Norway Oil And Gas Upstream Market Analysis by Mordor Intelligence

The Norway Oil and Gas Upstream Market is expected to register a CAGR of greater than 1% during the forecast period.

- The development of new oilfields is likely to drive the market over the forecast period.

- The discovery of new small oilfields is likely to provide an opportunity for the upstream oil and gas companies operating in Norway in the near future.

- The availability of oil reserves and increasing investment in the upstream sector are likely to drive the market over the forecast period.

Norway Oil And Gas Upstream Market Trends and Insights

Development of New Oilfields to Drive the Market

- Norway is one of the largest oil producers and exporters in the European region. In 2019, the country's crude oil production was 1437 thousand barrels per day, which accounted for about 47.9% of Europe's total crude oil production. The average offshore rig count was 16 in 2020.

- The major oilfields in the country are reaching their maturity, and, as a result, since 2016, the oil production of Norway has declined significantly. However, in January 2021, about 30 companies have received offers of ownership interests in a total of 61 production licenses (34 are in the North Sea, 24 are in the Norwegian Sea, and three are in the Barents Sea) on the Norwegian shelf in the Awards in Predefined Areas (APA) 2020. Hence, with the award of 61 new production licenses, the upstream segment is likely to make more profitable discoveries on the Norwegian shelf during the forecast period.

- Moreover, Johan Sverdrup oilfield, the third-largest oil field on the Norwegian continental shelf, operated by Equinor, announced its plan to increase its daily production capacity up to 535,000 barrels of oil by mid-2021. Also, with expected resources of 2.7 billion barrels of oil, the field is one of the most important industrial projects in Norway for the next 50 years. Phase 1 of the field was opened in October 2019, and phase 2 is scheduled to begin production in the Q4 of 2022.

- Some of the major fields that are expected to come on stream during the forecast period are the Johan Sverdrup oilfield, Martin Linge, and Johan Castberg. Therefore, new upcoming discoveries of oil fields and expansion of existing oil fields are likely to reverse the trend and register significant growth in the market over the forecast period.

Availability of Oil Reserves to Drive the Market

- Norway holds the largest share in terms of total oil reserves among the European countries. According to the Norwegian Petroleum Directorate, there are around 8 billion standard cubic meters of oil equivalent (Sm3 o.e.) of resources (oil and gas) remaining on the Norwegian continental shelf (NCS), of which 52% (4.2 billion Sm3 o.e.) of resources are proven, as of February 2021. The production on the Norwegian shelf in 2020 was 229 million Sm3 o.e.

- Around 43% of the remaining resources are concentrated in the North Sea. The distribution of the rest indicates that 38% are in the Barents Sea and 19% are in the Norwegian Sea. In the Barents Sea, large parts of the remaining planned resources are not confirmed. At the end of 2020, there were 67 producing fields in the North Sea, 20 producing fields in the Norwegian Sea, and two producing fields in the Barents Sea.

- As of December 2020, the estimated total unproven resources were 665 million Sm3 o.e., 665 million Sm3 o.e., 2,505 million Sm3 o.e. in the North Sea, Norwegian Sea, and the Barents Sea, respectively. Hence, with plenty of proven and unproven resources in the country, the oil & gas upstream sector is likely to witness significant growth over the forecast period.

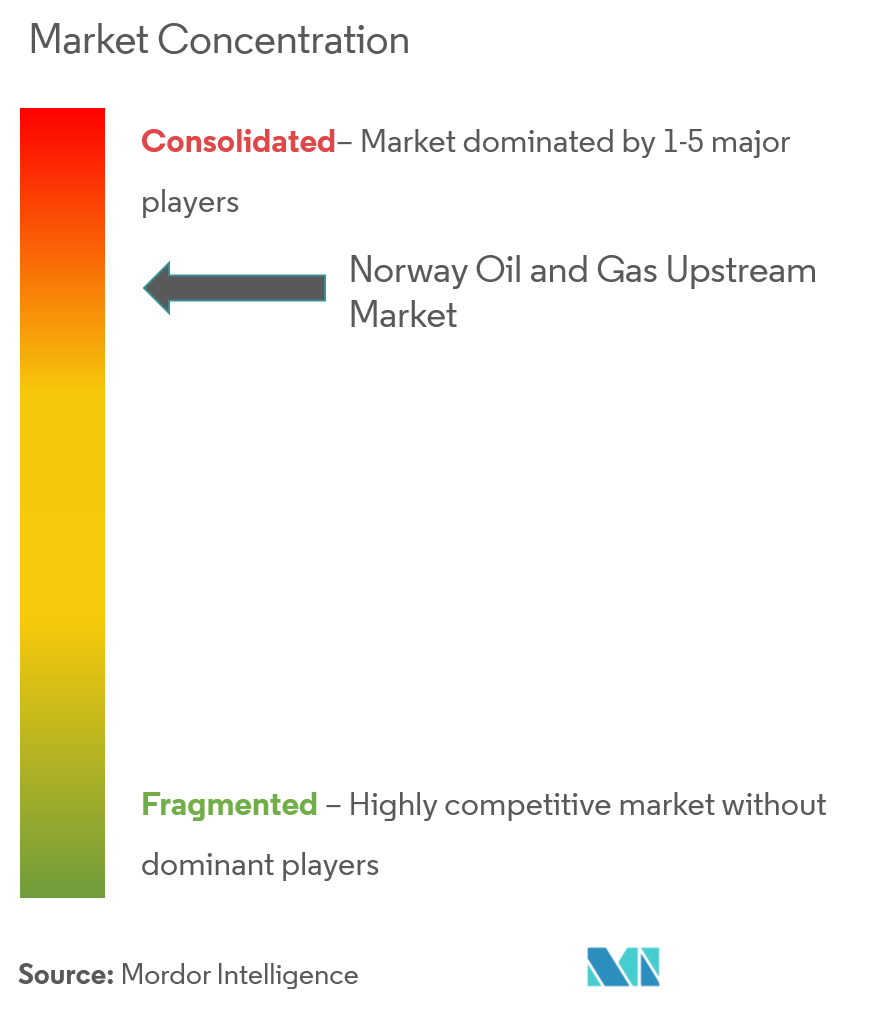

Competitive Landscape

The Norwegian oil and gas upstream market is partially consolidated. Some of the major companies operating in this market include Equinor ASA, Aker BP ASA, Total SA, ConocoPhillips, and Royal Dutch Shell PLC.

Norway Oil And Gas Upstream Industry Leaders

Equinor ASA

ConocoPhillips

Total SA

Aker BP ASA

Royal Dutch Shell PLC

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- March 2020: the Skogul field located in the central part of the Norwegian North Sea, operated by Aker BP had started production. The field is estimated to contain recoverable resources of 1.5 million standard cubic meters of oil (9.4 million bbls).

- December 2020: ConocoPhillips Skandinavia AS (operator) announced the discovery of a new oil discovery (wildcat well 6507/5-10 S) on the Slagugle prospect located 14 miles north-northeast of the Heidrun Field in the Norwegian Sea. The well is estimated to have 12 to 32 million standard cubic meters (Sm3) of recoverable oil equivalent.

- February 2021: Equinor discovered hydrocarbons near the Troll field in the North Sea. The wells (wildcat well 31/1-2 S, and appraisal well 31/1-2 A) were drilled about 10 kilometers northwest of the Troll field in the North Sea and 130 kilometers northwest of Bergen. Both wells are estimated to have 7 to 11 million Sm3 of recoverable oil equivalent.

Norway Oil And Gas Upstream Market Report Scope

The Norwegian oil and gas upstream market report includes:

| Onshore |

| Offshore |

| Location of Deployment | Onshore |

| Offshore |

Key Questions Answered in the Report

What is the current Norway Oil and Gas Upstream Market size?

The Norway Oil and Gas Upstream Market is projected to register a CAGR of greater than 1% during the forecast period (2025-2030)

Who are the key players in Norway Oil and Gas Upstream Market?

Equinor ASA, ConocoPhillips, Total SA, Aker BP ASA and Royal Dutch Shell PLC are the major companies operating in the Norway Oil and Gas Upstream Market.

What years does this Norway Oil and Gas Upstream Market cover?

The report covers the Norway Oil and Gas Upstream Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Norway Oil and Gas Upstream Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.