Market Trends of Cloud Security in Banking Industry

This section covers the major market trends shaping the Cloud Security in Banking Market according to our research experts:

Cloud Email Security Software to Grow Significantly Over the Forecast Period

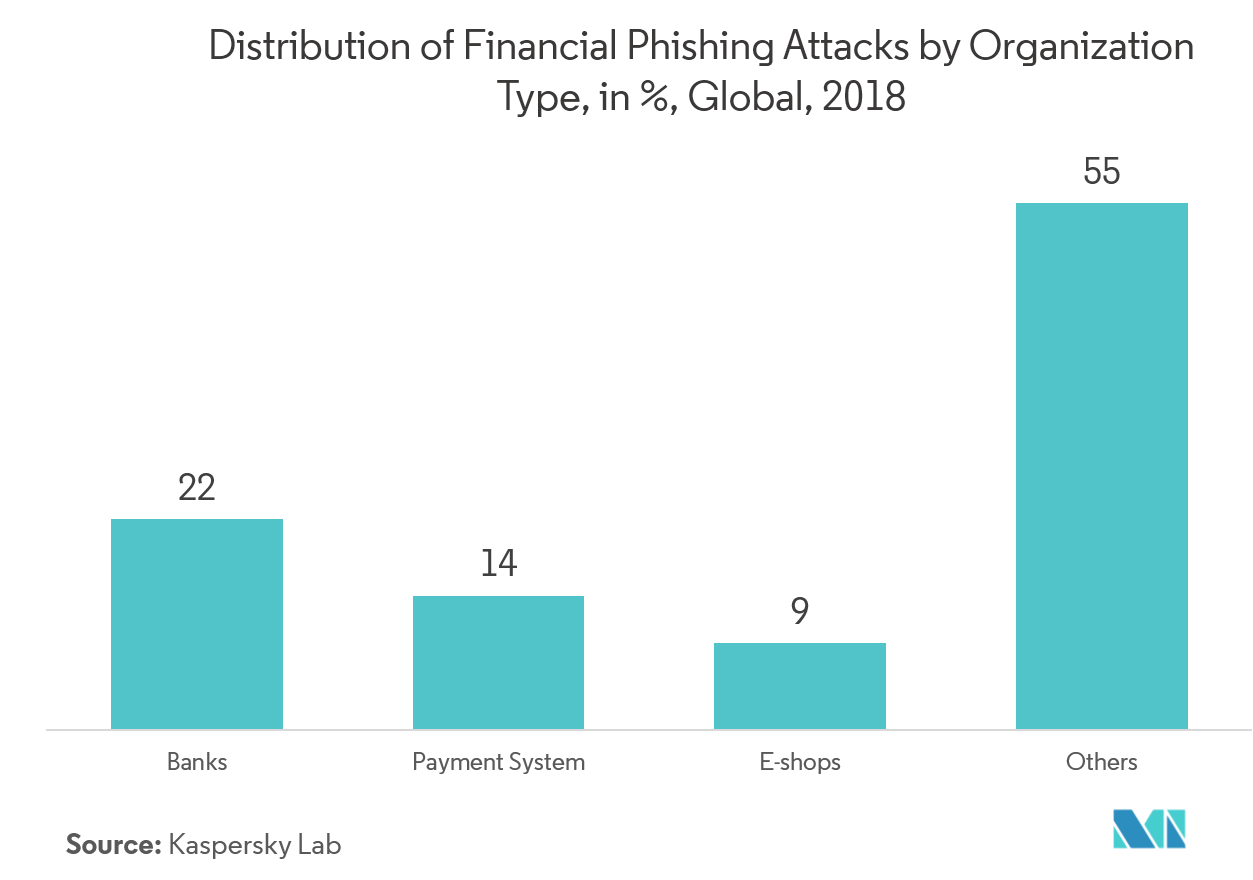

- The banking industry is one of the top targets of hackers using phishing attacks to breach security. According to Kaspersky Lab, in 2018, the number of users attacked with banking Trojans was 889,452, which was an increase of 15.9% in comparison with 767,072 in 2017, globally.

- Recently, in May 2019, the UK banking giant, TSB, experienced one of these phishing-related emergencies. The messages were crafted to resemble authentic communications and informed recipients that TSB Bank accounts had been suspended due to “recent technical and security issues” and account verification is needed by which 1,300 customers reported their bank accounts had been robbed of everything they owned.

- Owing to this rise in mail phishing in banking, where fraudulent e-mails can look like they come from a real bank e-mail address, the need for security has gained significant importance. Cisco Advanced Phishing Protection deploys as a lightweight sensor via the cloud or on-premise, where the sensor receives all messages considered clean by the secure email gateway and determines if the message is malicious or not in the banking.

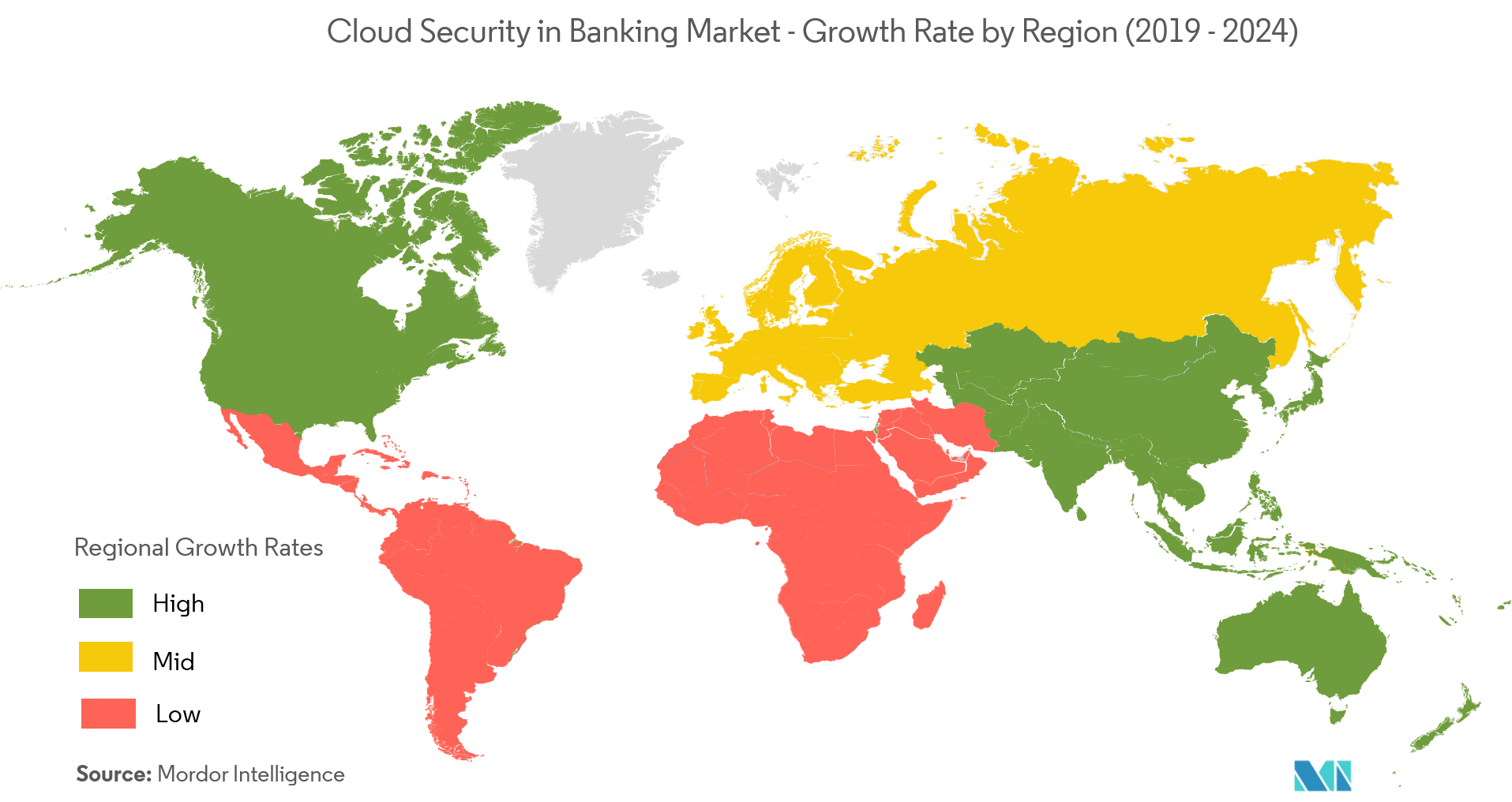

North America to Account for Significant Share

- North America is holding the highest share as the most number of data breaches in banks occur in this region. In July 2018, hackers used phishing emails to break into a Virginia bank in two separate cyber intrusions over eight months, making off with more than USD 2.4 million total. With rising cyberthreat, the need for cloud security software in North American banks is increasing which is driving the market.

- Most banks have begun to explore the cloud’s potential as a business building asset for transforming their operating and delivery models, clarifying requirements and governance issues and addressing regulatory and security issues in this region.

- Retail banks have been quick to explore cloud options. Accenture worked with a large bank in the United States to create a cloud architecture that would automate the conversion of data from multiple sources into useful insights for making business decisions and providing more security.

- Bank of America chooses the Microsoft Cloud to support digital transformation and help deliver new business efficiencies, support digital culture change, and meeting customer needs. Additionally, Bank of America is one such institution that won the best cloud initiative category at 2019 AFTAs for project Greenfield. The bank is aiming to host around 80 percent of its applications in its private cloud to secure all the customer data and give high cybersecurity.