Market Trends of LAOS Freight And Logistics Industry

This section covers the major market trends shaping the LAOS Freight & Logistics Market according to our research experts:

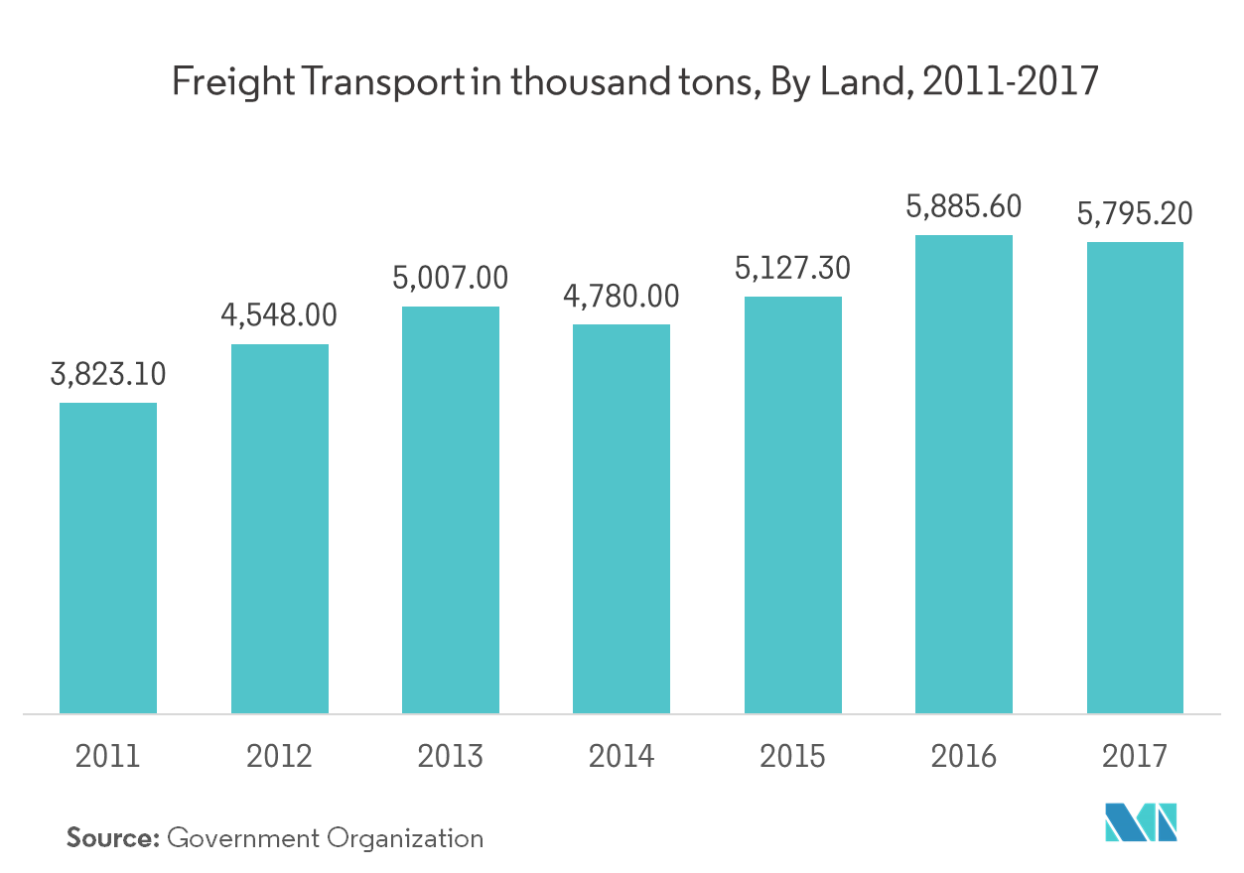

Land Transport is the Major Mode of Transportation

Road transport dominates freight transport in the country with the country being landlocked. More than 80% of the freight traffic (ton-km) is carried by roads. Out of the total road length in the country, more than 90% of it is unpaved. The road density in Laos has improved over the years and stands at more than 20 km per 100 sq. km. This is low when compared to other ASEAN countries. In terms of regional connectivity, many national roads in Laos have been upgraded and linked with the road networks in the neighboring countries.

Laos has almost 20 cross-border linkages to its neighbors (9 between Laos-Vietnam, 8 between Laos-Thailand, 2 between Laos-China, and 1 between Laos-Cambodia). Thailand is the major trading partner in the Intra-ASEAN region for Laos, whereas, China is the major trading partner in the Extra-ASEAN region.

The rail services in Laos are almost non-existent. The country has only a short section of 3.5 km railway from Thanaleng to Nongkhai (Thailand). Rail offers a cheaper mode of freight transportation. According to industrial sources, the transport of goods by railway can reduce the costs by 30% to 50%, when compared to road transportation costs.

Laos has become one of the priorities in the Belt and Road Initiative (BRI) of the Chinese government, which aims at increasing connectivity and the economic and political ties of China with more than 60 countries in Asia, Africa, and the Middle East, mainly through infrastructure projects. One of the key projects of the BRI is a railway connecting Kunming, in southern China, to Singapore, running through Laos, Thailand, and Malaysia. In Laos, the project stretches from Boten, in the Lao-China border, to Vientiane, Lao capital, and a bordering city with Thailand.

The Boten-Vientiane is a complex engineering project where 62% of the track’s length is made up of tunnels and bridges. The construction was launched in December 2016 and the line is expected to open in December 2021. The project, once completed, is expected to reduce the time it takes to travel from Mohan-Boten to Vientiane from three days to three hours. The passenger trains will run at 160 km per hour, while the freight trains will run at 120 km per hour.

Logistics Services plays a key role in the Growth of Laos Agriculture Sector

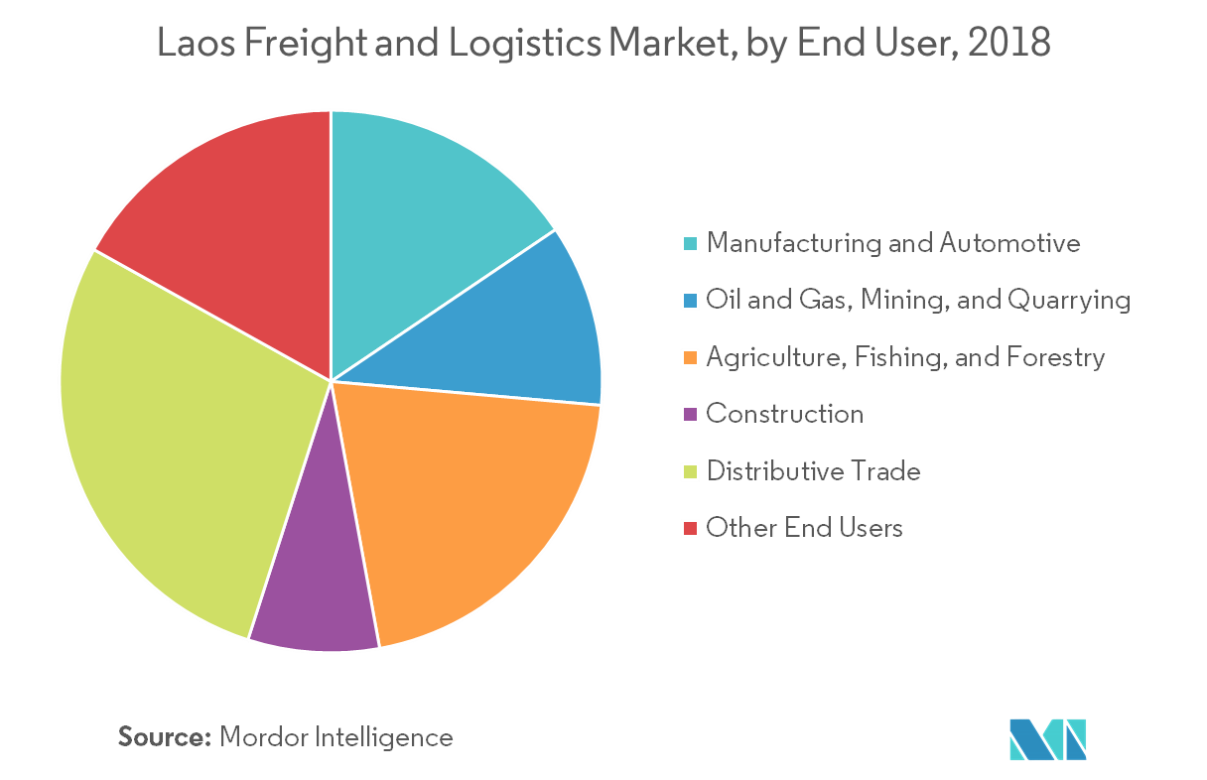

The Agriculture, Fishing, and Forestry sector account for more than 15% of the economy of Laos. According to a five-year development plan until 2025 by Lao Ministry of Agriculture and Forestry, the GDP of agriculture and forestry sector to grow at an average rate of 3.4%, which indicates that the sector would contribute 19% to the national economy.

The agriculture exports of the country have increased in the recent years, driven by the increased participation of traditionally small-scale farming households in the production of export linked commodities, such as rice, fruits, vegetables, rubber, etc. The agriculture sector of the country is traditionally focused on rice, but the improved commodity prices and external demand has promoted commercialization and export of other non-rice crops, such as vegetables, rubber, fruits, cassava over the past decade. The production of meat, eggs, fish and aquatic animal are on rise and the exports of meat products are also expected to rise as production and processing operations are being modernized.

Rice is the major commodity produced by Laotian farmers and it supports many jobs in milling, trading, and food services. Rice stock is stored and managed at a central location, warehouses do not exist at the local level and farmers sell paddy to an assembler who sells it to mills. The assemblers drive up to three days from farmer to farmer buying a few bags (50 kg) of paddy from each to fill their truck.

Some medium-sized rice mills located near to the capital Vientiane, transport rice to customers in their own trucks instead of relying on transport companies. This is due to the small volumes of trade. The large size mills in the country are relatively few and most of them are operated by the Government and donor funded. The government mills have large warehouses and drying facilities. The number of large private mills and warehouses is limited as the surplus is widely dispersed. The transport costs internalized by mills are about 20–30% cheaper than rates available on the market.

Alongside, the Laos freight and logistics market is expected to witness significant growth from other end-users such as manufacturing, construction, and others. Laos can emerge as a vital link in the regional value chain. With the economy of the country growing rapidly, Laos is being considered by foreign firms as a destination for production base.