Market Trends of LA Glass Bottles and Containers Industry

This section covers the major market trends shaping the Latin America Glass Bottles & Containers Market according to our research experts:

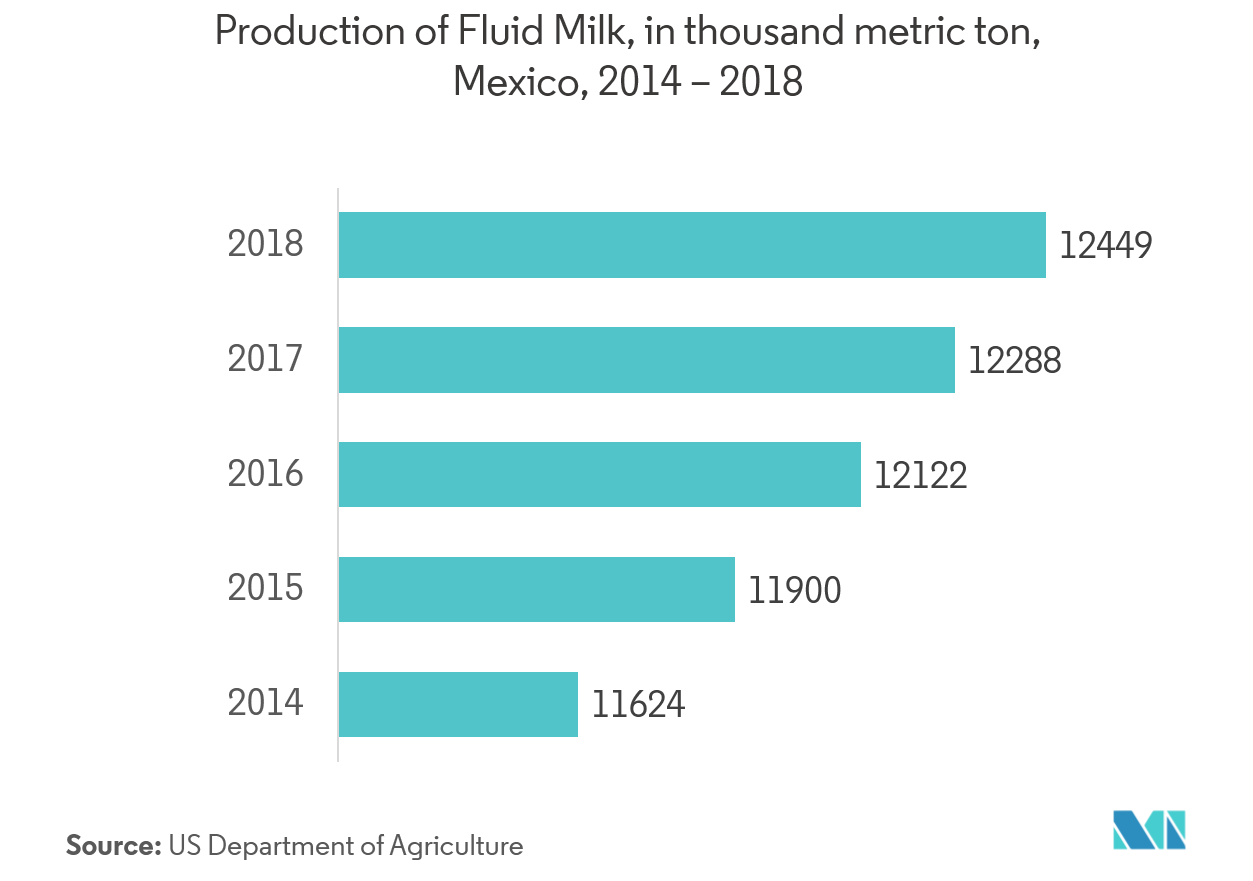

Milk and other Dairy Products to Hold a Significant Share

- Latin America's dairy market is one of the fastest growing markets in the world. While wider prosperity has helped shift demand from glass to rigid plastic and metal, demand for value added packaging like reusable glass is still high. Refillable glass bottles have long made beverages, like milk more affordable for consumers in this region.

- Amcor has developed ‘glass-look-a-like’ clear polyethylene terephthalate (PET) bottles to address the growing demand for transparent dairy packaging in Latin America. To protect the contents, the container includes a 38-mm finish and an ultraviolet (UV) blocker.

- The production of fluid milk is increasing in Mexico. According to the US Department of Agriculture, in Mexico, production of fluid milk increased by 12% during 2010-2019. Glass bottles are mainly used for packaging of milk as it preserve the flavor of dairy products, such as milk, much longer than other types of packaging. This is because glass is less likely to allow contents to mix with air or other possible chemicals.

- Large number of firms in Mexico has increased the shelf-life of pasteurized fresh milk from 7 days to 15 days. This is achieved by incorporating silver-based microparticles with antimicrobial, bactericidal, and self-sterilizing properties into the plastic bottles that are used for packaging milk.

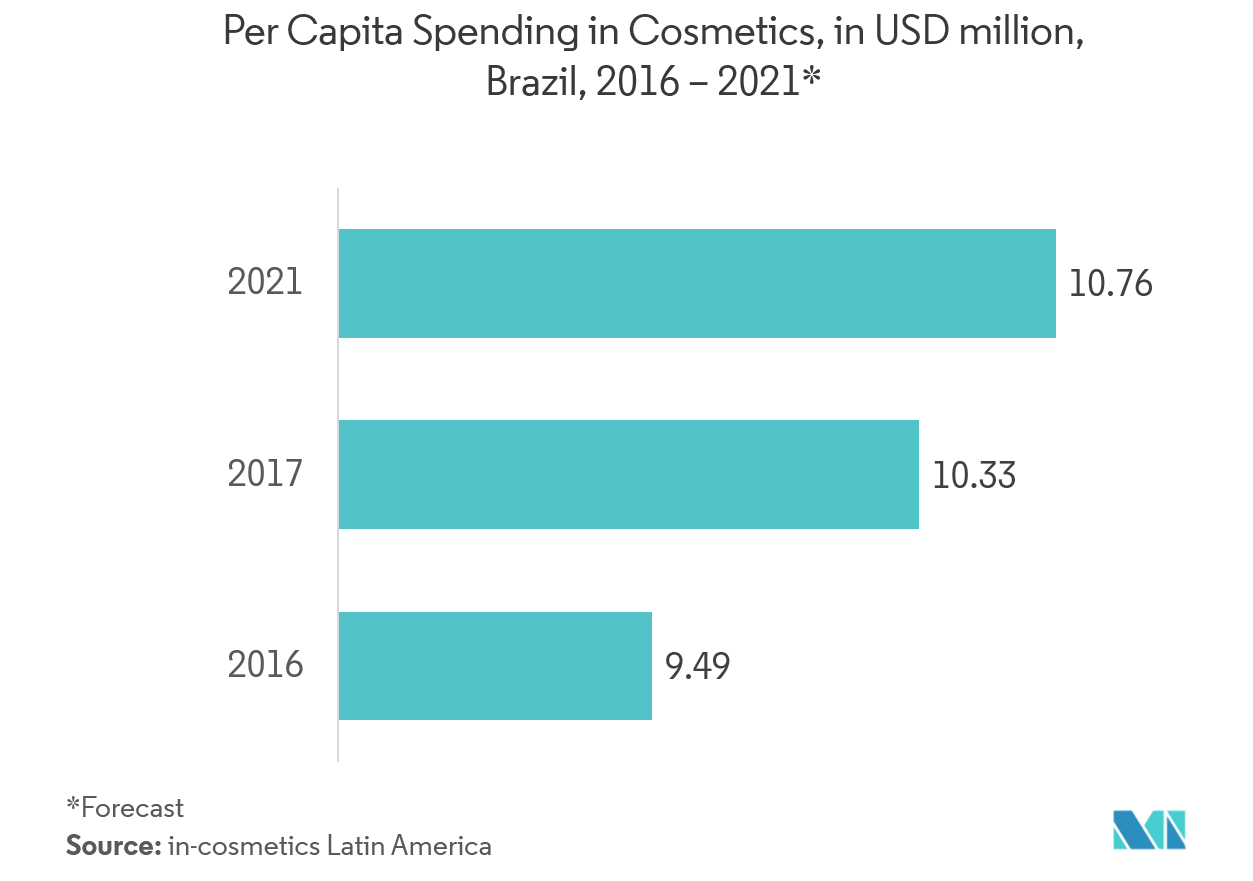

Cosmetics sector to Drive the Market Growth

- The cosmetic packaging segment, includes skincare products, hair care products, and perfumes. In latin america, there is an increasing incorporation of glass packaging in the cosmetic industry for high-end luxury products. This is gaining traction, as glass renders the product an elegant look and imparts a premium status.

- The increasing disposable income in the countries, such as Brazil, is further adding to the demand for premium cosmetics products around the world. The cosmetics industry in this country is continuously expanding, and has placed itself as one of the fastest growing and most vibrant cosmetic industry across the world.

- Additionally, the Brazilians are now showing interest in grooming and personalization. In the last decade, the sales of cosmetic products increased by 8% to 10%. The increased sales made Brazil the largest consumer of cosmetic products in Latin America. Men’s grooming products continue to be popular among the youth who are conscious about their appearances. This gives a high demand of glass packaging in cosmetics.

- Verescence (formerly SGD) has sold its Brazilian subsidiary Verescence do Brasil to Wheaton Brasil Vidros, the leading producer of high-end glass packaging for the cosmetics, perfume and pharmacy markets in Brazil. Wheaton consolidates its position in the Brazilian market and becomes one of the world’s leading glass manufacturers for the luxury sector.