Market Trends of IoT Sensor Industry

This section covers the major market trends shaping the IoT Sensor Market according to our research experts:

Automotive and Transportation Industry to Drive the Market Growth

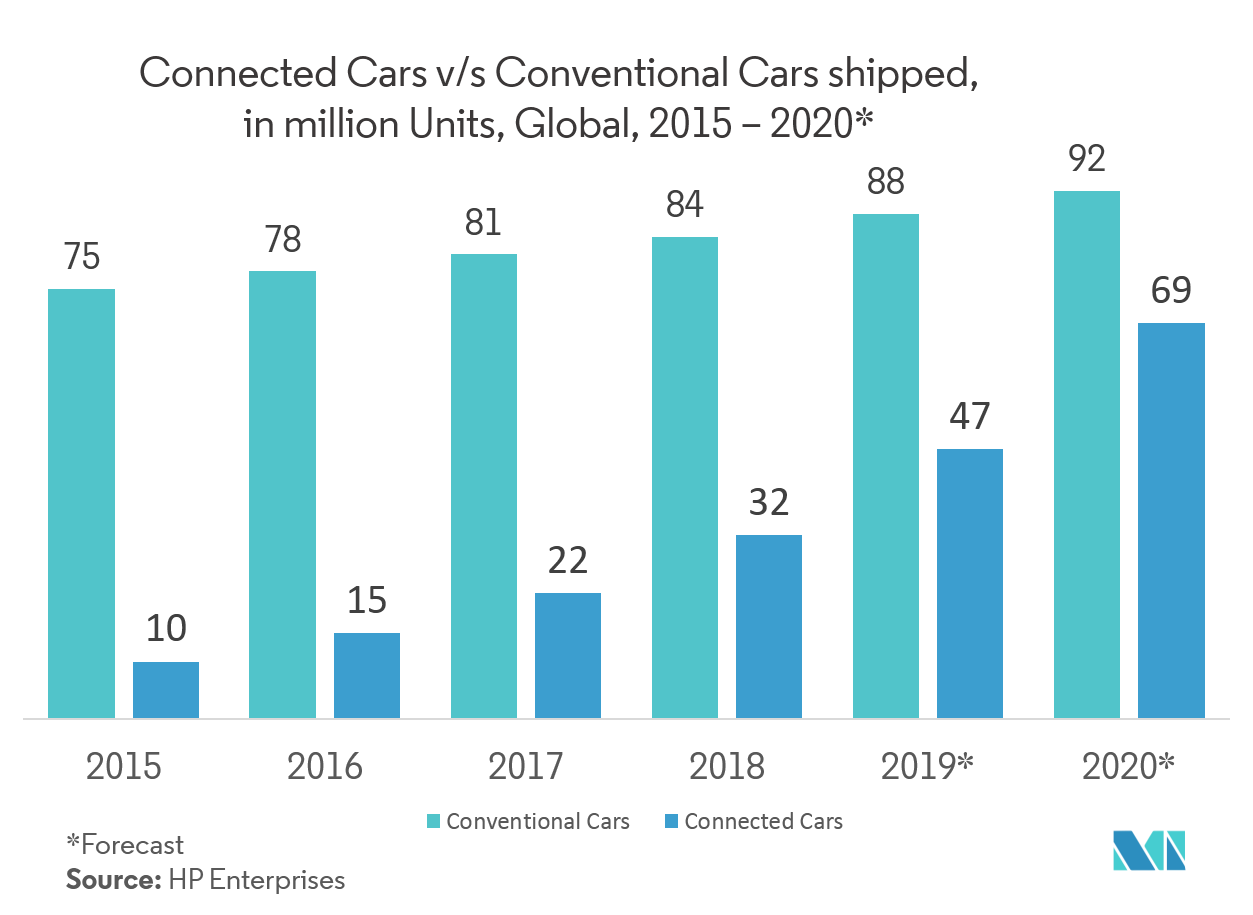

- The automotive sector across the globe is steadily transitioning toward an autonomous era, owing to the recent business collaborations and joint ventures among automotive giants, cybersecurity providers, chip makers, and system integrators.

- This indicates the inevitable advent of highly (Level 4) and fully (Level 5) autonomous vehicles, at the earliest, by 2020. Vehicle connectivity is expected to become necessary for proper communication among vehicles for 'decision-making' proper assimilation and comprehension of visual, geographical, audio, and other data.

- As smart cities emerge, Car2Car connectivity and advanced fleet management are expected to emerge, thus, providing scope for IoT sensors. This has fuelled rapid innovation and the adoption of intelligent sensor technology, driving the demand for IoT sensors.

- Companies such as Mercedes-Benz, Volkswagen, Volvo, Toyota, and Google Inc. are increasingly investing in developing smart cars with rich features that deliver safer, convenient, and comfortable driving experiences. According to a NASDAQ, driverless cars are likely to dominate the market by 2030. Moreover, DHL SmarTrucking aims to build a fleet of 10,000 IoT- enabled trucks by 2028. This is expected to boost the adoption of IoT sensors over the forecast period.

- IoT is also bringing a massive revolution in the automotive, transportation, and logistics industries. Access to preventative maintenance, connected mobility, and real-time data access are significant factors driving IoT adoption in the studied segment. The global IoT transportation and logistics spending almost increased by an exponential rate in the recent times.

- The IoT has enabled many transportation organizations to map the most efficient routes, maximize fuel usage, logistics companies track-and-trace their shipments, and parking start-ups to monitor their available spots in real-time. IoT devices are deployed in traffic congestion control systems in telematics systems within motor vehicles, reservation and booking systems used by transport operators, security and surveillance systems, and remote vehicle monitoring systems.

North America to Account for a Significant Market Share

- North America is one of the largest markets due to several established vendors in the region and the earliest adoption of IoT technology in various industries. Most of the companies in this region are increasingly adopting IoT to keep track of their offering's performance, thus, avoiding costly breakdowns or inefficient routine maintenance shutdowns.

- The usage of IoT in the region is also significantly driving the studied market. For instance, according to a study by Stanford University and Avast, North American homes have the highest density of IoT devices in any region in the world. Notably, 66% of homes in the region have at least one IoT device. Additionally, 25% of North American homes boast more than two devices.

- Further, devices like IoT-enabled medical wearable temperature sensors that transmit data remotely to a central monitoring system are already implemented. Medical staff is alerted based on trends and thresholds, identifying the patient and room, and can respond accordingly.

- Additionally, end-users in Canada have also been investing in the market. For instance, the Canadian energy sector has been procuring internet-connected sensors toward monitoring a range of activities across generating plants, distribution networks, and smart home meters. However, compared to the United States, Canadian companies have been slower to adopt advanced technologies, as per the 2020 Advanced Manufacturing survey of SMEs in North America.

- Further, the demand for IoT sensors in the region is anticipated to grow with the increasing demand for ADAS systems. According to Deutsche Bank, the US ADAS unit production volume will reach 18.45 million by 2021.