Market Trends of Aviation Cyber Security Industry

This section covers the major market trends shaping the Aviation Cyber Security Market according to our research experts:

Airport Management Holds a Significant Market Share being the Passengers Contact Point

- With the number of air travel passengers increasing at a rapid rate year-over-year, airports continue to upgrade their infrastructure intelligence to improve passengers 'travel experience and to support the growth. By enabling the exchange of real-time information on the flight schedule, collaboration, and airport-wide process integration, airports significantly improve operational efficiencies, passenger services, and advanced security capabilities. These factors drive the adoption of these systems, thus, impacting the market

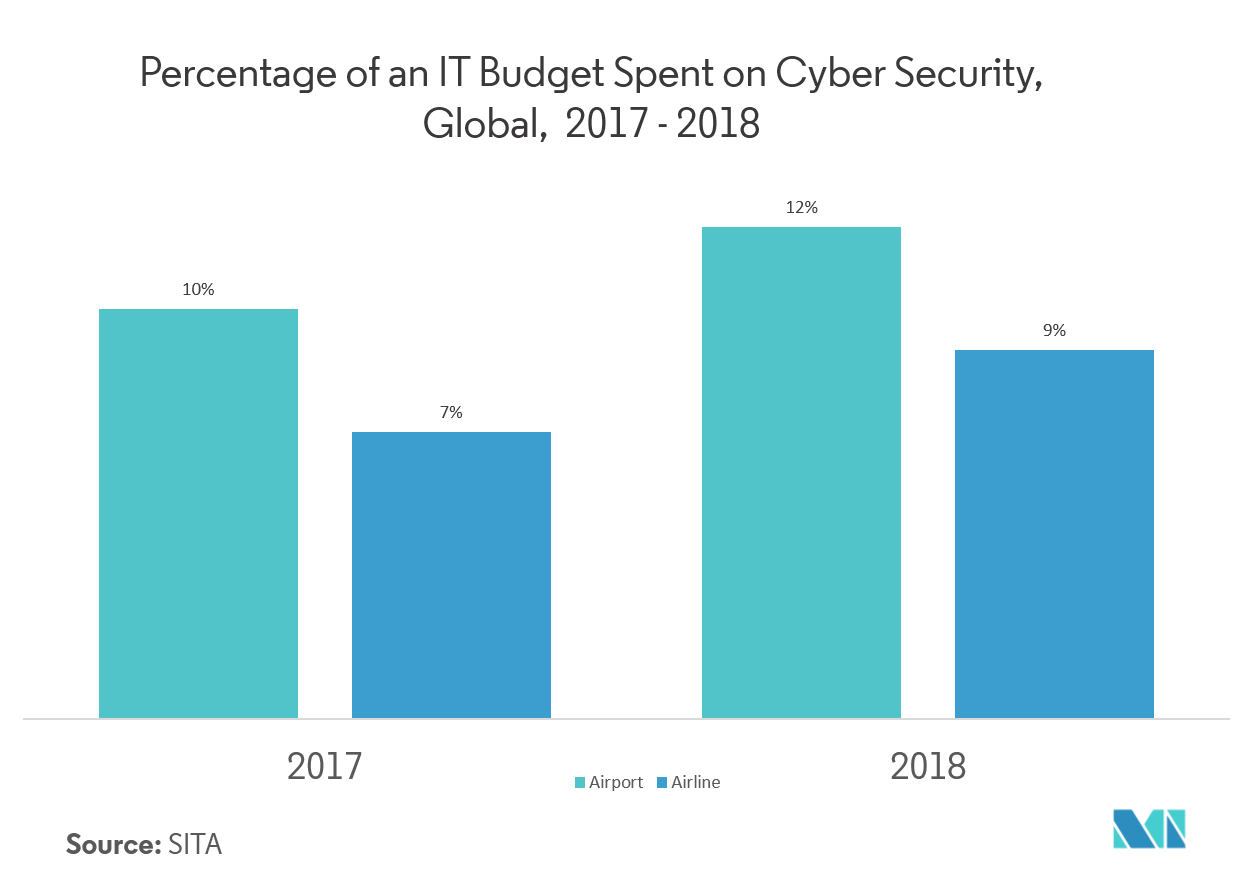

- According to SITA Air Transport IT Trends Insights Report, 2018, the airport and the airline have IT investment prioritized as cybersecurity, with 94% of studied airports planning to invest in the cybersecurity programs, over the next three years.

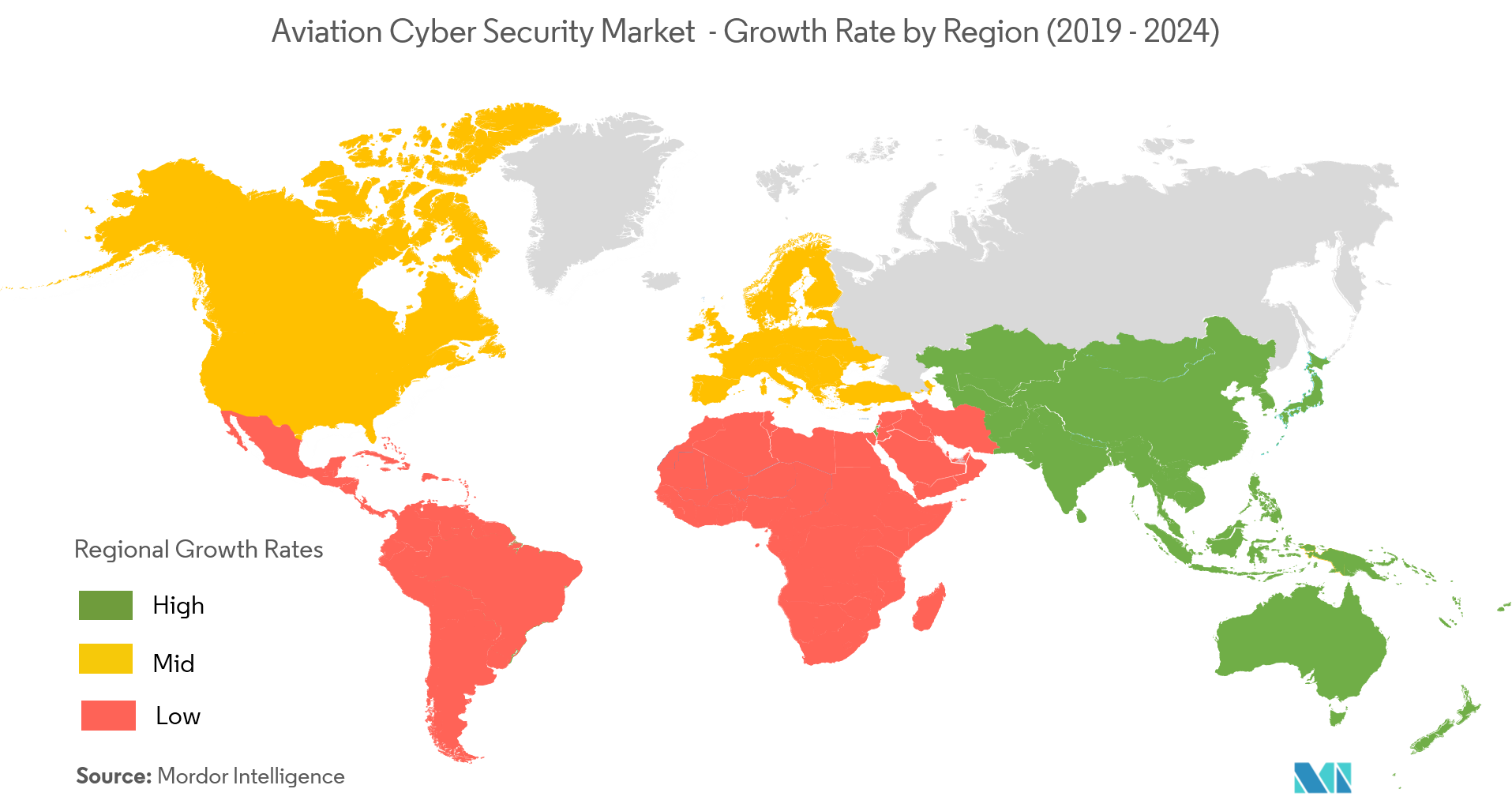

- There is an increase in demand for cyber security in aviation in the Asia-Pacific region. According to the Indian Government's Vision 2040, India needs approximately 200 commercial flight airports and an estimated investment of USD 40 to USD 50 billion to handle at least 1.1 billion passengers. Also, the civil aviation authorities of the world are emphasizing the enhancement and ensuring of safety and security standards, across the fast-growing aviation ecosystem.

North America Holds the Largest Market Share

- According to the Cyber Security Breaches Survey 2018, in the United States, the state of California lost more than USD 214 million through cybercrime, alone. Such cases created a need for cyber security in the country and impacted the demand.

- In the United States, the transportation companies and air carriers, especially the aviation sector, are incorporating more advanced cyber security programs that align with the National Institute of Standards and Technology (NIST) standards.

- The United States lays high emphasis on its aviation sector and invests mainly in the R&D of advanced cybersecurity systems. For instance, 2019 President’s Budget includes USD 15 billion of budget authority meant for cyber security-related activities, along with Airport and Airway Trust Fund having USD 32.4 million of 2019 budget.

- In addition, the new budget spending for Canadian infrastructure protection is marked at USD 144.9 million over five years, including Canada’s critical cyber systems, including sectors in the finance, telecommunications, energy, and transport sectors.