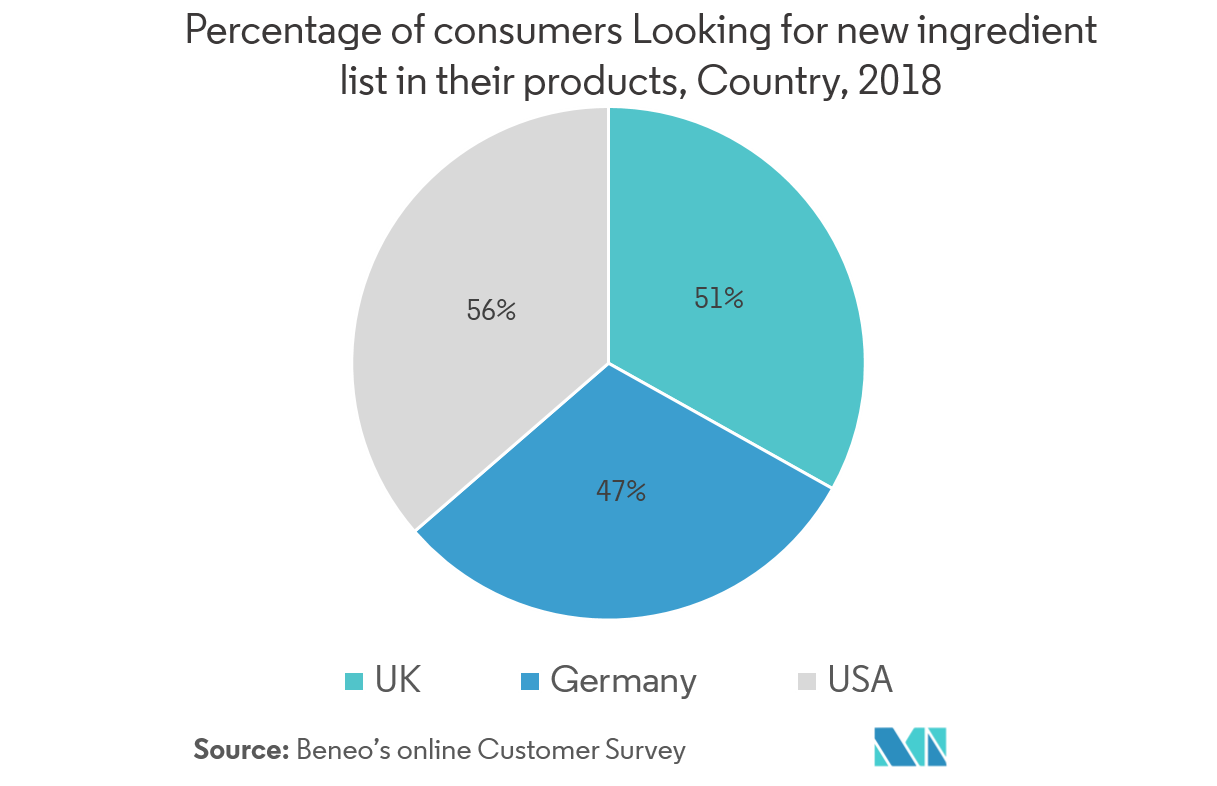

清洁标签能量棒的增长趋势

清洁标签和不含成分的产品在欧洲处于领先地位,欧洲能量棒市场的增长速度更快。为了满足消费者对透明度、健康定位产品和标签的需求,许多欧洲公司正在按照清洁标签要求重建其能量棒,从而使许多常用成分变得遥不可及。更多公司通过使用替代蛋白质来源、改变风味特征以及依靠具有前瞻性思维的原料供应商来满足这一趋势,从而推出创新产品。为了与这种清洁标签趋势保持一致,英国公司 Mule bar 将其营养棒描述为真实、可识别且天然,而 Natural Balance Foods 公司强调其能量棒含有 5 种成分,而传统能量棒通常含有 30 种成分。

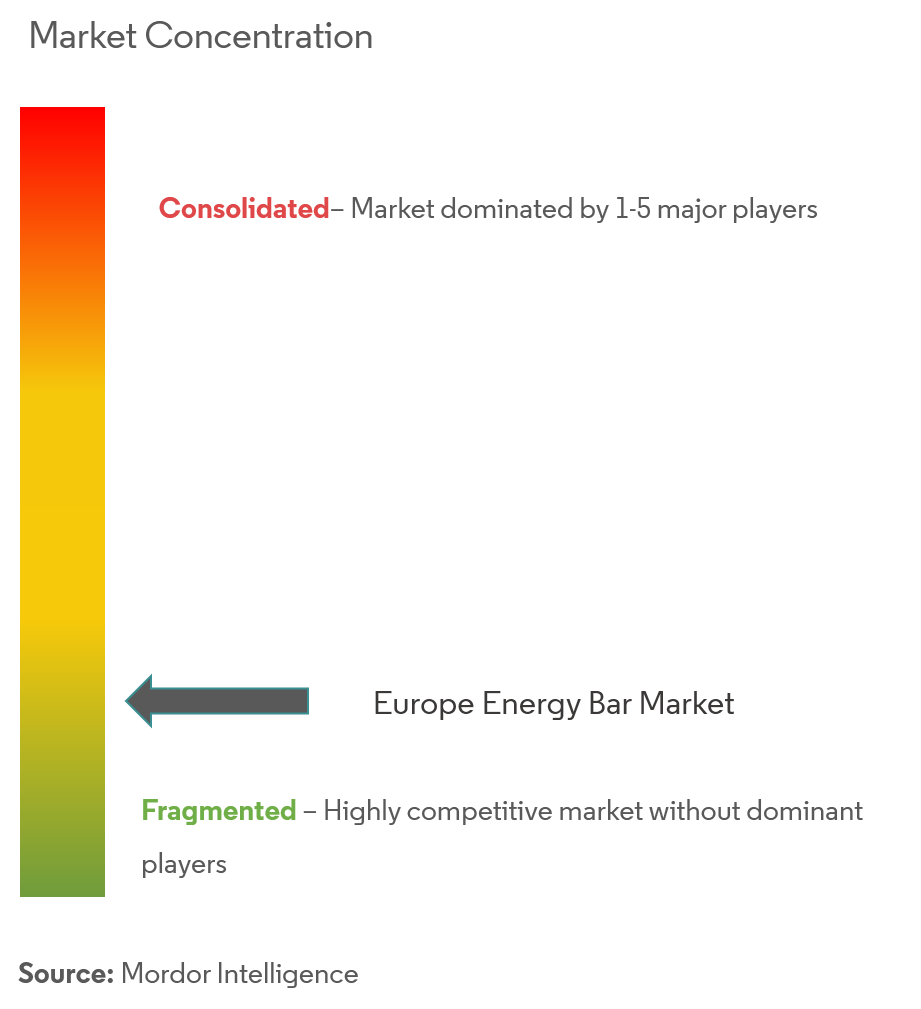

欧洲能量棒行业概况

欧洲能量棒市场分散,参与者众多。主要参与者包括 General Mills Inc、The Kellogg Company、QuestNutrition LLC、Probar LLC、Clif Bar and Company 等。公司不断推出新产品以满足消费者的需求。例如,2016年,MioBio公司在欧洲市场推出了Superheraw能量棒,这是一种高品质的生态产品,不含人工香料、添加糖或添加剂。随着需求的增加,该产品在整个欧洲表现良好。该产品的创新包装设计于2017年荣获著名设计奖红点传播设计奖。

。

欧洲能量棒市场领导者

General Mills Inc

The Kellogg Company

QuestNutrition LLC

Probar LLC

Clif Bar & Company

- *免责声明:主要玩家排序不分先后

欧洲能量棒行业细分

欧洲能量棒市场按分销渠道细分,包括超市/大卖场、便利店、专卖店、在线零售店和其他分销渠道。该研究还涉及对西班牙、英国、德国、法国、意大利、俄罗斯和欧洲其他地区等地区的分析。

| 超市/大卖场 |

| 便利店 |

| 专卖店 |

| 网上零售店 |

| 其他分销渠道 |

| 欧洲 | 西班牙 |

| 英国 | |

| 德国 | |

| 法国 | |

| 意大利 | |

| 俄罗斯 | |

| 欧洲其他地区 |

| 按分销渠道 | 超市/大卖场 | |

| 便利店 | ||

| 专卖店 | ||

| 网上零售店 | ||

| 其他分销渠道 | ||

| 地理 | 欧洲 | 西班牙 |

| 英国 | ||

| 德国 | ||

| 法国 | ||

| 意大利 | ||

| 俄罗斯 | ||

| 欧洲其他地区 | ||

欧洲能量棒市场研究常见问题解答

目前欧洲能量棒市场规模有多大?

欧洲能量棒市场预计在预测期内(2024-2029)复合年增长率为 4.80%

谁是欧洲能量棒市场的主要参与者?

General Mills Inc、The Kellogg Company、QuestNutrition LLC、Probar LLC、Clif Bar & Company 是欧洲能量棒市场运营的主要公司。

欧洲能量棒市场涵盖哪些年份?

该报告涵盖了欧洲能量棒市场历年市场规模:2019年、2020年、2021年、2022年和2023年。该报告还预测了欧洲能量棒市场历年规模:2024年、2025年、2026年、2027年、2028年和2029年。

页面最后更新于:

欧洲能量棒行业报告

Mordor Intelligence™ 行业报告创建的 2024 年欧洲能量棒市场份额、规模和收入增长率统计数据。欧洲能量棒分析包括 2029 年的市场预测展望和历史概述。获取此行业分析的样本(免费下载 PDF 报告)。