Market Trends of Threat Intelligence Security Services Industry

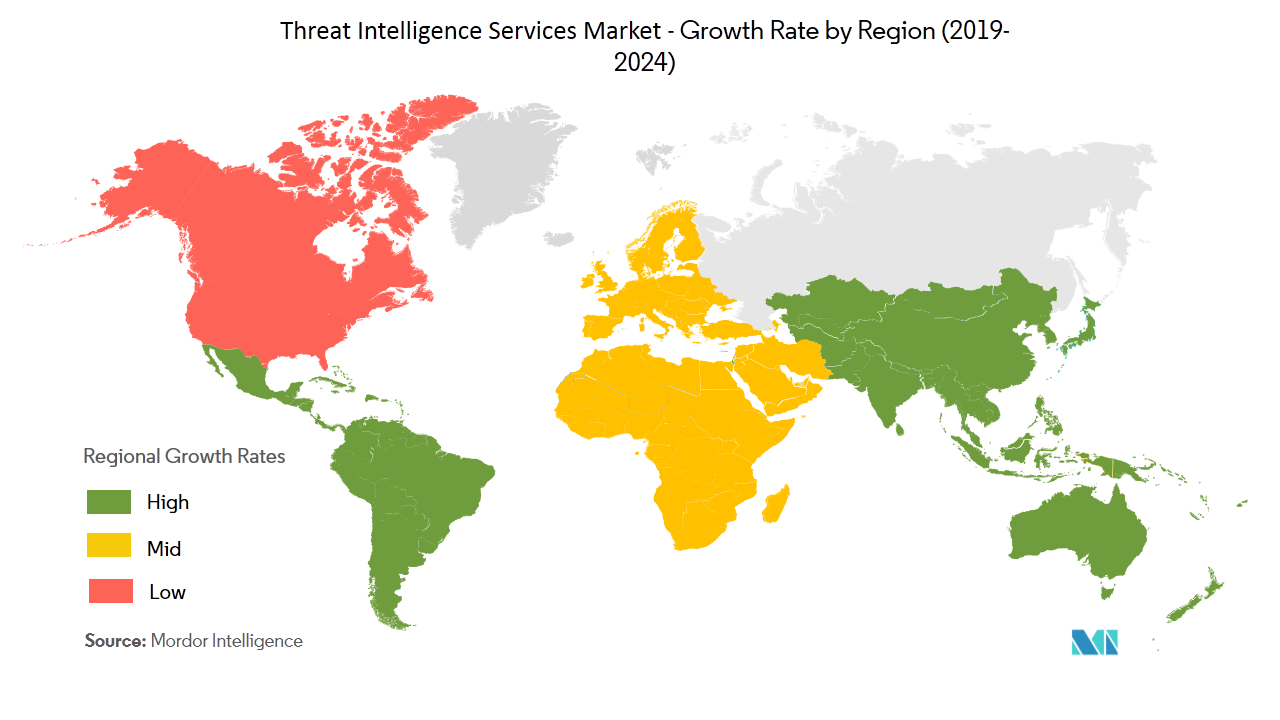

Geographic Trends

The United States is the largest market for threat intelligence services due to the increasing amount of spending by discrete manufacturing and federal/central government. Also, increase in smart devices (which generate a massive amount of data), the need for faster processing, dependency on IoT devices, BYOD, cloud adoption, pressures on the network, and increased cyber threats are further aiding the market growth.

In the US IT sector, it was estimated that in the past three years, BYOD adoption witnessed an increase of 44.42%, which depicts the need for the adoption of threat intelligence services. Moreover, the country has a strong foothold of threat intelligence service vendors, which adds to the growth of the market. Some of them include Juniper Networks Inc., IBM Corporation, Cisco Systems Inc., FireEye, and Symantec Corporation, among others.

With continuous enhancements in technology, cybersecurity attacks are growing day-by-day, by avoiding all the traditional security tools. This has directly led to the demand for advanced protection techniques, such as cyber threat intelligence solutions.

The growth in the number of data breaches is pushing many organizations to take threat intelligence services. For instance, Equifax, one of the largest credit agencies in the country, suffered a breach in 2017 that affected approximately 143 million consumers. JPMorgan also witnessed one of the biggest bank breaches in history, as hackers got access to the financial information of 3,500 customers.

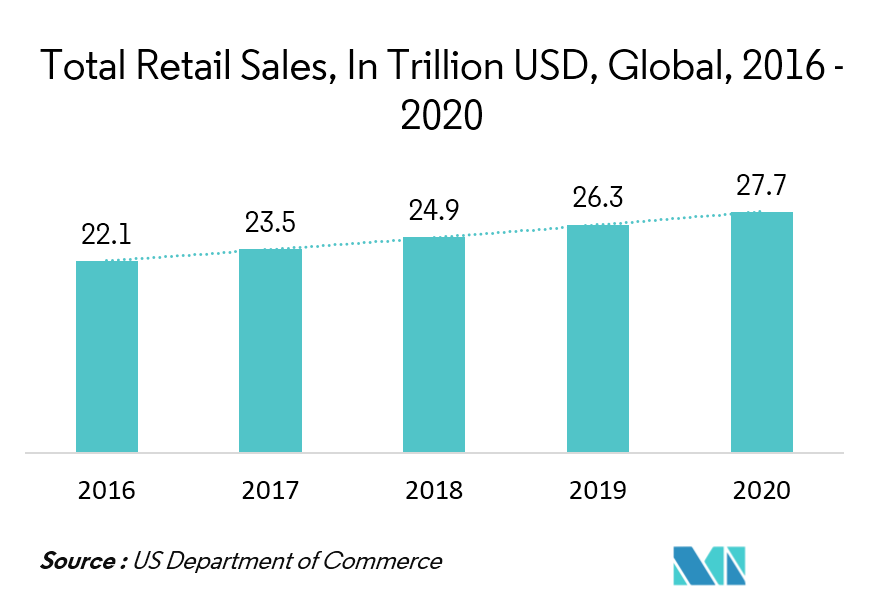

Retail and Consumer Goods segment is expected to have highest growth

With the introduction of E-commerce over two decades ago, the retail industry has entered into the digital age where the retailers have the opportunity to collect more information about their customers. Retail is seeing a huge data that is generating from the various channel modes - social sites, blogs, and data generated from different apps. Much of the unstructured data produced is left unused, which provides valuable information.

This digital transformation did not end with the E-commerce channel. An increasing number of connected devices have made their way into physical stores in the form of kiosks, point-of-sale (POS) systems, and handheld devices, and they are all designed to collect and access customer information.

To ensure that a retailer’s network, data, application, and endpoints should remain secure (away from any malware and breaches), several software applications and services are evolving to deal with these threats. For instance, according to NTT Security, in retail sectors, the cyber targets within APAC, the United States, and Australia were the sources of 93 % of attacks and brute force attacks led with 64 % of the hostile activity.

Data compromises involved the travel industry—including airlines, travel agencies, and travel websites. Further, the retail sector was slanted heavily in favor of data from CNP transactions, while attackers are targeting the food and beverage industries mostly through card track data.