Enterprise Mobility in Retail Market Size and Share

Enterprise Mobility in Retail Market Analysis by Mordor Intelligence

The Enterprise Mobility in Retail Market is expected to register a CAGR of 26.25% during the forecast period.

- Differentiation in retail stores has never been more important than it is now. Consumers have more shopping options than ever before, from mass merchandisers to large retail departmental stores, offering one-stop discount shopping, and the convenience of the 24x7 global online marketplace.

- Retailers face relentless demands from consumers for more product choices, faster fulfillment, and improved service. Enterprise mobility can ease the burden of these demands, by implementing solutions such as in-store digitization mobility.

- The retail industry is generating huge amounts of data from its various channel modes - social sites, blogs, and from different apps. Much of this unstructured data is left unused, despite providing valuable information. With the introduction of e-commerce, the retail industry entered into the digital age, where retailers have the opportunity to collect more information about their customers.

- Leading retailers are leveraging enterprise mobility in retail services, to deliver better user experience and maximize store performance. From location analytics to drive engagement in order to understand shopper patterns, there is a fast-paced growth in retail expenditure, due to the rapid growth of urbanization.

- For instance, Snapchat and Amazon announced a partnership, which makes it easier to buy whatever Snapchat users come across in real life. Users point their Snapchat camera at a physical product or barcode and are then redirected to an Amazon pop-up card for that product, or something similar.

- Moreover, the integration of the Internet of Things (IoT) in the retail industry has increased, over the past few years, through the ascending utilization of devices such as RFID and sensor. According to Hewlett Packard Enterprise, 50% of retailers around the world, have adopted the IoT technology.

- However, to ensure that a retailer's network, data, application, and endpoints remain secure (away from any malware and breaches), several software applications and services are evolving to fulfill these requirements. According to NTT Security, the retail industry in APAC, the United States, and Australia were the sources of 93% of attacks.

Global Enterprise Mobility in Retail Market Trends and Insights

Substantial Growth in E-commerce to Spearhead the Growth

- E-commerce is the fastest-growing retail segment in the world. The increasing levels of mobile and internet penetration globally are providing a suitable environment for the rapid growth of e-commerce. According to the E-commerce Research Center (ECRC), China alone employed more than 3 million people in the e-commerce industry.

- While most of the jobs represent the workers at fulfillment centers, it is estimated that the delivery task has gained the second-largest job role in the industry. The most significant applications of enterprise mobility in the e-commerce industry include point of sale, inventory management, and consumer relationship management and feedback.

- Mobile applications are another great mobility solution to the e-commerce industry. They are in fact the heart of the e-commerce business in the current scenario. They present the retailer with a broad range of opportunities. At the same time, they also give customers an array of incentives, which encourages them to develop loyalty towards an online brand or the vendor.

- Moreover, analysis of history, location, and contextual information can help retailers to make better sales. With an increasing turnover of e-commerce globally, vendors are expected to tend more toward enterprise mobility solutions to gain a competitive edge over their rivals leading to considerable demand in enterprise mobility in the retail market.

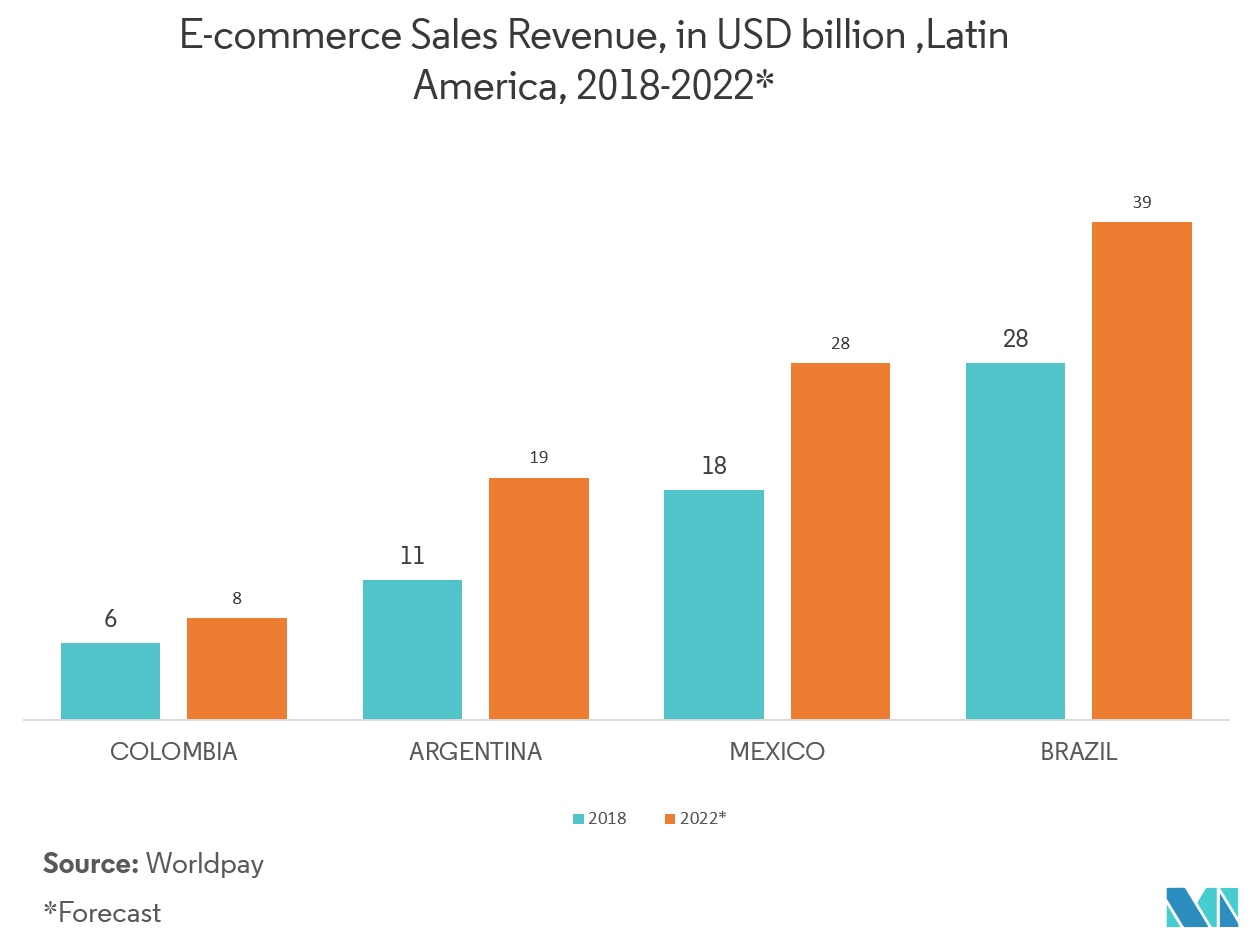

- In the coming years,developing region such as Latin America will have increased sales revenue from E-commerce. This show that enterprise mobility in retail market will have a substantial growth in the years to come.

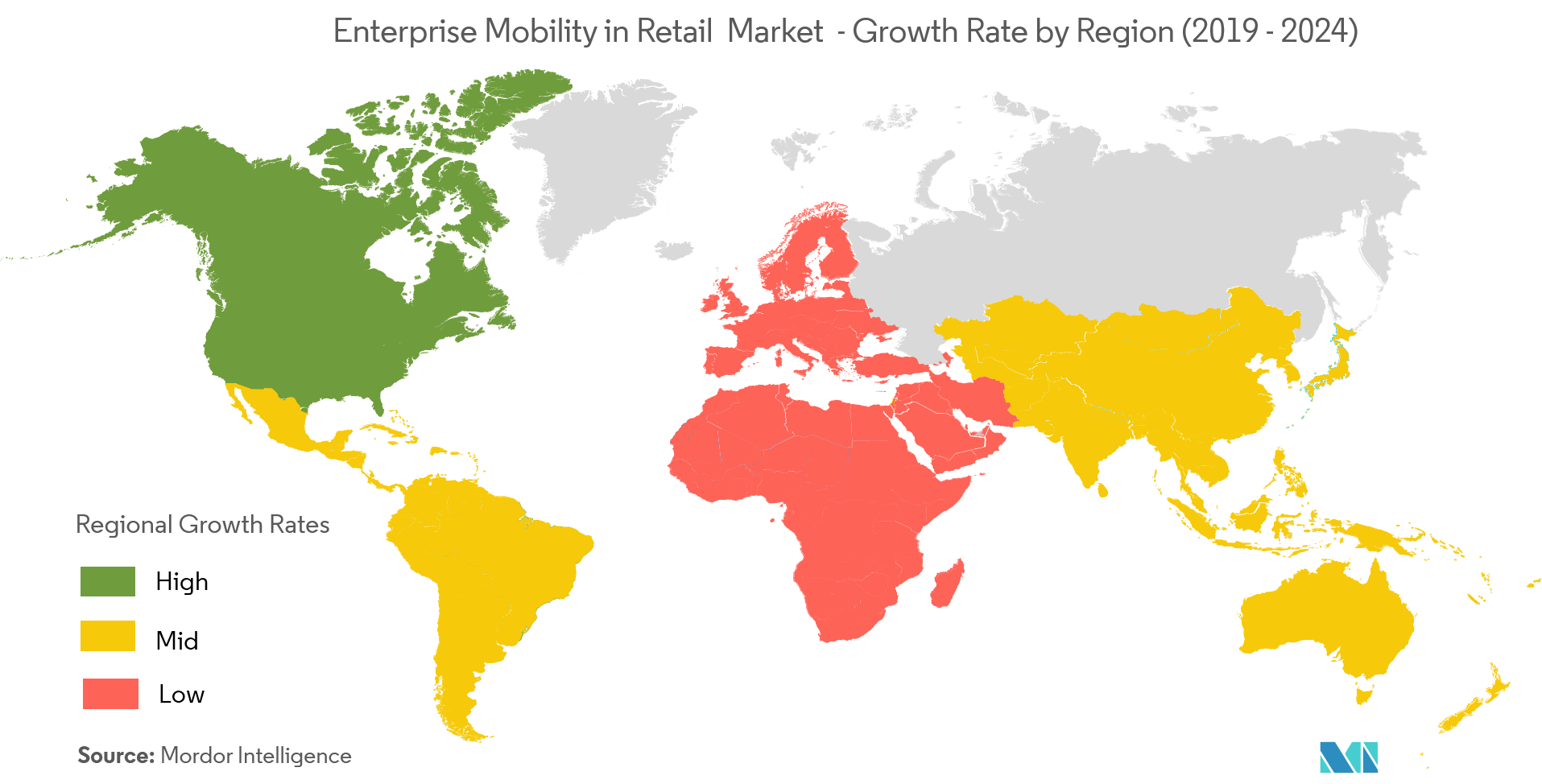

North America to Account for Largest Market Share

- North America is anticipated to have the largest market share for the enterprise mobility market in retail, due to its high adoption of new digital technologies, and, due to the rising acceptance of analytics among small and medium businesses (SMEs).

- The major trends responsible for the growth of enterprise mobility in retail, in the North American region, include the growing number of smartphone devices and the increase in adoption of social apps, which generate ample amounts of data that contain valuable information.

- The region is experiencing many investments and technological advancement, in the market studied. Emerging countries in the region are adopting enterprise mobility in retail spaces, where there is a huge shift from traditional retail to organized retail, in order to improve customer experience, through the application of analytics.

- The region has a strong presence of enterprise mobility market providers, which is anticipated to drive the market in the region. Some of the major players in the market are IBM Corporation, Microsoft Corporation, and Cisco Systems, Inc., among others.

Competitive Landscape

The enterprise mobility in retail market isconsolidated.The market is concentrated due to acquisitions and partnerships among players. Increasing awareness regarding mobility security among enterprises is causing the major players to rethink security and visibility. Some of the key players includeCisco SystemsInc.,Citrix Systems Inc.,Microsoft Corporation,SAP SE,Sonata Software,IBM Corporation, among others.

- February 2019- British Security firm Sophos announced that it will be integrating its Mobile Device Management system with Microsoft's Intune. It will help IT admins configure individual device usage policies as per the corporate data laws.

- February 2019- IDEMIA and MobileIron announce a partnership to bring eSIM and connectivity management capabilities to the MobileIron UEM/MDM platforms. The IDEMIA Smart Connect Hub integrates with mobile network operator (MNO) systems and brings control of eSIM profiles and their subscription plans within the MobileIron portals.

Enterprise Mobility in Retail Industry Leaders

Cisco Systems Inc.

IBM Corporation

Microsoft Corporation

SAP SE

Citrix Systems Inc.

- *Disclaimer: Major Players sorted in no particular order

Global Enterprise Mobility in Retail Market Report Scope

| Smart Phones |

| Laptops |

| Tablets |

| Other Devices |

| North America |

| Europe |

| Asia-pacific |

| Latin America |

| Middle East & Africa |

| By Device | Smart Phones |

| Laptops | |

| Tablets | |

| Other Devices | |

| Geography | North America |

| Europe | |

| Asia-pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Enterprise Mobility in Retail Market size?

The Enterprise Mobility in Retail Market is projected to register a CAGR of 26.25% during the forecast period (2025-2030)

Who are the key players in Enterprise Mobility in Retail Market?

Cisco Systems Inc., IBM Corporation, Microsoft Corporation, SAP SE and Citrix Systems Inc. are the major companies operating in the Enterprise Mobility in Retail Market.

Which is the fastest growing region in Enterprise Mobility in Retail Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Enterprise Mobility in Retail Market?

In 2025, the North America accounts for the largest market share in Enterprise Mobility in Retail Market.

What years does this Enterprise Mobility in Retail Market cover?

The report covers the Enterprise Mobility in Retail Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Enterprise Mobility in Retail Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Enterprise Mobility in Retail Market Report

Statistics for the 2025 Enterprise Mobility in Retail market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Enterprise Mobility in Retail analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.