Market Trends of Crime Risk Report Industry

This section covers the major market trends shaping the Crime Risk Report Market according to our research experts:

Growth in Digitalization and Cloud Adoption is Influencing the Market Demand

- Financial institutes across regions are implementing IT solutions to augment business operations. Cloud-based crime risk solution providers are gaining significant returns, by maintaining competitive costs, rapid innovation, and portfolio expansions. Recently, in 2019, Oracle Corporation expanded its cloud-based Anti-Money Laundering (AML) solution for smaller banks to enhance their capability in crime risk management.

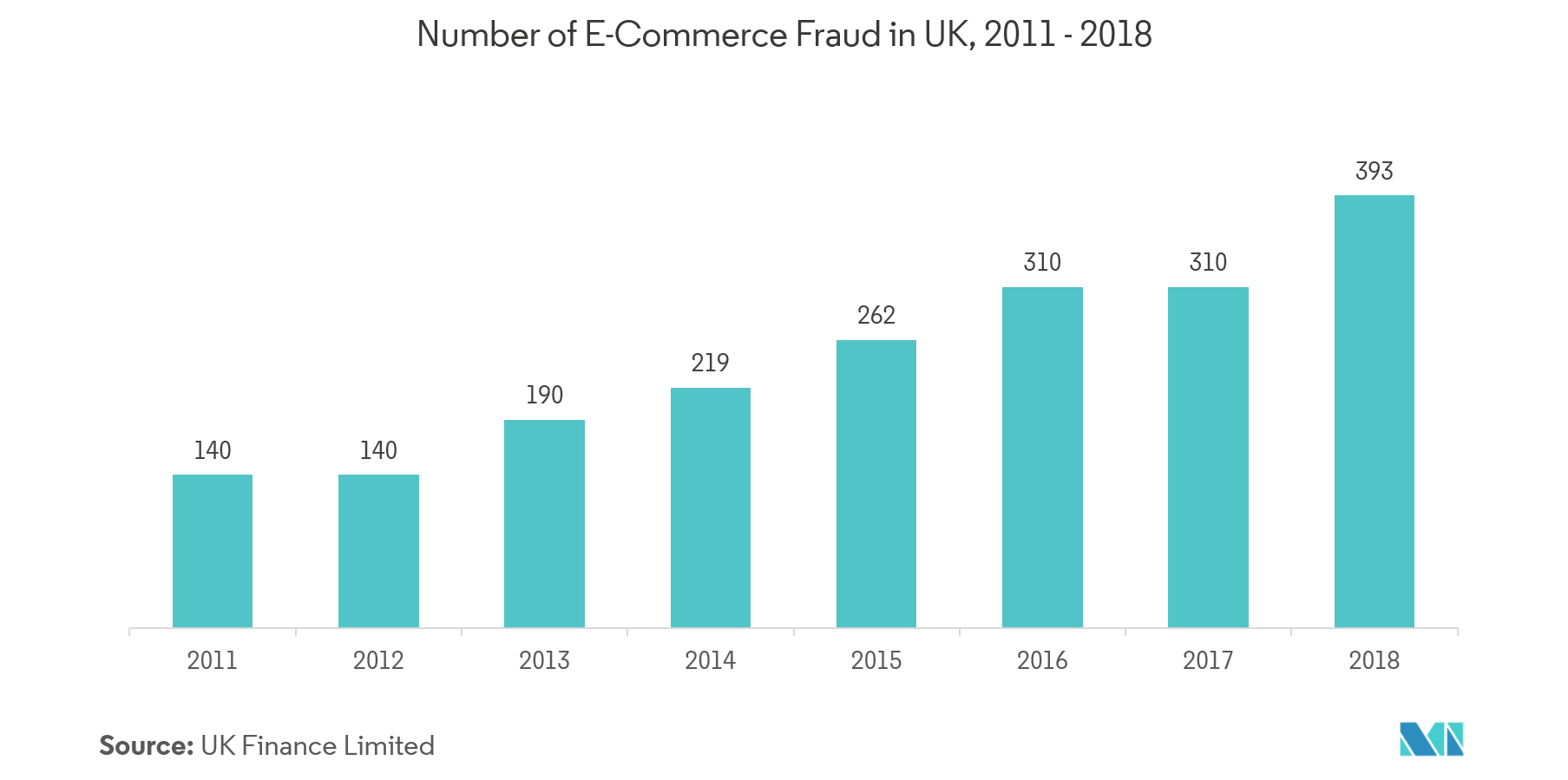

- Due to rapid digitization and emergence of mobile apps, industrial processes have become virtual, which in turn has given rise to online security risks and fraudulent behaviors in recent years. Online payment modes and digital transactions are some of the most affected areas in crime risk portfolio. According to UK Finance Limited, the number of e-commerce fraud has shown a growth of 26% in 2018 than in previous years.

- According to the Reserve Bank of India, financial transactions volume of the second populated country in the World (India) increased by 5% in the FY 2018 than previous FY 2017, which is anticipated to provide a great opportunity to vendors in the crime risk report market in the coming years.

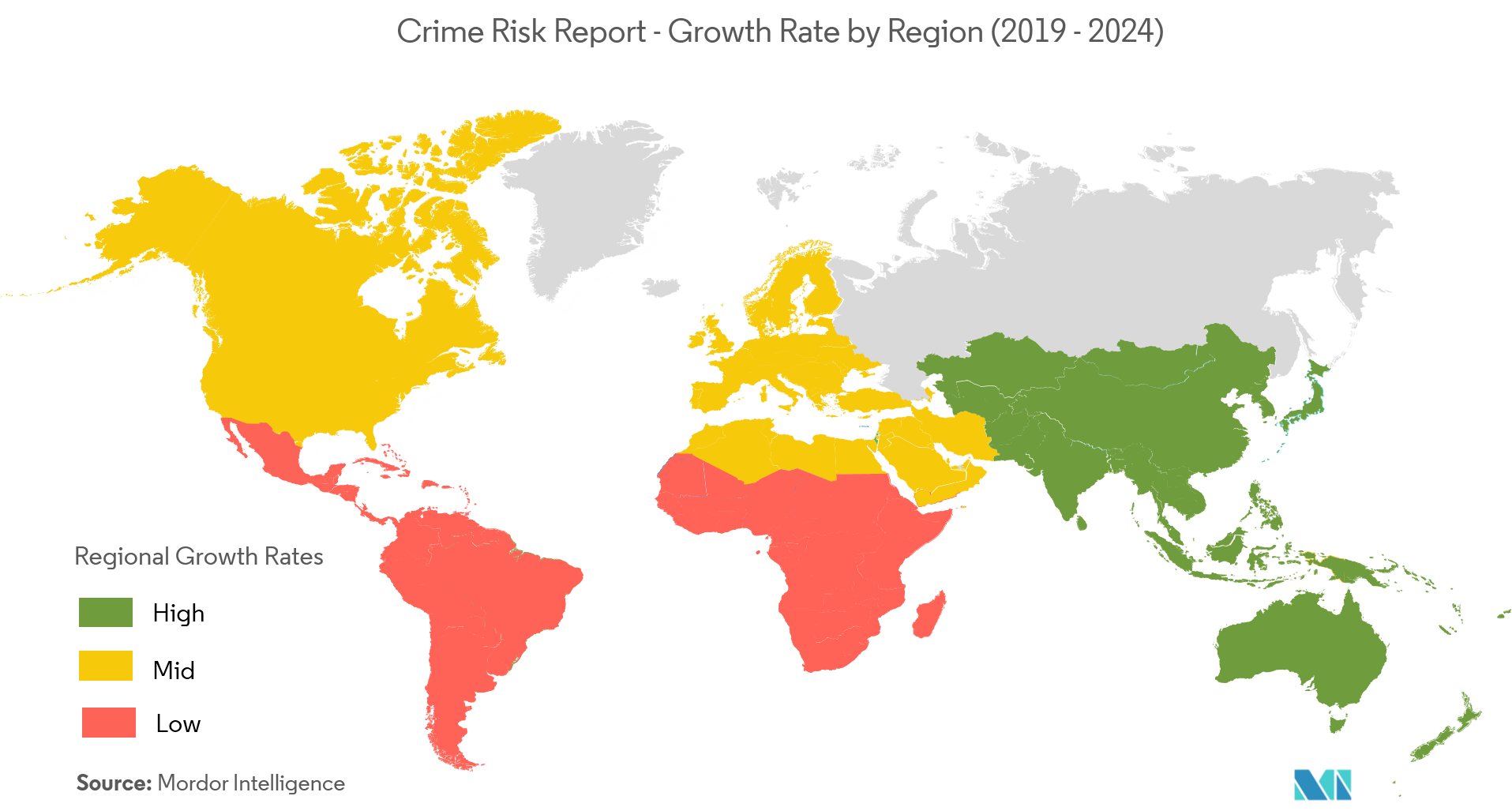

Asia-Pacific is the Fastest Growing Region

- The region's strong presence in the finance sector, rapid growth in internet banking users and cloud platform deployment for the various finance-related solution is some of the factors influencing the market growth in the Asia-Pacific region.

- According to Fair Isaac Corporation, 75% of the bank in the region is estimating a rise in fraud-related activities in the coming years. Also, the Asia-Pacific region with 50% of global online retail transactions will provide potential space for market development of risk-related solutions in the forecast period.

- Specifically, China, Japan, South Korea, India, Singapore, and Australia are expected to create huge potential for crime risk report solutions in the coming years. A number of Chinese banks have surged their IT spending in 2018. China Merchants Bank and China Construction Bank (CCB) have increased their IT spending by 35.2% and 22% respectively in 2018 than the previous year, which will eventually create potential space for vendors offering crime risk solutions in the country for the years to come.