Europe Coil Coatings Market Analysis

The Europe Coil Coatings Market is expected to register a CAGR of greater than 5% during the forecast period.

- By End-user Industry, the building and construction segment dominated the Europe market and it is expected to witness the highest CAGR, during the forecast period.

- Increasing demand for fluoropolymer coatings for architectural applications is projected to act as an opportunity for the market in future.

- The polyester segment dominated the market and is expected to grow during the forecast period, as it is one of the most widely used products in the industry since it offers excellent corrosion and weather resistance to the coated material in most conditions.

Europe Coil Coatings Market Trends

Rising Demand from the Building and Construction Industry

- The building and construction industry are by far the largest consumer of coil coatings. The main resins, which are used extensively in construction, are a polyester resin, and silicone-modified polyester and polyvinylidene fluorides (PVDF) or fluoropolymer. With the rising number of building codes that promote energy-efficient structures, home builders and consumers are gradually moving toward building strategies that deliver performance and energy savings in the long run.

- In addition to aesthetic look, durability, and functionality, coil coatings are known for their infrared-reflective pigment technology. This technology saves energy on cooling, by helping to ease the building’s interior temperature.

- According to the department of energy, heating and cooling costs account for 48% of the energy use in a typical Europe home. Its superior properties like capability to be molded into any shape, excellent resistance aiding superior longevity, infinite aesthetic color and texture options, and environmental benefits make it a perfect option for both interior and exterior construction applications.

- With the consistent economic growth in the European countries, such as Germany, United Kingdom, France, Italy, and Spain, the demand for construction of new buildings, both commercial and residential, is consistently increasing, which, in turn, is increasing the demand for coil coating in the European region.

- Furthermore, these coatings are also used in making gutters and downspouts, as a part of rainwater collection installations. Another rising use of coil coating is for various leaf and debris prevention systems, which have recently been introduced to the market.

Germany to Dominate the Market

- Germany had the largest market for coil coatings in Europe, which is expected to increase during the forecast period. Germany has the largest construction industry in Europe.

- According to industry experts, the demand for new houses is estimated to be around 350,000 per year until 2020, which is expected to boost the construction sector.

- The non-residential and commercial buildings in the country are expected to witness significant growth prospects in the coming years. The growth is supported by lower interest rates, an increase in real disposable incomes, and numerous investments by the EU and the German governments.

- The short-term and mid-term outlook for the German construction market forecasts a strong demand for infrastructure and housing investments. The construction sector in the country shows a high degree of capacity utilization, with increased competition for sub-suppliers and faces workforce shortness.

- Currently, apart from the few very large constructions groups, internationalization does not seem to be a major driver, as most players show a quite high degree of capacity utilization resulting from domestic demand.

- The factors are estimated to boost the demand for coil coatings in Germany during the forecast period.

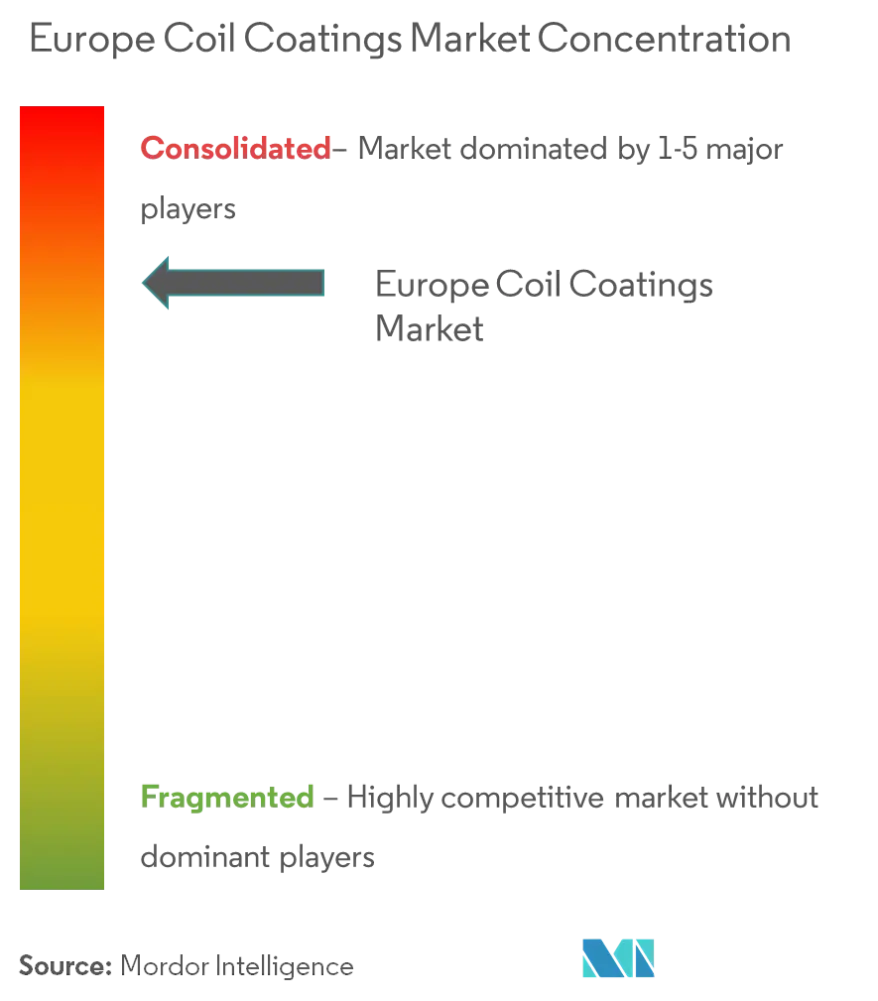

Europe Coil Coatings Industry Overview

The European coil coatings market is expected to be partially consolidated, with the top five-six players occupying a significant position in the market. Key players in the European coil coatings market include AkzoNobel N.V., Beckers Group, The Sherwin-Williams Company, and PPG Industries, Inc., among others.

Europe Coil Coatings Market Leaders

-

AkzoNobel N.V.

-

Beckers Group

-

The Sherwin-Williams Company

-

PPG Industries, Inc.

- *Disclaimer: Major Players sorted in no particular order

Europe Coil Coatings Industry Segmentation

The Europe coil coatings market report includes:

| Resin Type | Polyester |

| Polyvinylidene Fluorides (PVDF) | |

| Polyurethane(PU) | |

| Plastisols | |

| Other Resin Types | |

| End-user Industry | Building and Construction |

| Industrial and Domestic Appliances | |

| Automotive | |

| Furniture | |

| HVAC | |

| Other End-user Industries | |

| Geography | Germany |

| United Kingdom | |

| Italy | |

| France | |

| Russia | |

| Spain | |

| Rest of Europe |

| Polyester |

| Polyvinylidene Fluorides (PVDF) |

| Polyurethane(PU) |

| Plastisols |

| Other Resin Types |

| Building and Construction |

| Industrial and Domestic Appliances |

| Automotive |

| Furniture |

| HVAC |

| Other End-user Industries |

| Germany |

| United Kingdom |

| Italy |

| France |

| Russia |

| Spain |

| Rest of Europe |

Europe Coil Coatings Market Research FAQs

What is the current Europe Coil Coatings Market size?

The Europe Coil Coatings Market is projected to register a CAGR of greater than 5% during the forecast period (2025-2030)

Who are the key players in Europe Coil Coatings Market?

AkzoNobel N.V., Beckers Group, The Sherwin-Williams Company and PPG Industries, Inc. are the major companies operating in the Europe Coil Coatings Market.

What years does this Europe Coil Coatings Market cover?

The report covers the Europe Coil Coatings Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Coil Coatings Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on: June 16, 2024

Europe Coil Coatings Industry Report

Statistics for the 2025 Europe Coil Coatings market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Coil Coatings analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.