Market Trends of Scale-Out NAS Industry

This section covers the major market trends shaping the Scale-Out NAS Market according to our research experts:

Cloud Deployment Holds the Significant Share in The Market

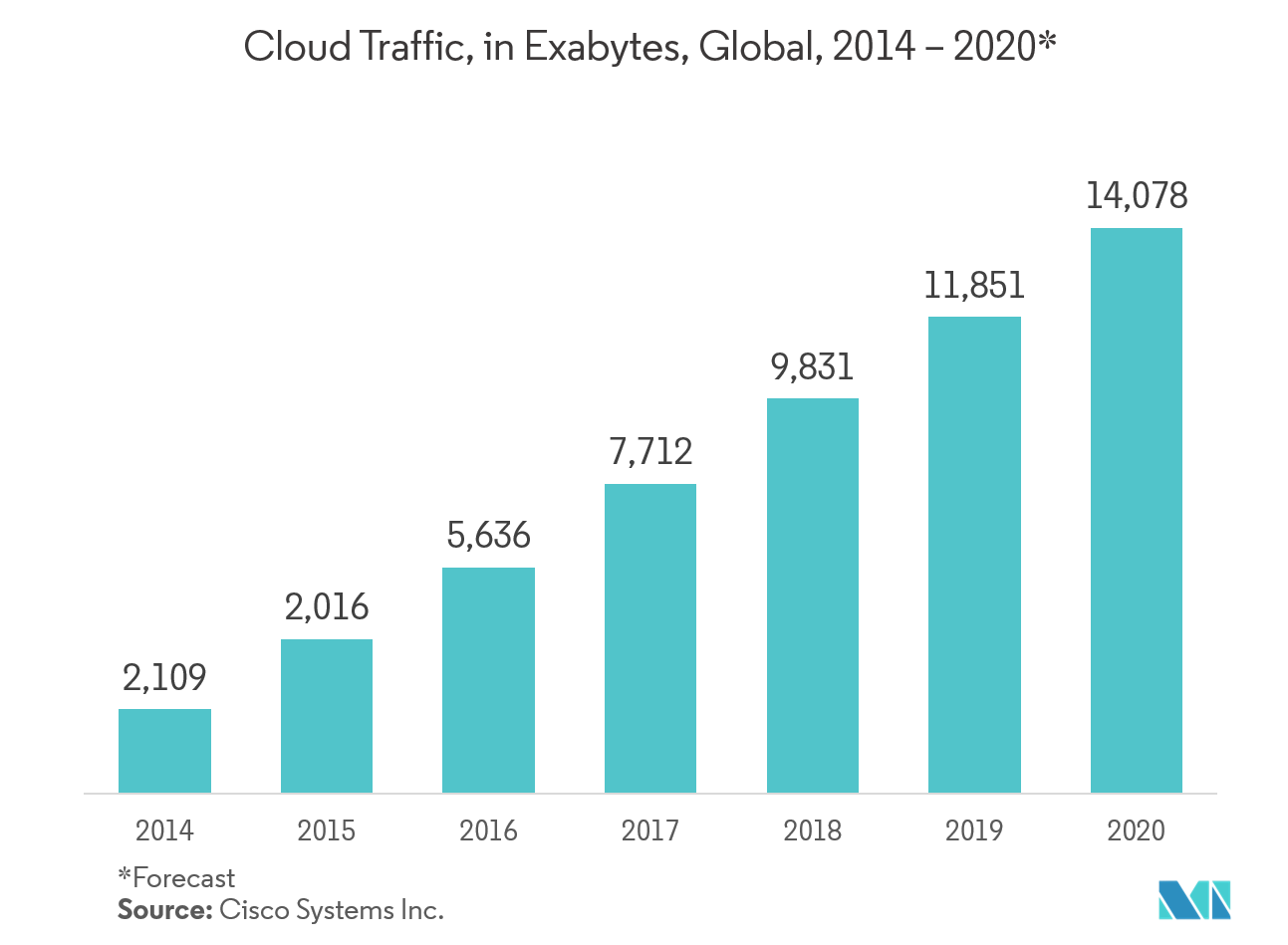

- Enterprises persistently struggle to stay ahead of a growing need for data storage, especially unstructured data. Scale-out NAS systems are an increasingly important tool in this battle. Among scale-out products from the big five storage vendors, hardware offerings are the cornerstone with the use of the cloud.

- For instance, top vendor Dell, offer Dell EMC’s scale-out NAS systems supporting CloudPools. This is the supplier’s cloud tiering system, which supports private clouds on Isilon or Dell EMC ECS, as well as Dell EMC’s own Virtustream, AWS S3, Google Cloud Platform, and Microsoft Azure.

- Various firms are innovating a new solution to easily integrate with the cloud platform. For instance, in Oct 2019, Cohesity revealed Cohesity SmartFiles, an intelligent NAS solution designed for web-scale, that goes beyond traditional scale-out NAS (network-attached storage) capabilities. It delivers transparent data tiering both on-premises and to the cloud. With SmartFiles, it is simple to create an automated policy to tier select data from an existing NetApp, Isilon, Pure Storage device or any other storage system to SmartFiles, as well as to archive even colder data to the cloud. This initiative approach is the way that storage needs to evolve to support today’s increasingly complex, multi-cloud data management requirements.

- Many times customers have been forced to choose between capacity versus entry point, performance versus price, or scale versus incremental cost, especially in small/medium-scale businesses. Companies are constantly improving and enhancing its software to deliver more performance and capacity per dollar for its customers across industries.

- For instance, in April 2019, Qumulo introduces a new hybrid storage platform, and advanced file system features that accelerate momentum in Media and Entertainment Storage Market. The introduction of C-72T delivers a 200 percent increase in reading performance over previous entry-level nodes and a 300 percent increase in storage density over a previous high-performance hybrid node. It expands support for legacy scale-out NAS While enabling powerful hybrid cloud capabilities.

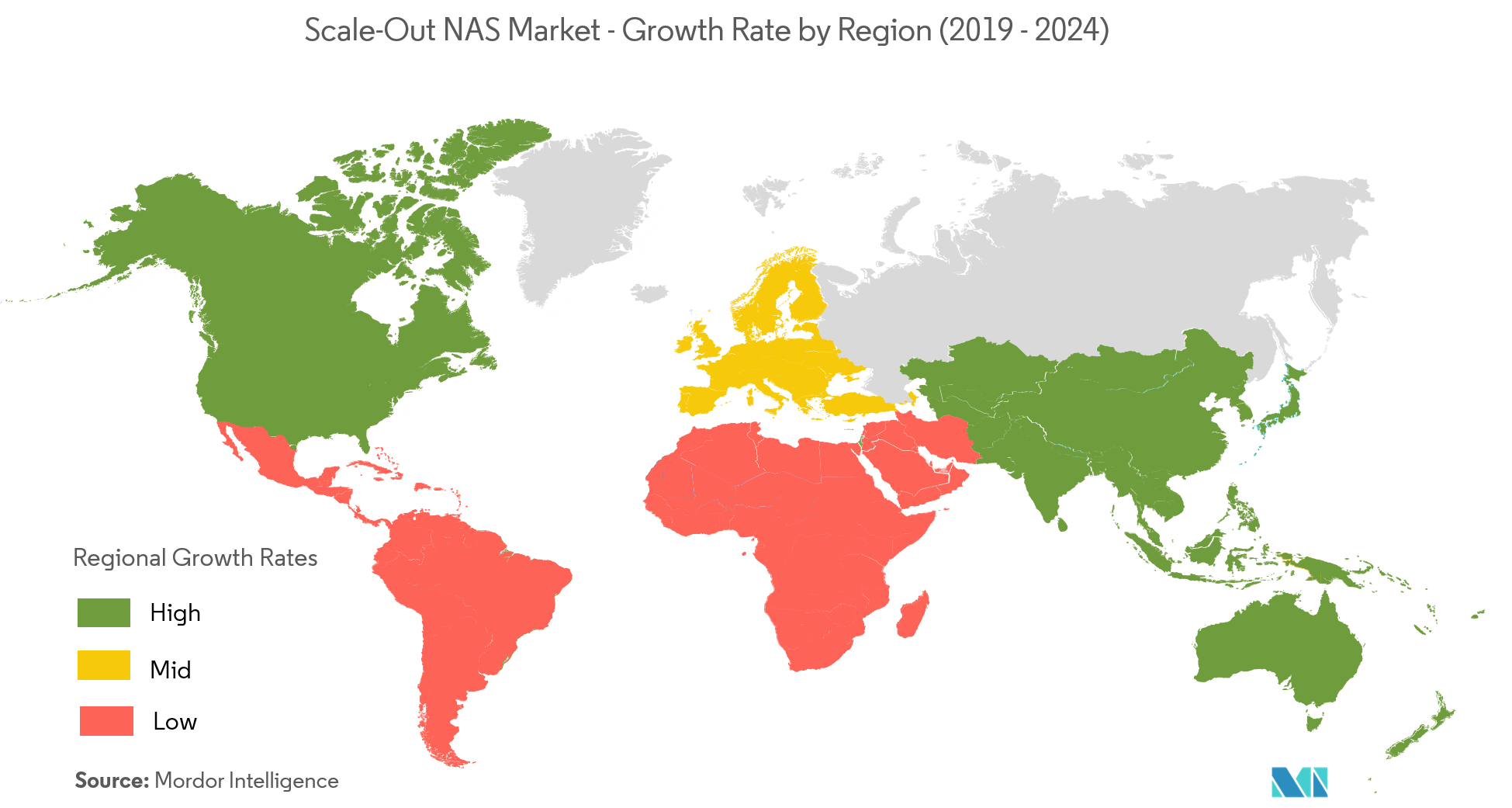

North America to Hold Highest Share in the Market

- North America grasp the largest market share due to its early adoption of advanced analytics solutions involving huge data storage requirements. According to Forbes, 55 percent of North American businesses have adopted big data analytics. Moreover, usage of digital solutions in sectors such as professional services and manufacturing sector has resulted in the generation of significant amounts of unstructured data.

- The presence of market incumbents, such as Dell Emc, IBM Corporation, HP Development Company, and Seagate Technology, in the storage segment, is another factor that is expected to promote the growth of the scale-out NAS market. Moreover, many other companies are expanding their distribution in North America region.

- For instance, StorONE, which offers low-cost storage and works with any protocol or use case especially with scale-out NAS, came to market initially through a limited channel and is now broadening out further with more distribution channel. On April 2019, StorONE announced that it is now expanding with a distribution deal with Tech Data, which will see StorONE products available through Tech Data first in North America, and eventually, globally.

- Moreover, various global players are involved in enhancing storage, data management and data protection solutions that directly affect an organization's data capital. For instance, to help customers keep pace with the data deluge in AI use cases like autonomous driving and in key industries including media and entertainment as well as healthcare, on April 2019, Dell EMC announced to boost the capabilities of its industry-leading Isilon scale-out NAS family. The latest Isilon release provides massive scalability, enhanced cloud integration and security to support the most demanding file workloads. This risen scalability will assist this region's business in various industries to enhance their productivity effectively.